Entering the third quarter of 2025, the "zero-threshold issuance" of meme coins on Solana has intensified. During the first weekend of July, the minting volume of LetsBONK.fun surged to 16,800 coins, capturing a 51% market share, surpassing Pump.fun for the first time (7,500 coins, 39.9%). Meanwhile, Pump.fun announced its token issuance and completed fundraising, launching trading in the early hours of July 15. As a platform that once led the frenzy, its direction has become a key indicator for the future trends of the meme market.

Such high-frequency "simultaneous issuance and speculation" has drastically compressed the lifecycle of the primary market—most new meme coins complete a cycle of explosive growth and sharp decline within a few days, with only a few (like USELESS, which once surpassed a market cap of $300 million) surviving and extending their popularity to the secondary market.

In this scenario of oversupply and extreme differentiation, the spot and contract markets of centralized exchanges (i.e., the secondary market) have become crucial arenas for testing the sustained value of meme coins, accommodating liquidity, and providing hedging tools. The following will focus on three mainstream CEXs: LBank, MEXC, and Bitget, using the latest 30-day returns, liquidity depth, spread costs, and risk control data to objectively compare their comprehensive performance in the meme sector, helping investors make professional and objective judgments:

As the primary market enters a "mass minting and mass elimination" phase, which exchange can convert short-lived themes into actionable and stable returns in the secondary market?

Price Increase and Returns: Which Platform Performs Best for New Coins?

For investors in meme coins, the most concerning aspect is the price increase performance after a new coin is launched. A comprehensive comparison of data from the past 30 days shows significant differences in the return performance of new meme coins across the three platforms: LBank, MEXC, and Bitget.

