Using "income-driven main coin," Berachain's new proposal has made a good start.

Written by: Deep Tide TechFlow

The crypto market is gradually warming up, with BTC and ETH leading the charge. However, many L1 public chains' main coin prices have failed to rebound in sync, and the current situation is far from the previous battle of hundreds of chains trying to kill Ethereum.

Currently, L1s are facing the challenge of "main coin marginalization": circulation unlocks, token dilution, and weak narratives make it difficult for these main coins to capture the value of ecological growth.

As an innovative EVM-compatible public chain, Berachain occupies a place in the public chain ecosystem with its unique Proof of Liquidity (PoL) mechanism. However, the three-token model has limited the value capture ability of its main coin BERA, which currently has a market cap of only $270 million.

The current predicament of $BERA stems not only from traditional token economics issues (such as unlocking pressure) but also from a lack of narrative and product application.

If $BERA is merely a tool for paying gas on the chain, its narrative imagination space will naturally be much smaller. However, a recent PoL V2 proposal in the official Berachain community may provide an opportunity for $BERA to turn the narrative and functionality around:

By reallocating 33% of PoL incentives, the aim is to transform $BERA from a marginalized gas token into a core income asset.

After the proposal was released on July 15, the price of $BERA surged 23% within 24 hours, breaking the $2.5 mark, and the market has interpreted this as a positive response.

Beyond the short-term effects, can PoL V2 bring long-term value to $BERA? Can it reshape the main coin's status through incentive mechanisms and attract institutional and user participation?

The Initial PoL: The Hidden Dilemma of $BERA's Value

To answer the above questions, we need to understand the current situation of the main coin $BERA under Berachain's PoL model.

