Bitcoin's Four-Year Cycle is Broken, ETF Could Push Prices to $200,000

Author: RiskHedge Research

Translation: Baihua Blockchain

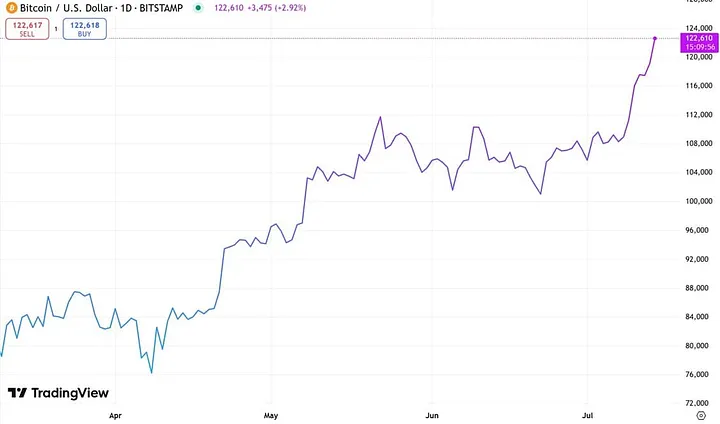

Bitcoin (BTC) is soaring.

It recently hit a historic high of $122,000 just a couple of days ago:

Image: Bitcoin Price, Source: TradingView

If you are still asking yourself, “What stage are we in the Bitcoin cycle,” I have news for you:

The Four-Year Cycle of Bitcoin is Broken

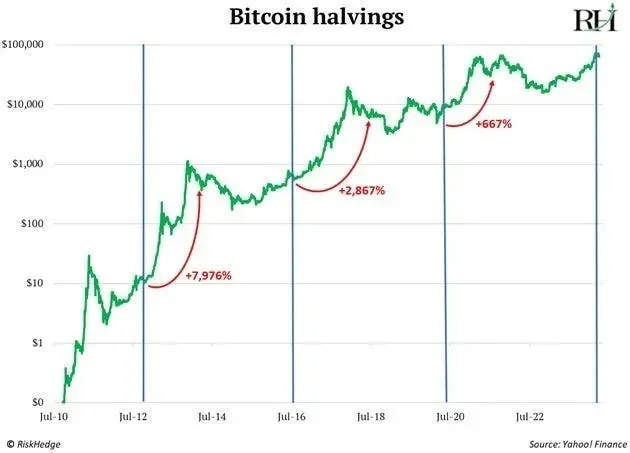

Since Bitcoin's inception, it has followed a reliable four-year rhythm.

This pre-programmed event—automatically halving the new supply of Bitcoin (hence called “halving”)—has historically triggered a predictable upward cycle each time it occurs.

Cryptocurrency prices typically bottom out 12-18 months before a Bitcoin halving. Then they start to rise before the halving… and surge even more in the 12 months following the halving.

Source: RiskHedge, Yahoo Finance

After the first halving, Bitcoin soared by 8000%… after the second halving, it increased nearly 30 times within a year… and the third halving brought a 6-fold return.

But this time, things have changed.

The Fourth Bitcoin Halving is set for April 20, 2024. However, Bitcoin's price has only risen 90% since then.

According to past patterns, we should now be in a full-blown cryptocurrency frenzy. But that is not the case.

Following the four-year cycle script, funds should also start flowing into smaller tokens. I’m referring to the so-called “altcoin season.” However, Bitcoin still firmly holds the dominant position.

Clearly, Bitcoin's cycle has been broken.

ETFs Break the Four-Year Cycle

BlackRock's Bitcoin ETF—iShares Bitcoin Trust ETF (IBIT)—has rewritten history.

In just 11 months, it has accumulated over $50 billion in assets, surpassing the issuance speed of any ETF in history. IBIT now holds more assets than BlackRock's gold ETF, which is the second-largest gold fund in the world.

Why is this important?

It means that large institutions have entered the cryptocurrency market.

Wall Street, pension funds, banks, and even 401(k) accounts can now gain exposure to Bitcoin with just a click.

This will transform Bitcoin from a niche asset into a global macro asset. Whether you like it or not, cryptocurrency has become part of the traditional financial system.