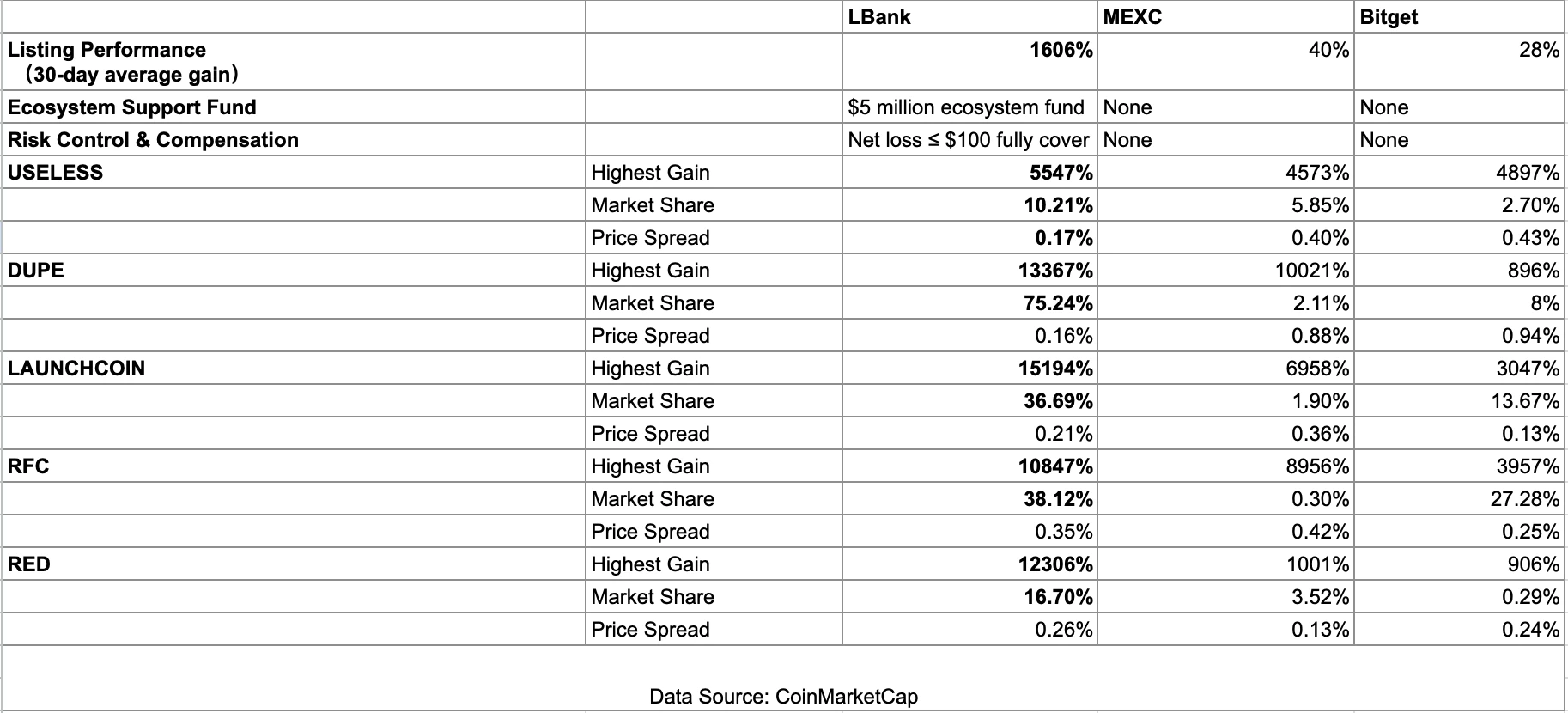

Comparison of Meme Sector Data Across Three Platforms: The above data compares key performance indicators in the spot and contract markets for meme coins on LBank, MEXC, and Bitget, including average price increase, ecological fund support, risk compensation mechanisms, and the highest price increases, market shares, and spreads of several typical meme projects.

First, in terms of the average price increase of meme coins 30 days after launch, LBank is far ahead. In the dimension of 30-day average price increase, LBank remains a "high scorer" among the current samples—with an officially disclosed average of about 1,606%, a figure significantly higher than MEXC's 40% and Bitget's 28%.

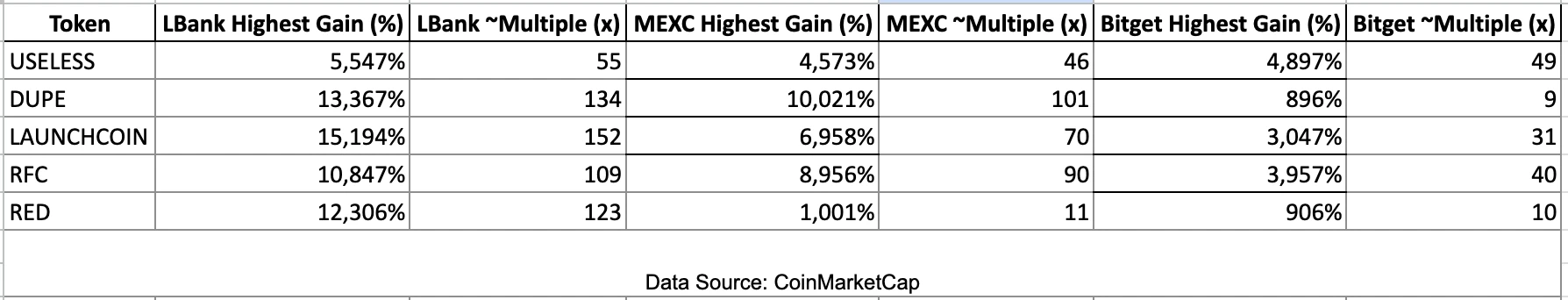

This difference in return performance is also reflected in specific cases. Taking a few recent typical meme coins as examples:

USELESS: After listing on LBank, the highest price increase reached about 55 times (≈5547%), slightly higher than MEXC's 47 times and Bitget's 49 times.

DUPE: LBank's highest price increase astonishingly reached 134 times (≈13367%), significantly ahead of MEXC's 101 times, while Bitget only saw about 9 times, showing a stark contrast.