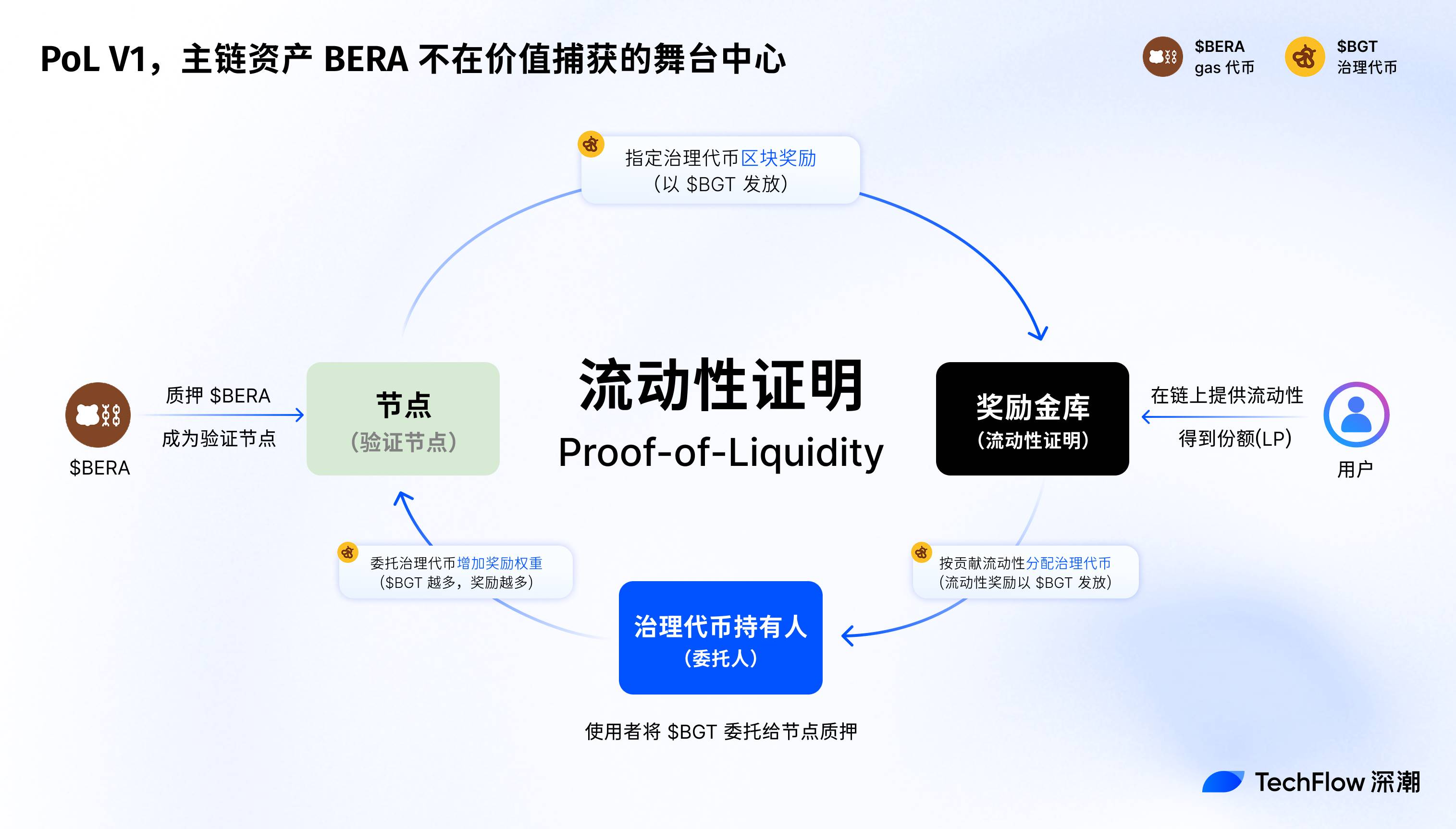

The initial Proof of Liquidity (PoL V1) mechanism of Berachain is essentially a consensus design at the economic level, aimed at enhancing network security and ecological prosperity by incentivizing liquidity providers (LPs) and dApp development.

Unlike traditional PoS, PoL utilizes a three-token model ($BERA, $BGT, $HONEY) to distribute block rewards to validators and ecological participants through bribery auctions.

In this model, $BERA serves as the gas token and network's base asset, $BGT is responsible for governance and staking rewards, while $HONEY supports liquidity as a stablecoin.

Since the mainnet launch on February 6, 2025, PoL has once driven the growth of Berachain's TVL, which peaked at $3 billion by the end of March this year.

