Written by: J1N, Techub News

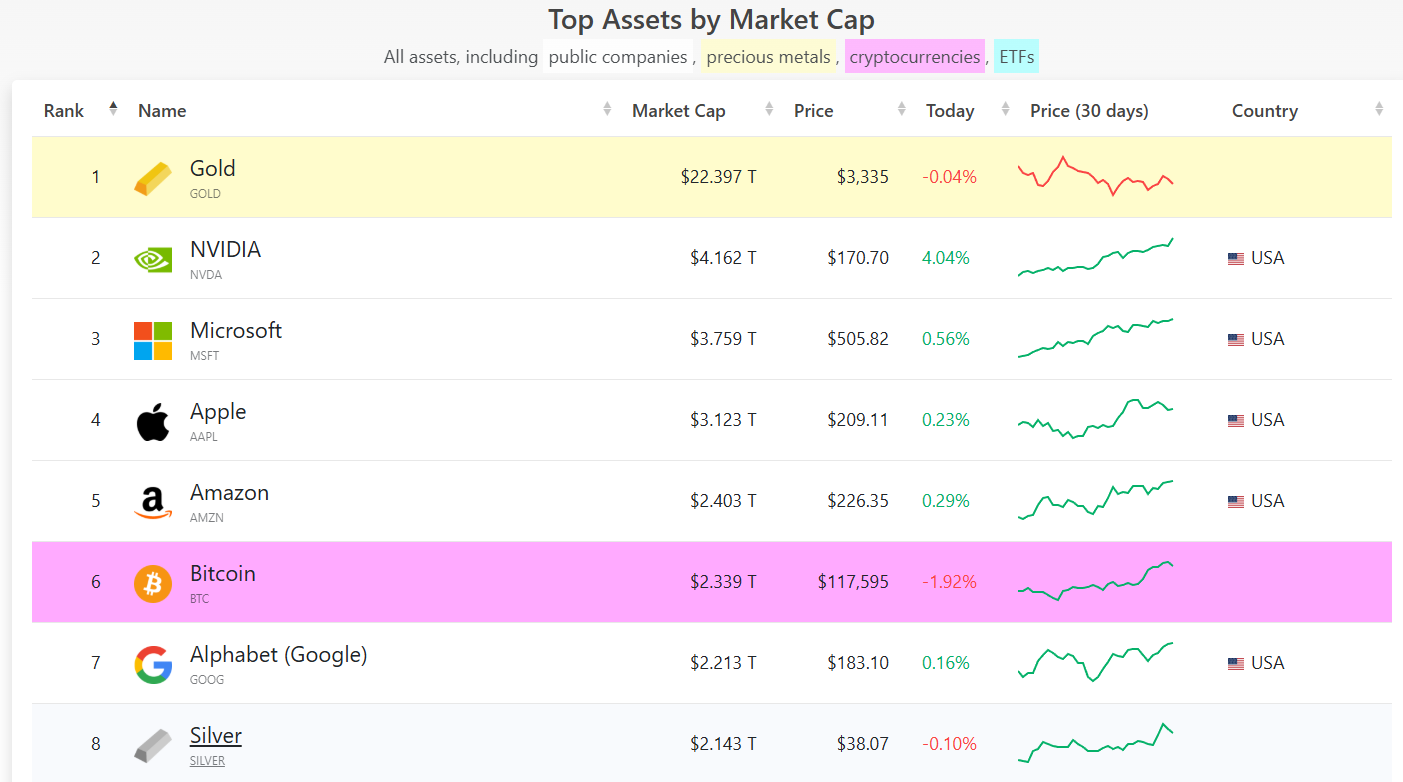

Binance's market data shows that Bitcoin reached $123,218 on Monday, setting a new all-time high and soaring nearly 13% over the past week. As of the time of writing, Bitcoin has retreated to $117,700. Its current market capitalization stands at $2.339 trillion, second only to Amazon's $2.4 trillion, ahead of silver's $2.2 trillion and Alphabet (Google)'s $2.19 trillion.

On the second day after Bitcoin broke its historical high, a Bitcoin address from the Satoshi Nakamoto era (bc1qmuxrzvnx34j8y6h9leg4zen5gnw7wmfmgp8v2p) reawakened after 14 years of silence. According to Arkham, this address transferred approximately 40,010 Bitcoins to Galaxy Digital in the past day, valued at about $4.6 billion. The address still holds 30,000 Bitcoins, worth approximately $3.54 billion. This address acquired 80,000 Bitcoins in 2011 at a price below $30, achieving over 4,000 times profit to date.

