In the ever-changing landscape of the cryptocurrency industry over the past decade, Gate has chosen a challenging path—consistently adhering to a strategy driven by technology, centered on users, and guided by long-termism. Since its establishment in 2013, Gate has witnessed Bitcoin's evolution from a niche experiment to a global asset, accompanying users through multiple bull and bear cycles. By the summer of 2025, Gate delivered a significant milestone—its registered users surpassed 30 million.

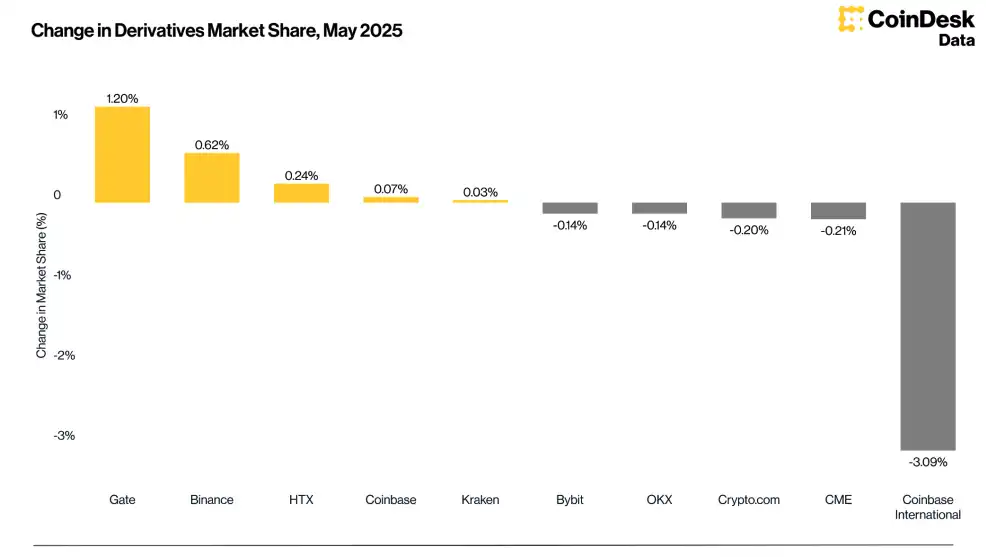

Currently, Gate has become the fastest-growing derivatives trading platform globally, with a market share rising to 4.13%, placing it among the top three worldwide. In addition to its contract business, Gate is also accelerating across multiple product lines, from Launchpool and Alpha platform to Web3 wallets and xStocks stock token areas, gradually building a complete crypto ecosystem encompassing trading, asset management, and strategy execution.

Behind this milestone is not just a surge in user numbers but also a symbol of traversing cycles and earning users' long-term trust. At this juncture, BlockBeats interviewed Gate's founder and CEO Dr. Han, delving into key topics such as the significance of growing from 0 to 30 million, Gate's product strategy and differentiation, compliance layout, and reserve mechanisms, attempting to outline the internal logic of this "slow company" thriving against fierce competition, as well as its preparations and judgments for the next cycle.

What does going from 0 to 30 million mean?

BlockBeats: Hello Dr. Han, congratulations on Gate's registered users surpassing 30 million. What does this milestone mean for you personally and for Gate?

Dr. Han: 30 million users is a highly significant milestone. Seeing so many users globally choose us and the Gate community becoming increasingly global and diverse indicates that people trust Gate. We cherish this trust, and it constantly reminds us of our responsibilities—to innovate continuously, maintain transparency, and always prioritize users.

BlockBeats: As an early advocate of Bitcoin, how do you evaluate Gate's current position in the industry? What has been the biggest challenge and the most successful milestone you've experienced?

Dr. Han: As a trading platform established for over twelve years, Gate's journey to this point proves one thing: long-termism is still effective in this industry. The industry changes rapidly, with many trends, and long-termism is fundamental to traversing cycles and winning users and markets.

The biggest challenges mainly stem from rapid growth, such as how to maintain a smooth user experience, ensure security during large-scale operations, and continuously optimize our internal processes. Our approach relies on three main points—significant investment in technology, building a professional team, and staying closely aligned with community feedback.

One of Gate's biggest successes has been our consistent commitment to the diversification of cryptocurrencies and strict vetting of listing projects over the years. We currently support over 3,600 digital assets, ranking first globally among CEXs in terms of the number of cryptocurrencies, covering both mainstream and emerging coins, fully meeting users' diverse investment needs.

BlockBeats: How has the competitive landscape of trading platforms changed compared to the early days of the industry?

Dr. Han: Compared to the early days of the industry, competition among trading platforms is now much more intense. Initially, everyone was competing for basic market traffic and cryptocurrency support, but now, as the industry matures, technical strength, user experience, compliance capabilities, and product innovation have become key factors determining competitive success. Gate consistently adheres to the principles of technology-driven and user-centric approaches, continuously optimizing trading performance and security guarantees, enriching our product matrix, and particularly leading the industry in compliance and transparency. We believe that only through continuous innovation and robust compliance can we maintain our lead in a fiercely competitive market.

