Original | Odaily Planet Daily (@OdailyChina_)

_

Being a Bitcoin investor is tough; every day is filled with the fear of rising prices.

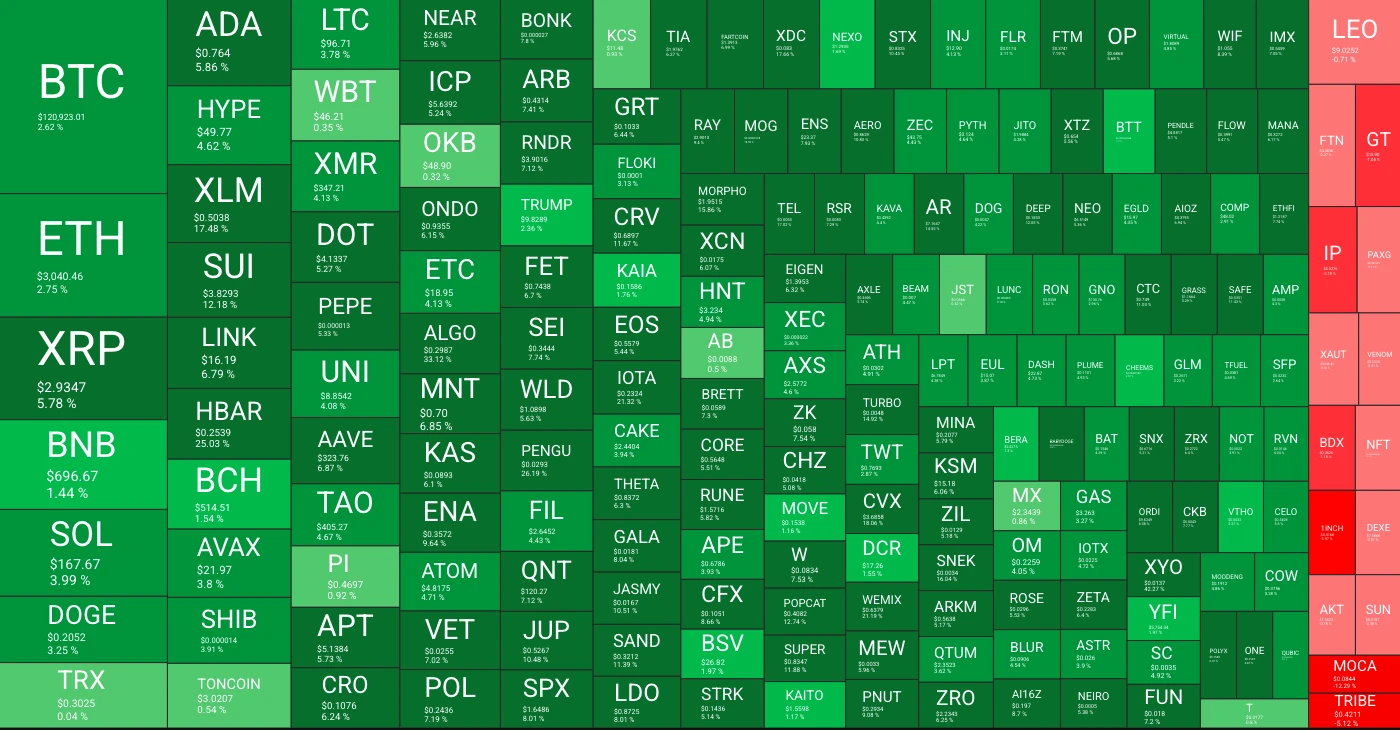

According to OKX market data, Bitcoin has risen today, breaking the $120,000 mark for the first time, setting a new historical high. Altcoins are also performing well; based on Quantify Crypto data, among the top 200 altcoins by market capitalization, only 15 tokens have declined in the past 24 hours, while the rest are on an upward trend. HBAR has surged over 25% in the past 24 hours, and SUI has increased by over 12.18%. Major altcoins like ETH, SOL, BNB, and XRP have also seen gains of 1-5% in the past 24 hours.

Meanwhile, cryptocurrency-related stocks in the Hong Kong market have also seen significant gains, with OKC Cloud Chain rising over 30%, Xiong'an Technology up 18%, and Blueport Interactive increasing by over 10%.

Just by looking at the above image, one can tell that the situation is very positive. However, unlike the previous breakthroughs of Bitcoin at $69,000 and $100,000, the market sentiment does not seem to exhibit much FOMO. Although social media is filled with various good news reports, community group chats are unusually quiet. Have industry insiders already taken profits and exited? Why is no one shouting "Take Off" this time?