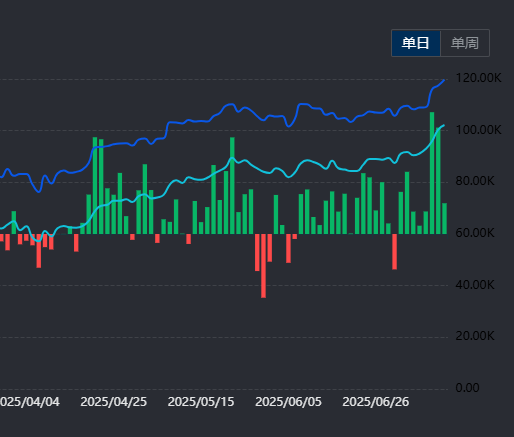

Additionally, the U.S. Bitcoin spot ETF had a strong start in July, attracting $3.6 billion in inflows so far. According to ichaingo, the last two trading days of last week set a record for net inflows of $2.2 billion, marking the largest two-day net inflow on record. Institutional inflows are often long-term and not speculative in nature, making short-term sell-offs less likely, thus providing some support for the current rebound.

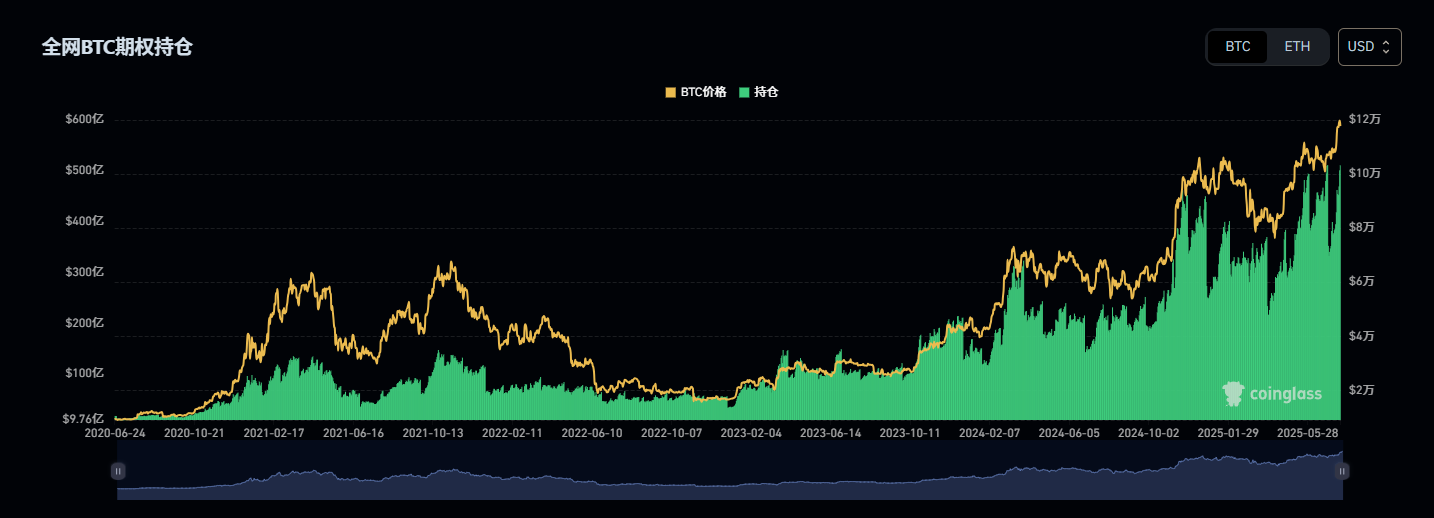

Meanwhile, data from Coinglass shows that as of Tuesday, Bitcoin options open interest surpassed $50 billion, setting a new historical high. A sustained increase in this metric typically indicates greater participation from large institutions in purchasing Bitcoin, as larger investors tend to hold larger long-term positions and use options for hedging.

Bitcoin options open interest

Furthermore, the funding rate for Bitcoin perpetual contracts remains low. Data from Coinalyze shows that the current average daily funding rate is 0.01%, significantly lower than the peak of 0.08% when it surpassed $69,000 before last year and the 0.04% when it first broke $100,000 at the end of last year. The low funding rate indicates a significant reduction in speculative demand in the market compared to previous times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。