Crypto Mining Taxes to Fund Kazakhstan Crypto Reserves

Kazakhstan Crypto Reserves to Include Seized Assets

Kazakhstan Crypto Reserves eyes on bitcoin as it Hits All-Time High. The Nation may soon begin investing some of its gold and foreign exchange pools, as well as the assets of the National Fund, in virtual market related instruments such as ETFs and shares linked to the electronic currency industry. Timur Suleimenov, the head of the country's National Bank, made this announcement at a recent press conference.

Source Wublockchain

Furthermore, the director of the National Bank stated that the country intends to establish a governmental treasury to deposit digital assets seized by law enforcement agencies. A separate infrastructure will be built for electronic currency.

Kazakhstan Crypto Reserves include plans for both portfolio investments and electronic currency that have been seized by law enforcement. It may also receive a portion of state-mined assets as mandatory contributions or tax payments, and will hold currency that has been seized from illegal operations. Suleimenov states that "such assets can bring high returns, but at the same time they are highly volatile." He also indicated that the government will be cautious while making choices about investments.

Bitcoin Mining Revenue Could Feed Kazakhstan Reserves

According to Suleimenov, if individual firms mine digital assets on behalf of the state, some of these assets may be transferred to the state treasury as taxes or mandated payments. Similar examples exist in practice around the world. Bitcoin trading in the country is limited to AIFC-approved exchanges. Kursiv previously claimed that the nation aims to impose administrative and criminal liability for "gray market" transactions using electronic money. The National Bank also aims to outlaw advertising for digital assets.

Global Trend of blockchain currency Adoption Inspires Kazakhstan Crypto Reserves

Source CoinGecko

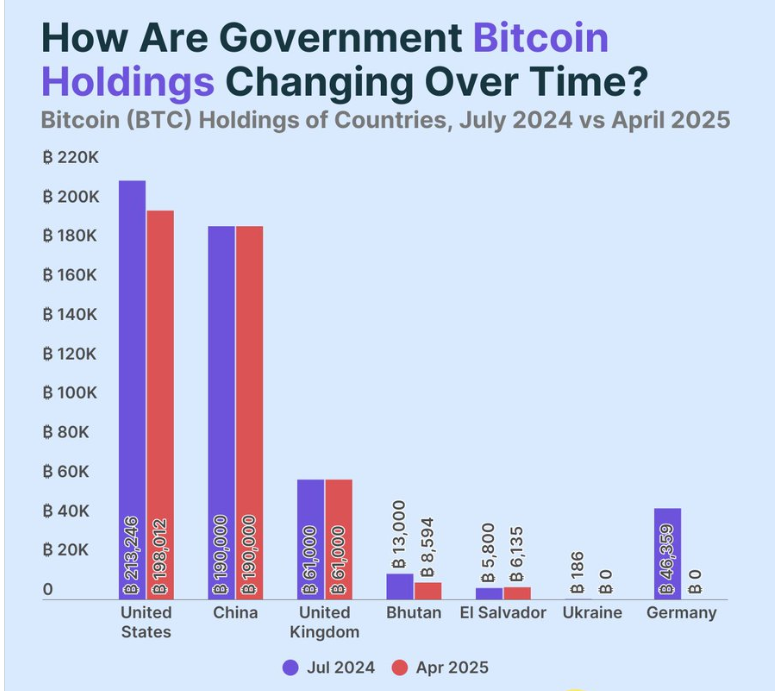

According to the data shown the government Bitcoin holdings have increased significantly, with 463,000 Bitcoin being held by nations worldwide, or roughly 2.3% of the entire supply. The US government remains the largest holder with approximately 198,012 BTC (as of Apr 2025).

China remains the second-largest and now holds 194,000 BTC. Whereas the UK acquired all BTC through crime-related seizures and holds 61,000 BTC (~$5.6 billion). Some nations, like El Salvador have actively increased their holdings, whereas the United States of America and Germany have liquidated their holdings. While Bhutan has mined between approx 12,000 BTC using its hydropower resources and recently in past weeks the government has liquidated 2,262 BTC ($200.46M) in six large-scale transactions, with an average selling price of $88,612 per BTC, despite the ongoing sell-off, maintaining a substantial Bitcoin treasury. This pattern includes a range of acquisition tactics.

Kazakhstan crypto reserves initiative would continue as a trend of countries around the world increasingly treasury. The choice made by Trump to create a Bitcoin treasury may have been the most visible example of adoption at the state level.

Final Thoughts

Kazakhstan Crypto reserves demonstrates a shift in institutional tactics toward digital asset adoption by creating treasury and using sovereign investing methods. This step signifies the nation's formal position in the increasing digital economy, as well as a broader institutional trend toward digital asset use. The country's plan to implement the initiatives of Kazakhstan crypto reserves is an important step toward building a stronger digital economy.

Also read: Federal Regulators Greenlight US Crypto Custody for Banks免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。