Bitcoin ETFs Surge to $150 Billion AUM After $1 Billion Inflow

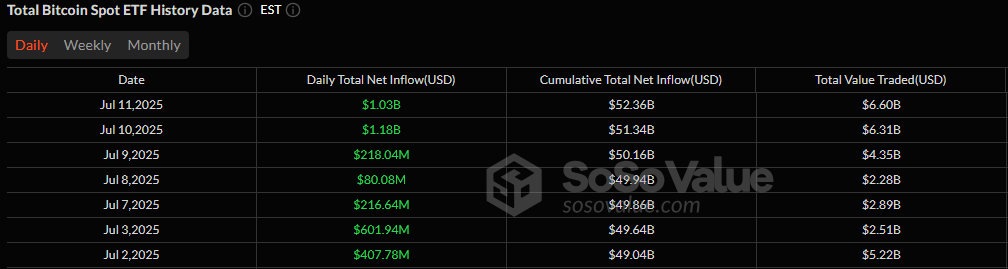

The wave keeps growing, and the numbers keep breaking records. Bitcoin ETFs notched their sixth consecutive day of inflows, fueled by a massive $1.03 billion in net inflows on Friday.

Blackrock’s IBIT once again dominated, accounting for the lion’s share with a $953.52 million injection. The rest of the day’s inflows were spread across other major players: Ark 21shares’ ARKB ($23.51 million), Grayscale’s Bitcoin Mini Trust ($20.93 million), Vaneck’s HODL ($20.01 million), Bitwise’s BITB ($6.41 million), and Invesco’s BTCO ($5.30 million). No ETF recorded outflows.

Source: Sosovalue

Total trading volume spiked to a new high of $6.60 billion, and net assets across all bitcoin ETFs soared to $150.60 billion. The segment now represents 6.43% of BTC’s total market cap, a clear marker of growing institutional conviction.

Meanwhile, ether ETFs kept pace, continuing their green streak with a solid $204.82 million in net inflows. Blackrock’s ETHA led the charge with $137.08 million, followed by Grayscale’s Ether Mini Trust ($25.51 million), Fidelity’s FETH ($11.99 million), and Grayscale’s ETHE ($9.96 million). Other notable inflows included Bitwise’s ETHW ($8.60 million), Vaneck’s ETHV ($6.59 million), and 21Shares’ CETH ($5.09 million).

Total Ether ETF trading hit $1.40 billion, and net assets rose to $13.53 billion, underscoring the continued interest in ether-based exposure. With momentum accelerating into the weekend, the ETF markets are showing no signs of fatigue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。