Stablecoins "Go Onshore," Opening the "Ceiling" of U.S. Crypto Finance Again.

Just last night, the U.S. House of Representatives officially passed the GENIUS Act and the CLARITY Act, providing a "framework for going onshore" for the stablecoin sector and setting a clear regulatory tone for the entire digital asset industry. The White House subsequently announced that Trump will personally sign the GENIUS Act this Friday. From now on, stablecoins are no longer experimental products in a gray area but are about to be written into U.S. law as "official currency instruments" backed by the state.

Almost simultaneously, the three major financial regulatory giants—the Federal Reserve, FDIC, and OCC—jointly released guidance a few days ago, clearly stating for the first time that U.S. banks can provide crypto asset custody services for their clients. Banks and institutions on Wall Street are already eager to act.

Traditional Banks Raise the Flag for Stablecoins

As the second-largest bank in the U.S., Bank of America (BoA) has officially confirmed that it is actively preparing stablecoin products and considering collaborations with other financial institutions for joint launches. They stated, "We are ready, but we are still waiting for further clarity from the market and regulators."

"We have done a lot of preparatory work," said Bank of America CEO Brian Moynihan, indicating that they are currently conducting in-depth research on customer needs and will launch stablecoin products at the appropriate time, possibly in collaboration with other financial institutions.

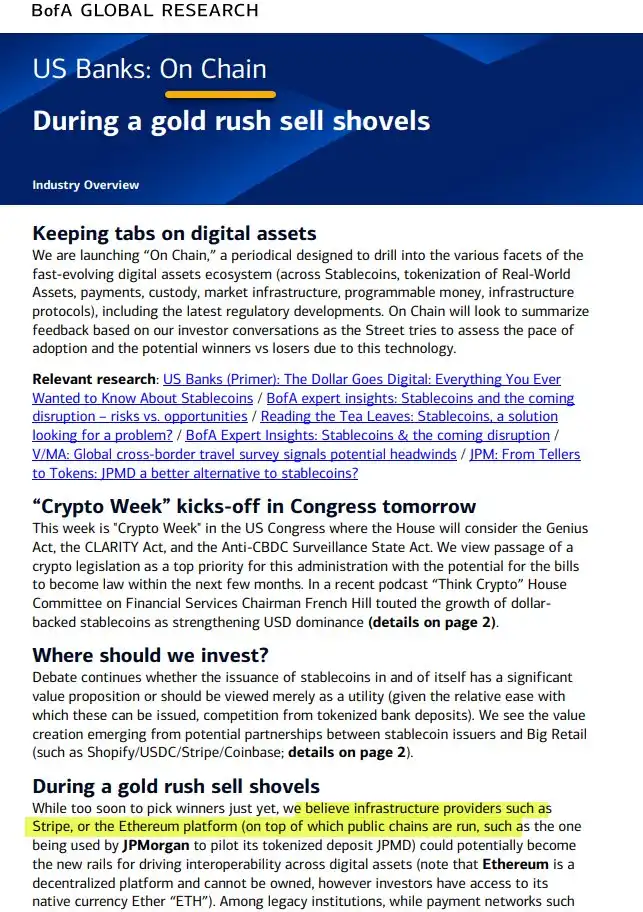

Meanwhile, Bank of America has also launched a weekly on-chain research report titled "On Chain," clearly focusing on stablecoins, RWA, payment settlements, and infrastructure. The release of "On Chain" coincides with a critical week in Washington, where legislators are reviewing the GENIUS Act, the CLARITY Act, and anti-central bank digital currency monitoring legislation, all of which could influence U.S. policy direction regarding stablecoins and digital infrastructure.

The research team pointed out, "Rather than speculation, we focus on the architecture that can truly change the financial foundation," emphasizing that Ethereum is expected to play a core role in promoting the interconnectivity of digital assets. They even revealed that they are already piloting stablecoin collaborations with mainstream retail platforms like Shopify, Coinbase, and Stripe, aiming to break through the original gameplay of stablecoins and bring about new business models.

"As long as regulations are clear, banks are ready to accept cryptocurrency payments," stated Bank of America CEO Brian Moynihan.

Citibank is also in a "waiting for the wind to fly" posture.

