Trump Tariffs $113B Collection: Good or Bad Factor for Crypto Market?

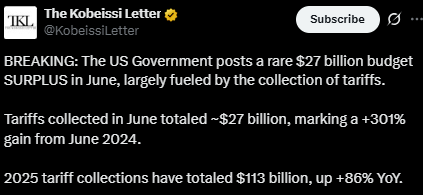

The United States has collected a massive $113 billion in tariffs so far in 2025, showing an 86% rise compared to last year. In June alone, the government collected around $27 billion, leading to a rare monthly budget surplus of $27 billion — the first since 2005. This sudden surplus is directly linked to the recent Trump announcements, which were increased and expanded in April and July, as per The Kobeissi Letter .

Source: X

However, this surplus follows one of the largest monthly deficits in U.S. history — $316 billion in May 2025. The economic shift has raised questions about how long this strategy will work and how it will impact other markets, especially cryptocurrency.

Donald Trump’s New Tariff Moves: Will the Game Continue?

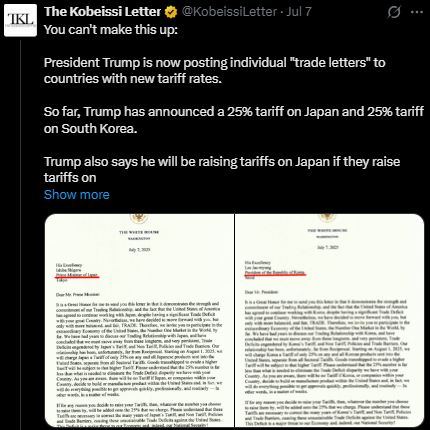

In July beginning, Donald Trump made new tariff announcements , targeting several countries with high tax rates. These include:

-

Brazil (50%),

-

Cambodia & Thailand (36%),

-

Bangladesh, Serbia (35%),

-

and even Japan and South Korea (25%).

These tariffs will be live from August 1 . Trump has clearly stated that any retaliation will lead to even higher duties, and no company aligned with BRICS or “anti-American” policies will be spared.

This aggressive tariff policy is now in the spotlight. The question is: Will Trump keep playing this high-stakes tariff game in 2025? Many believe he will, especially considering the clear profit from rising collections and growing political pressure. As the US President thinks from a business point of view, he will try to impose more tariffs on more countries for economic growth.

Crypto Market Reacts: Mixed Signals Amid Global Tensions

Interestingly, the cryptocurrency market crash seen earlier in 2025 was partly caused by fears. Back in February, Donald Trump’s tariff announcement caused panic selling, dropping Bitcoin’s price to $94,000. But confidence bounced back when the pause was announced, leading to more inflows into digital assets.

Today, despite rising trade pressure, the market is up again. At the time of writing, Bitcoin price is trading above $117,000, showing a 0.65% in a day. Total market cap now stands at $3.68 trillion, with steady 24-hour volumes.

Source: CoinMarketCap

This growth may be tied to inflation concerns, dollar volatility, and investor interest in safer, decentralized assets. Tariffs weaken global fiat currencies, making digital alternatives more attractive..

On July 10, Trump said crypto is “through the roof,” and highlighted that Nvidia rose 47% since his tariff changes . But this rise comes with risks. Trade wars can slow down economies and lower global liquidity. If major economies respond with countermeasures, it could harm overall investment — including in crypto.

Will Surpluses Trigger Tighter Crypto Rules?

The Trump copper tariffs, along with wider trade duties, are boosting government revenue. But some experts fear that continued surpluses might attract more regulatory attention to digital assets. Governments may view high-performing crypto as an untapped revenue source or a risk to national currency control.

Also, as the collection of tariffs increases, the government can be more strict with cross-border assets flow, particularly for the sanctioned nations or high-tariff nations. This can pose new challenges to global crypto exchanges as well as blockchain projects.

Thus even while the existing market appears to favor virtual assets, long-term consequences of trade policies may portend opportunity and challenge.

Conclusion

The increasing tariff receipts and economic changes are generating hope and fear among crypto traders. Dollar weakness and inflation on one side could trigger Bitcoin and other cryptocurrencies' demand. Conversely, if global trade declines and regulations rise, the market will experience headwinds. Investors will have to remain cautious in tracking policy action, all the while.

Disclaimer: This is for general informational purposes only. It's not an investment recommendation. Get a professional before making an investment choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。