With the continuous acceleration of Web3[1] applications, more and more central banks and institutions are developing digital asset products, with stablecoins being a key focus. Stablecoins combine the efficiency and transparency of blockchain with the stability of traditional finance, and are set to reshape the global payment system and financial infrastructure. However, to promote the mainstream adoption of stablecoins[2], a solid foundation must be laid in terms of user trust, regulatory compliance, and compatibility with existing Web3 systems.

Under a strict compliance framework, formal verification is considered a highly promising methodology that can help build reliable stablecoin contracts while verifying key compliance requirements. This article will focus on the following directions:

A comprehensive understanding of the regulatory requirements for stablecoins is crucial for all stablecoin issuers;

When launching stablecoin projects in the United States, the GENIUS Act is an indispensable basis for assessing compliance risks;

Formal verification can help stablecoin projects more effectively meet the compliance requirements of the GENIUS Act.

Overview of Stablecoin Regulatory Landscape

Since the launch of the first batch of crypto stablecoin projects in 2014[3], stablecoins have been seen as a bridge connecting the traditional financial system and the Web3 world. The traditional financial system generally suffers from high latency, lack of transparency, and high costs. To improve these shortcomings, stablecoins introduce:

Real-time settlement

Immutable records

Smart contracts that can automatically verify rules or redirect foreign exchange paths

Broader financial inclusion, allowing anyone to participate easily

The electronic money (E-Money) regulatory framework[4], introduced in 2009, was not initially designed for Web3 scenarios, but has gradually extended to cover Web3-compatible solutions, including stablecoins.

Currently, regulatory agencies in multiple regions, including the Abu Dhabi Global Market (ADGM) and the Hong Kong Monetary Authority (HKMA), have central banks testing related solutions. The U.S. Congress has passed the GENIUS Act, outlining a regulatory roadmap for the compliant development of stablecoins.

