Bitget's AI trading assistant GetAgent effectively simplifies the cryptocurrency trading decision-making process by integrating multidimensional information and natural language interaction, providing full-process support from information acquisition to trade execution for users at different levels. It has demonstrated practical profitability and the significant importance of tool equity during testing.

Introduction: Research Background and Evaluation Motivation

The information density and strategy complexity in the cryptocurrency market are increasing daily. Even users familiar with candlestick charts, fundamental analysis, and on-chain data often feel overwhelmed by information overload.

This is why I have always maintained a keen interest in the combination of AI and cryptocurrency trading. In recent years, more and more platforms have begun to integrate AI features, but most remain at the functional level or simple information aggregation. Bitget's promotion of GetAgent as the "world's first all-in-one cryptocurrency trading assistant" aims to help users acquire information, analyze strategies, and execute trades. During the testing process, I unexpectedly benefited from a surge in BTC.

This article evaluates GetAgent in the context of daily trading scenarios, primarily verifying two specific questions: "Can it simplify the decision-making process?" and "Can it lead to higher profits?" The evaluation results are provided for readers' reference and discussion.

1. Product Positioning and Basic Functionality Overview

GetAgent is essentially an AI trading assistant embedded in the Bitget App. Its positioning is similar to that of an "AI personal investment advisor," completing tasks such as information processing, strategy generation, position diagnosis, and simple trading suggestions through natural language interaction. Its biggest highlight is the chat interaction combined with over 50 professional-grade MCP tools.

Currently, there are many usable scenarios, including market analysis, position suggestions, and even automated trading:

- Market analysis and trend interpretation: You can directly ask, "How is BTC doing today?" The system returns a comprehensive interpretation that combines candlestick indicators, on-chain data, and market sentiment.

- Strategy suggestions and risk warnings: For example, "Is it suitable for me to increase my position in ETH now?" GetAgent will provide range references and take-profit/stop-loss suggestions based on technical signals and individual risk preferences.

- Smart money tracking and hot topic simulation: In a sense, it simulates a hot topic warning by tracking on-chain funds, whale transfers, and KOL social mentions.

- Position analysis and rebalancing recommendations: Based on the composition, concentration, and correlation of the coins in your account, it provides adjustment suggestions.

- Conversational learning AI: Supports basic question answering, such as "What is AMM?" and "Who is suitable for dollar-cost averaging strategies?"

- Automated trading: Supports direct trading through conversation, such as "Buy 1 ETH" or "Increase position by 100 BGB," executing orders directly through commands.

From a functional logic perspective, GetAgent attempts to cover the complete closed loop from information input to execution suggestions, acting as a true "AI personal investment advisor."

2. Actual User Experience: Interaction Process from Input to Output

The most direct feeling is that as an "AI personal investment advisor," you can converse with GetAgent using natural language just like using ChatGPT, without needing to switch interfaces or consult chart data. The overall user experience is quite smooth.

