Author: Obol Collective

Translation: Felix, PANews

Key Points:

- Ethereum is entering a new decade, stepping into a brand new era. As the world's most secure and decentralized programmable blockchain, it has become the preferred platform for institutions. Just as Bitcoin has earned the title of "digital gold," Ethereum's native asset is gaining recognition as "scarce digital oil."

- Major institutions are competing to accumulate ETH as part of their long-term strategic reserves, with "strategic ETH reserves" increasing by over 1.7 million ETH by 2025. As these institutions increase their holdings of ETH, it has become the first digital commodity that can generate yield.

- ETH can be viewed as an internet bond, and staking provides institutions with a risk-free way to accumulate returns. As Ethereum's adoption rate continues to rise, ETH is becoming increasingly scarce, and institutions will turn their attention to staking and distributed validators due to their security advantages.

- Institutions recognize that Ethereum will drive the development of the global on-chain economy. This is one of the main catalysts for Ethereum's future as a trillion-dollar network.

The Institutional Era of Ethereum Has Arrived

Institutions are embracing Ethereum. As major players on Wall Street discover the potential of innovations like stablecoins, DeFi, and RWA, Ethereum is becoming their preferred decentralized platform. Institutions like BlackRock, JPMorgan, and UBS are building on Ethereum, as it dominates these verticals while also offering significant decentralization and security advantages.

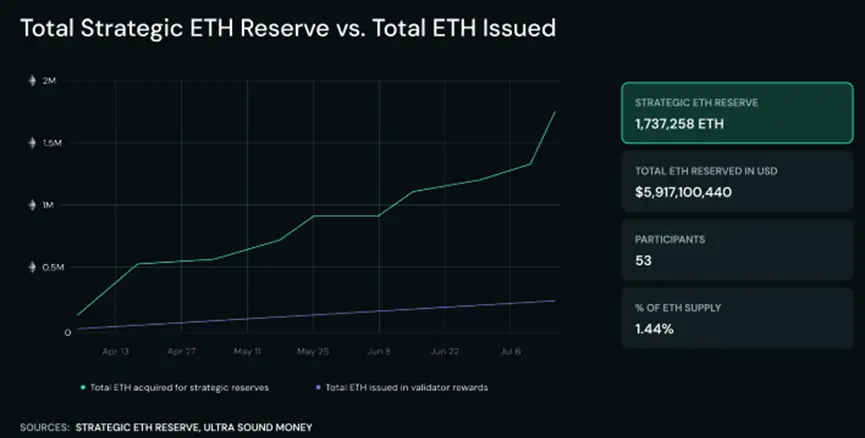

ETH is gradually becoming a reserve asset. In recent years, several large companies have included BTC in their reserve assets. However, recently, a wave of publicly traded companies, DAOs, and crypto-native foundations have begun accumulating ETH as a long-term holding asset. Today, over 1.7 million ETH (worth $5.9 billion) have been locked in reserve assets, with total reserves doubling year-on-year.

Ethereum is the next layer of global finance. Institutional investors are reserving ETH because they recognize that ETH is the monetary foundation of this layer. ETH is the first digital asset to possess reliable neutrality, scarcity, utility, and yield. BTC is recognized as the first reserve asset of cryptocurrency, while ETH is the first yield-generating reserve asset.

This report will focus on the first institutions to adopt ETH as a strategic reserve asset. It will also look ahead to explain how these institutions will stake ETH, the role distributed validators will play in establishing institutional staking standards, and why the race to adopt ETH as a reserve asset will become a trillion-dollar catalyst for Ethereum.

1. Why Institutions Prefer "Digital Oil" Over "Digital Gold"

Bitcoin rightfully holds the title of the world's first digital gold. Bitcoin serves as a non-sovereign store of value with unique properties that are highly attractive to institutions. However, Ethereum is a more dynamic asset because it drives the global on-chain economy. As the world moves on-chain, Ethereum's utility and scarcity will increase in tandem. If Bitcoin is digital gold, then Ethereum is digital oil.