LAUNCHCOIN: LBank increased nearly 152 times, while MEXC saw about 70 times and Bitget about 31 times, demonstrating LBank's advantage in discovering such hundredfold coins.

RFC: LBank increased 109 times, slightly higher than MEXC's 90 times, while Bitget was around 40 times.

RED: LBank increased over 124 times, while MEXC and Bitget only had increases of about 11 times and 10 times, respectively.

The LBANK EDGE section is currently performing quite well, but since its launch on June 12, it has listed fewer than 20 assets, meaning any extreme price increase of a single coin will significantly raise the overall average.

In contrast, MEXC and Bitget have launched dozens of meme coins, making their sample distribution closer to the "entire market," naturally including many mediocre or even declining projects, which lowers the average.

These coins have often completed their first round of explosive growth on-chain or on other smaller exchanges, and LBank only allows Edge listings at this point, meaning users may miss out on the initial 0→10× early-stage dividends.

LBANK EDGE

Coin Listing Rhythm: Only 12 assets listed, with strict low-frequency screening.

Listing Timing: Typically opens after the first round of on-chain explosive growth ends and cross-exchange liquidity stabilizes.

Wealth Effect: 30-day average price increase of about 1,606%, with a high hit rate for hundredfold coins; however, users often miss the first few hours or days of hundredfold openings.

Risk / After-sales: Provides "net loss ≤ 100 USDT full compensation" and a $5 million ecological fund.

MEXC (including DEX+)

Coin Listing Rhythm: Adheres to "large inflow and outflow," with hundreds of new meme coins listed monthly, almost zero threshold.

Listing Timing: Tokens are listed as soon as on-chain heat begins, and can also connect directly to Uniswap, Pancake, etc., via DEX+, closest to T0.

Wealth Effect: High-multiple coins frequently emerge (the average peak value of the top 10 in a single month is about 8×), but a large number of long-tail projects dilute the average, resulting in a 30-day average increase of only 40%.

Risk / After-sales: No spot compensation or centralized fund; offers 0 trading fees and up to 200× contracts—high leverage, high self-bear risk.

Bitget

Coin Listing Rhythm: More cautious in listing, fewer coins, slower rhythm, often listing after project heat has settled.

Listing Timing: Usually later than LBank, essentially missing the initial explosive growth, focusing on later liquidity.

Wealth Effect: 30-day average increase of about 28%, with the highest increases generally lower than those of LBank and MEXC.

Risk / After-sales: Has a contract insurance fund and liquidation protection; supports Copy Trading, quantitative robots, and GetAgent AI, with controllable strategies.

The above data indicates that LBank stands out in terms of price increases for meme coins, partly due to its strict selection of quality seeds (projects with greater potential for hundredfold explosions); on the other hand, it also benefits from the platform's own liquidity support and user base. MEXC, due to its almost "no coin unlisted" policy, has captured many high-multiple projects but also includes many underperforming coins, which lowers the average performance. However, it is worth noting that MEXC launched 160 new projects in April 2025 alone, with the average peak increase of the top 10 reaching as high as 832% (8 times), indicating that its users also have opportunities to capture impressive returns. Bitget tends to list relatively mature or already popular meme coins, missing some of the initial explosive growth phase, thus resulting in the smallest overall increase. This also reflects Bitget's more cautious listing style: prioritizing stability over chasing high volatility. Overall, if investors seek short-term explosive returns, LBank's EDGE section undoubtedly offers a higher success rate; MEXC provides a broader opportunity pool, requiring investors to discern themselves; Bitget is suitable for those who prefer stability and entering after the frenzy subsides.

Liquidity and Slippage: Comparison of Trading Depth and Costs

In addition to price increases, trading liquidity and slippage (the bid-ask spread) are also core indicators of concern for users. Platforms with sufficient liquidity can ensure that large buy and sell orders have little impact on prices, resulting in low slippage and a better trading experience. From the market share and spread data of several meme coins, the differences in liquidity among the three platforms are also evident. In this section, we selected several of the hottest meme coins recently as primary observation data.