Citibank CEO Jane Fraser clearly stated that the bank is actively advancing stablecoin-related plans and views them as an important cornerstone for future international payments. Citibank's bet on stablecoins reflects a reconsideration of global cross-border payments: high fees and slow transaction times. Currently, the hidden costs of cross-border transactions can reach as high as 7%, while the existing interbank network lags far behind on usability and efficiency compared to on-chain solutions. Citibank's goal is to build a new payment track that is always available and programmable with stablecoins, allowing corporate clients to transfer money globally at low cost and high efficiency.

As a "familiar face" in the crypto space, JPMorgan is moving even faster.

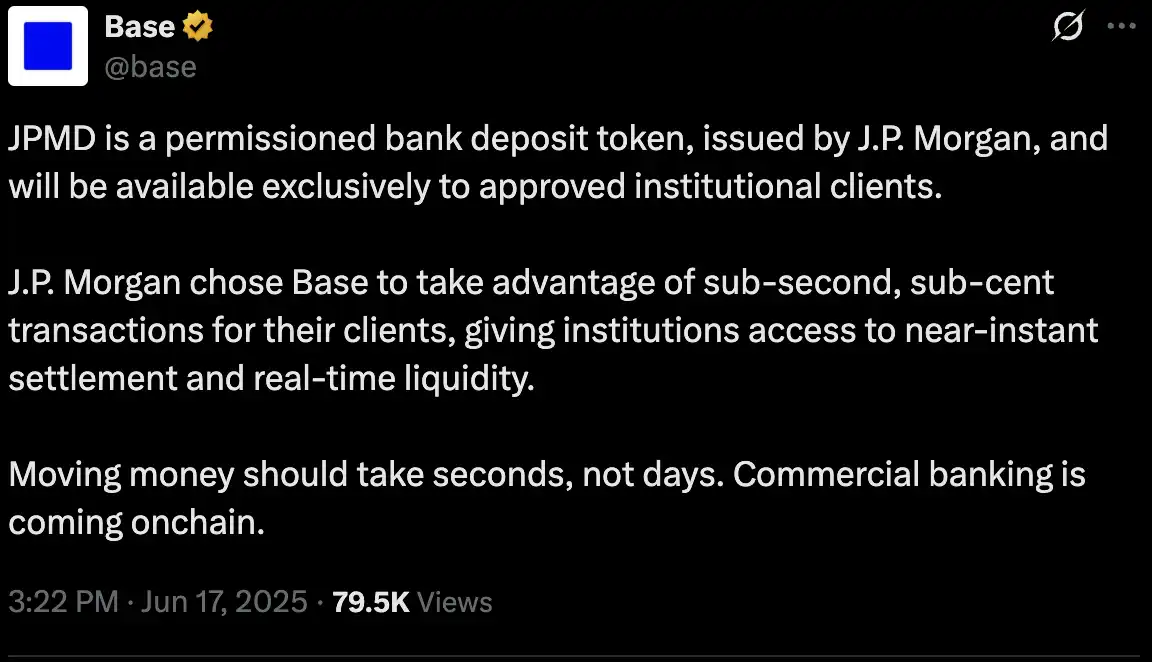

On June 18, JPMorgan announced it would pilot a deposit token called JPMD, deployed on the Base blockchain supported by Coinbase. Initially, this token will only be available for JPMorgan's institutional clients, with plans to gradually expand to a broader user base and more currencies after receiving regulatory approval in the U.S.

This marks the first time a Wall Street giant has directly issued traditional bank deposits on-chain, signifying a key step in the deep integration of traditional finance and the decentralized world. JPMD is a "permissioned deposit token" that corresponds 1:1 to JPMorgan's dollar deposits, supports 24/7 real-time transfers, has transaction costs as low as $0.01, and enjoys traditional financial protections such as deposit insurance and interest.

Compared to existing stablecoins, JPMD has stronger regulatory compliance and trust backing, promising to bring unprecedented capital volume and institutional liquidity to the Base chain. Naveen Mallela, head of JPM blockchain, stated, "This is not about embracing crypto; it's about redefining banking."

Looking at the entire U.S. banking industry, the speed at which stablecoins are entering the market and moving on-chain far exceeds the most optimistic expectations in the crypto circle. The true wave of financial transformation has already arrived.

"Green Light is On," Traditional Banks Can Buy Bitcoin Now?

"The green light is on, and traditional finance is rapidly entering the market. The barriers between banks and cryptocurrencies are collapsing. This is extremely beneficial for cryptocurrencies."