Institutions are beginning to favor digital oil over digital gold, a trend expected to continue over the next decade. There are three reasons for this:

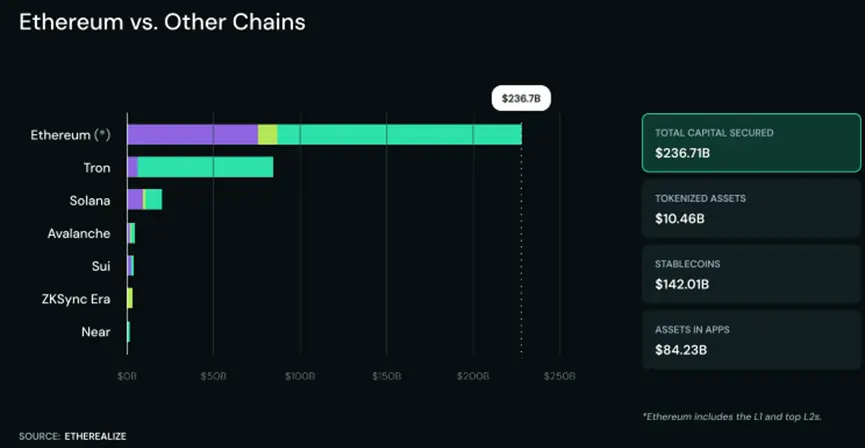

BTC is idle, while ETH is actively building. Bitcoin has succeeded by serving as a passive store of value. In contrast, Ethereum's success comes from its continuous efficient output. Ethereum is the indispensable fuel for the world's most decentralized and secure smart contract blockchain. Every operation in Ethereum's vast decentralized finance ecosystem, every NFT minting, and every layer-two network settlement requires ETH as a transaction fee. Since the launch of EIP-1559 in August 2021, Ethereum has burned approximately 4.6 million ETH, worth about $15.6 billion at current prices, indicating that this asset plays the role of digital oil in the on-chain economy. Currently, Ethereum secures approximately $237 billion in value across L1 and top L2 networks, and as the global economy shifts more on-chain, demand for ETH will continue to grow. Ethereum holds a 57% share in the RWA market and a 54.2% share in the total supply of stablecoins. In short, Ethereum holds advantages across multiple metrics, and ETH is the driving force of its ecosystem.

BTC has inflationary tendencies, while ETH is gradually becoming anti-inflationary. BTC's supply schedule is fixed, with the current issuance rate around 0.85%, which will programmatically decrease over time. As block rewards are halved every four years, miners will increasingly rely on transaction fee income to sustain operations. Some believe that BTC's security budget poses a potential threat. Ethereum has adopted a different monetary policy directly linked to economic activity. The total issuance cap for ETH is 1.51% to incentivize network security, but since approximately 80% of transaction fees are burned through EIP-1559, the net issuance rate of ETH has averaged only 0.1% per year since the merge. ETH often experiences net deflation, and as demand for Ethereum block space grows, the total supply (currently just under 120 million ETH) is expected to decrease. In other words, as Ethereum becomes more popular, ETH will become increasingly scarce.

BTC does not generate any yield, while ETH is a yield-generating asset. Bitcoin itself does not produce yield. However, ETH is a high-yield digital commodity. ETH stakers can lock Ethereum as validators and earn a current real yield of about 2.1% (nominal yield - new issuance). Stakers can earn from ETH issuance and a portion of transaction fees (the part that is not burned), with no counterparty risk, incentivizing long-term holding and active network participation. What sets ETH apart from all other major crypto assets is that as the throughput of the Ethereum economy expands, the yield for validators will also increase.

ETH as the Leading Global Reserve Asset

ETH has become the leading global reserve asset due to its unique attributes. ETH meets three core requirements in a way that no other asset can:

Pure settlement collateral. As the new economy continues to build on tokenized assets that carry issuer and jurisdictional risks, the financial system needs a trustworthy, neutral, non-sovereign collateral asset. That asset is ETH. Apart from BTC, ETH is the only "pure" collateral in the on-chain economy that can completely withstand external counterparty risks. With $237 billion in collateral value, ETH serves as the cornerstone of the next-generation financial system, offering censorship resistance.

Strong liquidity. ETH is the most liquid and primary asset in DeFi trading pairs. The role of ETH in the on-chain economy is similar to that of the dollar in traditional foreign exchange markets. The deep liquidity and broad utility of ETH prompt DAOs, foundations, and publicly traded companies to compete to accumulate ETH as a strategic asset. "Strategic ETH reserves" are rapidly expanding, and hoarders benefit from its programmability. BTC sits idle in vaults, while ETH can be deployed through staking and collateralized lending use cases.

Protocol-native yield. Corporate financial officers seek yield, but obtaining it without taking on significant credit or counterparty risk is not easy. ETH staking offers 2-4% risk-free yield, with returns directly sourced from L1 staking. This means financial officers can obtain an efficient, cash-flow-generating tool for reserves, directly linking their balance sheets to the growth and security of the new economic base layer.

