Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

PUMP: Today's discussions about PUMP focus on the upcoming token sale and its potential impact on the crypto market. PUMP's innovative token issuance strategy and its ambition to challenge traditional social media platforms have garnered widespread attention. Key discussion points include PUMP's token economic model, its partnership with Kraken, and a potential airdrop plan for early supporters. Meanwhile, the community is also actively discussing PUMP's market share layout and its revenue-sharing mechanism, with some voices expressing caution or skepticism regarding the project's valuation and market expectations.

GMX: GMX has become the center of public attention today due to a significant security vulnerability in its V1 protocol on Arbitrum, resulting in approximately $40 million in losses. The attack was attributed to a reentrancy attack, primarily affecting the GLP liquidity pool, but GMX V2 and the GMX token itself were not impacted. In response to the incident, GMX has suspended trading and GLP minting operations on Arbitrum and Avalanche and is working with security partners to investigate the matter. The team has also announced a 10% bounty for the return of the stolen funds. Despite having undergone multiple audits in the past, this incident has raised significant concerns about DeFi security and led to a notable drop in GMX token prices.

BNB: Today's discussions around BNB mainly focus on the progress of tokenizing on-chain US stock assets. With the help of partners like Kraken and Backed, BNB Chain now supports non-US users to trade tokenized stocks like AAPLx, TSLAx, and NVDAx in BEP-20 format, further enriching its DeFi ecosystem. Additionally, Binance announced the launch of Lagrange (LA) and a large airdrop for BNB holders, sparking market discussions. The expansion of xStocks to BNB Chain and the upcoming launch of the BNB Treasury Company in the US are also seen as key indicators of BNB's growing influence in both the crypto and traditional finance sectors.

OKB: Today's discussions about OKB focus on the strategic partnership between OKX and Circle. This collaboration aims to enhance the overall liquidity of USDC by supporting seamless 1:1 exchanges between USD and USDC for over 60 million users. This initiative is viewed as an important step for OKX towards compliance while optimizing the trading experience for users. Furthermore, the "BTC Fixed Income" feature launched by OKX, which offers stable Bitcoin returns for VIP users, has also received widespread attention. These developments are considered key strategic moves for OKX in expanding its market and seeking regulatory approval.

Selected Articles

On July 11, ETH returned to the $3,000 mark after nearly five months, igniting market interest. With bullish signals emerging on the mainnet, the meme sector within the ETH ecosystem also saw a collective rebound, with multiple tokens experiencing short-term surges, leading to a rapid recovery in market sentiment. Therefore, deeply exploring projects within the ETH ecosystem that truly possess growth potential has become a key path for finding Alpha. This article will focus on four potential projects that currently have both popularity and solid fundamentals, providing analysis and summaries.

Ethereum has officially broken the $3,000 mark, leading altcoins and related concept stocks to rise together, with more and more US companies and mining firms turning to purchase Ethereum as a strategic reserve. At this critical juncture, the Ethereum Foundation is once again restructuring its team. New teams like EcoDev and other groups are being formed to accelerate the development of the ecosystem. Will Ethereum improve this time?

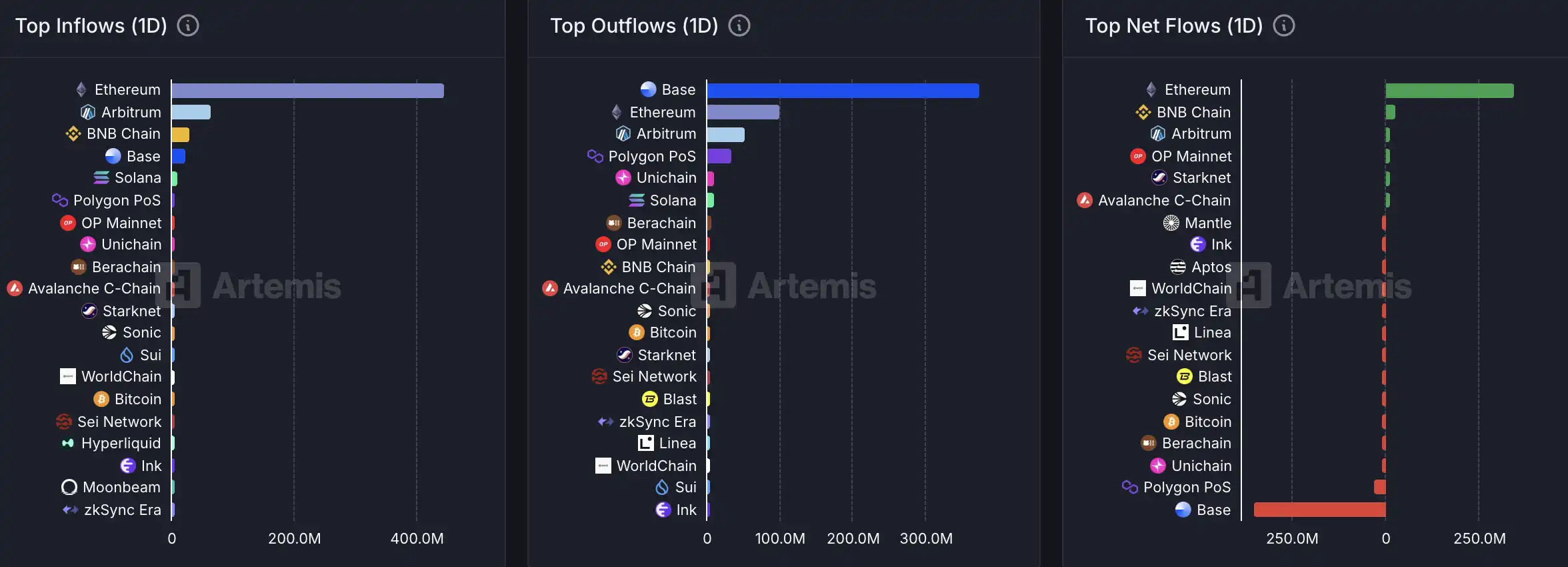

On-chain Data

On-chain capital flow situation on July 11

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。