Master Discusses Hot Topics:

Last night during the US market hours was indeed a bit dramatic. First, the PPI data came out and the whole market was high. There was a renewed hope for interest rate cuts, but then the next moment, news broke that Chuanzi was going to stir up rumors about Old Bao, and the market sentiment immediately reversed.

You say you want to stir things up, but why bring up details like drafting a dismissal notice? It almost made everyone believe it, but then Chuanzi came out to refute the rumors, saying Old Bao wouldn't be moved, and casually mentioned that Hassett might take over. Chuanzi is still so outrageous, shouting that the stablecoin bill can pass while simultaneously adding to the market's woes.

But at the end of the day, it's still that saying: good news will never wait for you to realize it before it rises. In the crypto circle, what’s truly powerful is not the news, but those sources of information; insider trading has already become a force driving trends.

What you think is good news turning into bad news is actually that they already knew where the good news was, pumped it up, waited for you to chase the highs, and then smashed your head with a sell-off.

So right now, it's not that there’s no good news in the market, but that the good news has already been digested. When the real big news comes out, the market may have already started to weaken. The news you see is the beginning of their selling.

Now, let’s talk about the long-term trend. Currently, I believe the overall market rhythm is a fluctuation from July to August. The second half of this bull market or the fourth segment of the weekly upward trend will end between 74.4K and 138.8K or 142K, depending on whether Japan raises interest rates on July 31. If they don’t raise, August can continue to rally. If they do raise, the market will likely hit the brakes.

September will definitely see a pullback; historically, the tail end of the third quarter has never been comfortable. Then October will be the final peak celebration of the entire bull market, and by mid-November, the bull market cycle will basically end.

Listen carefully, it’s mid-November, not the end of the month. Don’t think about escaping the peak at the end of November; by then, you’ll already be at the top of the mountain, ready to jump. And right now, Bitcoin is in a slow bull market, while Ethereum hasn’t even gone crazy yet; it’s still in the early stages of a bull market.

Who still talks about that broken four-year cycle every day? This is the era of monetary policy and international capital taking over the crypto circle; this bull market won’t follow the old script, the cycle will be extended while the market trend will be rewritten.

And I’ve always said, analysis is for trading. It’s not just to comfort oneself; contracts are the best way to validate your understanding. If I think it’s right, I’ll open a position; if I’m wrong, I’ll take it and stand straight. That’s why I’ve held onto my mid-line short position above 122K since Monday, because I need to validate my thinking.

Master Looks at Trends:

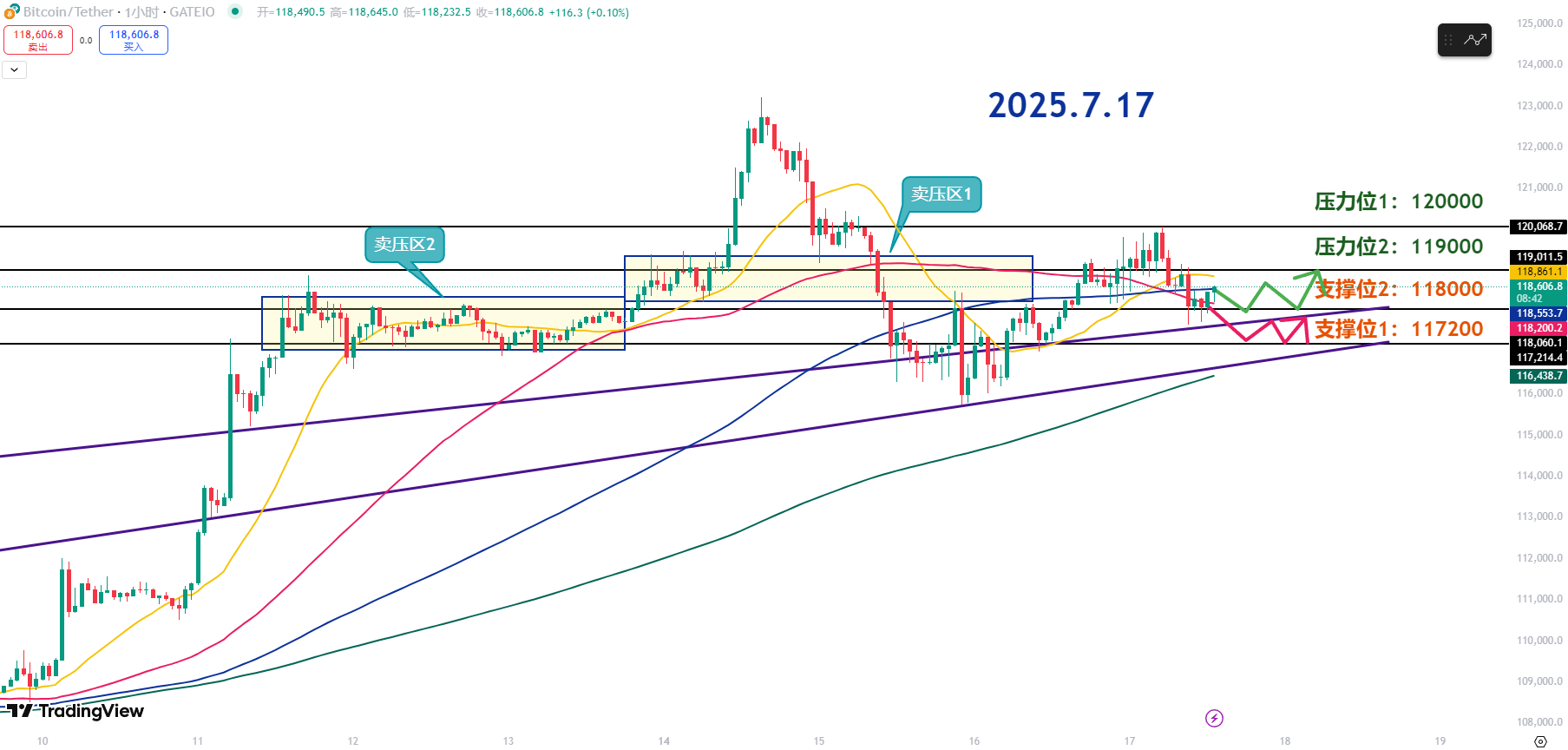

Resistance Level Reference:

Second Resistance Level: 120000

First Resistance Level: 119000

Support Level Reference:

Second Support Level: 118000

First Support Level: 117200

The selling pressure area that broke through yesterday at the two high points of 118K serves as short-term support. The 118K area will see brief breakouts and repeated pullbacks, and the short-term upward trend line should be monitored during the day.

The 118K~119K area has formed selling pressure area 1, and currently, the box fluctuation trend should be observed. The selling pressure area 2 from 117.2K~118K has been broken, serving as a support selling pressure area.

If the 118K support holds, continue to monitor the green arrow trend; if it breaks, then watch the direction of the red arrow. If accompanied by trading volume breaking through the first resistance level of 119K, then expect further upward movement beyond the upper edge of selling pressure area 1.

After the breakout, pay attention to whether the 118.8K~119K area stabilizes before deciding on entry strategies. The second resistance level is 120K, which is also a strong resistance level. Major peaks won’t break through all at once; it’s more likely to break through after multiple retests.

The first support level of 118K is an important support that must be maintained for a short-term rebound and can be seen as short-term support. However, a breakout may occur, so the upward trend line below also serves as additional support.

The second support level of 117.2K corresponds to the lower edge of selling pressure area 2 and can serve as a potential entry opportunity, with the 200-day moving average below as the corresponding support range.

7.17 Master’s Wave Strategy:

Long Entry Reference: Buy in batches in the 117000-117200 range, Target: 118000-119000

Short Entry Reference: Not currently applicable

If you truly want to learn something from a blogger, you need to keep following them, not just make hasty conclusions after a few market observations. This market is filled with performers; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "catch every peak and bottom," but in reality, it’s all hindsight. A truly worthy blogger will have trading logic that is consistent, coherent, and withstands scrutiny, not just jumping in when the market moves. Don’t be blinded by exaggerated data and out-of-context screenshots; long-term observation and deep understanding are needed to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). If you want to learn more about real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official public account (as shown above), and any other advertisements at the end of the article or in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。