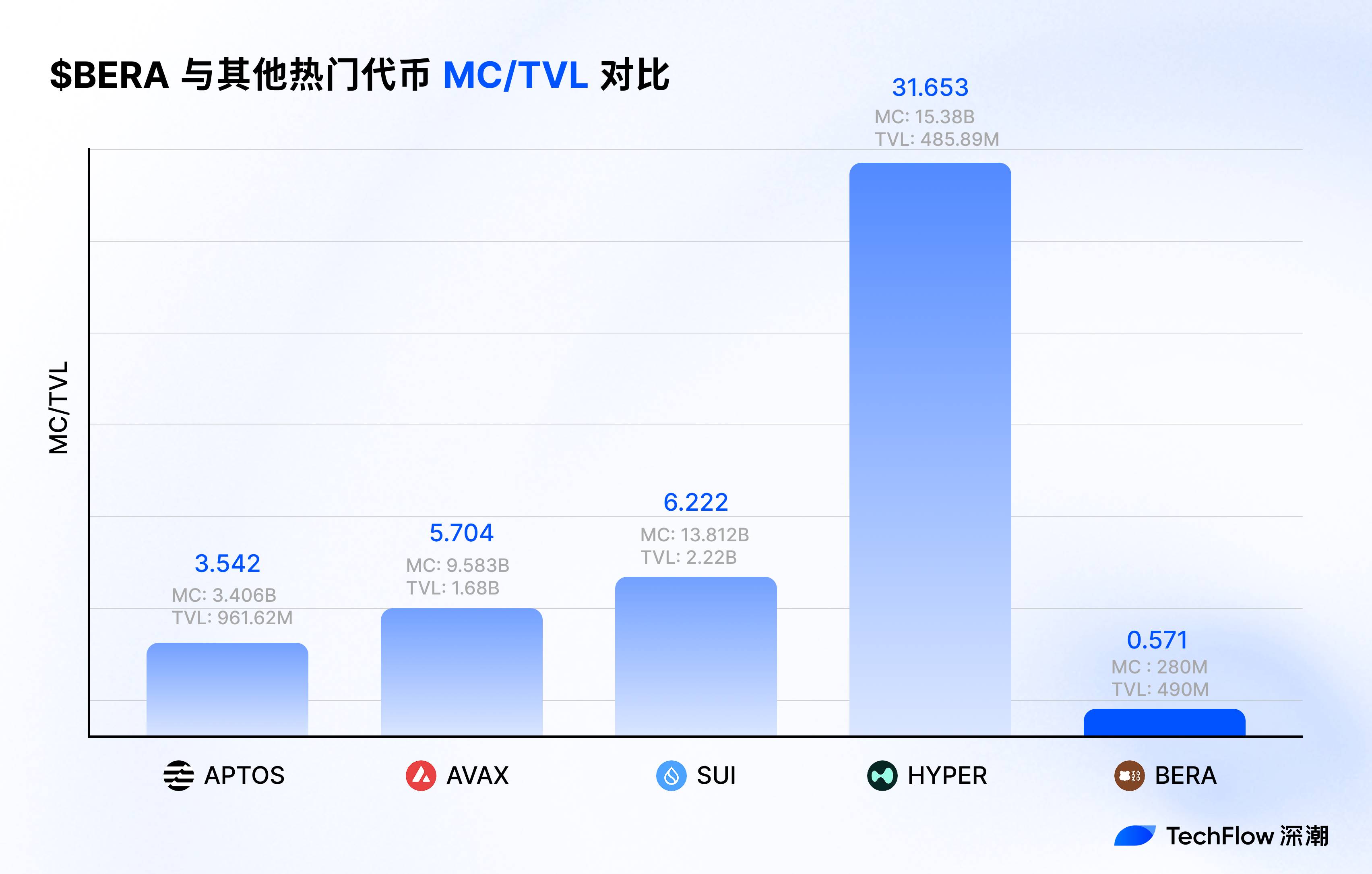

In contrast, during the same period, the market cap of the main coin BERA was only $900 million, with an MC/TVL ratio of less than one-third. It seems that $BERA has not gained better market performance from Berachain's ecological appeal.

Where is the problem?

Looking back at the initial design of PoL, I believe this was an arrangement that served the overall interest, where incentive distribution and mechanism restrictions led to the dilution of BERA's value.

The initial PoL, in order to gain more ecological activity, cleverly designed bribery and emission mechanisms structurally to serve Berachain's overall development. However, $BERA, as the main chain asset, did not receive equal development opportunities, which is reflected in:

LPs capture the full staking rewards through the PoL bribery mechanism and distribute them using $BGT, while $BERA is only used for gas payments, lacking independent revenue sources.

Bribery incentives are prioritized for $BGT holders, neglecting the needs of $BERA stakers, which indirectly reduces the market demand for $BERA.

The reward treasury mechanism of PoL V1 concentrated liquidity incentives on dApps rather than the mainnet asset $BERA.

Overall, while Berachain can thrive, the ecosystem can flourish, and meme creation can thrive, $BERA has not thrived. "Main coin elevation" has become an urgent task for enhancing the influence of the public chain in the next phase.

V2 Proposal: Let $BERA Become the Core Asset of the Ecosystem

Understanding the limitations of the initial PoL on BERA's value capture, let's look at the changes brought by the PoL V2 proposal.

To conclude, PoL V2 focuses more on incentive redistribution and functional expansion, attempting to transform $BERA from a marginalized gas token into a core asset of the ecosystem.

Specifically, PoL V2 introduces the following key changes:

- Incentive Redistribution:

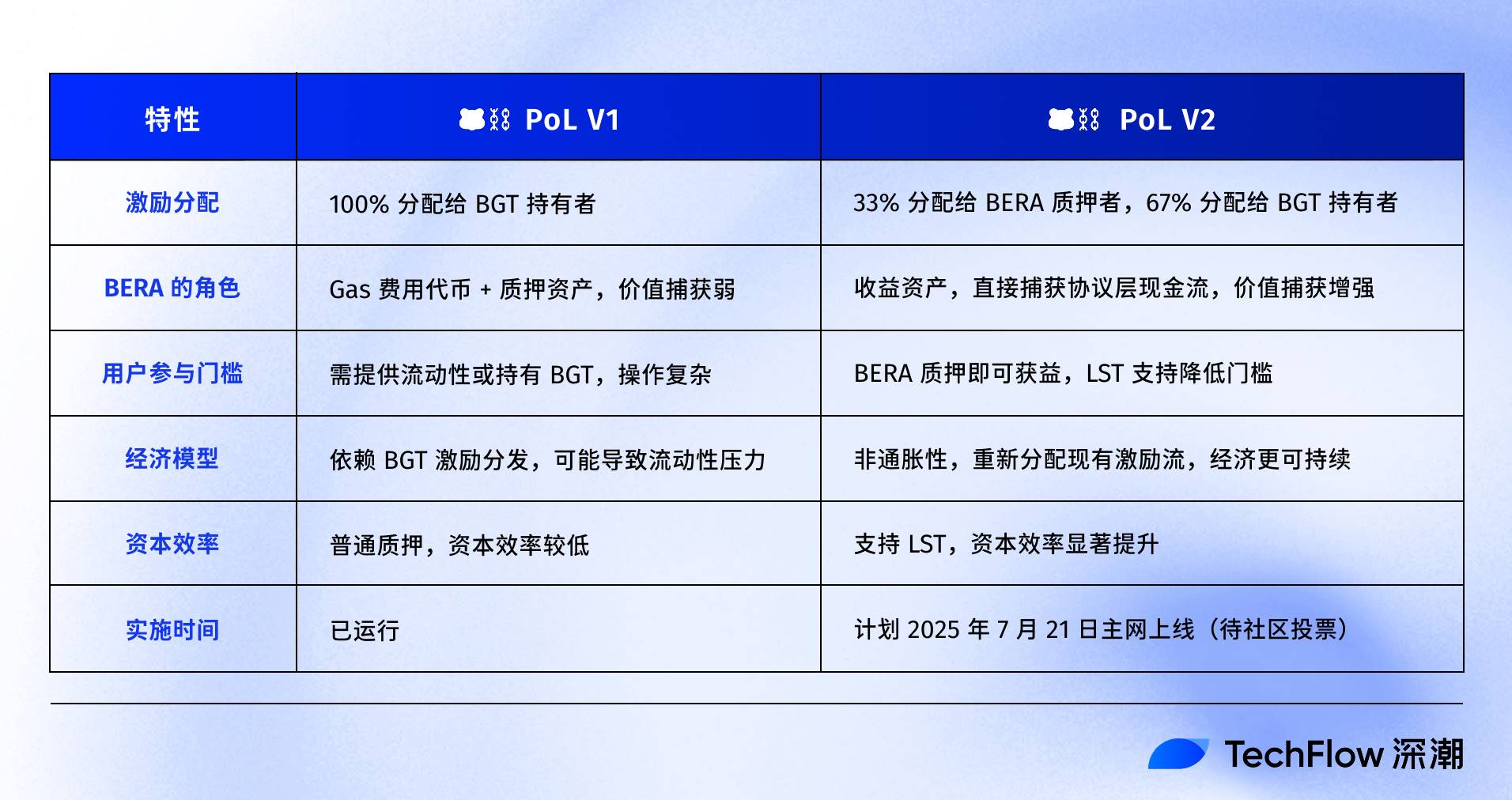

PoL V2 reallocates 33% of the DApp bribery incentives from BGT (governance token) holders to BERA stakers.

