According to the Financial Times, citing three informed sources, U.S. President Donald Trump plans to sign an executive order allowing U.S. 401(k) retirement plans to invest in alternative assets beyond stocks and bonds, including cryptocurrencies, digital assets, metals, and funds focused on infrastructure deals, corporate acquisitions, and private loans. This executive order is expected to be signed within this week and aims to introduce a broader range of investment options to the U.S. retirement savings market.

Core Content of the Executive Order

According to the Financial Times, the executive order will instruct Washington regulators to explore the most effective ways to incorporate cryptocurrencies into 401(k) plans and investigate any remaining obstacles needed to achieve this goal. This move signifies a potential significant transformation in the U.S. retirement savings system, providing investors with more diversified asset allocation options.

The Appeal of Cryptocurrencies

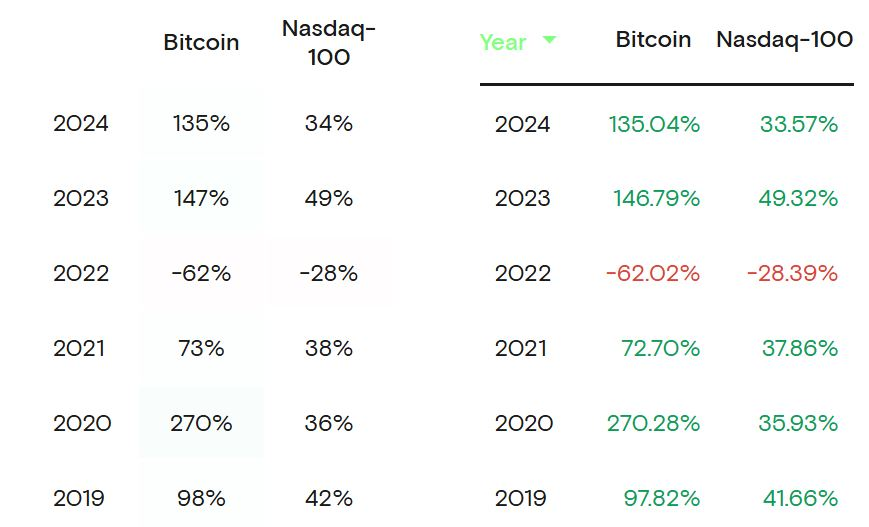

Over the past six years, Bitcoin's annual return has exceeded that of the Nasdaq index in five of those years, demonstrating its potential as a high-return asset (data source: Curvo). This performance has attracted the attention of investors and policymakers. However, White House spokesperson Kush Desai emphasized in an interview with Cointelegraph that any related decisions should not be considered official unless they come directly from President Trump himself. He stated, "President Trump is committed to restoring prosperity for ordinary Americans and securing their economic future. But unless confirmed by the President himself, any decision does not carry official weight."

Current Status of 401(k) Plans

A 401(k) is a common retirement savings plan offered by U.S. employers that allows employees to invest a portion of their pre-tax wages into funds. As of September 30, 2024, the total assets in the U.S. 401(k) market reached $8.9 trillion, covering over 715,000 plans. Traditionally, investments in 401(k) plans have primarily focused on asset classes such as mutual funds, exchange-traded funds (ETFs), stocks, and bonds, and the introduction of alternative assets could significantly change this landscape.

Shifts in U.S. Policy and Industry

In May of this year, the U.S. Department of Labor rescinded guidance issued during the Biden administration that restricted the inclusion of cryptocurrencies in 401(k) plans, clearing some obstacles for cryptocurrencies to enter the retirement savings space. Meanwhile, financial services giant Fidelity launched a new retirement account in April that allows Americans to invest in cryptocurrencies, managing assets totaling $5.9 trillion. This indicates a growing interest in cryptocurrencies as a retirement investment option within the industry.

At the state level, legislators in North Carolina are also actively promoting cryptocurrency investments. In March of this year, the state’s House and Senate introduced a bill requiring the state treasurer to allocate up to 5% of the state retirement fund to cryptocurrencies like Bitcoin.

International Trends

The U.S. is not the only country focusing on cryptocurrency investments in retirement plans. In November 2024, U.K. pension expert Cartwright reported that an unnamed pension fund had allocated 3% of its assets to Bitcoin. The Japanese Government Pension Investment Fund also indicated in March 2024 that it is considering Bitcoin as a potential diversification investment tool.

The executive order that Trump plans to sign could open a new investment era for U.S. 401(k) retirement plans, allowing investors to include alternative assets like cryptocurrencies in their retirement savings portfolios. Although this policy has not yet been officially confirmed, its potential impact has sparked widespread discussion in financial markets and policy circles. As global interest in cryptocurrency investments continues to grow, this U.S. initiative may further promote the adoption of cryptocurrencies within the traditional financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。