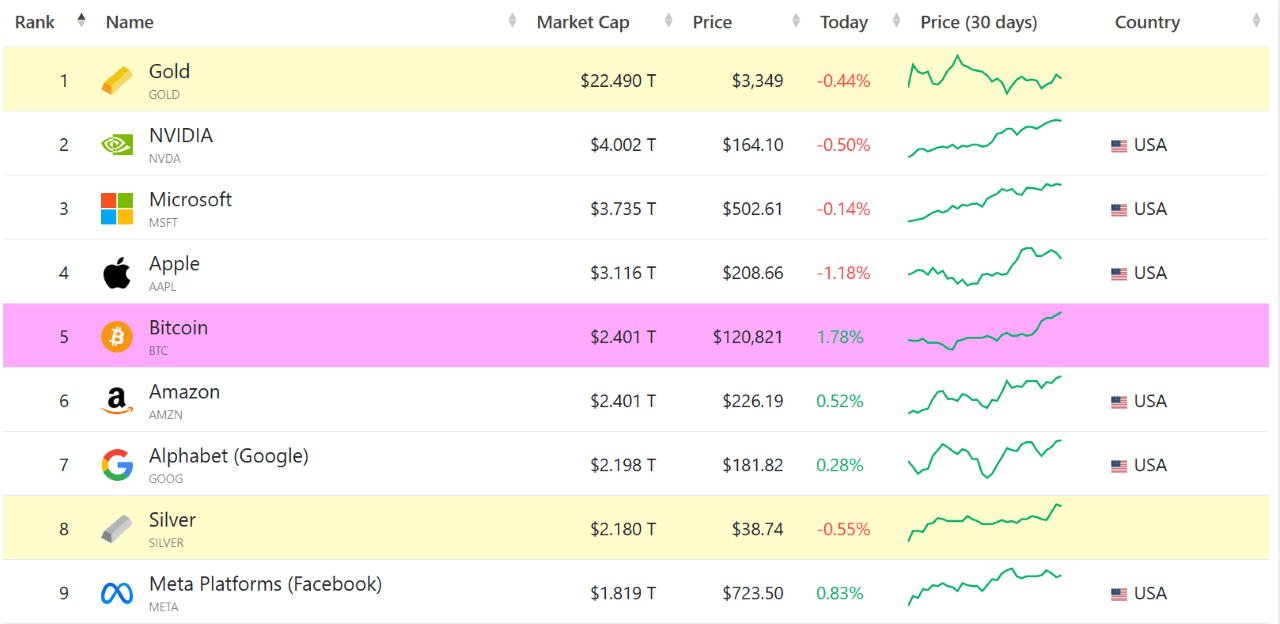

Bitcoin’s rally has gone into overdrive and at $120K, the cryptocurrency is now the fifth most valuable asset on earth, worth more than Google and Amazon. Bitcoin’s market capitalization is currently sitting at approximately $2.4 trillion, just a hair above Amazon’s market value, but significantly more than Google (Alphabet) which is valued at a little under $2.2 trillion.

( BTC at $120K is now worth more than many of the largest tech firms such as Amazon, Google, and Meta / companiesmarketcap.com)

Institutional capital has been pouring into the BTC ecosystem ever since the launch of the first bitcoin exchange-traded funds (ETFs) in early 2024. That inflection point was further buoyed by U.S. President Donald Trump’s landslide victory in November. The Trump administration has been crucial in creating a crypto-friendly regulatory environment. The nomination of Paul Atkins as chairman of the Securities and Exchange Commission (SEC) was perhaps the most pivotal regulatory development this year.

Then a curious trend began to take shape. Dozens of companies with no connection to bitcoin started raising ungodly amounts of capital to purchase bitcoin for their balance sheets. The blueprint came from the success of software firm turned bitcoin treasury company Strategy (Nasdaq: MSTR), whose Chairman Michael Saylor stumbled upon the cryptocurrency in 2020 while looking for a place to park his firm’s $500 million in cash assets during Covid’s ultra-low interest rate environment. MSTR has since skyrocketed by more than 3,700%, inspiring numerous copycats and triggering a deluge of institutional BTC purchases.

And now, it appears a perfect storm has taken shape, and multiple tailwinds have helped bitcoin reach uncharted price territory, making the cryptocurrency even more valuable than some of the most iconic tech firms that have ever existed.

