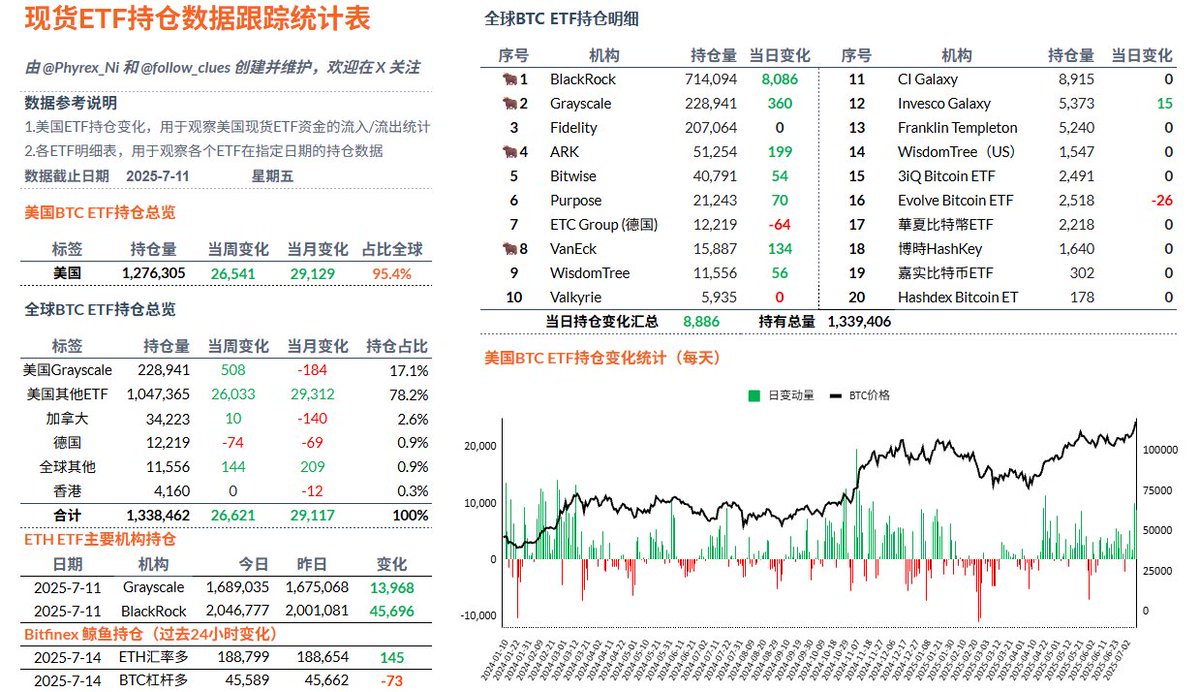

On Friday, based on trading volume and price trends, it was already possible to guess that the data for the $BTC spot ETF should be good, and indeed it was. Although it is not yet at the level of FOMO seen at the end of 2024, the consecutive new highs have still increased the purchasing power of some traditional investors. Interestingly, most of this is concentrated in BlackRock, with over 90% of the buying volume coming from BlackRock investors.

In contrast, investors from other institutions are mostly in a wait-and-see mode, with negligible buying volume, which is different from the situation on Thursday. In the data for week 78, the overall purchasing power of investors increased by about 8 times compared to week 77, indicating that the buying sentiment among traditional investors is gradually rising.

However, it is important to note that this week there are also CPI and PPI data releases, which may have some impact on the market.

Data link: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。