In terms of market trading share, LBank occupies a major market share for several new meme coins. For example, over 75% of the trading volume for the coin DUPE occurs on LBank, far exceeding MEXC's 2.11% and Bitget's 8%. This means that most DUPE holders and traders choose to buy and sell on LBank, which has almost become the primary market for this coin. Similarly, LAUNCHCOIN has about 36.7% of its trading volume on LBank, significantly higher than MEXC's 1.9%, and although Bitget has a 13.7% share, it still falls short of LBank. For some projects like RFC, LBank and Bitget split the main market (approximately 38.1% and 27.3%, respectively), while MEXC is almost absent (only 0.3%).

Overall, LBank often captures a large share of trading for popular new meme coins, indicating higher user participation and more active trading for these coins; Bitget has a certain share in individual coins but often occupies a secondary market position; MEXC, due to the large number of projects, has its liquidity dispersed, resulting in a smaller share in these examples. It should be noted that MEXC does not necessarily list every coin—users may trade coins not officially listed on exchanges through its DEX+ aggregator, resulting in a lower concentration of transactions within the exchange.

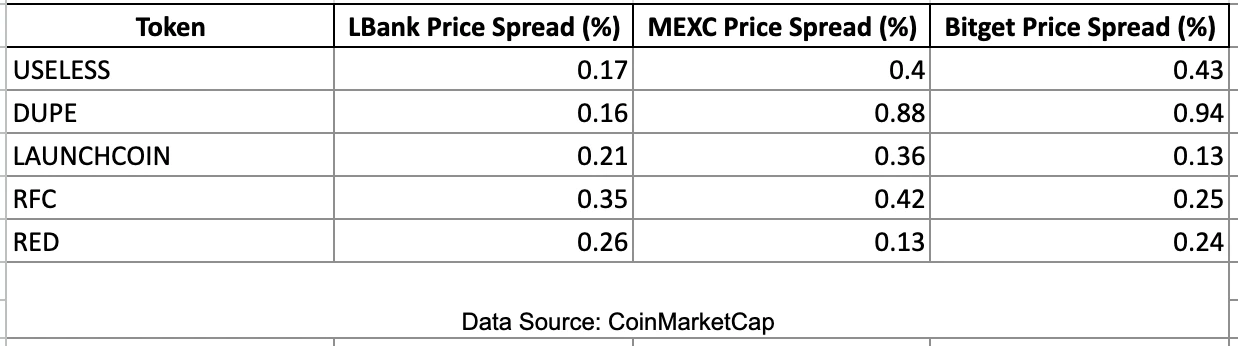

In terms of price spread (slippage), LBank also demonstrates overall superior trading depth. Measured by the bid-ask spread percentage, most meme coins on LBank maintain a spread in the range of 0.1% to 0.3%, which is quite tight. For example, the spread for USELESS on LBank is about 0.17%, while on MEXC it is 0.40% and on Bitget it is 0.43%; DUPE has a minimal spread of only 0.16% on LBank, whereas MEXC and Bitget have spreads as high as 0.88% and 0.94%, respectively, showing a difference of an order of magnitude. A smaller spread indicates better order book depth and sufficient buy and sell orders, resulting in less slippage for users trading at market prices. Overall, LBank provides more ample liquidity support for these coins and attracts more market makers and traders, making market pricing more efficient. In contrast, some long-tail meme coins on MEXC and Bitget experience larger spreads due to inactive trading and sparse order books, meaning investors may face higher hidden costs if they trade recklessly.

However, there are exceptions: for LAUNCHCOIN, Bitget's spread is only 0.13%, slightly better than LBank's 0.21%, indicating that when Bitget provides liquidity support for specific coins, its trading depth can also approach leading levels. Similarly, RFC has a spread of about 0.25% on Bitget, also due to Bitget having a considerable share of that coin's market. But overall, for most newly launched meme coins, MEXC is limited by resource dispersion and the abundance of long-tail coins, resulting in sometimes lower single-coin liquidity compared to more focused platforms; Bitget has ample liquidity for mainstream meme coins but relatively lacks depth for small-cap coins; LBank offers the deepest trading depth and lowest slippage, making it suitable for large capital high-frequency trading.

