Crypto Week 2025: Will U.S. Crypto Bills Set a Global Legal Standard?

The United States Congress has officially kicked off the Crypto Week schedule, and it may turn into one of the most important weeks for digital assets in 2025. As it began on July 14, U.S. lawmakers started discussing three major U.S. crypto bills : the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act. But this debate has turned into more than just a U.S. matter—it might shape how the whole world handles digital assets.

Crypto Week 2025 : A Turning Point in Regulation?

The Week US debate started in the House Committee on Rules. Three bills, mostly supported by Republicans, are at the center:

-

CLARITY Act : Gives the Commodity Futures Trading Commission (CFTC) more control over digital commodities and limits SEC involvement in mature blockchains.

-

GENIUS Act 2025 : Focuses on regulating stablecoins with 1:1 reserves and applying strict financial laws like the Bank Secrecy Act.

-

Anti-CBDC Surveillance State Act : Tries to stop the Federal Reserve from launching a Central Bank Digital Currency (CBDC) due to privacy concerns.

While Republicans praised these bills as steps toward innovation and freedom, Democrats like Jim McGovern and Maxine Waters raised concerns. They called it Trump’s bill strategy, pointing to conflicts of interest with World Liberty Financial—a firm linked to Donald Trump’s family. Their coins, USD1 and TRUMP, have also been criticized.

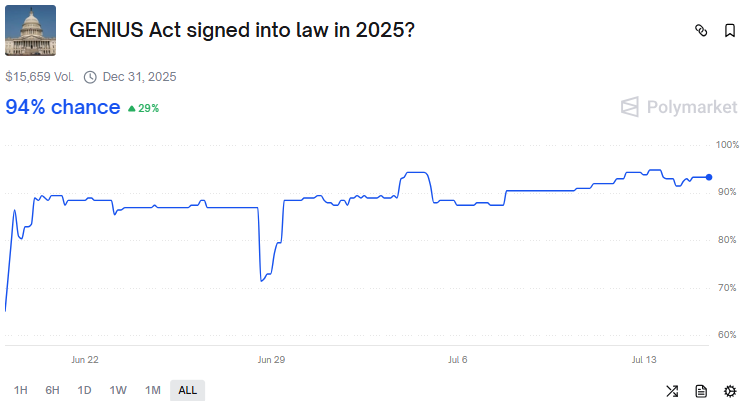

Still, the GENIUS Act status looks strong—it has bipartisan support and a 94% chance of passing according to prediction markets like Polymarket.

Source: Polymarket

But the CLARITY Act crypto bill has only a 52% prediction rate, showing mixed confidence.

Why Is the World Watching Crypto Week News Closely?

Other countries are observing the developments. That’s because the U.S. still sets a strong example for global finance. If these bills pass, it could:

-

Reduce legal confusion around digital assets in the U.S.

-

Encourage fair innovation

-

Build stronger trust in digital currencies

-

Inspire countries to update their own digital asset laws

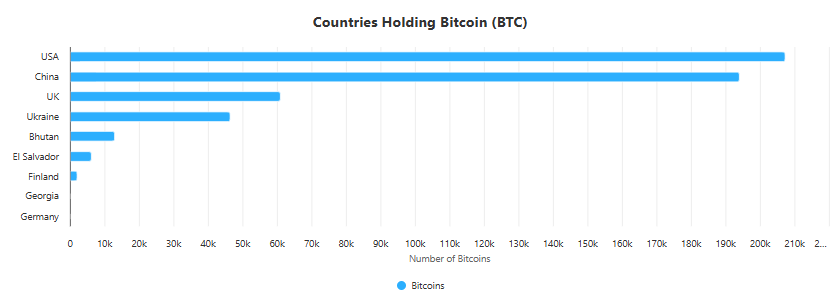

Crypto regulation in the US has always been closely linked to global actions. If the U.S. provides clearer and stricter rules, it might push countries like Japan, UAE, Switzerland, and El Salvador to follow. Even big Bitcoin holders like China, Ukraine, Bhutan, and Nigeria could build stronger frameworks in response.

Source: Bitbo

In fact, these nations were named in a recent Bitbo report as top Bitcoin holding countries. With clearer U.S. laws, they can also increase investor confidence, attract businesses, and reduce scams.

Where the Global Regulations Stand Now

Data from Chainalysis shows that most countries are still behind in full regulation. Here's what the numbers say:

-

Only 8 out of 25 major jurisdictions have full rules (under 20% market coverage)

-

58% of the market has AML/CFT laws, but gaps remain

-

Just 21% of the market has anti-market abuse rules

-

Consumer protections vary widely, often limited to advertising policies

So, passing these regulation bills during Crypto Week US could be a big leap forward not just for America—but for everyone. As this debate heats up, so does the market. On July 14, 2025, Bitcoin all time high was recorded at $123,091.61. However, at the time of writing, Bitcoin is down to $117,082.51, with a $2.33 trillion market cap.

Source: CoinMarketCap

If passed, these U.S. crypto bills will create clear rules for digital assets, inspiring countries worldwide to adopt similar frameworks. This global regulatory alignment will reduce legal uncertainty, curb scams, and attract institutional investors—boosting trust, stability, and growth in the crypto market. It's a strong positive signal for mass adoption.

Conclusion

This Week news could be the start of a new era for the digital asset world. If the bill trio is passed, then America will be a leader in developing balance-based regulations for innovation and security. It may not influence just Americans—it may set the standard for crypto laws globally. What happens this week may determine the future of assets not only in America, but globally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。