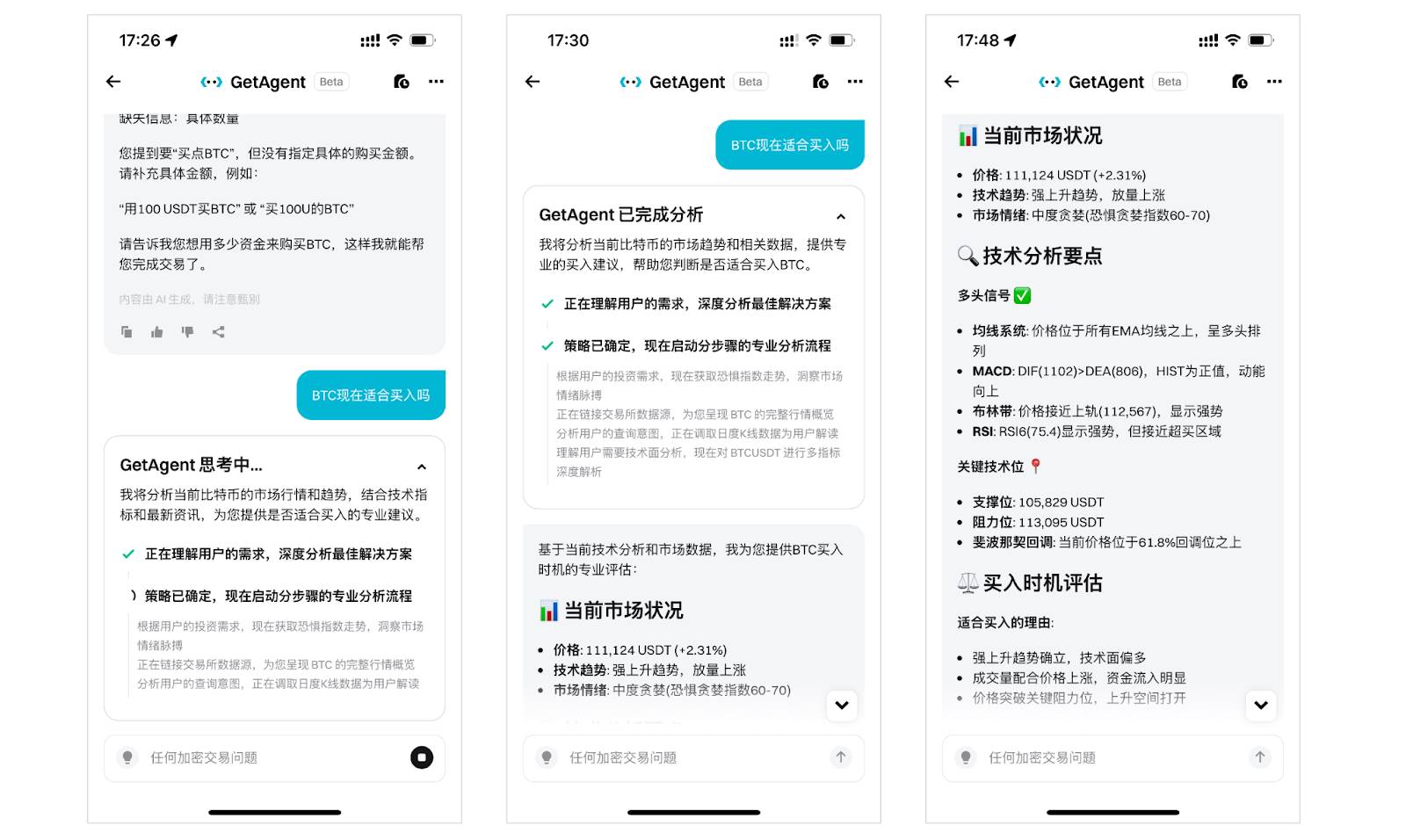

For example, during testing, I asked, "Is it a good time to buy BTC?" GetAgent entered a thinking state, and in the UI, I could click to view its thought process:

- "Understanding user needs, deeply analyzing the best solution"

- "Strategy determined, now initiating a step-by-step professional analysis process," which breaks down into several sub-steps, including:

- "Acquiring the fear index trend based on user investment needs, gaining insight into market sentiment"

- "Linking to exchange data sources to present a complete market overview of BTC"

- "Analyzing user query intent, retrieving daily candlestick data for interpretation"

- "Understanding the need for technical analysis, now conducting a multi-indicator deep analysis of BTCUSDT"

Unlike the often-mocked thinking process of DeepSeek, the above is clearly a standard thought process defined by developers to ensure GetAgent provides vertical domain services, aligning with basic analytical paths.

Ultimately, GetAgent provided a relatively detailed analysis, including:

- Price trends and volume changes over the past month;

- Status of key indicators such as RSI/MACD/Bollinger Bands;

- Whether BTC has seen capital inflow amid market hot topic changes;

- Technical support and resistance ranges at the current price level;

- External sentiment references (such as community sentiment and frequency of mentions by major influencers);

The output text is highly structured and can essentially serve as a decision-making reference.

In terms of interaction experience, I believe its most successful aspect is translating complex quantitative and fundamental analysis into plain language for users. Beginners can lower their learning threshold, while experienced traders can enhance their decision-making efficiency.