Risk Protection and Ecological Support: Protecting User and Project Interests

When investing in high-volatility meme coins, risk control is equally important. The three platforms adopt different strategies for user protection and project ecological support, with LBank's measures being the most noteworthy.

In terms of user risk protection (compensation mechanism), LBank not only has a $100 million risk protection fund for mainstream coins but also launched a unique mechanism for novice traders on LBANK EDGE, offering "full compensation for net losses ≤ 100 USDT within a specified time for new coins." Simply put, if a user incurs a net loss of no more than 100 USDT in a single meme coin transaction, the platform will fully compensate them. This effectively provides a "safety net" for new users trying out small amounts in the highly volatile meme market. This measure is rare in the industry and is seen as a major highlight for LBank in attracting newcomers to meme coin trading. In contrast, MEXC and Bitget do not have dedicated spot trading compensation policies (most exchanges do not have such precedents); users must bear all market risks themselves. Of course, both platforms have regular risk reserves and liquidation protection mechanisms for contract trading, but there are no compensation plans for losses incurred from trading new coins in the spot market. It can be said that LBank's compensation mechanism is effective in protecting user confidence, lowering the psychological barrier for new users to try high-risk assets.

In terms of project support and user risk protection, LBank's financial investment far exceeds the initially publicized $5 million Edge ecological fund. This fund is primarily used for the subsequent liquidity, market promotion, and technical integration of newly launched meme projects, ensuring that quality projects still have "operational funds" after the first round of explosive growth. Meanwhile, LBank announced the establishment of a $100 million Futures Risk Protection Fund in February 2025: when major perpetual contracts like BTC, ETH, and SOL deviate from their reasonable price by more than 2% within one minute and quickly rebound, users who incur losses due to liquidation or stop-loss will receive 120% USDT compensation, credited to their spot accounts within 48 hours, along with an additional airdrop of 10,000 USDT to all users holding positions, greatly enhancing the predictability of high-leverage trading. In addition to regular protection, LBank continuously invests in industry public welfare and community assistance: in March 2024, it led the establishment of the Slerf donation pool, publicly raising over 2,600 SOL through an on-chain address to compensate users who did not receive SLERF private placement shares; in August of the same year, it reached a strategic cooperation with GMGN.AI to build a shared discovery and liquidity network for the meme super cycle. In February 2025, LBank once again collaborated with MEXC Ventures, HashKey Capital, SevenX Ventures, and Mask Network to launch a $15 million donation plan to compensate community users affected by the DEXX private key leak and established the Meme Prosperity Committee to publicly disclose the allocation progress. It is evident that LBank has integrated its funding system into three main lines: "long-term project operation, extreme market compensation, and industry accident relief," providing both capital support for the meme ecosystem and a quantifiable, traceable safety net for users.

In contrast, MEXC and Bitget have not yet announced any ecological fund plans specifically targeting meme coins/new projects. MEXC focuses more on attracting projects through airdrop incentives, such as its "Airdrop+" event in April 2025, which attracted over 40,000 users and distributed approximately $1.5 million worth of new coin rewards; these marketing activities increased project exposure but are user incentives rather than direct investments in the projects themselves. Bitget currently does not have a dedicated project support fund, although it has previously launched activities like Launchpad/Launchpool and its venture capital department has participated in some project investments, but these do not equate to ongoing ecological support. Overall, LBank conveys long-term confidence in the selected projects to the market through its substantial ecological fund, providing users with a "reassurance"—the project parties are more likely to continue operating with financial support. In contrast, MEXC and Bitget are more conservative in this regard, primarily allowing the market to dictate project performance, lacking additional bottom-line measures.

Vertical Products and Strategy Support: Trading Tools and Investor Adaptation

In the competition for users in the secondary market for meme coins, each platform not only competes in terms of coin selection and returns but also launches distinctive vertical product modules and strategy support tools to meet the needs of different investors.

