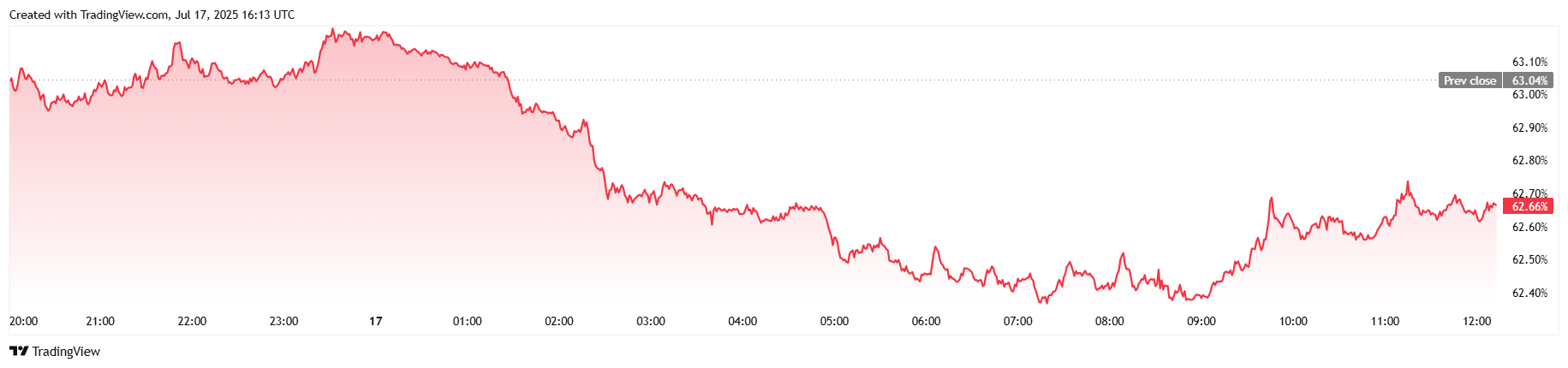

U.S. jobless claims fell to a 3-month low on Thursday, and at least 44 companies beat their quarterly estimates this week. Stocks jumped on the news, but bitcoin ( BTC) showed little reaction to the upbeat economic data, remaining mostly flat as altcoins gained on the cryptocurrency whose dominance of the market fell below 63%.

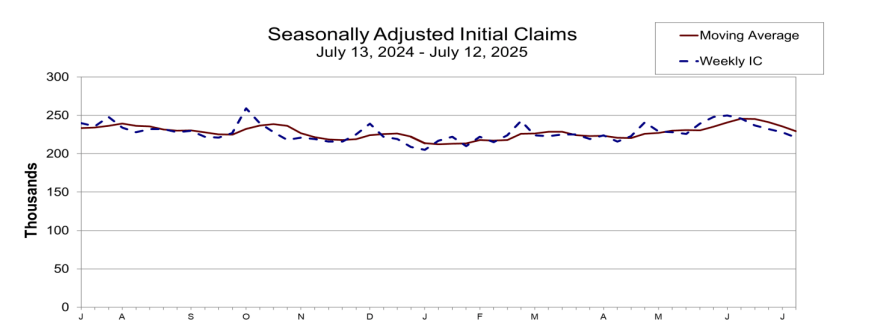

The Department of Labor released its initial jobless claims report, which counts the number of people filing for unemployment benefits for the first time. There were 221,000 applications for the week ending July 12, a decrease of 7,000 compared to the previous week and the lowest number of claims in three months.

(Jobless claims fell to a 3-month low for the week ending July 12. / U.S. Department of Labor)

Additional positive economic data from Wall Street shows that 44 companies so far have blown past analysts’ predictions of quarterly earnings, according to CNBC. The S&P 500, Nasdaq, and Dow all climbed 0.45%, 0.74%, and 0.40% respectively. The crypto market rose 1.56%, but it was altcoins, not BTC leading the rally.