As Merlijn, founder of Profitz Academy, stated, on July 14, the three major U.S. banking regulators—the Federal Reserve, FDIC, and OCC—jointly issued a statement confirming that banks must establish a comprehensive risk governance system in areas such as key management, asset screening, cybersecurity, audit supervision, third-party custody, and compliance risk control when providing related services.

Although no new regulations were established, this guidance systematically clarifies the expectations of regulators regarding crypto custody services for the first time. Crypto finance is transitioning from a "gray experimental field" to "regulatory compliance," and traditional finance is no longer watching from the sidelines.

This signal quickly sparked market reactions. Wall Street giants are disclosing the latest developments in their stablecoin and other cryptocurrency businesses, trying to seize the initiative in the new round of financial infrastructure reconstruction. Meanwhile, crypto-native institutions like Circle and Ripple are also actively promoting compliance processes, aiming to solidify their market positions as the global regulatory framework gradually takes shape.

This also means that the boundaries between future banks, crypto asset management, and trading platforms are beginning to blur. Traditional banks are even directly "seizing" market share from crypto asset management and trading platforms.

Traditional Banks and Native Asset Management's Crypto Clash

On July 15, Standard Chartered Bank announced that it would provide spot trading services for Bitcoin and Ethereum to its institutional clients, becoming the first globally systemically important bank (G-SIB) to do so. The service will initially launch in London, Hong Kong, and Frankfurt, covering Asia and Europe, with plans to operate 24/5 continuously in the future, directly connecting with traditional forex platforms. Corporate clients and asset management companies will no longer need to go through hoops or circumvent regulations to open accounts; they can directly buy and sell Bitcoin and Ethereum like forex, with settlement and custody options available for either self-operated or third-party services.

In fact, Standard Chartered has been laying the groundwork for digital asset custody and trading through Zodia Custody and Zodia Markets for several years; this is merely a public unveiling of all accumulated capabilities. Rene Michau, Standard Chartered's global head of digital assets, made it clear: the spot crypto business will initially focus on BTC and ETH, with plans to expand to more crypto products in the future, including forwards, structured products, and non-deliverable contracts, fully aligning with the business lines of crypto trading platforms.

Meanwhile, JPMorgan, Bank of America, and others are also preparing to launch cryptocurrency custody and related services. What you once thought impossible is now a settled fact. Just 12 months ago, you were questioning whether "JPMorgan would custody Bitcoin," and now the only question left is "which bank will seize the largest market share first."

Equally noteworthy are the "new banks"—for example, Revolut in London, which has relied heavily on crypto trading for a significant portion of its revenue, with a long-term goal of applying for a U.S. banking license to fully enter the mainstream financial ecosystem.

Peter Thiel's Ambition: Building a New Silicon Valley Bank

In addition to asset custody and seizing market share from crypto-native asset management and trading platforms, Wall Street's ambitious players are also finding new entry points in account services and credit support.