How is the derivatives business being strengthened?

BlockBeats: According to a May report from CoinDesk, Gate's derivatives trading volume surged nearly 70% month-on-month, and its market share rose to 4.13% globally. How did Gate achieve such breakthroughs in the competitive contract space?

Dr. Han: First is the advantage of liquidity. Gate ensures industry-leading stability in large transactions, slippage control, and matching efficiency through high-frequency market maker access, order book depth optimization, and cross-asset pools. With this technological foundation, professional users can trade with confidence, and retail users can also execute trades smoothly and enjoy a stable experience even in extreme market conditions.

Secondly, it is the breadth of cryptocurrency coverage. Most of the contract cryptocurrencies launched on Gate are market firsts. This long-tail advantage stems from our deep understanding of the characteristics of early asset trading: high volatility, concentrated demand, and strong time sensitivity. Based on this judgment, we have established a complete set of efficient review and listing mechanisms, allowing emerging assets to receive derivatives support promptly, occupying a strategic high ground as the "first stop for new coin contracts."

BlockBeats: Currently, Gate's derivatives platform ranks third globally. What differentiated advantages does Gate's derivatives platform have in product design or user experience?

Dr. Han: Gate has not chosen to compete head-on with giants in the mainstream cryptocurrency market but has focused on the "long-tail market" of perpetual contracts, precisely covering the hedging and speculative needs of small and medium-sized cryptocurrency traders. This differentiated strategy has allowed us to successfully escape homogeneous competition and form a unique market perception. Additionally, the platform's ability to retain funds has continuously strengthened, indicating that users are willing to deploy more strategic funds on Gate, fully demonstrating their trust in our trading environment.

In terms of trading functionality experience, we have made comprehensive innovations. In profit-taking and stop-loss, Gate offers the industry's richest combinations, including full position/partial position settings, trailing stop-loss (dynamically adjusting the stop-loss line to capture more profits), and MMR automatic stop-loss based on maintenance margin ratios, significantly enhancing trading flexibility and risk control capabilities.

At the same time, in terms of order types, we provide diverse tools such as time-limited orders, segmented orders, and smart market orders to meet the different needs of retail and professional strategy users. Various large order splitting functions not only ensure transaction efficiency but also reduce slippage, conceal trading intentions, and avoid market impact, fully reflecting our adaptability to professional trading scenarios.

BlockBeats: How will Gate continue to strengthen its derivatives business in the future?

Dr. Han: In the future, Gate will continue to strengthen its derivatives business from several directions to enhance our competitiveness in this field.

First is the continuous upgrade of technology and experience. This year, we completed a comprehensive redesign of the App interface and interaction, making it visually simpler and more intuitive in interaction, with overall improvements in system response speed, order execution efficiency, and stability. This not only enhances users' experience in daily trading but also strengthens the platform's capacity to handle extreme market conditions. In the future, we will continue to optimize the underlying architecture to ensure stability and security for both professional users and retail traders in derivatives trading.

Secondly, we are diversifying our product matrix. Gate is evolving from "a user-friendly professional trading platform" to "a user-centered diversified trading ecosystem." Currently, we have launched on-chain derivatives, strategy tools, Web3 asset access, AI trading assistants, and other modules, and we will continue to enrich tools and functions around users' trading needs throughout their lifecycle, helping users formulate more flexible and personalized trading strategies.

Finally, we are deepening ecosystem and community building. We are no longer encouraging isolated short-term trading but rather a trading ecosystem where users, developers, and project parties participate and co-build together. This not only allows users to gain richer asset choices and strategy tools but also promotes a healthier and more sustainable development of the industry.

Gate's platform reserve transparency and risk control system

BlockBeats: Gate has been ranked among the top four platforms globally for total reserves by CoinDesk, with reserves exceeding $10.4 billion as of June, and an overall reserve ratio of 123%. How has Gate achieved such a robust reserve guarantee system?

Dr. Han: Gate's ability to establish a robust reserve guarantee system stems primarily from our commitment to "user fund security" as our bottom line and primary promise from the very beginning. We were one of the first platforms in the industry to publicly commit to 100% reserves. On a technical level, Gate employs zero-knowledge proofs and Merkle tree structures, allowing users to verify whether their assets are included in the reserves without disclosing details, while also using cold and hot wallet confirmations and balance snapshots to form a complete data closed loop, creating a comprehensive and efficient user verification mechanism.

BlockBeats: As users' demands for platform transparency increase, what mechanisms and layouts does Gate have in terms of asset disclosure and user fund security?

Dr. Han: We have made significant technical investments in asset disclosure and fund security. First, regarding cold and hot wallet confirmations, we transfer the platform's wallets to designated addresses of auditing firms to prove wallet ownership through actual operations. Secondly, we use Merkle trees combined with zk-SNARK zero-knowledge proofs, allowing users to verify that we indeed hold 100% reserves without disclosing personal information.

Additionally, we have made our code open-source, publishing the relevant proof logic on GitHub and inviting Hacken for third-party code audits, further enhancing transparency and credibility.