"Internet Bonds"

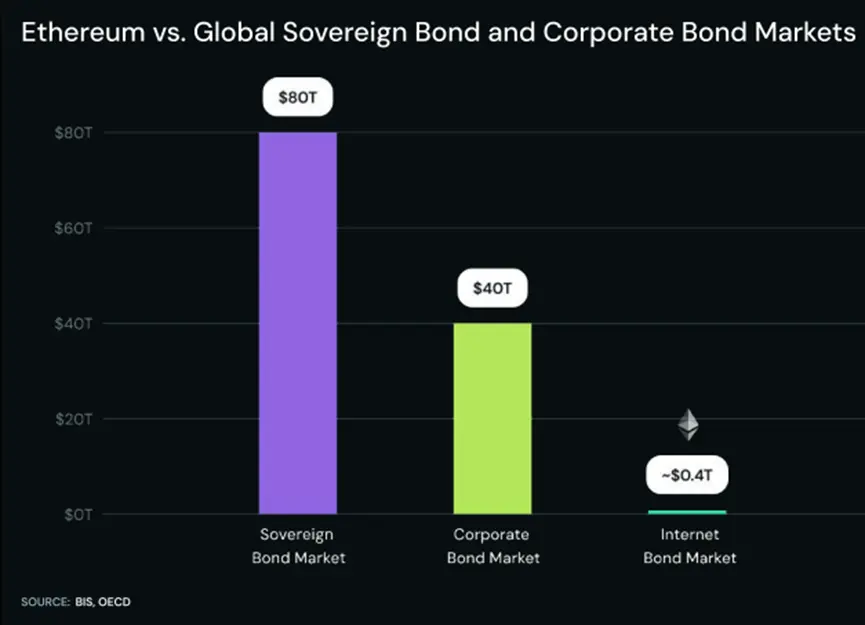

Due to staking generating native protocol yield, ETH has become the world's first "internet bond." Historically, corporate financial officers have typically allocated funds to sovereign bonds (valued at approximately $80 trillion) and corporate bonds (valued at approximately $40 trillion). ETH staking creates a new category of bonds that have a broad understanding of issuance, risk, and yield conditions. Today, this market is several orders of magnitude smaller than the sovereign and corporate bond markets. However, unlike corporate and sovereign bonds, ETH has no maturity date, and yields are generated perpetually. Since yields are generated by the protocol, ETH staking also eliminates counterparty risk; there is no default risk from bond issuers.

ETH is a global, censorship-resistant commodity, and its yields are not affected by traditional interest rate cycles. Currently, the Federal Reserve's fund rate is between 4.25% and 4.5%. Meanwhile, the current real yield for ETH stakers is about 2.1%. As borrowing costs decrease, capital allocators tend to favor risk assets over short-term government bonds when interest rates fall. Institutions continue to show interest in Ethereum staking even when short-term government bond yields are higher, indicating their strong conviction. If interest rates decline, these institutions can benefit from higher yields on the underlying asset, and as market risk appetite increases, the underlying asset will also appreciate.

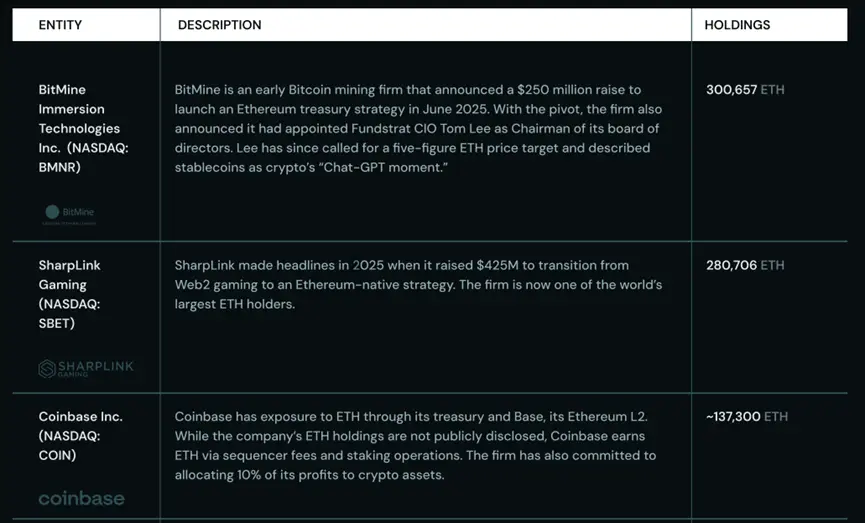

2. Institutions Compete to Accumulate ETH

Cryptocurrency has firmly established itself as a legitimate asset class, with Bitcoin serving as the gateway for institutions entering the space. However, Ethereum is the natural evolution of this trend. Ethereum combines the value storage appeal of Bitcoin while providing native yield and securing the evolving on-chain economy of stablecoins, RWA, and DeFi. Strategic Ethereum reserves highlight this significant shift: institutions are hoarding ETH as a long-term strategic reserve asset.