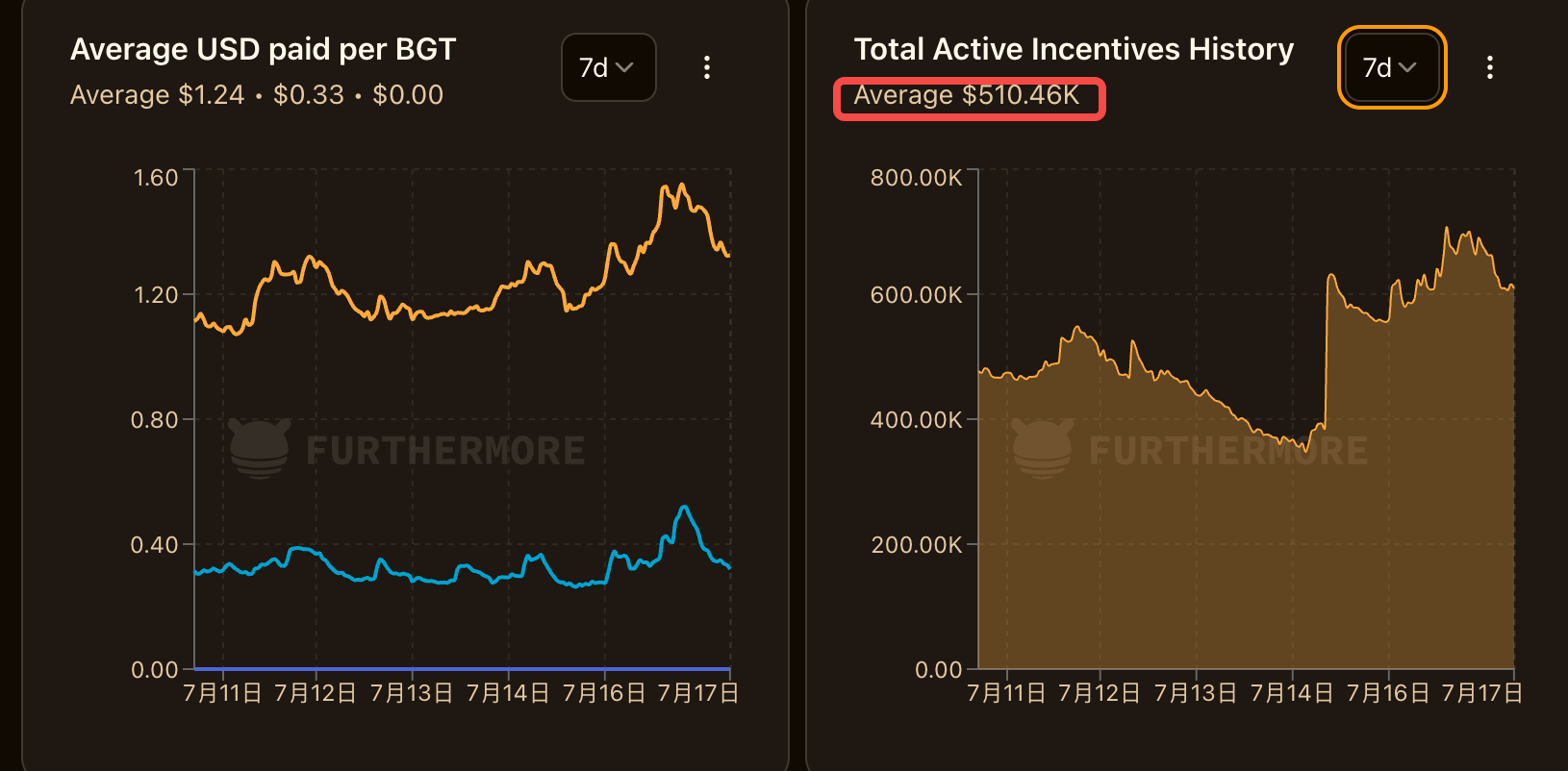

According to furthermore data, Berachain has had a total incentive of about $500,000 daily over the past week, which means that one-third of this (i.e., $150,000) will be directly injected into the BERA staking pool, creating sustained buying pressure on BERA to some extent.

The remaining 67% of the incentives continue to be distributed to BGT holders, maintaining their liquidity incentive leverage effect and ensuring that the rights of existing stakeholders are not harmed.

Note that this effectively provides additional income for BERA holders, and the method of provision is not simply through the issuance of more BERA, but through structural adjustments to redistribute cash flow within the protocol, avoiding the risk of BERA inflation.

- Functional Module Expansion:

PoL V2 supports liquid staking tokens (LST), allowing BERA stakers to earn validator rewards while also taking out their staked tokens to further earn PoL incentive income. This significantly improves the capital efficiency of BERA.

BERA stakers do not need to engage in complex DeFi strategies or hold BGT to directly profit from on-chain protocols (such as BEX, etc.), lowering the participation threshold.

We can also use a table to clearly compare the differences between V2 and V1 versions of PoL:

In contrast, PoL V1 seems more like a stage tailored for $BGT, with most rewards flowing to it, while $BERA can only silently pay gas fees, with value growth relying entirely on indirect ecological stimulation.

V2 places $BERA at the center stage, simplifying the reward acquisition process through new reward distribution and bond tools.

Value Capture, Still Value Capture

Value capture is a high-frequency term in the crypto industry, but for BERA, where exactly does it anchor?

As BERA transforms from a single gas token to the core income asset of the ecosystem, the anchoring of value will undergo subtle changes. This change lies in mental positioning and the ecosystem.

The core upgrade of PoL V2 is to grant BERA the ability to directly capture cash flow at the protocol level, similar to BERA having protocol dividend rights, thereby reshaping its price logic.

We can do a theoretical calculation.

Assuming the V2 proposal passes, by distributing 33% of the DApp bribery incentives to BERA stakers, the earlier data mentioned a total incentive of about $500,000 daily, which means one-third of this (i.e., $150,000 daily, approximately $1.1 million weekly) becomes the income for staking BERA.

