When BTC broke through $118,000, it seemed like the pulse of the entire crypto world quickened. But beneath this wave of celebration, the on-chain ecosystem is brewing a transformation that is more intriguing than price fluctuations—from the wild growth of the BRC2.0 protocol to the covert battle over the 1sat transaction fee proposal, from the art of PenguVC's operations to Pumpfun's "shadow dance" on exchanges, these lesser-known details are the true keys to determining the next round of wealth distribution.

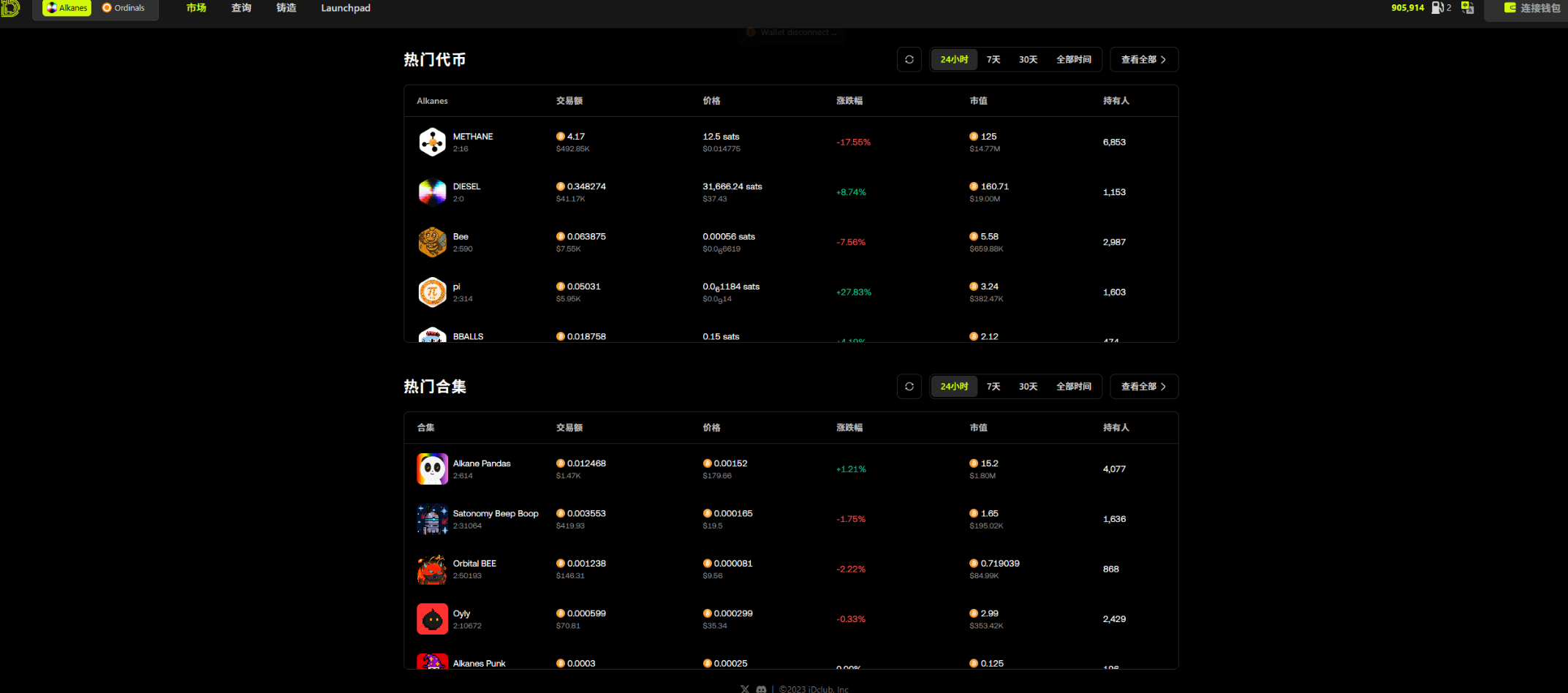

BRC2.0: A New Betting Table Opened by Protocol Programmability

Do you remember the quietness when the BRC2.0 protocol was just launched a month ago? Now it has become a new holy land for on-chain gold miners. This protocol, which allows for simple smart contracts on the Bitcoin network, is replicating the airdrop frenzy of the Rune protocol back in the day—the upcoming large-scale airdrop at block 909969 has already allowed early participants to taste the sweetness. For example, that squirrel NFT costing $20 has skyrocketed to $200 in the secondary market, a tenfold increase that starkly reflects the early benefits of the protocol. But the host must remind: in the frenzy, please keep your finger on the stop-loss button; the code audit of BRC2.0 has not yet undergone a complete market cycle test, and those seemingly "guaranteed" interactions could turn into on-chain tombstones due to protocol vulnerabilities in the next second.