Previously, Bitcoin operated at its own pace, following the four-year halving cycle.

Now, it fluctuates in sync with the larger market… reacting to inflation data, interest rates, tariffs, and central bank decisions.

Look at how closely Bitcoin's price has tracked the S&P 500 this year:

Image: BTC vs S&P 500, Source: Koyfin

ETFs have brought hundreds of billions of new investor funds into the cryptocurrency market.

Washington's 180-degree turn on cryptocurrency will bring trillions of dollars in funding

Remember, just nine months ago, the U.S. government was openly against cryptocurrency.

Senators formed an “army” against cryptocurrency. The U.S. Securities and Exchange Commission (SEC) sued every moving crypto project.

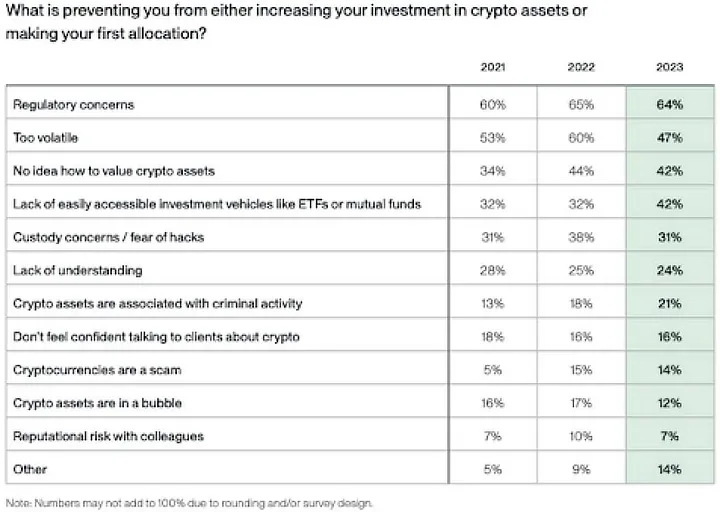

Members who have long followed Venture know that regulatory uncertainty is the number one factor hindering cryptocurrency development. Bitwise's three-year survey of professional investors consistently shows that regulatory issues are their primary reason for avoiding cryptocurrency:

Source: Bitwise

In just a few months, the situation has changed dramatically.

Congress has declared this week as “Cryptocurrency Week.”

The U.S. House of Representatives aims to push three significant cryptocurrency bills that have been stalled for years.

This is the most serious and coordinated push for cryptocurrency policy to date.

In short, these bills will greenlight Wall Street's large institutions to enter the cryptocurrency market. This means more funds will start flowing into cryptocurrency.

How high can Bitcoin go?

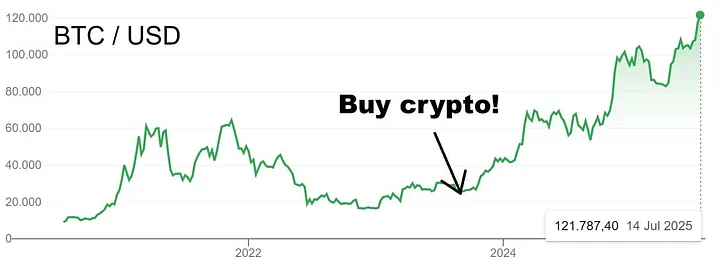

In August 2023, when Bitcoin's price was $27,000, I told members of RiskHedge Venture that Bitcoin would reach $150,000. Since then, Bitcoin's price has more than quadrupled:

Source: Google Finance, RiskHedge Venture

Based on all the positive regulatory developments, Bitcoin could reach $200,000 in the next 12 months.

The breaking of the four-year cycle is a good thing.

It means that cryptocurrency will no longer be confined to a fixed timetable.

In the future, cryptocurrency bull markets could last for years, just like the stock market.

Those -80% crashes that happen every four years are likely a thing of the past.

Bitcoin is just digital cash, and owning some Bitcoin is wise. But if you are seeking rapid growth, it is not the best cryptocurrency.

The real upside potential lies in smaller, lesser-known crypto projects.

Article link: https://www.hellobtc.com/kp/du/07/5964.html

Source: https://a.c1ns.cn/ZcRjE

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。