Investors Numbed by Bitcoin's Rise

Even a small rebound in altcoins after an 80% retracement can excite trapped investors into calling for a bull market; however, with Bitcoin continuously reaching new highs, even if no investors are currently trapped, the relative percentage gains are becoming increasingly insignificant, leading to numbness. Moreover, with the continuous positive developments in global cryptocurrency regulatory policies, an increase in Bitcoin treasury-listed companies, and the compliance operation phase of stock tokenization, Bitcoin has recorded three consecutive months of monthly gains since April 2025, with an increase of over 46% in three months.

The excitement threshold for investors is gradually rising, with more expectations placed on altcoins. Google Trends data also shows that public interest in Bitcoin searches is far below the levels seen during the bull markets of 2017 and 2021.

The latest report from 10x Research also points out that Bitcoin's recent historical high is not driven by market speculation but stems from deeper macroeconomic changes. The increase in the U.S. debt ceiling by $5 trillion, massive deficit spending, and the upcoming cryptocurrency policy report from the Trump working group are collectively reshaping the macro landscape. The report suggests that Bitcoin has transformed into a macro asset that hedges against unchecked fiscal spending, fundamentally changing its narrative logic. The FOMC meetings on July 22 and 30 could become key catalysts for redefining Bitcoin's role in the financial system.

Therefore, regarding Bitcoin's breakthrough of $120,000, there is no direct stimulus in the market; rather, it is the result of a series of previously favorable developments continuing to ferment. Cryptoquant analyst Axel Adler Jr. also provided reasons for the July rise from an empirical perspective, stating, "Based on historical data from 2012 to 2025, July is one of the most reliable months for Bitcoin growth: 10 out of 14 cases (71%) showed positive returns. Additionally, October has the highest reliability, with the proportion of 'positive' months reaching 77%."

Altcoins Show Improvement but Fall Short of Expectations

Another significant reason affecting market sentiment may be that although altcoins have seen gains since July 11, they have not met investors' expectations. According to OKX market data, after a gap of five months, ETH has today risen above 3050 USDT (February 3), but sadly, five months ago (February 3), Bitcoin's highest price was $102,500, meaning Bitcoin still has a 17% increase, while Ethereum has remained stagnant.

The trend of "Bitcoin's unique strength, with altcoins not following or even declining" has been a topic of ongoing discussion among investors since 2024. At that time, Bitcoin was supported by the U.S. Bitcoin spot ETF and institutional purchases, while altcoins faced crises of VC trust, large unlocks causing sell-offs, and meme coins siphoning off speculative funds, making shorting altcoins a primary trading strategy. Thus, even until now, some investors still harbor reservations about altcoins and do not hold high hopes for the altcoin season.

However, the cryptocurrency market is ever-changing, and as investors, we should assess the situation and adjust accordingly. Bloomberg ETF analyst James Seyffart released a prediction in July regarding the approval probability of cryptocurrency spot ETFs by the end of 2025, indicating that the SEC may approve multiple altcoin ETFs in the second half of 2025, with LTC, SOL, and XRP having a 95% approval probability, while DOGE, HBAR, Cardano, Polkadot, and Avalanche are expected to have a 90% approval probability. SUI is projected to have a 60% approval probability, and Tron/TRX and Pengu are expected to have a 50% approval probability.

Additionally, various "altcoin" versions of micro-strategies are being established, and CZ even stated that at least over 30 teams want to launch public company projects related to the BNB treasury, indicating that altcoins will usher in an era supported by ETFs and institutional purchases.

Several KOLs have also expressed optimism about the upcoming altcoin season in July. LD Capital founder and "General E" Yi Lihua wrote that the altcoin season may have to wait until August or September after interest rate cuts are confirmed before the market truly experiences liquidity overflow.

Crypto KOL Miles Deutscher commented on the recent PUMP, where $500 million was sold out in 12 minutes, stating that "this indicates that when the right opportunity arises, there is still a significant amount of liquid capital willing to participate. Altcoins are not 'dead'; they just need the right narrative." Further reading: PUMP Sold Out in 12 Minutes, Two Scenarios After Opening, Which One Do You Believe?.

BitMEX co-founder Arthur Hayes also expressed that "the sentiment has shifted; Bitcoin has broken historical highs with good trading volume; Ethereum is following closely and will outperform, the altcoin season is coming, and the market believes Trump will take unexpected actions on tariffs. The Arthur Hayes family office fund Maelstrom has increased its bullish positions."

Of course, there are many more indications that the altcoin season is approaching, but listing them all is not as effective as the firm confidence that investors hold in their hearts. Hopefully, next time we can all shout together, "Altcoins Take Off!"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。