1sat Transaction Fee Proposal: The Silent War Between Miners and Traders

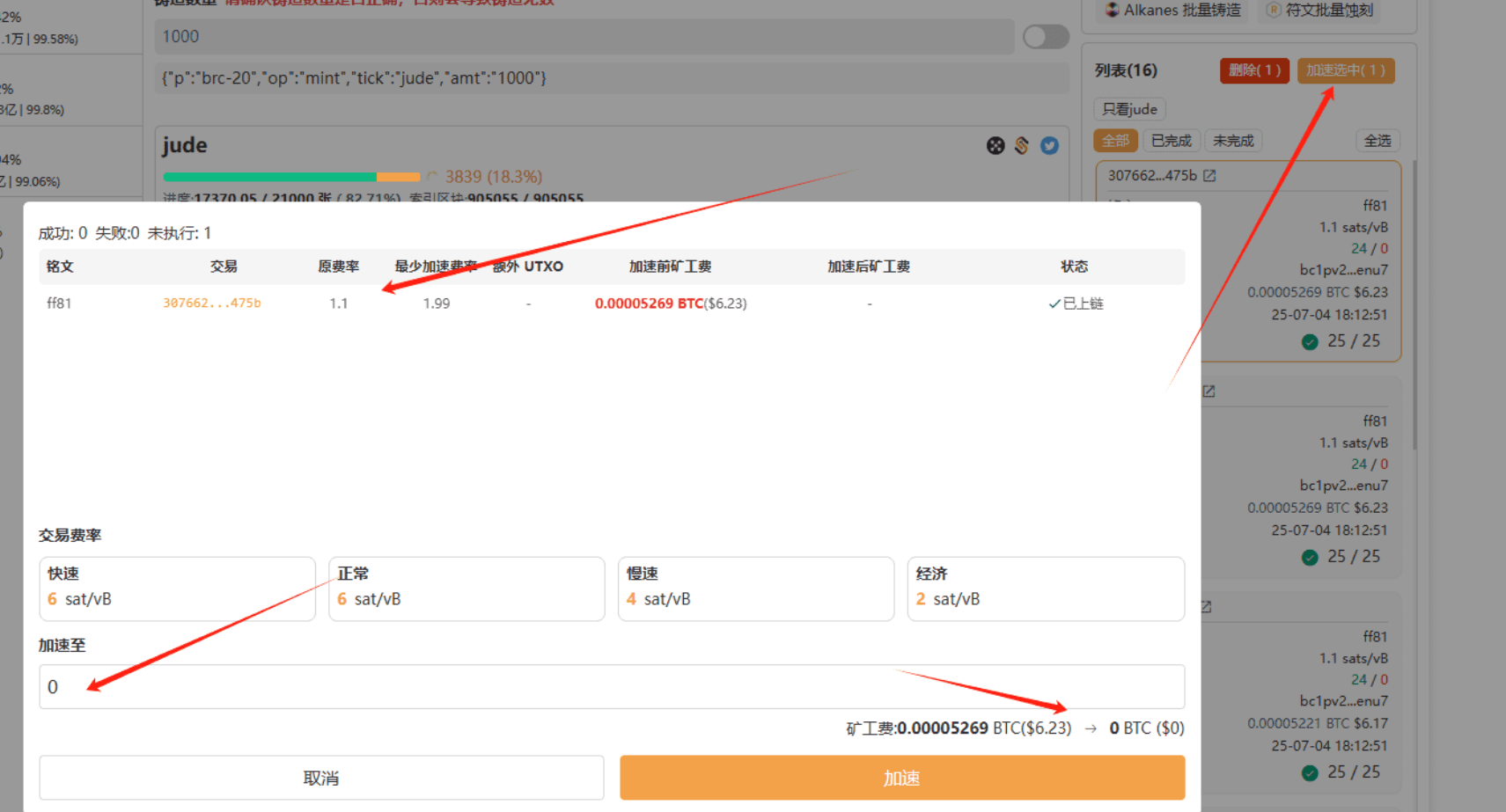

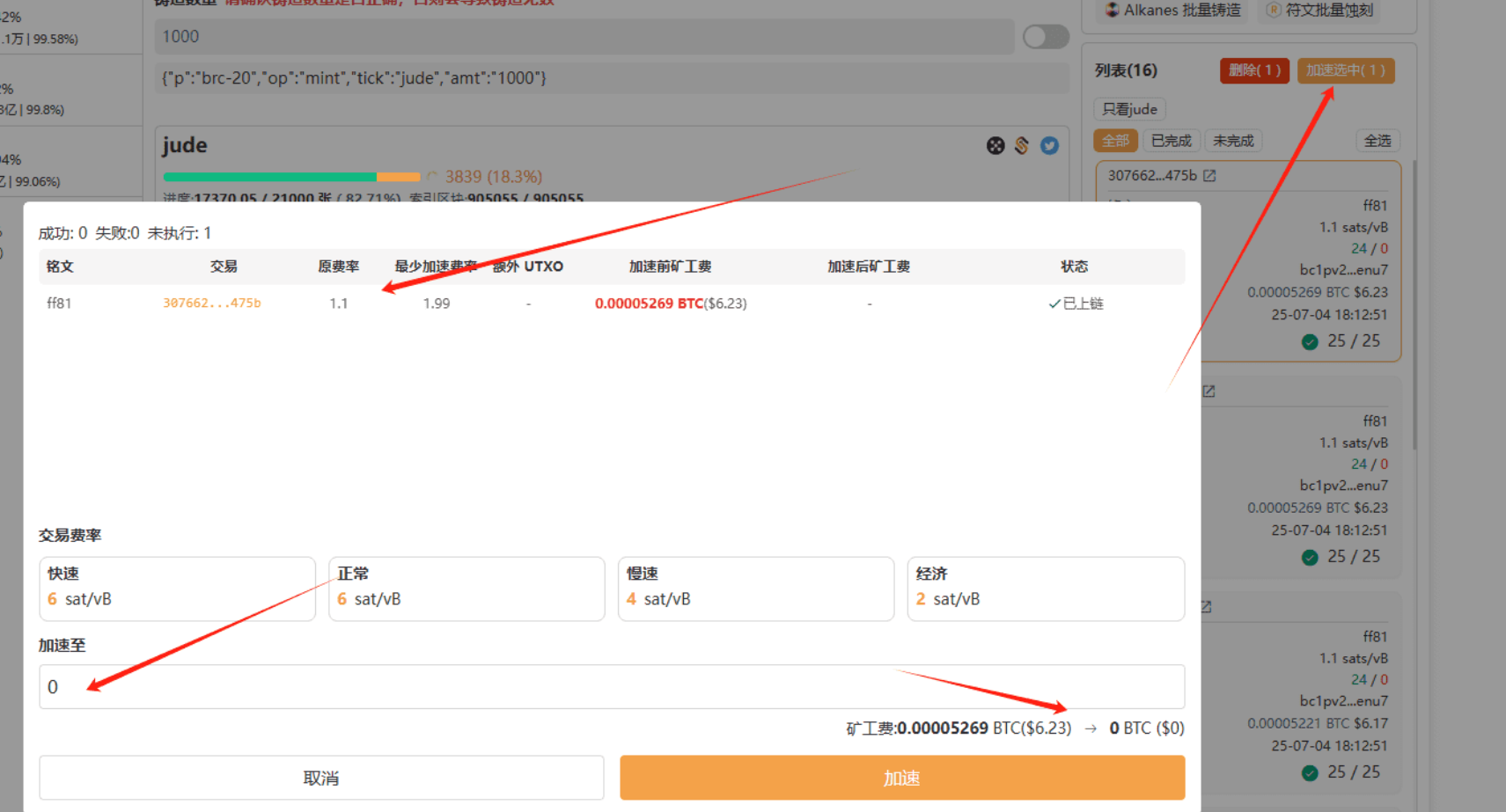

When OGs proposed to lower the transaction fees on the BTC chain to below 1sat, they were actually playing a much larger game. Imagine this: the transfer cost that originally required $5 suddenly drops to $0.5, meaning the same amount of funds can complete ten times the frequency of on-chain operations—this is practically a nuclear weapon-level tool for new investors. But miners clearly won't easily concede, as transaction fees are their core source of income. Currently, the privately tested MCT acceleration tool can allow users to seize block space at a cost of $0.6 within 20 seconds, and behind this gray efficiency is a signal that the underlying game is reshaping the entire BTC economic model.

PenguVC and Pumpfun: The "Open Card Game" of Institutional Players

PenguVC's precise pull on Coinbase has exposed a harsh reality: today's bull market is no longer a playground for retail investors. They monitor on-chain data to identify liquidity gaps on the CB exchange, and with the media releasing "technical upgrade" news, they use programmatic trading to complete the full set of actions—building positions, lifting prices, and distributing—within 15 minutes. Pumpfun is even more cunning—by creating false liquidity on secondary exchanges to attract follow-up trades, they then sell off when mainstream exchanges follow suit. These operations are like a meticulously choreographed drama, and ordinary investors always receive their scripts three beats behind the actors.

