XRP, ETH, BTC Fuel $4 Trillion Crypto Market Cap

Total crypto market cap hits $4 trillion for the first time ever today

For the first time ever, the total value of the global cryptocurrency market cap surpassed $4 trillion. One of the biggest bullish periods in the history of the crypto market cap is currently happening. The majority of significant cryptocurrency assets trade in the green zone. While some are getting closer to new all-time highs, many are reaching new peaks.

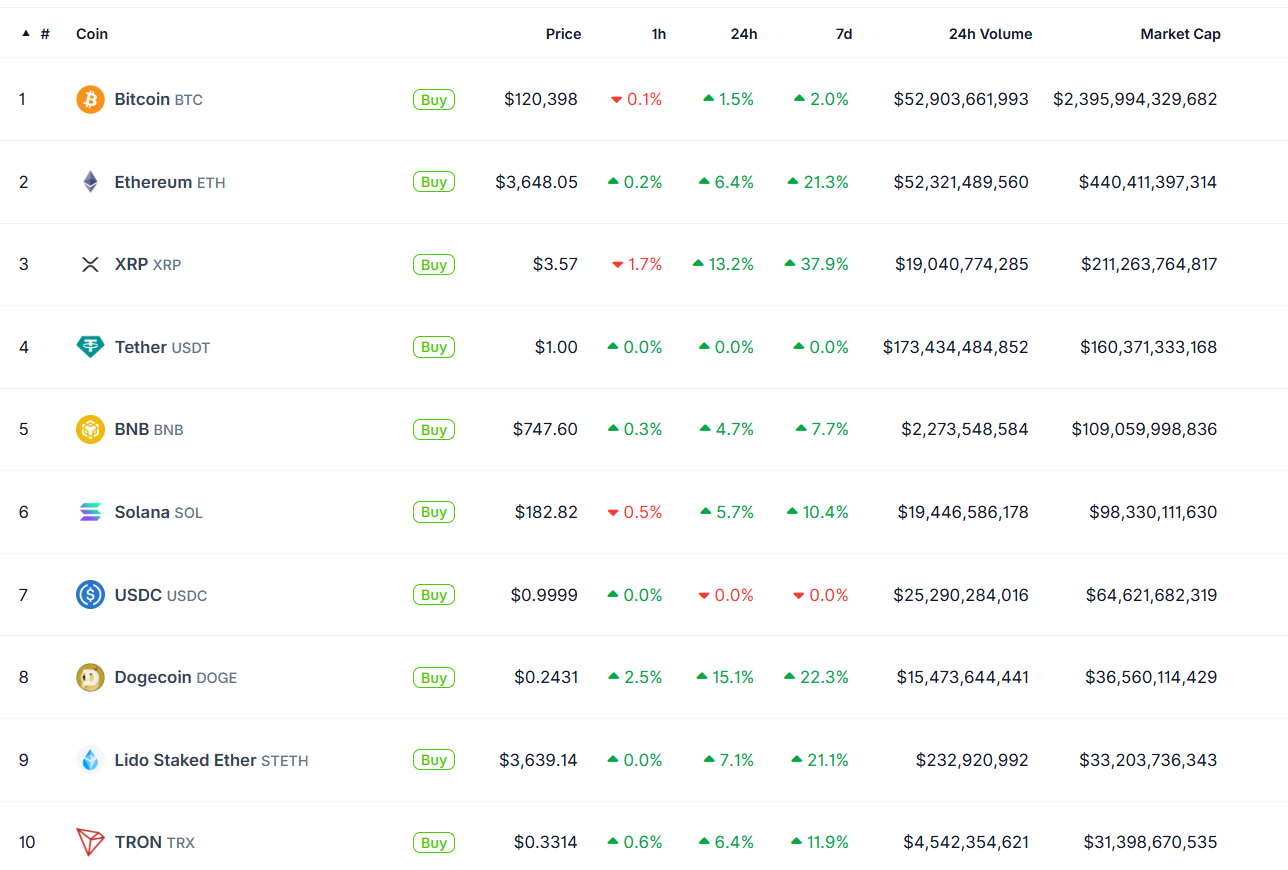

Source: Coingecko

Key Drivers Behind the Rapid Growth of the Crypto Market Cap

The cryptocurrencies space is expanding as a result of regulations, institutional investments, growing demand for decentralized financing (DeFi), and growing usage of blockchain technology. Users are drawn to improved security, transparency, and speedier transactions. Additionally, the integration of digital assets with payment systems and their increasing popularity promote the worldwide ongoing expansion.

July Sees Major Surge: BTC, ETH, XRP Hit New Highs

Source: Coingecko

July is the month of digital currency boom, with BTC surging to an all-time high of $122,834 on July 14. The total capitalization of Bitcoin (BTC) is $2.4 trillion, comfortably dominating at 59.6%. Ethereum is dominating at 11% with a total monthly spike of 44.5%. Ripple's XRP coin has reached a new all-time high of $3.59. XRP has shown a massive high of 65.3% in past weeks. Binance's BNB coin is also approaching a new all-time high. The asset is down only 6.8% from a new high.