PoL V2 grants BERA a revenue stream similar to "protocol dividends," meaning holding BERA equates to sharing the real income generated within the entire ecosystem, creating buying pressure under the positioning of income-generating assets; clearly, the price of BERA is also affected by token unlocks, and the actual multiple may vary due to TVL growth, adoption rates, or market cycles. However, if the native coin is not limited to paying gas and possesses more productive functions, based on the current performance of the BERA token, there is evidently greater growth potential.

In comparison, when looking at other public chains, the current MC/TVL ratio of BERA appears even more promising.

Moreover, the positioning of BERA as an income-generating asset may trigger broader market imagination.

Externally, companies like MicroStrategy have demonstrated strategic interest in holding crypto assets through Bitcoin reserves. Companies like SharpLink have begun to reserve Ethereum, primarily because ETH is a "productive asset."

If PoL V2 grants BERA a stable revenue stream and a non-inflationary design, making it an income-generating asset, it also provides a suitable environment for the current "coin-stock play."

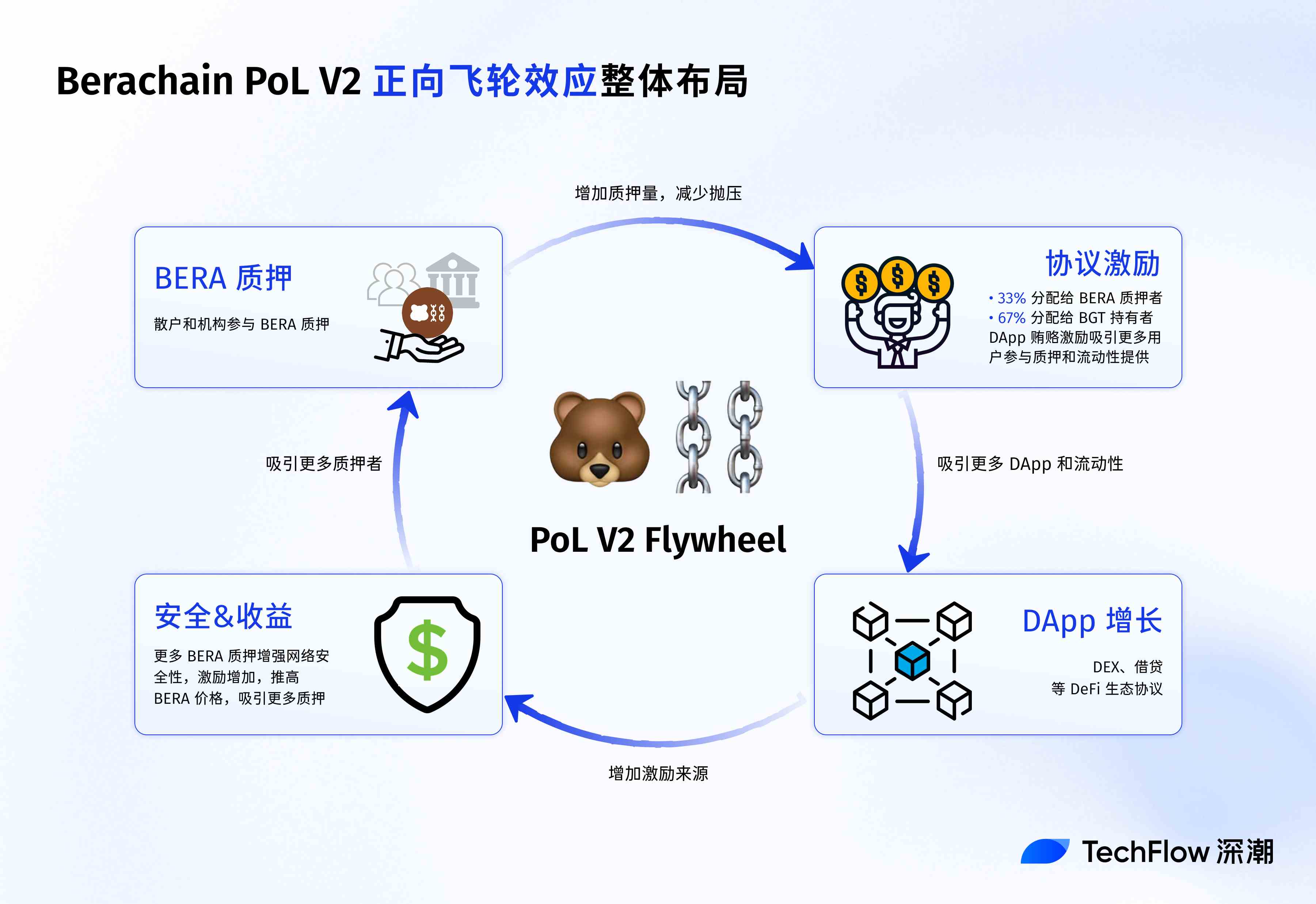

Internally, PoL V2 has spawned a positive flywheel mechanism.