In simple terms, we use cutting-edge cryptographic technology to achieve "visible security" and "verifiable transparency."

Coordinated development of multiple product lines, what is the future direction of Gate's ecosystem?

BlockBeats: Besides derivatives, several product lines at Gate are also accelerating. Can you introduce which product lines are currently experiencing the most significant growth?

Dr. Han: The most significant recent growth has been in Gate Launchpool. This is our staking airdrop platform, allowing users to stake various tokens such as GT, BTC, ETH, and USDT to receive corresponding new coin airdrop rewards hourly. The platform has a low entry threshold and a high annualized return rate, helping users seize market opportunities.

In June, Gate Launchpool launched a total of 16 new projects, distributing airdrop rewards worth over $2.8 million, with the highest annualized return rate reaching 1513%. During the same period, Gate HODLer Airdrop also launched 13 projects, with a total airdrop value exceeding $350,000. These two platforms continue to provide users with opportunities to participate in the early development of projects, which is highly popular among users.

BlockBeats: Will Gate launch a more systematic ecological integration plan in the future regarding Web3 wallets, Launchpad, Alpha, and other areas?

Dr. Han: We are continuously upgrading Gate Wallet to create a unified asset management center, integrating portfolio management, strategy execution, and NFTs into one seamless interface.

In the Web3 space, Gate Alpha will soon support more cross-chain interactions, real-time data analysis, and AI-driven automated trading strategies. At the same time, our payment system Gate Pay is also continuously expanding its capabilities, bridging fiat and cryptocurrencies and providing solutions for merchants.

BlockBeats: What is your view on the trend of AI and blockchain integration? Is Gate making any moves in this area?

Dr. Han: AI has already begun to change the way users interact with financial systems. We believe that the value of AI in the crypto space is not only reflected in on-chain automation or enhanced security but, more importantly, it can help users make smarter decisions.

Currently, we have deeply integrated AI at various levels of the platform. For example, the smart support line uses technical indicators to provide early warnings, helping users assess market trends and avoid liquidation risks; the AI coin selection mechanism analyzes market sentiment using the fear and greed index, helping users quickly understand the overall market state to make more rational and data-driven decisions; and our Ultra AI trading bot can automatically generate neutral and objective market judgments and investment strategies, allowing users to choose from three strategy types—“high-yield,” “stable,” or “holding” based on their needs.

At Gate, AI acts more like a trading advisor, helping users manage trading risks, lower trading barriers, and personalize strategies.

BlockBeats: Do you agree with the judgment that "the CEX dividend period is over"? How is Gate responding to the general decline in wealth effects among trading platforms in light of this structural change in the industry?

Dr. Han: Over the past decade, the surge in demand for crypto trading has driven a significant increase in the number of CEXs and DEXs. While CEXs dominate the market, DEXs are also increasing their market share year by year, showing clear advantages in long-tail assets and cross-chain trading, while CEXs enhance user experience through Web3 layouts and service integration.

I believe that any trading platform that wants to maintain a long-term lead in the industry must possess five core capabilities: serving billions of users, supporting millions of tokens, executing billions of transactions, managing trillions of dollars in funds, and fully adapting to global compliance regulations. Gate continuously refines and hones its operations around these five core capabilities, allowing us to respond calmly to market fluctuations and continue to grow.

BlockBeats: What is your view on the recent trend of "coin-stock integration" becoming a global focus in the crypto industry? What preparations does Gate have in this regard?

Dr. Han: This is actually an inevitable trend of deep integration between asset digitization and traditional finance, aimed at enabling more people to conveniently participate in investments. As a pioneer in the industry, we have been actively laying out this market. In July of this year, Gate officially launched the xStocks trading area, supporting both spot and contract markets, making it the world's first stock token trading platform that supports the crypto contract market.

The first batch of listed assets includes eight popular targets such as COINX, NVDAX, CRCLX, AAPLX, METAX, HOODX, TSLAX, and GOOGLX, allowing users to trade these tokenized stocks directly with cryptocurrencies like USDT. At the same time, Gate Alpha has also opened the trading functionality for xStocks, with the first batch of supported contracts including MSTRx, CRCLx, SPYx, NVDAx, TSLAx, and AAPLx, greatly enriching users' choices in on-chain asset trading and strategy exploration.

Our goal is not just to provide an additional trading category but to fundamentally reconstruct the relationship between users and assets. By building a truly global, borderless investment platform that uses crypto assets as a bridge, Gate hopes to enable everyone to equally access global financial opportunities.

BlockBeats: Standing at this new starting point of 30 million users, what is your next key goal for Gate?

Dr. Han: From this new starting point of 30 million users, we will not only continue to focus on product and technological innovation but also actively promote compliance layouts globally. Following our successful acquisition of the VASP license in Dubai and the acquisition of a licensed trading platform in Japan, we will continue to advance our compliance process, ensuring that more users can access and use crypto assets in a safe and legal manner, creating a truly trustworthy and sustainably developing trading ecosystem for our users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。