However, for questions requiring analysis of specific coins, GetAgent's response time generally takes 30 seconds or longer, which feels a bit long for a mobile product experience. This is an area I believe should be prioritized for optimization.

3. Testing Three Core Functions: GetAgent's Actual Capabilities

Market Interpretation

The first test was basic market analysis. I asked similar questions about BTC, ETH, and PEPE: "Is it a good time to buy at the current price?" The system's response included price ranges, support and resistance levels, the status of major technical indicators, and changes in sentiment indicators. The completeness of this data is quite good, especially as it combines technical, on-chain, and sentiment dimensions.

Compared to traditional methods—where I would need to use multiple platforms to gather this information—GetAgent summarizes it in a single text, saving a lot of switching time.

Smart Money Tracking

This feature is a highlight I focused on. After asking, "Have there been any significant movements from large holders regarding PEPE recently?" GetAgent provided data on large on-chain addresses, DEX inflow and outflow trends, and the frequency of mentions by hot topic KOLs. When I inquired, "What are whales buying recently?" GetAgent provided some tokens and related data (24-hour price increase, current trading volume, and market cap) for reference. When I asked about "Cathie Wood's recent actions," it provided investment trends, investment logic analysis, investment references, and market impact analysis.

The responses from this feature may seem a bit thin for seasoned traders, but overall, it approaches the analytical depth of a professional research team. Moreover, it is very user-friendly and easy to understand for retail investors, especially newcomers, bridging the information gap with professional traders at a very low cost.

Position Diagnosis

This was another small feature that pleasantly surprised me. GetAgent analyzed the structure of my account's holdings, pointing out risks such as my high concentration in ETH, lack of hedging coins, and missed opportunities to use stablecoins for building positions. It also suggested establishing a "market cap balancing mechanism" to reduce the weight of altcoins.

This third-party perspective, different from the user's own, is clearly valuable in assisting trading decisions. Especially since the system provides detailed reasoning and thought processes rather than mechanically directing what to do. This "explainability" greatly enhances my trust in the suggestions themselves.

4. Can it bring "excess returns"?

This is a question all readers are concerned about. During testing, I used GetAgent to execute a few small strategies, following the suggested entry points precisely. I unexpectedly caught the upward surge of BTC, with both the buying and increasing positions being spot on, resulting in an 8% increase in one day. Unfortunately, I missed the opportunity to open contracts based on the suggestions, missing out on contract profits!

Therefore, in my view, GetAgent is a valuable decision optimization tool that can help you make better decisions and earn profits. Its advantages mainly include:

- Saving time on information search and integration;

- Outputting structured entry suggestions;

- Highlighting potential overlooked risk points;

- Enhancing the data foundation for your decision-making;

- Ultimately executing orders based on your judgment.

Of course, it will not directly and accurately predict tops and bottoms; you still need to make your own judgments, make decisions, and take responsibility for risks. My attitude towards it is similar to that towards autonomous driving: AI cannot and should not replace the subjective judgment of traders.

5. How has it changed decision-making behaviors?

Before using GetAgent, I typically relied on three dimensions of data for cross-confirmation: technical indicator charts, on-chain trends, and community sentiment. This meant I had to switch between at least three platforms and manually annotate and summarize. Since incorporating GetAgent into my daily use, I have found the process of information integration and rapid judgment to be much more efficient.

Compressing Decision Processes and Enhancing Decision Efficiency

From the moment I input a vague question like "Is BGB suitable for short-term entry?" to receiving suggested ranges, stop-loss reference points, and support/resistance levels, it took less than 20 seconds. More importantly, this information did not require me to switch charts or verify MACD/EMA values, and it directly provided a credible thought process.

This transformed my daily decision-making rhythm from "collect → summarize → judge → act" to "filter → judge → act."

Changes in Decision-Making Perspectives

In the past, I relied heavily on the shape logic of chart patterns or technical indicators, such as "triangle breakout" or "golden cross." Now, I focus more on "cross-validation provided by the system," such as whether sentiment indicators and capital inflows are diverging. Has the narrative heat of a coin declined?

