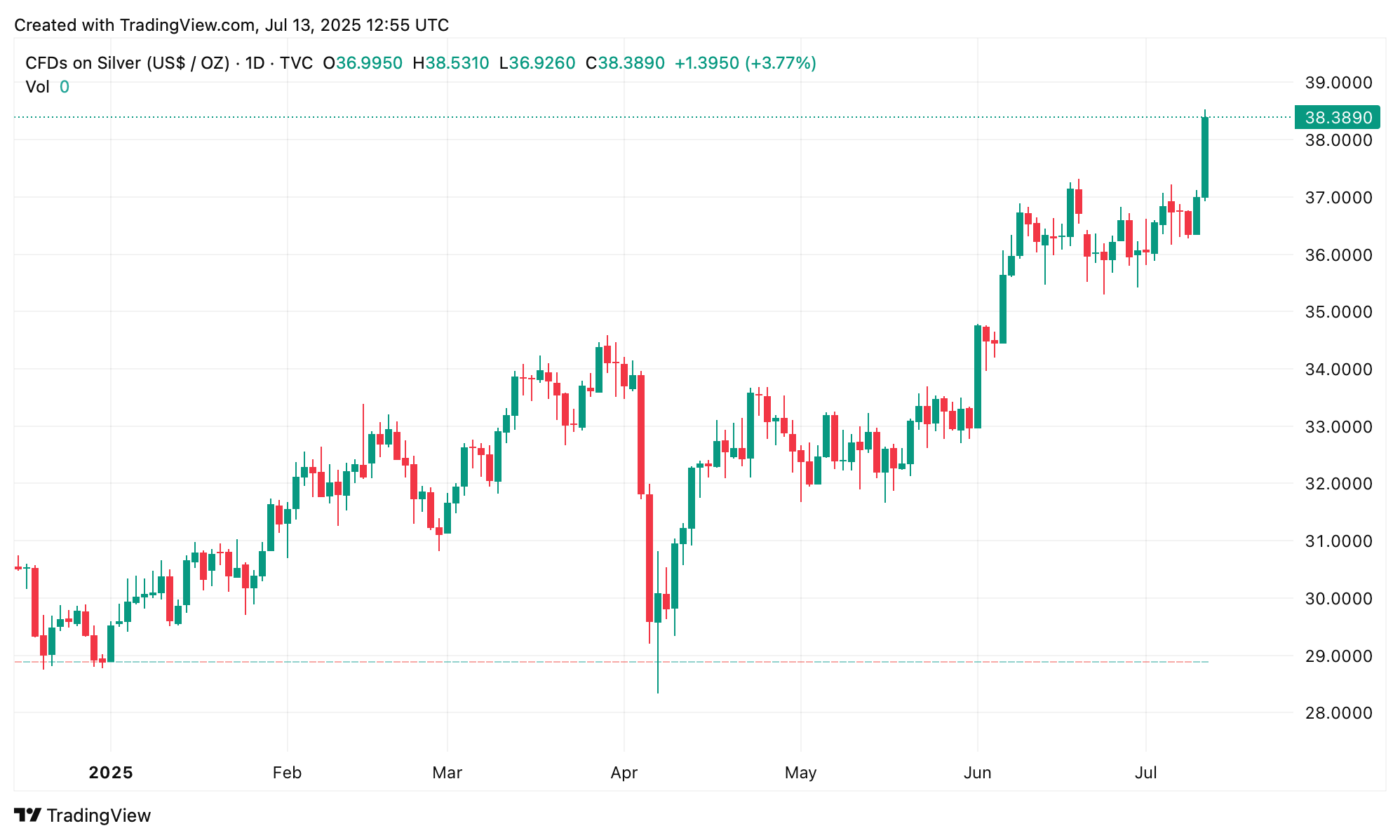

Now trading at $38 per ounce for .999 fine silver, the metal has made a serious comeback this year. Since Jan. 1, silver has jumped over 32% against the U.S. dollar. Precious metals enthusiasts remain confident the rally isn’t done. Some predict silver will break into the $50 territory, while longtime analyst Michael Oliver, founder of MSA Research, is calling for a push well beyond $100.

“What is going on right now is silver is compensating for having been restrained for so long by forces that are trying to hold it back,” Oliver explained to King World News (KWN) this week. “And the problem with that is that when it bites them they are on the short side of the market so the squeeze is them exiting what are now vulnerable short positions,” Oliver added.

Silver on Sunday, July 13, 2025.

It’s been 14 years since silver last hovered in this price territory—back in March 2011, it broke past $47 per ounce. Before that peak, silver had already touched above $35 in March 1980, but between those milestones, its value was largely held down—and in March 2020, it even slipped below $14. This week, Philip Streible, chief market strategist at Blue Line Futures, told Kitco News it’s finally silver’s time to shine.

Streible stated:

“Platinum’s been on a tear, and gold has held steady above $3,300, so it’s not surprising that we’re seeing a strong rotation into silver—It’s silver’s turn.”

Longtime gold advocate Peter Schiff has argued several times this week that bitcoin’s price peaks are merely a “distraction,” insisting that silver is the true standout in today’s market. “Despite bitcoin’s new high today, had you followed the advice to sell bitcoin and buy silver in yesterday’s post, you would be better off. Plus, you would have taken on a lot less risk,” Schiff said on Friday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。