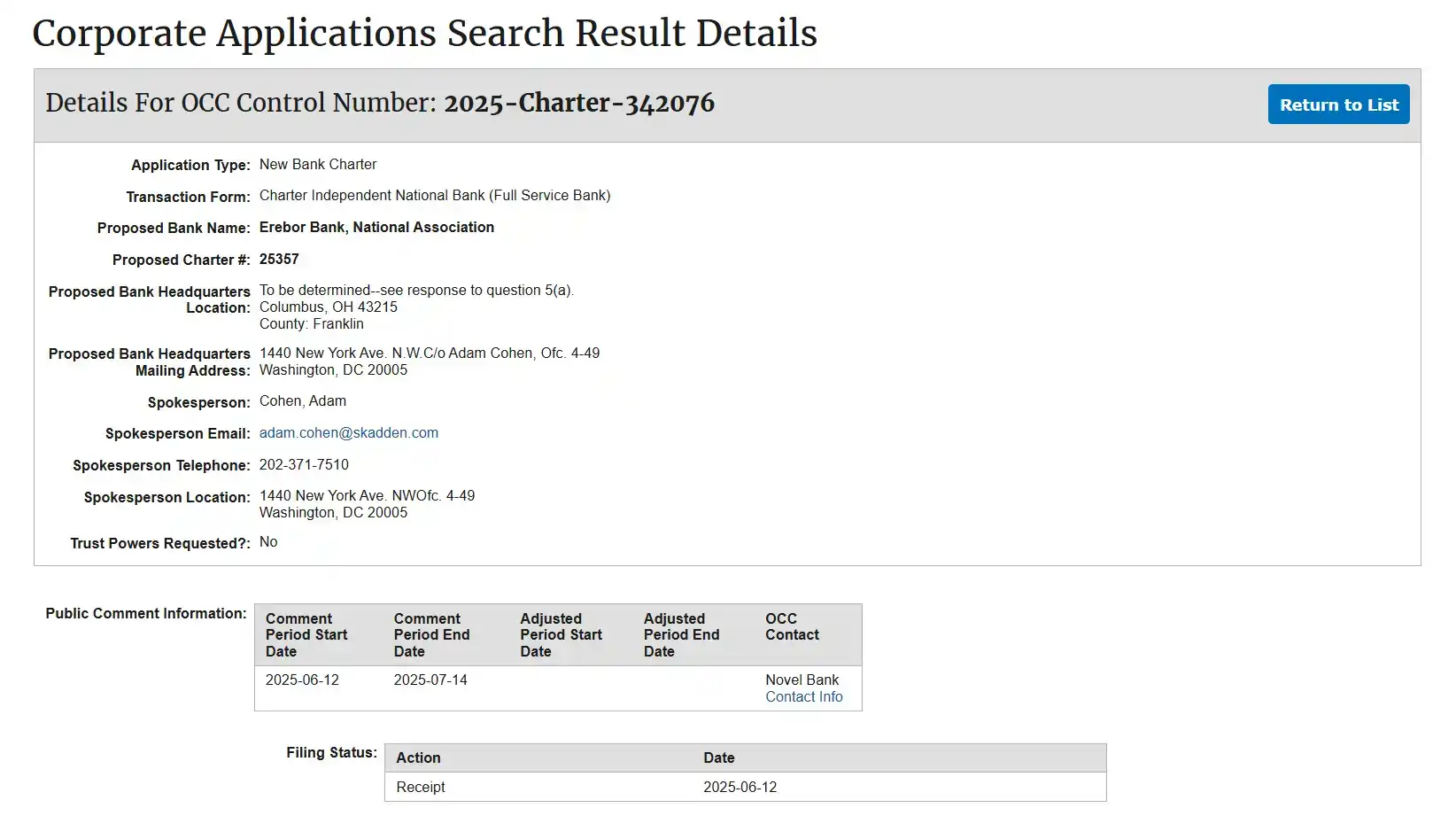

Multiple mainstream financial media outlets have confirmed that Peter Thiel is collaborating with tech billionaires Palmer Luckey and Joe Lonsdale to launch a new bank called Erebor, and they have formally applied for a national bank charter with the OCC. This bank aims to serve startups in cryptocurrency, AI, defense, and manufacturing that mainstream banks are unwilling to serve, attempting to become a replacement for Silicon Valley Bank after its collapse.

The founders of this bank also exhibit a distinct "Silicon Valley political capital crossover" characteristic: Peter Thiel (co-founder of PayPal and Palantir, leader of Founders Fund), Palmer Luckey (founder of Oculus, co-founder of Anduril), and Joe Lonsdale (co-founder of Palantir, founder of 8VC). All three are significant political donors to Trump in the 2024 U.S. presidential election and are closely linked to the current Congress's advancing GENIUS Act.

According to the application documents submitted by Erebor to the OCC, Founders Fund will participate as the main capital supporter, and the three founders will not be involved in daily management but will intervene in the governance structure as directors. The bank's management will be led by a former Circle advisor and the CEO of compliance software company Aer Compliance, aiming to clearly delineate the boundaries between politics and operations and highlight its institutional financial institution application positioning.

Learning from the lessons of Silicon Valley Bank, Erebor has explicitly proposed to implement a 1:1 reserve requirement and keep the loan-to-deposit ratio below 50% to prevent maturity mismatches and credit expansion from the source. Its application documents indicate that stablecoin services will be one of the bank's core businesses, planning to support the custody, minting, and redemption of compliant stablecoins like USDC, DAI, and RLUSD, aiming to create "the most comprehensively regulated stablecoin trading institution," providing enterprises with legal and compliant fiat entry and exit channels and on-chain asset services.

