The sunset is free, and so are the four seasons. We often rush for many unattainable things, yet miss the flowers by the roadside, the sunset falling on the mountains in the evening. While busy with life, remember to appreciate the small details in life. Besides the trivialities and monotony, there are delicious foods and blooming flowers!

In terms of the market over the weekend, it basically maintained a state of fluctuation. Under such market conditions, there isn't much to review. In terms of operations, I haven't opened any large Bitcoin positions in the past two days, but I did short a bit of Ethereum, Ripple, and some other altcoins. Some made a profit, some incurred losses, and some got stuck. In the past, I wouldn't dare to short altcoins after Bitcoin had risen and fluctuated, but in the current market, with insufficient liquidity and Bitcoin's altcoins siphoning off the market, it can only be said that altcoins are becoming increasingly difficult. So I tried to short a bit while also experimenting with trading models to see if I could find the most reasonable way to operate. I don't know when it started, but I personally have also lost some enthusiasm for purchasing altcoins, especially those in the secondary market. It seems that shorting secondary market altcoins can more easily find the optimal trading model. So I will study for a while, continuously trade altcoins, gather market operations, and refine operational rules. Please stay tuned!

In terms of the market, under the weekend's fluctuations, liquidity indeed began to show slight changes. After clearing the previous high short liquidity following Friday's surge, there was clearly more long liquidity below. After a small pullback, it entered the weekend's fluctuations. Currently, it is quite evident that the long liquidity below is starting to decrease, likely due to profit-taking by long positions, while new shorts are beginning to gather above. This aligns with the stubborn nature of shorts; after all, at the current high levels, shorts still believe that if a pullback occurs, there will be more space below. Perhaps this is just human nature. Now, looking at it, the new short liquidity clearing intensity is starting to gather around 120500. At this point, the shorts likely think that the long positions at the round number of 120000 won't break through immediately. Currently, after a strong surge, the market has directly flattened out, which is quite interesting. If the market's fluctuations end and we see shorts gathering again above, followed by another surge to clear, if it continues like this, it would be a very typical case of sideways instead of down, gradually leading to a bullish market. Thus, seeing higher targets above would become much simpler. If the market chooses to go down next, based on market sentiment, many people will wait for a pullback to go long, which could lead to a drop in the market. Long liquidity would continue to increase, potentially forming a series of long liquidations. Therefore, judging solely from liquidity, the current view is that before a pullback occurs, it is still seen as a bullish market.

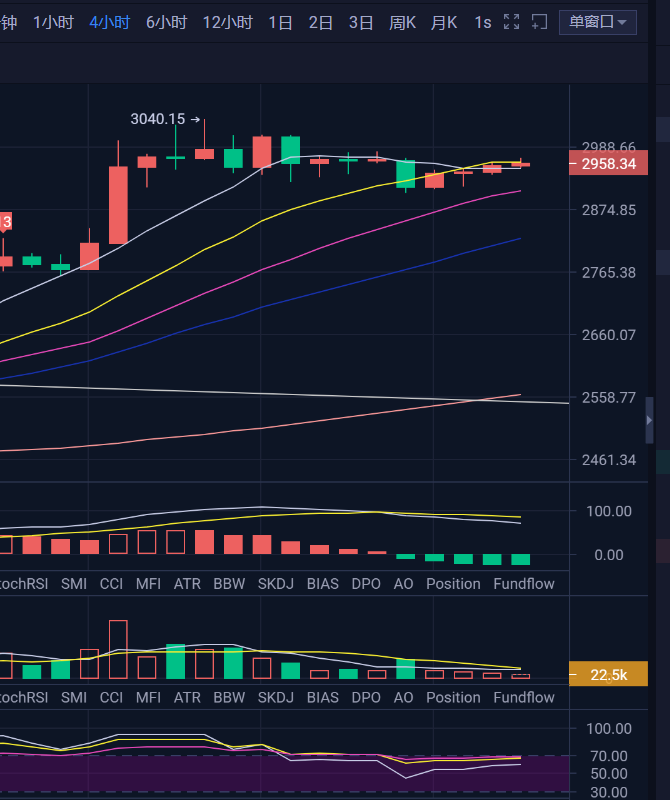

On the technical side, due to the recent strong market driven by bullish momentum, the daily structure is currently a very clear bullish structure. There’s nothing particularly noteworthy to emphasize here; it’s the same as before, with moving averages arranged upward, the MACD indicator showing a golden cross above zero and diverging, and the RSI entering the overbought zone. Therefore, the technical daily level and liquidity judgment are the same: before a pullback occurs, the structure will not change, and it is viewed as bullish. The four-hour chart is in a high-level fluctuation, considering the continuation of the trend. After all, neither the structure nor the decline has broken the trend. The current market is undergoing indicator repairs through fluctuations, and the K-line is almost forming a straight line. We will wait for 4-6 hours for the indicators to repair. As before, Sunday evening and early Monday are also times when market changes are likely to occur. Once repaired, if the price has the expected decline, that would be better; if not, it would be stronger, and we need to continue to get on board.

In terms of operations, the perfect scenario would be a small pullback, then a surge until clearing the short liquidity around 120500, creating a FOMO sentiment among market bulls, forcing them to chase long positions, followed by a sell-off for a pullback. Currently, shorting trends is not suitable; if we can break through the 120500 area for the first time, that would be good. For now, the short-term range of 116500-118300 can be played with short-term trades, and then we can make real-time trades based on the market's movements after the fluctuations end.

Ethereum's short-term trend is quite similar to Bitcoin's. I actually hope to see Ethereum lead a strong surge for altcoins because I genuinely want to see altcoins rise, giving them space. Later, when Bitcoin pulls back, the downward space for shorting altcoins would be larger, which would be very friendly for my plans to trade altcoins. Let's wait and see, looking for opportunities to short altcoins, which I really like.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market changes in real-time may lead to delayed information. Specific operations should be based on real-time strategies. Feel free to contact and discuss the market.】

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。