Currently, the market's rise is more due to the extension of tariffs to August 1 and the expectation that Trump may select a new Federal Reserve chairman in July. Of course, the passage of the big beautiful bill has also led the market to predict that there may be short-term liquidity entering, although this is also a form of "drinking poison to quench thirst." But the market doesn't care too much; it's all about making a profit first, as long as the last stick isn't in their hands.

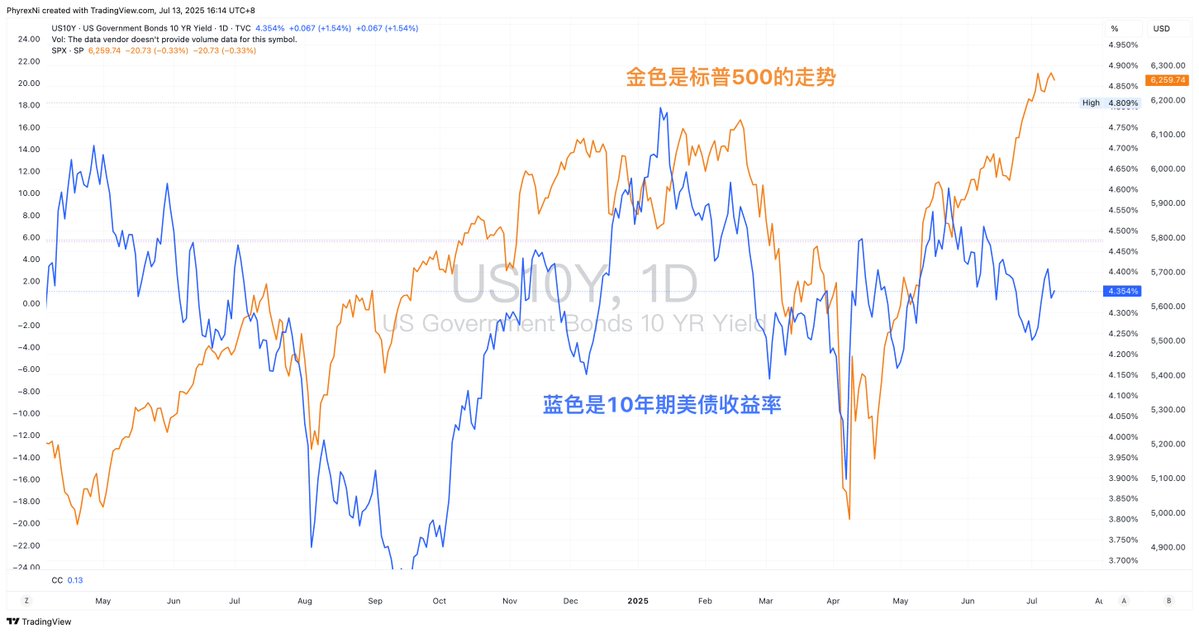

In addition to what Wu said about the 10-year Treasury bond, the 20-year and 30-year Treasury bonds are also approaching 5%, which means the market does not believe the Federal Reserve can easily control inflation, nor does it believe that U.S. fiscal policy can continue to expand without cost.

Generally speaking, the 10-year yield = inflation expectations + real interest rate + risk premium.

The 10-year U.S. Treasury is the world's most important risk-free interest rate benchmark, and almost all assets are directly or indirectly anchored to its valuation. Changes in the 10-year U.S. Treasury reflect the market's expectations for future medium- to long-term inflation and interest rate paths. In simpler terms, while the risk market is rising, the bond market believes that U.S. inflation will not be easily controlled, and that U.S. rate cuts will not be very smooth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。