The GENIUS Act

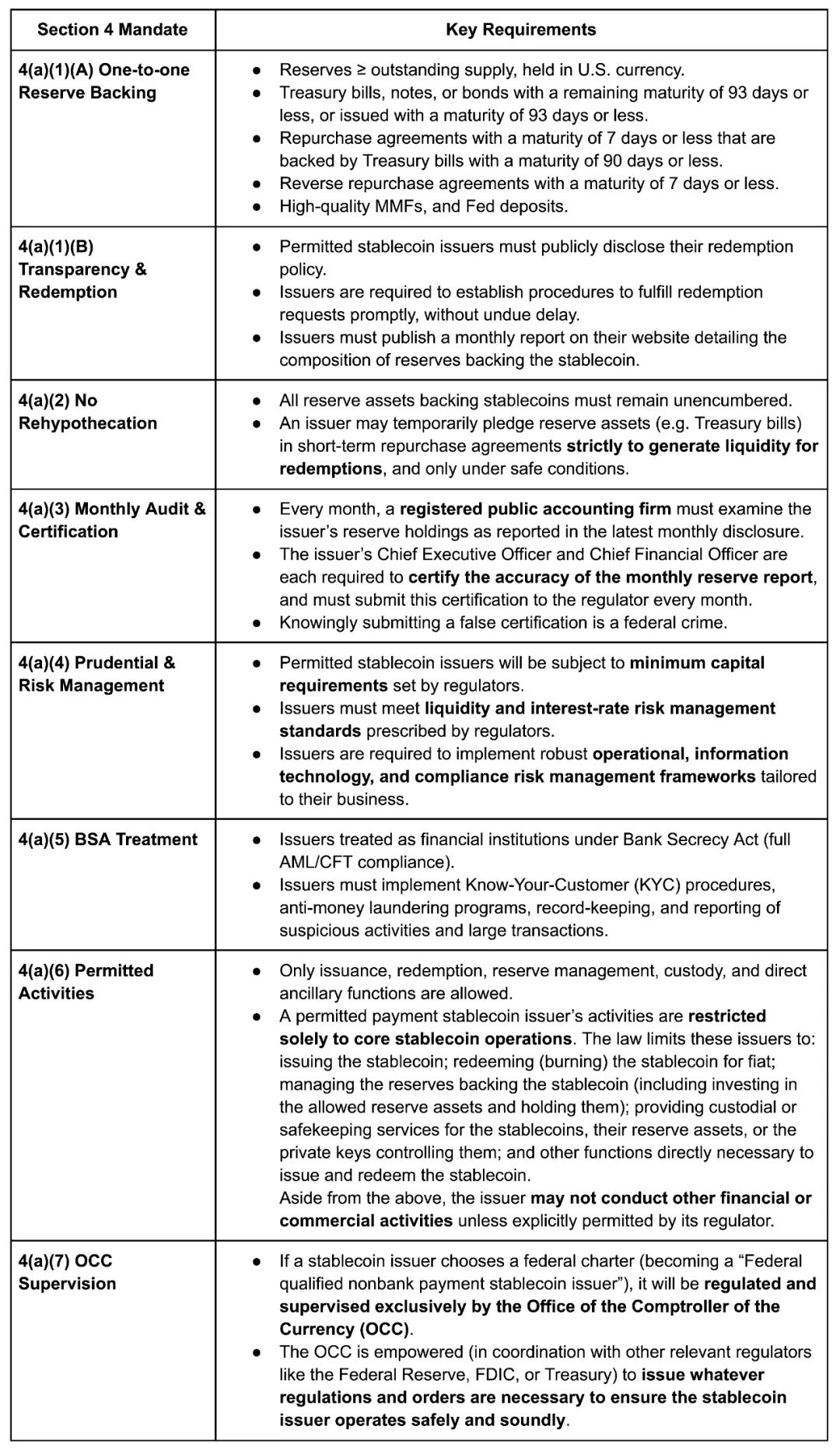

Launched in June 2025, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) establishes a mandatory compliance framework for stablecoin payments in the United States:

Excerpt from the GENIUS Act

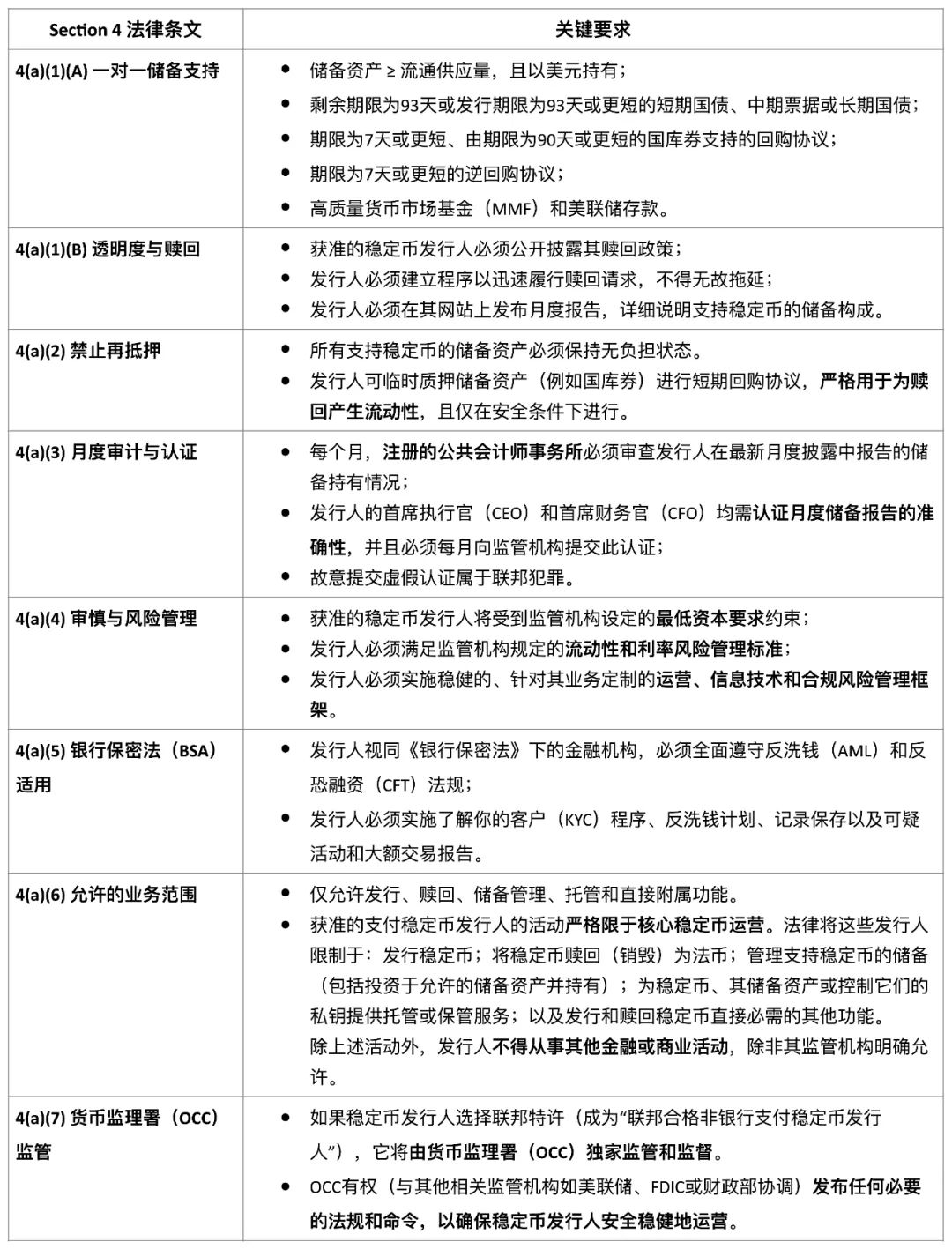

The following is a reference to some legal provisions in Chinese:

Why is the GENIUS Act Crucial?