First, the earnings of BERA stakers attract more long-term holders, increasing the token lock-up amount and reducing market selling pressure;

Secondly, the stable price of BERA and higher network security attract more developers to deploy DApps, further increasing the sources of bribery incentives. In turn, more incentives flow to BERA and BGT holders, forming a closed loop of "staking-incentives-DApp growth."

For example, the trading volume of BEX (Berachain's core DEX) may increase due to incentive optimization, thereby boosting the usage of HONEY (the native stablecoin) and strengthening the overall ecosystem's stickiness.

Compared to other Layer 1s that rely on issuing tokens to incentivize users, Berachain's model is closer to "protocol dividends," providing long-term stability for the ecosystem.

Finally, from the user perspective, the value capture of PoL V2 has different emphases for different groups.

For retail investors, staking BERA offers a low-risk income path similar to "crypto savings," attracting more long-term holders. For DeFi players, the introduction of LST means higher capital efficiency and strategic flexibility, such as using LST to provide liquidity in BEX while stacking PoL incentives.

For institutional users, the income-generating properties and non-inflationary design of BERA make it a potential strategic reserve asset, similar to stablecoins or high-yield bonds.

The current PoL V2 proposal was released on July 15, 2025, in the Berachain public forum and is currently in the community feedback phase, with a deadline of July 20, 2025.

If it receives a majority vote, the mainnet will launch this proposal on July 21, 2025, at which point the changes in BERA's value capture will be reflected.

However, it should be noted that the development of any public chain and the appreciation of its tokens cannot be solved by a single proposal; the crypto market has reached a point where pure conceptual speculation has been debunked, and only projects with practical applications, revenue, and solid fundamentals can stand out in the second half of the competition.

As a complement to the PoL V2 mechanism, as the ecosystem becomes more active, the earnings around BERA will rise. Because more protocols bidding for BGT means higher bribery amounts, which in turn means better staking rewards for BERA.

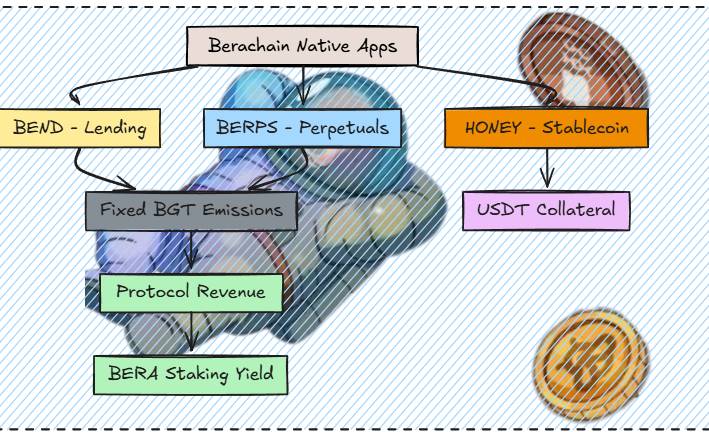

Next, we can expect to see more native DeFi protocols for Bera go live, such as the native lending protocol Bend, which will launch in four weeks; Berp, as a contract DEX, has confirmed its launch and is currently under development; Honey will expand to include more stablecoins as collateral and will also go live within three weeks, enhancing its role as a stablecoin more than before.

(Image source: @0xRavenium)

Additionally, the new Berahub page has recently gone live, upgrading the UI design, introducing a new asset portfolio page, and one-click Vault operations. This facilitates users in exploring the Berachain ecosystem through the explore page and participating in various PoL earning opportunities, no longer limited to providing liquidity.

Perhaps the projects themselves are gradually realizing that public chains must first make themselves valuable in order to make the ecosystem valuable.

Using "income-driven main coin," Berachain's new proposal has made a good start.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。