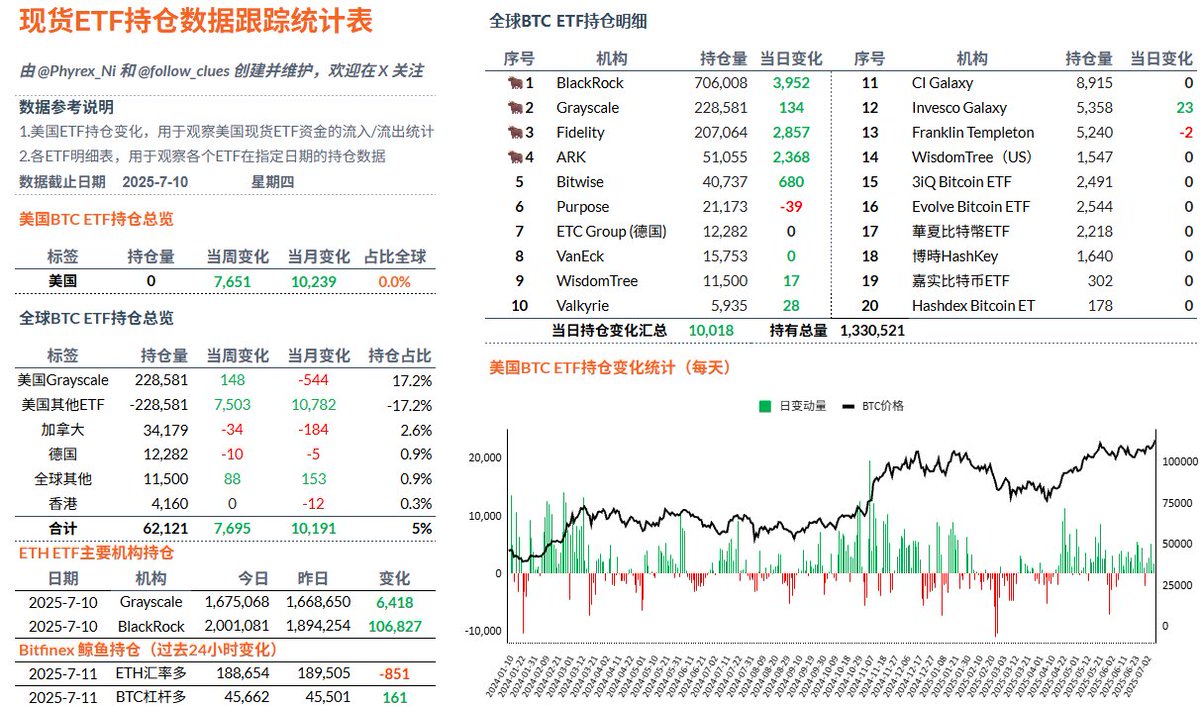

Chasing highs and cutting losses is a gap that traditional investors find hard to cross. After the price of $BTC broke new highs for two consecutive days, we finally saw a rise in FOMO sentiment among ETF investors yesterday. I have been saying that the contribution of traditional investors to purchasing power is too small, with a gap of more than double compared to the end of 2024. However, yesterday, Bitcoin spot ETF investors experienced a net outflow of over 10,000 BTC, reaching last year's high range.

This data finally shows that traditional investors are beginning to pay more attention to the cryptocurrency space. BlackRock, Fidelity, and ARK all saw net inflows greater than 2,000 BTC, with BlackRock's inflow nearing 4,000 BTC, indicating that short-term price-sensitive investors are starting to buy in.

Data source: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。