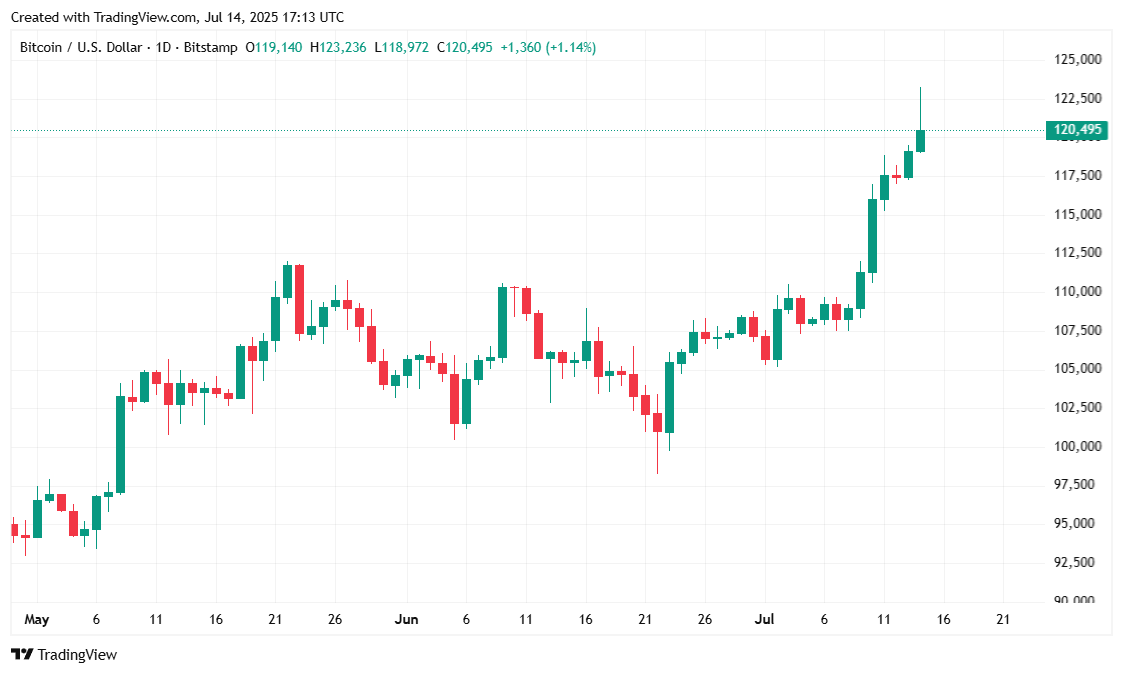

Bitcoin is currently trading at $120,469.84 as of this writing, although its price has bounced around between $118,346.59 and $123,091.61 over the past 24 hours according to Coinmarketcap. The current price represents a 1.53% increase since yesterday and a much larger 11.51% jump over the past week.

( BTC price / Trading View)

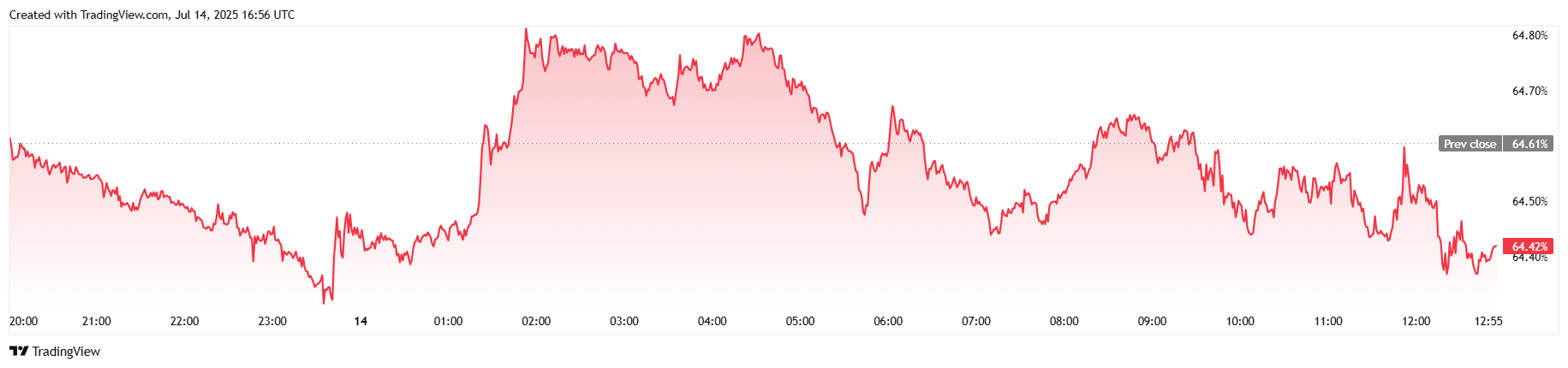

Trading volume soared $280.04% since yesterday to $177.71 billion. Even with the expected weekend surge factored in, the triple-digit increase in volume is significant. Bitcoin’s market capitalization rose 1.33% over 24 hours and was at roughly $2.4 trillion at the time of reporting. BTC dominance edged lower by 0.33% 64.42%, despite the increase in market value. The slightly lower dominance ratio hints at a corresponding altcoin rally.

( BTC dominance / Trading View)

The total value of BTC futures open interest climbed 4.10% over 24 hours to reach $88.13 billion. Bitcoin liquidations have been heavy since last week, and the case remains as such at the time of writing. Coinglass currently has total BTC liquidations at $486.62 million, with short sellers once again being responsible for the lion’s share of losses. Shorts lost $435 million while bulls with long positions had a smaller but non-trivial $51.61 million wiped out.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。