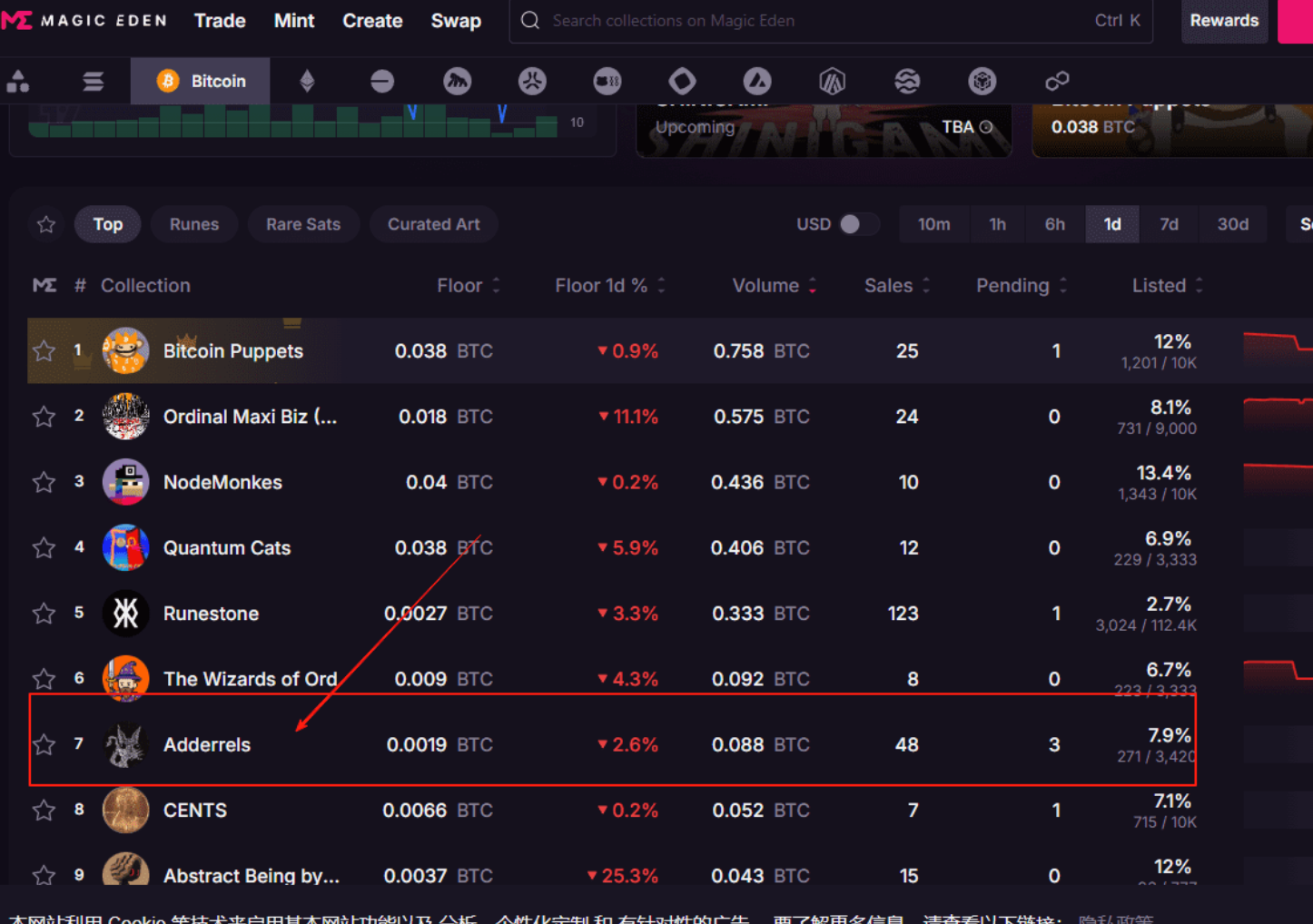

The Data Trap Behind the Over 100 Million Inscriptions

The total number of inscriptions in the BTC ecosystem surpassing 100 million is indeed shocking, but the host has noticed a strange phenomenon in the news backend: over 60% of inscriptions have their last transaction time lingering three months ago, which means that most of the so-called "ecological prosperity" is actually a pile of zombie data. Truly valuable projects are often hidden within those address clusters with sustained interactions—like the recently exploded LOVE BOMB project, where 41% of its holders also hold BRC2.0 assets; this on-chain fingerprint is a reliable indicator for judging the flow of hot money.

Survival Manual for Practitioners

For players looking to mine gold on-chain, the host's three iron rules may help you pay less tuition:

Minting Cost ≠ Value Guarantee: When the secondary market price is below the minting price (for example, the initial cost of the PI project is $20 vs. a market quote of $10), don’t rush to bottom-fish; first check the changes in large holders' positions.

Gas War Requires "Chicken Stealing": Use the MCT tool to ambush acceleration 30 seconds before block confirmation; the cost can be 80% lower than the exchange's built-in service.

Beware of "Moon's Love": When KOLs start using emotional language to promote a coin (like "community consensus" or "cultural IP"), it often means their sell orders are already lurking near the sell one price.