LBANK EDGE: Positioned as the "100x Meme Zone" – LBANK EDGE focuses on discovering hundredfold potential coins. EDGE integrates features such as AI screening, rapid listing mechanisms, and user protection. Nearly 60% of the new projects listed on LBank are meme assets. Through EDGE, LBank rigorously screens and empowers early projects: the listing speed is fast but the quantity is carefully selected (currently, a total of 12 EDGE projects have been launched), while also providing financial and operational resources to boost project growth and offering the aforementioned compensation measures for novice losses to reduce user risk. It can be said that LBANK EDGE resembles a boutique meme trading zone, helping users filter out projects with explosive potential while enjoying the protection provided by the platform. It is suitable for investors with medium to high risk tolerance who hope for platform endorsement—these users seek high returns but also value a certain level of protection and project quality screening from the platform, preferring not to "needle in a haystack" through thousands of miscellaneous coins. Through EDGE, these users can position themselves early in quality meme projects, enjoying high returns while partially transferring the black swan risk to the platform within a certain timeframe.

MEXC DEX+: An aggregator for on-chain trading – Compared to LBank's selective approach, MEXC takes a "large and comprehensive" route and further expands its boundaries through the DEX+ module. MEXC is known for its extensive list of coins, offering over 2,950 spot trading pairs and over 1,000 contract trading pairs (including a large number of small-cap meme coins). In 2025, MEXC launched the "DEX+" decentralized trading aggregation platform, allowing users to access liquidity from decentralized exchanges directly through MEXC. Simply put, even if a new meme coin has not officially launched on MEXC, users can use DEX+ to link to on-chain markets like Uniswap and Pancake with one click, with MEXC serving as a convenient aggregation entry. This strategy ensures that "MEXC users do not miss any market hotspots," truly achieving an "all-encompassing" meme trading experience. Additionally, the MEXC platform itself offers contract trading with leverage of up to 200 times and zero trading fees to attract high-frequency traders. Overall, MEXC DEX+ is more suitable for seasoned "Degen" players and high-risk tolerant traders—they want to get involved in every hot meme coin as soon as possible, whether in centralized or decentralized markets; they have a clear understanding of risks and are adept at self-screening projects, relying less on platform endorsements and focusing more on the comprehensive tools provided by the platform (such as high leverage, low fees, and a vast array of coins) to implement their trading strategies. For these users, MEXC and its DEX+ module offer a significant degree of freedom and choice, with the trade-off being that users must bear the responsibility of discerning quality projects and controlling risks themselves.

Bitget: Advantages in Derivatives and Copy Trading – In the wave of meme coins, Bitget has not launched a dedicated "Meme Zone" product, but it still attracts a unique user base thanks to its accumulation in contract trading and social trading. Bitget has long been known in the industry for its Copy Trading feature, which covers both spot and contract trading, allowing novices to automatically replicate the actions of experienced traders. For users who want to participate in meme coin trading but lack experience, the active star traders and strategy providers on Bitget can help them formulate strategies and even directly copy trades for profit. Additionally, Bitget supports a rich array of quantitative trading tools and trading bots (such as grid trading), and in July, Bitget launched GetAgent, which can analyze real-time market conditions, market sentiment, and technical indicators using AI to provide precise recommendations. Investors can utilize these tools to implement automated strategies in the highly volatile meme market (such as shorting at highs and increasing positions at lows), improving trading efficiency. Bitget allows leverage trading of up to 125 times in contracts and offers hundreds of mainstream and popular perpetual contracts (though not as many as MEXC, it covers larger market cap meme coins like DOGE, SHIB, PEPE, etc.). Its contract liquidity and trading depth rank among the best in the industry, making it suitable for professional traders who enjoy leveraged hedging and shorting. Overall, Bitget's platform is more oriented towards derivatives; after focusing on spot trading last year, it has become more cautious with meme coin listings, making it suitable for strategic and conservative investors: on one hand, there are users who wish to participate in meme coins using professional trading tools and expert experience (such as reducing human judgment errors through copy trading and quantitative strategies); on the other hand, there are investors with lower risk tolerance who still want to benefit from hot trends, who may not rush into projects at the earliest stage but prefer to wait until a coin has some scale before engaging in bidirectional trading (long or short) in Bitget's contract market to gain profits. For these users, Bitget provides a more mature and stable trading environment and a comprehensive risk control experience, trading off slightly less coin variety for more controllable trading risks.