Its target clientele is also precise: focusing on innovative enterprises in virtual currency, artificial intelligence, defense technology, and high-end manufacturing, which are viewed as "high-risk" by traditional banks, as well as their employees and investors; it will also serve "international clients"—those who find it difficult to enter the U.S. dollar financial system and rely on dollar clearing or wish to reduce cross-border transaction costs using stablecoins. Erebor plans to establish "agent bank relationships" to act as a super interface connecting these enterprises to the U.S. dollar system.

Its business model also has a strong crypto-native flavor: deposit and loan services are backed by Bitcoin and Ethereum as collateral, without involving traditional mortgages or auto loans; at the same time, it holds a small amount of BTC and ETH on its balance sheet for operational needs (such as paying gas fees) and does not engage in speculative trading. Notably, Erebor has also clarified its regulatory boundaries: it does not provide asset custody services that require a trust license, only offering on-chain fund settlement without directly holding user assets.

In short, this is an upgraded version of Silicon Valley Bank, and under the push of various crypto-friendly policies, Erebor is likely to strive to become one of the first "dollar relay banks" to custody mainstream stablecoins like USDC and RLUSD in a compliant manner, providing a federal clearing path for stablecoins.

Related Reading: "Peter Thiel personally 'sets up' Erebor, aiming to be the 'alternative' to Silicon Valley Bank"

National Bank Charter: The Future of Crypto Banks

Against the backdrop of the stablecoin legislation being finalized and the green light in Washington, it is clear to everyone that the next ranking competition among Wall Street bankers has quietly begun.

The "National Trust Bank Charter" is an important point in this ranking competition. It is one of the "ceiling-level" licenses in the U.S. financial system and the most realistic path for all crypto assets, institutional custody, and stablecoin companies to enter the mainstream financial system.

The U.S. banking system consists of three core federal licenses: National Bank, Federal Savings Association (FSA), and National Trust Bank. The first two are traditional banks and savings associations with a long history, high licensing barriers, and outrageous thresholds. The National Trust Bank charter is specifically designed for trust, custody, pension, and other businesses, aligning perfectly with new players in the crypto space looking to comply with "holding assets."

Its value is even higher than most people imagine. First, the National Trust Bank charter acts as an interstate passport; once obtained, it allows business operations in all 50 states without needing to apply state by state. Additionally, this charter permits licensed institutions to provide institutional-level asset custody, digital currency custody, corporate trusts, pension management, and other diverse financial services. Although it cannot accept retail deposits or issue loans, this actually aligns perfectly with the "urgent needs" of crypto custodians—what everyone wants is asset security and a compliant, transparent title for fiat custody.

More importantly, this is a license directly issued by the Office of the Comptroller of the Currency (OCC), belonging to the federal level of banking licenses. With this license, crypto companies can apply to access the Federal Reserve's payment and clearing system, greatly enhancing liquidity and settlement efficiency.

Anchorage Digital: The First Crypto Custody Bank to Take the Plunge

The first crypto asset management company to take the plunge is Anchorage Digital.

Founded in 2017 and headquartered in California, Anchorage Digital is a fintech company that focuses on "digital asset custody" services, specifically providing secure and compliant digital asset storage and custody services for institutional clients (such as funds, family offices, and trading platforms).

Before 2020, crypto asset companies could only legally conduct custody business through state-level trust licenses (such as New York's BitLicense or South Dakota's trust license), which had significant limitations in scope and reputation.

However, in 2020, the OCC welcomed a "friend of the crypto space"—former Coinbase executive Brian Brooks. Upon taking office, he clearly stated for the first time: innovative digital asset companies are welcome to apply for federal banking licenses. Anchorage seized the opportunity and rushed to submit its application, preparing dozens of documents and hundreds of pages of materials, covering KYC/AML, compliance, technical risk control, and management structure in detail. On January 13, 2021, the OCC announced its approval, and Anchorage Digital Bank National Association officially launched—this was the first truly compliant digital asset national trust bank in the U.S.

After becoming the first "federally certified" crypto custody bank in U.S. history, Anchorage Digital's status soared, being regarded as a Wall Street-level institutional custodian for digital assets, serving firms like BlackRock and Cantor Fitzgerald.

Unfortunately, the good times did not last long; the policy direction changed abruptly. The OCC underwent personnel changes, regulations tightened, and new applications for digital asset trusts were essentially "frozen" overnight. Anchorage became the only player in this space, and the track was directly "frozen" for more than three years.