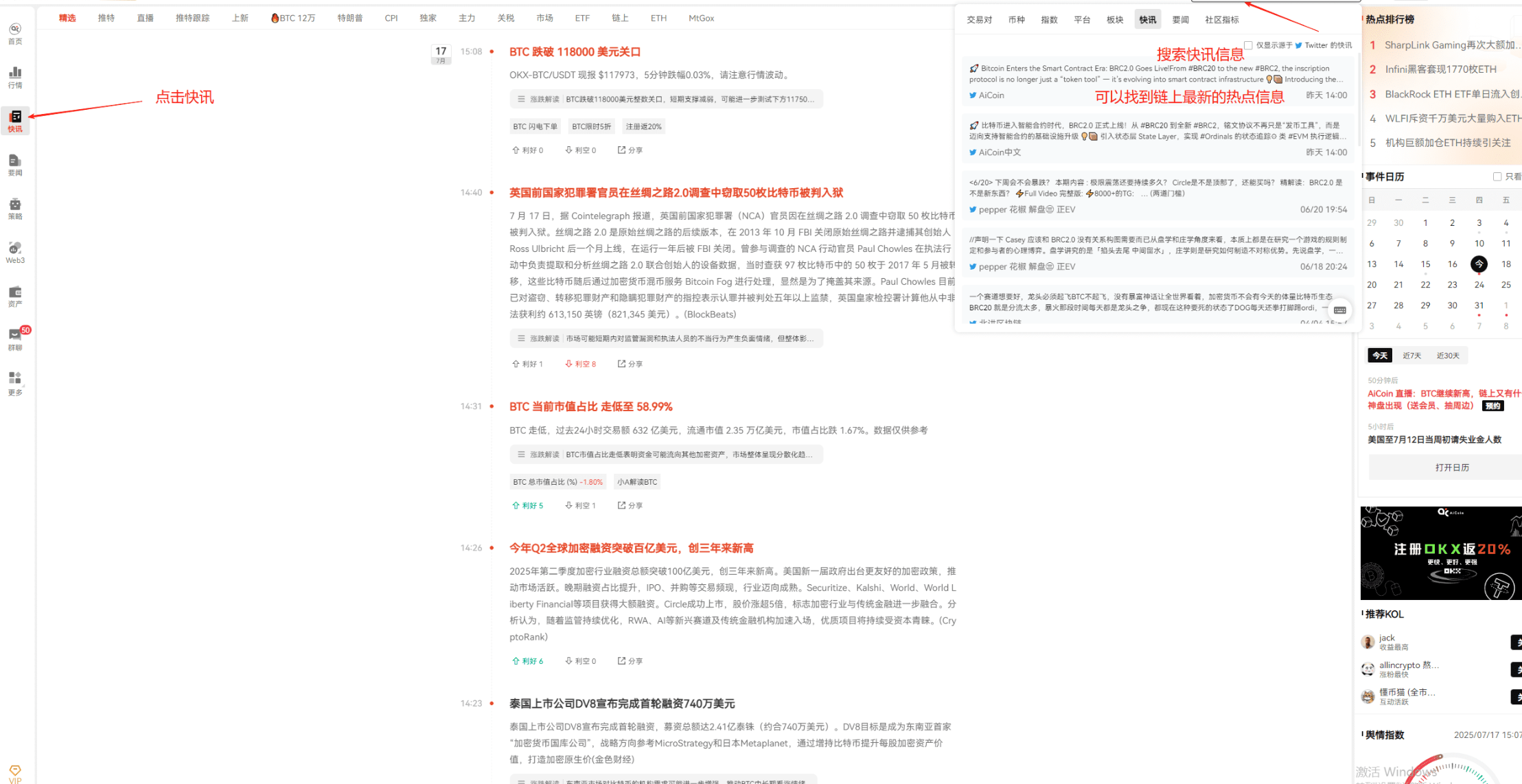

At this moment, BTC's candlestick chart is still refreshing its heights, but the real opportunities always belong to those who can see through the fog of on-chain data. When most people are screaming at the price, the smart ones are using AiCoin's PRO membership tools to scan for the next BRC2.0-level protocol vulnerabilities—after all, in this market, information asymmetry is the eternal alpha.

(All projects mentioned in this article do not constitute investment advice. Please be sure to complete your own DYOR before engaging in on-chain operations. The host's official Twitter quality inspection report shows: among the 12 on-chain opportunities highlighted in the past three months, 7 achieved excess returns, 3 went to zero, and 2 fell into a stalemate—this is the real crypto world.)

This article only represents the author's personal views and does not represent the stance or views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。