Many publicly traded companies and Ethereum-native organizations have implemented ETH fund management strategies. Most strategies aim to generate yield, while others view ETH as the foundational currency for long-term operations. Many organizations balance both approaches.

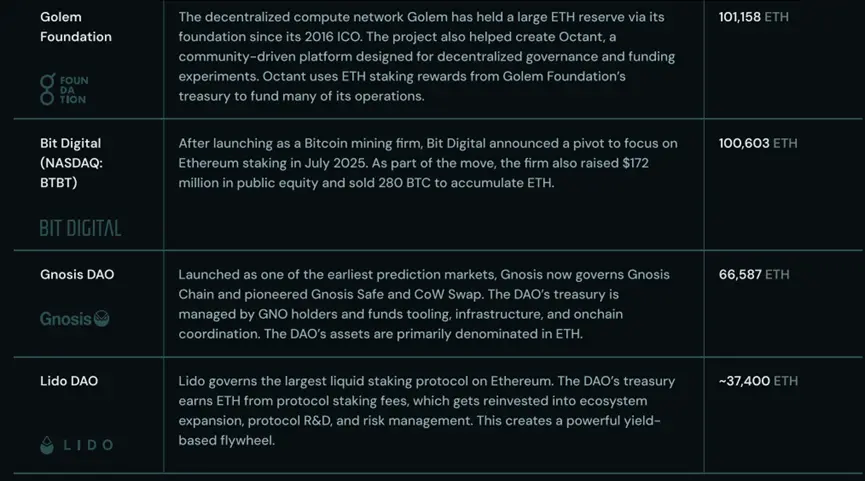

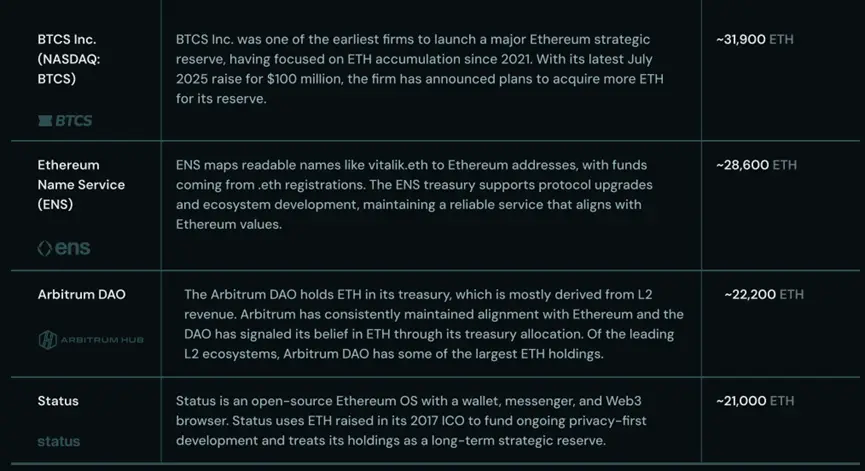

Data shows that approximately 1.7 million ETH (worth about $5.9 billion, or about 1.44% of the supply) are currently held in strategic reserves.

Since the beginning of the strategic reserve race in early Q2, the amount of ETH hoarded by institutions has far exceeded the ETH issuance paid to validators. As this competition intensifies, ETH is experiencing increasing deflationary pressure.

3. ETH is a Yield-Generating Asset

Clearly, institutions are adopting the Ethereum network, and ETH has become their preferred supporting asset. Various signs indicate that as government bond yields decline, the demand for ETH staking among institutions will soar, as these institutions seek to achieve real returns on their capital, and staking provides this yield with minimal risk. Distributed validators play a key role in this process, as institutions place a high emphasis on security and reducing counterparty risk in their capital allocation strategies.