The recent increase in crypto market cap may be the result of the Thumzup Media investment $250 million in digital assets treasuries, including XRP, joining corporations like VivoPower and Webus, which intend $421 million in XRP acquisitions, and regulatory positive momentum from the House passing crypto-friendly laws. The measure significantly alters the US regulatory framework for cryptocurrency. The act states that the main regulator of the digital asset will be the Commodity Futures Trading Commission (CFTC).

Institutional Adoption of BTC and ETH Signals Long-Term Confidence

With the major dominance of both the coin over the global crypto market cap. Large institutions have already chosen the networks they're building on. Some in secret, some in broad daylight. These innovations are directly inline with what we've seen discussed by world leaders for the past few years. Standard Chartered has recently opened spot trading for BTC and Ethereum represents a turning point in traditional finance's use of cryptocurrencies. Metaplanet and Michael Saylor’s Strategy (MSTR) have heavily invested in their BTC treasury. Sharplink Gaming and Blackrock have been acquiring Ether aggressively from the past month. The cryptocurrency reserves of giant Institutions shows us the well built future of the cryptomarket ahead.

Trump Family Emerges as Major Player in the Cryptocurrency Space

As soon as Donald Trump became the president of the USA, the crypto market cap volume gained immensely. Trump's family has also become a significant cryptocurrency investor, having agreed to buy more than $2 billion in digital currencies like bitcoin through their publicly traded Trump Media & Technology Group, as well as developing a stablecoin and other valuable digital tokens. Recently WLFI token got approval to trade openly on various exchanges. Trump’s dinner event to promote his memecoin is generating chaos among politicians and big corporations.

Is Global Crypto Mining Driving the $4 Trillion Boom Right Now?

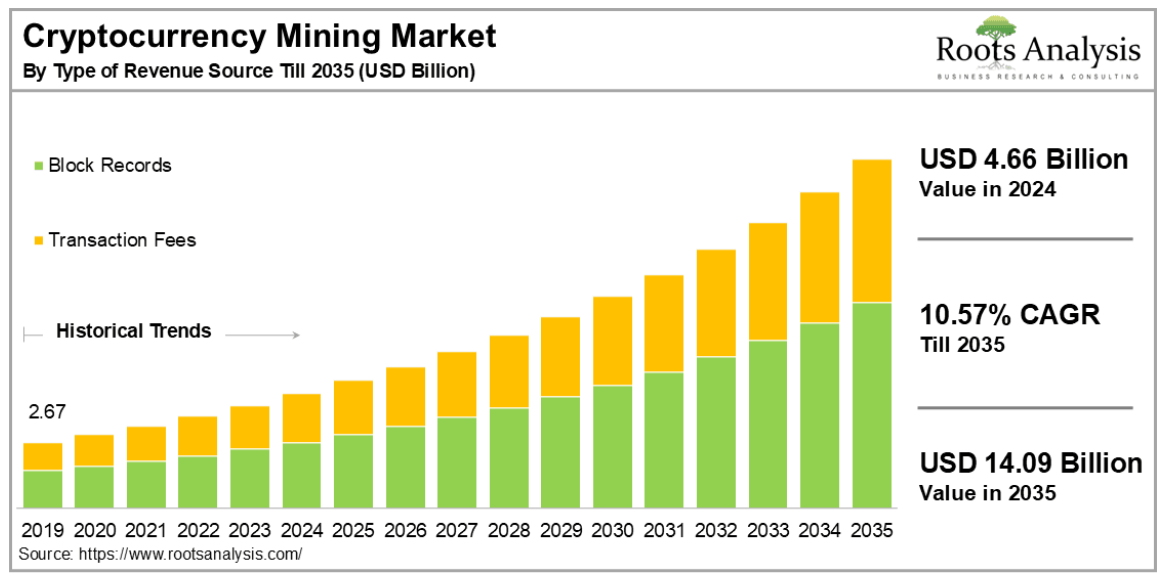

Source: Roots analysis

According to the worldwide cryptocurrency mining space size forecast, this is expected to develop at a compound annual growth rate (CAGR) of 10.57% from USD 4.66 billion in 2024 to USD 14.09 billion by 2035. For Bitcoin and other cryptocurrencies, cryptocurrency mining is a basic procedure for creating new coins and confirming transactions results in increased crypto market cap. Many developing nations, such as Bhutan, have developed and filled their BTC reserves by hydromining.

Bullish Momentum Faces Profit-Taking Risks

Over the coming days, there's the potential that the crypto market cap may continue its present upswing. However, as assets continue to rise, we may witness a rise in profit-taking. This surge may result from higher rates and increased profit-taking . It remains to be seen how things turn out.

Also read: Xenea Wallet Quiz Answer 18 July 2025: Play and Earn $Gems免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。