Ethereum Price Prediction: $4K Target Fueled by Squeeze, Buying

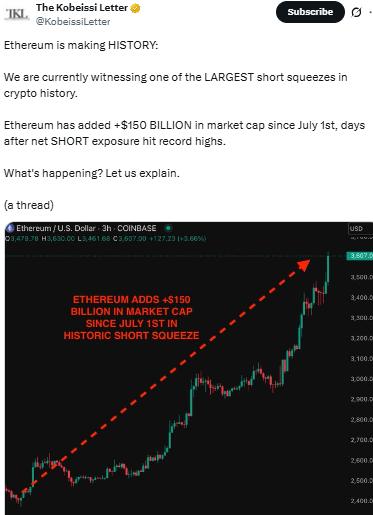

Ethereum is again in the spotlight after a stunning price rally earlier this month. As per the Kobeissi letter reporting , in less than a month, it has gained nearly 70%, pushing its market cap up by over $150 billion. This surge has now started a major discussion: what is the latest Ethereum price prediction?

Source: The Kobeissi Letter

Source: The Kobeissi Letter

Experts and traders alike are watching closely as the crypto market experiences one of the largest short squeezes in its history.

With this digital currency gaining so much in such a short time, the future looks more bullish than ever.

What Triggered the ETH Price Rally?

Before the Ethereum Price Prediction, heading into July, many traders expected it to fall. They opened leveraged short positions, betting the price would drop.

-

Regulatory clarity from US crypto bills passed during the crypto week could accelerate adoption

-

According to ZeroHedge , net short exposure was 25% higher than in February 2025, an extremely bearish outlook.

-

But the currency went contrary, as the price rose, short traders panicked buy back ETH to avoid losses. This brought a short squeeze, where panic buying drove prices up even faster.

This type of market move often leads to major price spikes, and it played a big role in shaping the current Ethereum price prediction trends.

Institutional Buying Heats Up the Market

President Trump’s World Liberty Financial recently bought $5 million worth of this cryptocurrency, adding fuel to the already growing fire.

Even more telling, BlackRock’s ETF reportedly added this digital asset on 29 out of the last 30 trading days before July began still the prices were low. BlackRock just made its biggest daily purchase ever of this cryptocurrency, buying $499.2 million worth of this currency in a single day yesterday . Right now, BlackRock holds a total of $6.94 billion in it .

SharpLink Gaming added $700M in ETH to its treasury since July 16 becoming the largest holder of this crypto.

Ethereum Price Prediction

More Liquidations Could Drive ETH Even Higher:

-

Right now, billions in short positions have already been wiped out.

-

If it climbs just 10% more, it could trigger another $1 billion in liquidations. Because many of these shorts are using borrowed money, this creates even more buying pressure.

ETH is trading between two significant Fibonacci levels.

-

The next level of resistance is at $3,903, while support is between $2,984 and $3,190.

-

A move above $3,903 could solidify the direction towards the $4,000 price target.

Yet warning signals are emerging.

-

The RSI is 83.6, its highest overbought reading since January 2025.

-

In addition, funding rates have surged 248% this week, and the risk of a long squeeze has increased.

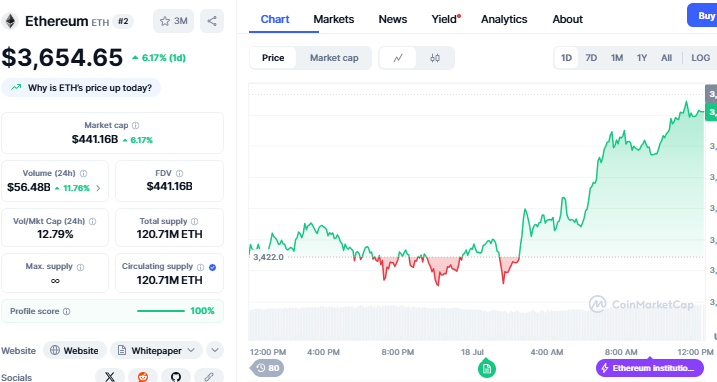

Apart from the Ethereum price prediction, the coin is now trading at $3654 with an increase of 6.17% in just one day. The trading volume has increased by 11.78%.

Source: CoinMarketCap

The combination of panic short-covering and real buying demand is making this digital currency one of the most closely watched cryptos today.

ETH Joins Bitcoin and Ripple in Market Recovery

ETH isn’t alone. Ripple (XRP) is showing strength, and Bitcoin has crossed $120,000, adding over $900 billion in market cap since April.

Having trailed for months, ETH is finally closing the gap, and the recent Ethereum price prediction indicates that it might be spearheading the next leg of the bull cycle.

Final Thoughts

ETH's explosive price movement has turned sentiment around. Strong institutional support, massive liquidations, and growing demand have led many to believe that $4,000 ETH is not an "if," but a "when.

The present Ethereum price prediction shows increasing optimism in both its short-term surge and overall resilience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。