Why Staking Prevails (and How Distributed Validators Fit In)

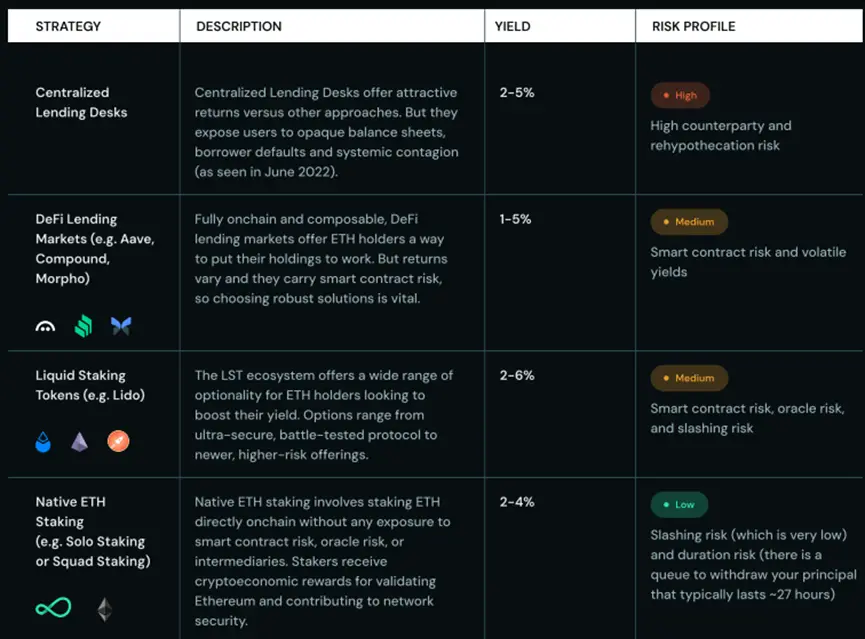

ETH staking is structurally different from all other ETH yield options. This is because it offers a predictable protocol-level yield linked to security incentives and network adoption.

Among all yield strategies that Ethereum holders might adopt, staking is the only option that does not generate borrower, counterparty, or credit risk.

Institutions related to Ethereum, such as Bit Digital, have recognized that staking is the best way to earn returns on their held assets. As more institutions adopt strategic ETH reserve strategies, staking will, in turn, attract more institutions because it provides a low-risk way to earn from "internet bonds."

For institutions seeking yield, ETH staking is the best route, as it offers an almost risk-free yield compared to other strategies.

However, even though financial officers recognize that native staking is clearly a strategically wise choice, they have other factors to consider. For these institutions, the question is not only whether to stake but also how to stake to achieve institutional-level security and resilience. While traditional validators are effective, they can create single points of failure. Distributed validators (DVs) address this issue. Distributed validators have the following characteristics:

- A single Ethereum validator (staking more than 32 ETH) is distributed across multiple nodes.

- Uses distributed key generation (DKG) to avoid single-point private key risks.

- Can maintain functionality even if up to half of the nodes are offline.

- Achieves performance equal to or better than traditional validators.

Although the field of decentralized validators (DVs) is still in its infancy, many institutions building strategic Ethereum reserves have begun using DVs. They can benefit from the following points:

- Institutional-level key security: DV keys are never stored in a single location, and no single operator can access them, providing users with a higher level of security.

- Fault tolerance: Users do not face risks from a single operator, such as penalties or missed rewards.

- Middleware design: Top staking operators globally trust middleware infrastructures like Obol's Charon, which provides them with a way to decentralize their operations without significant modifications.

- No need to hold long-tail assets: Vaults do not need to accumulate long-tail assets to stake Ethereum. There is no need to consider collateral assets, margin, or liquidation mechanisms.

4. Why Does ETH Hold a Trillion-Dollar Opportunity?

ETH is no longer a misunderstood speculative asset. Following Bitcoin, Ethereum is becoming an institutional asset held by large enterprises, DAOs, and other institutions. But ETH has advantages that BTC does not possess: it is the foundation of the Ethereum network, which is the cornerstone of the next-generation financial system. As the first reserve asset with "productivity," ETH serves as a trusted neutral store of value, settlement collateral, and yield-generating reserve asset.

Ethereum lays the groundwork for the next-generation financial system. Today, institutions are recognizing this.

As adoption increases, ETH's unique position makes it likely to become even scarcer. As the base currency of Ethereum, ETH has a deflationary mechanism, and its supply will decrease as the network develops. No other asset can simultaneously possess these characteristics and provide trusted neutrality.

In Ethereum's first decade, it established the foundational layer for transformative innovations such as DeFi, stablecoins, NFTs, and ICOs.

As the second decade begins, Ethereum is entering its institutional era. Major companies view ETH as a primary "productive" asset, and the accumulation race is accelerating. In this new era, the path for Ethereum to become a trillion-dollar network has never been clearer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。