Although M2 has been growing recently, it is still necessary to remind everyone about the liquidity issues. Currently, the overall macro data is still quite chaotic, especially with China's deflation, where various economic indicators are still struggling in the mire. Europe is affected by the 30% tariffs from the United States; today, Renault and #ASML saw their stock prices plummet due to disappointing earnings reports, which indirectly reflects the fragility of the European economy. The biggest problem now is the potential liquidity crunch caused by high long-term bond yields.

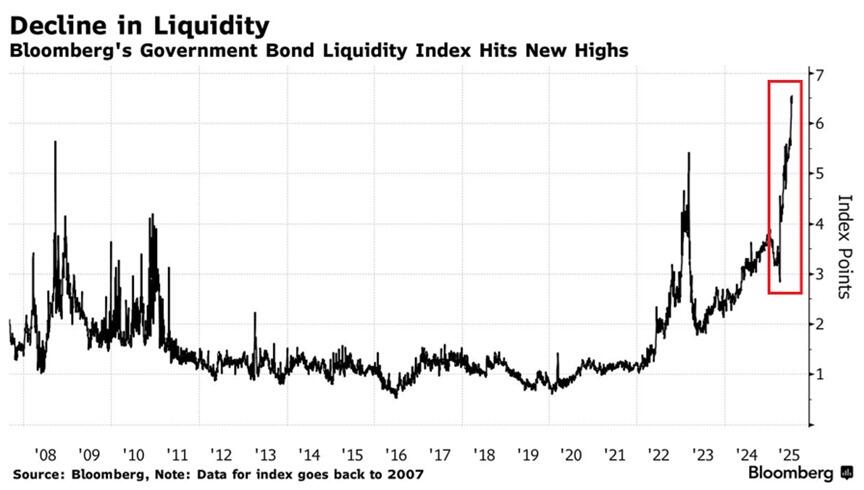

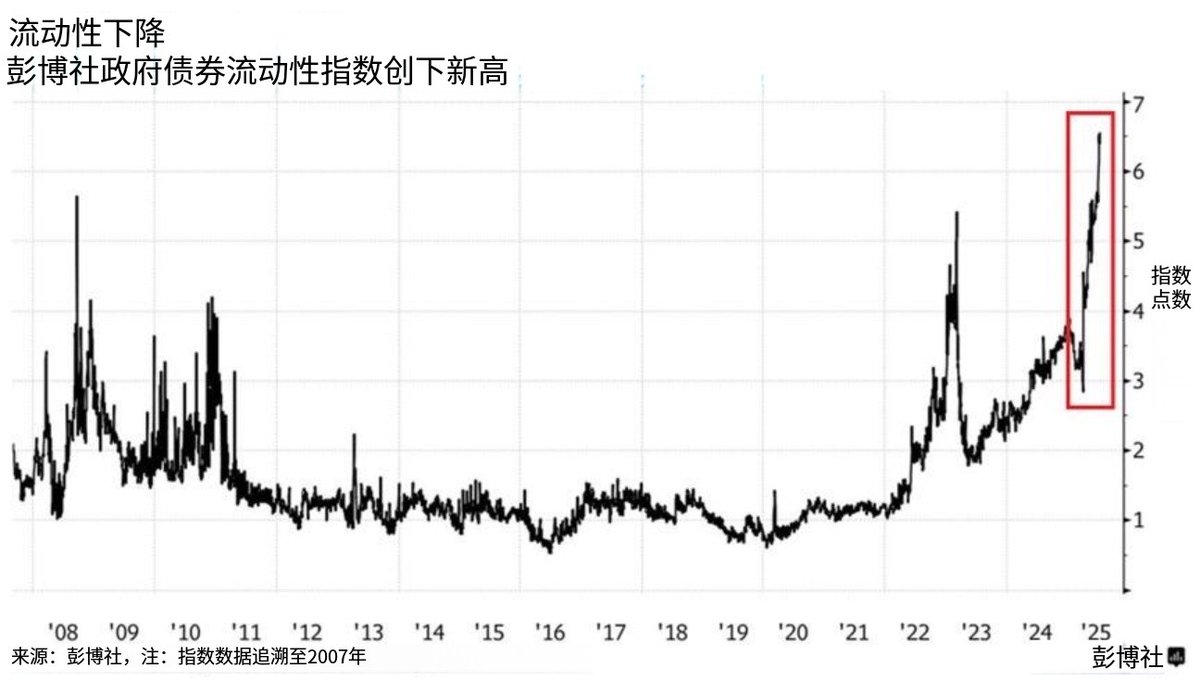

Bloomberg's government bond liquidity index (Figures 1 and 2) — simply put, the higher this index, the more difficult it is to buy and sell in the bond market, and the more "stuck" the market becomes. You can think of it as a major traffic jam suddenly appearing on a highway; it's not that no one is driving, but rather that there are too many cars on the road, the road is too narrow, and there's not enough fuel. This index has now surged to 6.5 points, reaching a historical high, even worse than during the 2008 financial crisis — this is not a joke.

Currently, the yield on Japan's 30-year government bonds has soared to 3.20%, a historical high; the yield on the U.S. 30-year government bonds has surpassed 5% (a rare occurrence in history), which is equivalent to the government issuing bonds recklessly, but no one dares to take on the debt of the U.S. and Japan, both of which are major debtors, as they have been issuing bonds on a large scale recently. Supply is surging, but demand is insufficient. Investors are leaning towards caution and are reluctant to buy, which makes it easy to trigger a liquidity crisis.

We often say that "the bond market is the foundation of the global financial system." If the liquidity of government bonds is problematic, then corporate bond issuance, bank lending, and investors' hedging will also get "stuck." Meanwhile, financing costs rise, making it harder for companies to secure funding, exposing banks to risks, and the stock market may also decline. Ultimately, this will affect the "blood circulation" of the economy, and in severe cases, it could evolve into systemic financial risk. This is also why there is an urgent need to cut interest rates now (U.S. Treasury Secretary Yellen is even considering ways to replace Powell).

In the end, the bond market is like the "heart" of the financial system, and right now, its heartbeat is becoming increasingly erratic. If this heart has problems, it will be difficult for U.S. stocks, cryptocurrencies, and real estate to remain unaffected. Therefore, we must be highly vigilant about this liquidity crisis. Although the U.S. stock market and the cryptocurrency market are still advancing rapidly, we should defend when necessary and secure profits when we can; we must not let our guard down. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。