This is essentially a transition from "indicator thinking" to a "system perspective," where GetAgent helps clarify logic rather than just providing numerical values.

Expanding the Dimensions of Information Perception

GetAgent also has a subtle effect: it makes you aware of certain crucial data points you may have never paid attention to, such as the increase or decrease of active addresses on-chain, the frequency of social mentions during meme sector rotations, and the behavioral trends of whale wallets transferring to exchanges.

The structural organization of this type of information, which was previously exclusive to institutions, is now clearly presented through conversational means. Over time, the dimensions I focus on while trading have become more diverse, naturally increasing the probability of avoiding pitfalls.

6. Usage Recommendations for Different Types of Traders

AI tools are not suitable for everyone, nor do they demonstrate optimal performance at all stages. In my testing, I attempted to analyze the adaptability of GetAgent from the perspectives of several typical users.

Beginner Users: Providing Friendly Onboarding Guidance

For users who are completely unfamiliar with charts and on-chain logic, GetAgent's core value lies in being "beginner-friendly." For example, it can help users plan dollar-cost averaging strategies, explain basic concepts, and use specific cases to clarify sources of volatility and risk points.

This is much more reliable than beginners blindly studying technical analysis or following KOL opinions. For new entrants, it serves as a good "AI coach" type of tool.

Heavy Traders

For users who frequently trade and have their own strategic frameworks, GetAgent provides decision support and blind spot reminders. It cannot replace the system you have built, but it can help you verify whether certain trends align with your understanding or issue warnings when you overlook details.

Especially during periods of frequent rotation among hot coins, using GetAgent can speed up judgment and reduce noise interference from massive amounts of information.

Aggressive Investors

For aggressive investors who engage in high-frequency trading, chase hot trends, and seek alpha, GetAgent's potential value lies in two directions:

- Hot Trend Prediction Mechanism: By analyzing narrative heat, community indices, and whale buying rhythms, it may provide signals before a surge.

- Risk Checklist Function: It will point out risks associated with tokens that have poor liquidity, low market capitalization, or frequent institutional selling, issuing warnings for potential risks.

The rationality of AI acts as a sheath for the sword, providing caution and restraint for aggressive investors.

7. What is the Value of GetAgent?

As a product still in the testing phase, GetAgent has not yet reached the level of perfectly replacing manual trading. However, I believe it has already made a very clear breakthrough in the user experience of cryptocurrency trading.

Current Stage: Learning Tool + Decision Support

In terms of functionality completeness, GetAgent is sufficient to be a comfortable tool, particularly suitable for:

- Navigation during the learning process for beginners;

- Intermediate users with a strategic framework but limited energy;

- Experienced traders who want to quickly focus on key information and reduce judgment blind spots.

Mid-term Potential: An Important Sign of Tool Equity

GetAgent's greatest potential lies in its ability to bridge the information gap between individuals and institutions. It integrates a wide range of data dimensions and has a relatively stable information model. While it cannot construct a true alpha strategy, it can quickly help users bypass ineffective noise and focus attention on effective information points.

In a sense, it brings "quantitative-level data services" into the hands of ordinary users in the form of a dialogue box.

Long-term Development: Potential to Become a Standard Entry Point for Trading Platforms

If GetAgent continues to optimize input parsing, strategy modeling, execution linkage, and other modules, I believe it is likely to become the default interactive entry point for trading platforms in the future. Just as today you use Google to search for information and Siri to control devices, in the future, the first step when opening trading software will be to "ask AI a question."

8. Summary and Conclusion

After testing over the past few days, I believe GetAgent can indeed serve as an excellent "AI personal investment advisor" for the cryptocurrency market. It helps you focus on information, reminds you of risks, provides directional suggestions, and allows you to make decisions before executing orders with a single click.

For traders keen on self-learning and enhancing their cognitive systems, this is a tool worth continuous attention. I will continue to use it for trading preparation, portfolio adjustment assistance, and hot topic validation, and I look forward to further optimizations in data depth, feedback speed, and execution interfaces.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。