Unlike bitcoin’s muted reaction, U.S. President Donald Trump’s response to the upbeat economic data was celebratory. Trump took to social media and used the positive news as an opportunity to take a jab at Fed Chairman Jerome Powell, who has been reluctant to cut rates until inflation drops from the current level of 2.7% to the Fed’s target of 2%.

“‘Too Late:’ Great numbers just out. LOWER THE RATE!!! DJT,” Trump wrote.

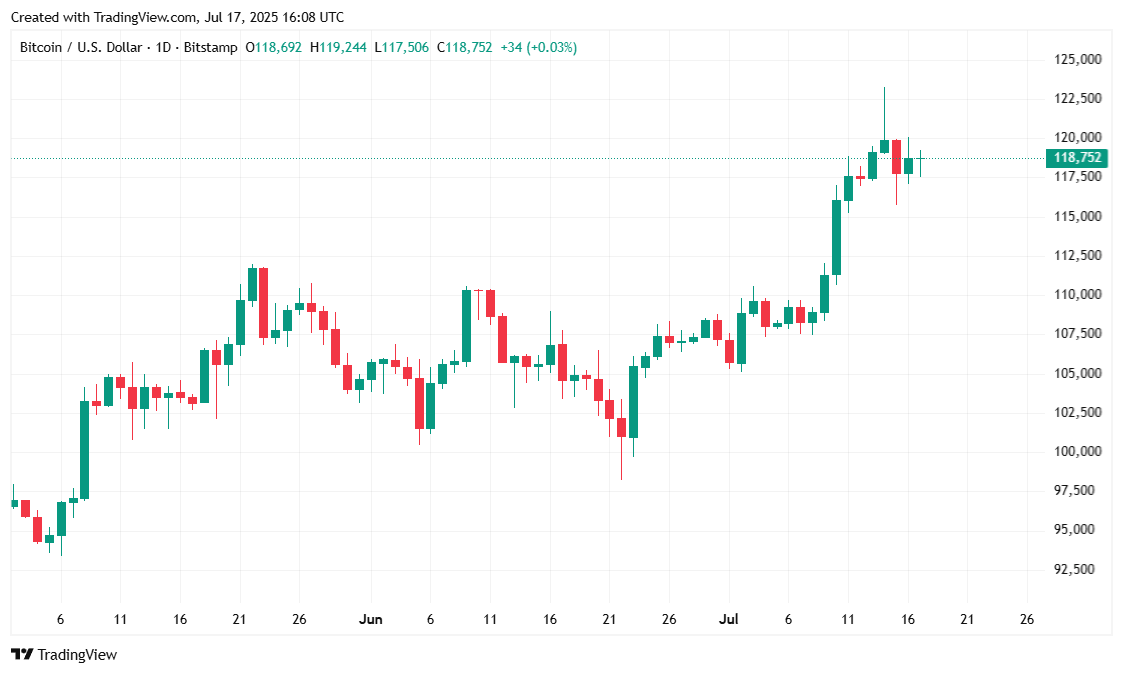

Bitcoin was quoted at $118,744.37 at the time of reporting, down slightly by 0.02% since yesterday, but still up 6.46% for the week, according to Coinmarketcap. The cryptocurrency traded as low as $117,508.22 and peaked at $120,065.25 over the past 24 hours.

( BTC price / Trading View)

Trading volume was down 7.22% today, coming in at $68.05 billion. The digital asset’s market capitalization dropped 0.1% and stood at $2.35 trillion at the time of writing. Perhaps more significantly, BTC dominance tumbled 0.56% to 62.65% as altcoins such as ether ( ETH) and XRP rallied earlier today, eating into bitcoin’s share of the crypto market cap.

( BTC dominance / Trading View)

Coinglass data shows that total open interest for BTC futures dipped 0.24% to $87.04 billion since yesterday. Bitcoin liquidations for the past 24 hours stood at $66.73 million. Short positions had $37.06 million wiped out and longs had $29.67 million liquidated, resulting in a relatively balanced ratio of bears to bulls.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。