Other major exchanges in the industry are also launching similar vertical products to compete for users. For example, Gate.io upgraded its original "MemeBox" to Gate Alpha, launching hundreds of new projects in May 2025 alone and initiating a points system that distributed over $1 million in trading rewards to nearly 100,000 users; Binance also launched the Alpha program, introducing MEV protection and points incentives to enhance user participation, ultimately turning into a battleground for point farming, leading to a price crash for BR due to liquidity mechanisms. All of this indicates that major platforms recognize the immense potential of the meme coin market and are entering the fray with differentiated strategies. However, regardless of how innovative the strategies are, users will ultimately choose the platform that best suits their own circumstances.

Which Platform is Suitable for Whom? An Overview of Investor Profiles

In summary, LBank, MEXC, and Bitget each have their own focus in the secondary market for meme coins, with no absolute good or bad, only suitability. Investors should choose a platform based on their own risk tolerance, trading style, and capabilities:

LBank – High Returns + Protection: Suitable for users who dare to pursue hundredfold coin returns but wish for some risk control protection from the platform. Especially for newcomers to the meme market or those with medium to high risk tolerance, LBank's strict project screening, compensation mechanism, and ecological support can provide them with confidence, allowing them to enjoy high returns while obtaining an additional safety net.

MEXC – Wide Coverage + High Flexibility: Suitable for experienced players who prefer to gamble on long-tail opportunities. These users are adept at discovering hotspots on their own, capable of discerning project quality, and seek a comprehensive range of coins and trading freedom. MEXC's massive influx of new coins and DEX+ aggregated trading ensures they hardly miss any market trends, but it also requires investors to have self-risk control and screening abilities. Low fees and high leverage tools also benefit high-frequency traders in executing their strategies.

Bitget – Strategy Tools + Stability: Suitable for professional/semi-professional investors who focus on trading strategies and risk control. For users who wish to participate in meme trends using copy trading and quantitative tools, Bitget provides an ideal platform. Additionally, those who prefer contract hedging and seek opportunities after the frenzy will also favor Bitget's stable trading environment and rich derivatives product line. This platform is more suitable for rational thinkers who place a high emphasis on risk management.

In today's competitive landscape of launch platforms, Pump.fun has finally arrived at the much-anticipated TGE moment. Nowadays, under the extreme rhythm of "issuing coins in seconds, hyping in minutes, and returning to zero in hours," the entire meme track is rapidly shifting from "anyone can issue" to "everyone is confused." The frenzy of coin issuance in the primary market is indeed lively, but the next steps of where to sustain the heat, how to manage volatility, and what tools to use for hedging drawdowns have become common questions for most retail investors and project parties.

LBank, MEXC, and Bitget provide three distinctly different "secondary paths" with their unique screening logic, liquidity structures, and risk support plans— the former exchanges selection and compensation for win rates and confidence, the latter relies on extreme coverage and on-chain connections to leave ample initial windows for high-risk tolerant users, while the latter uses derivatives and strategy tools to provide a hedging haven for stable funds. As the primary market continues to experience high-frequency competition, making it difficult to distinguish between good and bad, what truly determines the investment experience may no longer be "whether one can grab the next new coin," but rather "which exchange is chosen to mitigate uncertainty." In the upcoming meme cycle, whoever can convert this heat into sustainable liquidity, measurable risks, and repeatable returns will ultimately require each user to cast their "trust vote" through their trading behavior.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。