Until now, with Trump in office and crypto-friendly factions in power, a crypto-friendly official from the Trump administration, Jonathan Gould, was appointed as the interim head of the OCC, reversing some of the Biden administration's "banking guidelines" for the crypto industry.

Earlier this month, the newly appointed OCC head Jonathan Gould, who previously served as Chief Legal Officer at blockchain infrastructure company Bitfury, has expertise in business, law, and regulation. His appointment has led the market to keenly sense that the federal compliance window has slightly reopened. Entrepreneurs, funds, and project parties in the industry are already "itching to move," waiting for a new round of license approvals.

The Ultimate Game: Accessing the Federal Reserve's Clearing System

For the crypto space, merely having a "National Trust Bank Charter" is not enough; what truly makes everyone envious is "accessing the Federal Reserve's clearing system"—that is, the legendary "Master Account" (Fed Master Account).

For the crypto industry, this is an even greater temptation.

Directly settling, clearing, transferring, and depositing with the Federal Reserve without relying on third-party major banks. For crypto companies, as long as they obtain Master Account eligibility, placing stablecoin reserves directly at the central bank means completely integrating into the U.S. financial infrastructure, no longer being "outsiders" or "second-class citizens," but truly becoming "regular troops" backed by the U.S. financial system.

Everyone in the circle understands that this is the true meaning of "normalization," transforming from being viewed as outsiders and second-class citizens by the banking system to being recognized as regular troops by the U.S. financial system. Therefore, crypto stars like Circle, Ripple, Anchorage, and Paxos are all working to secure federal trust bank licenses while fiercely pursuing Master Account approvals.

However, due to concerns that "Master Accounts" could be misused by crypto companies, posing financial stability risks (such as a sudden large-scale liquidation of risk assets affecting system liquidity), as well as potential regulatory challenges related to money laundering, illegal fund flows, and technical security, no purely crypto company has been approved for a Federal Reserve Master Account to date. Even Anchorage, which was the first to "take the plunge," has not received approval for its Master Account despite obtaining its federal trust bank license.

So who else is vying for banking licenses?

Circle was the first to submit materials at the end of June 2025, planning to establish a new bank called First National Digital Currency Bank, N.A. to directly custody USDC reserves and provide institutional-level custody services.

Following closely, Ripple also announced in early July that it had submitted an application to the OCC while simultaneously applying for a federal Master Account, aiming to place its stablecoin RLUSD reserves directly in the central bank system, taking a very aggressive stance.

Established custody company BitGo is also not falling behind and is awaiting OCC approval. According to public information, BitGo is one of the designated service providers for the "Trump $1 stablecoin" reserve custody.

In addition to these three most representative crypto "regular troops," Wise (formerly TransferWise) has also submitted a license application positioned as a non-deposit custody bank. New tech players like Erebor Bank have boldly announced their intention to include AI, crypto, defense, and other new economic industries within their service radius. The first-generation blockchain bank, First Blockchain Bank and Trust, had previously tested the waters during the Biden administration but quietly withdrew due to overly tight regulatory windows. It is rumored that Fidelity Digital Assets also plans to submit materials, but this has not been confirmed officially.

If Circle, Ripple, and BitGo can obtain this license, they can bypass state-level compliance, expand nationwide, and even hope to access the Federal Reserve Master Account—once achieved, the dollar reserves of stablecoins can be placed in the central bank's vault, and their custody and clearing capabilities can compete head-to-head with traditional Wall Street giants.

It seems that regulators have always been both hopeful and cautious about crypto companies wanting to become banks. On one hand, the OCC's personnel changes and warming policies have indeed provided a "window period" for crypto companies; on the other hand, these licenses do not equate to full banking operations, as they still cannot accept demand deposits or issue loans.

A new window has opened, but the threshold has not lowered. Who will be the first to knock on the Federal Reserve's door? This will be the most exciting game between Wall Street bankers and crypto moguls in the second half, with the winner potentially rewriting the financial landscape of the next decade.

For the crypto industry, the formal onshore status of stablecoins and the opening of banks mark the long-awaited convergence of the parallel crypto world and Wall Street under regulatory sunlight. Once repeatedly debated by regulators, banks, and capital markets, crypto assets are now entering the daily accounts of every American and the balance sheets of every global financial institution as "mainstream assets."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。