⚡️I discovered that Pendle has launched a new pool on Terminal, so I’m going to put some in to test the waters—

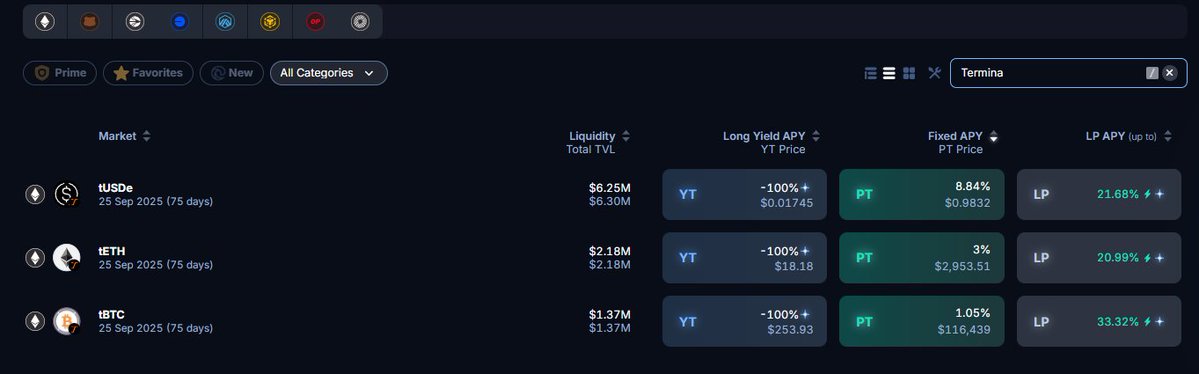

I looked at the assets that have been launched: tUSDe, tETH, tBTC, especially tUSDe, which is naturally suitable for PT/LP strategies.

We are currently in the pre-storage phase, with additional point bonuses, making it quite cost-effective:

🔺60x Root points from Terminal

🔺An additional 50x Ethena Sats

🔺Storing tETH also allows you to earn Etherfi points

Many people may not be familiar with the Terminal project; it focuses on providing liquidity for institutional assets through a yield trading DEX, listed on Converge, with a positioning leaning towards TradFi integration.

To be honest, for protocols like @pendle_fi that have already broken down yields into finer details, the key to going further in the future is how to embed themselves into a larger financial system. In this regard, Terminal's positioning is quite fitting.

I’ve started with some PT and LP here, and if Terminal gains traction later, it could attract a wave of institutional liquidity.

If they open up collateralized lending later, we could directly use Morph's leverage for wealth management!

Currently, the tUSDE PT rate is 8.8%, and the LP rate is 21.6%, so it’s worth keeping an eye on: https://app.pendle.finance/trade/markets?search=Terminal

@tn_pendle

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。