The act establishes a unified federal-level "certification" for stablecoins, helping to reduce regulatory fragmentation and providing clear institutional guidance for product design, risk management, and auditing preparation. Adhering to the norms in the GENIUS Act is not only a basic requirement for compliance but also a key guarantee for enhancing the security of user asset transactions.

As the formal verification research team at CertiK, we aim to introduce formal verification methodologies to help prove the key attributes of stablecoin smart contracts. By utilizing rigorous mathematical derivations and machine-checkable logical proofs, we ensure that the code meets compliance and security requirements under any boundary conditions.

From Legal Provisions to Formal Verification Lemmas

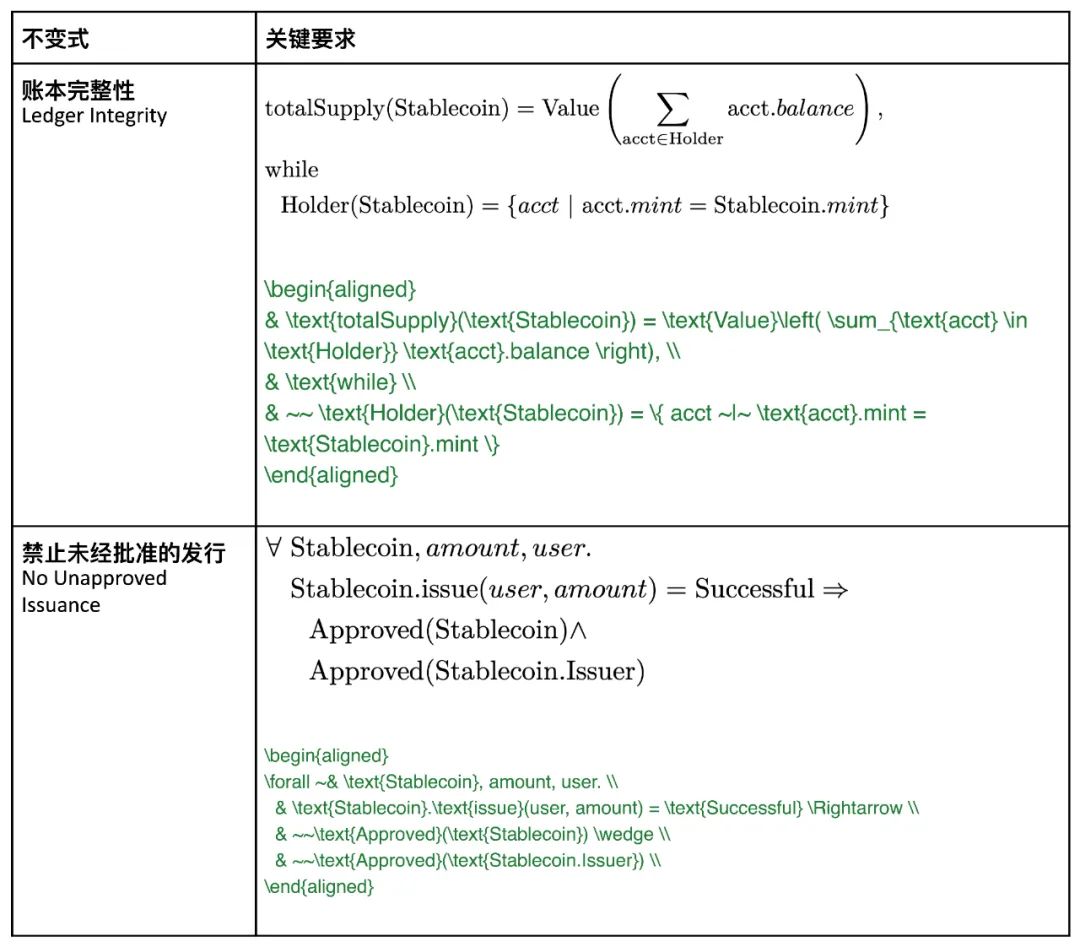

Formal verification expresses each compliance requirement as an on-chain invariant or liveness. Taking the GENIUS Act as an example, the aforementioned legal provisions can be formally expressed as the following lemma:

Additionally, certain technical invariants of stablecoins should be strictly proven to ensure compliance with specific legal requirements.

Technical Invariants of Stablecoins:

These formal lemmas will become proof obligations within the selected verification framework (TLA⁺, Coq, K, Isabelle, or Why3).

However, only some of these norms are related to the formal verification process at the smart contract stage. In the following example, we have built a case based on the Solana stablecoin system and formally verified its specifications.

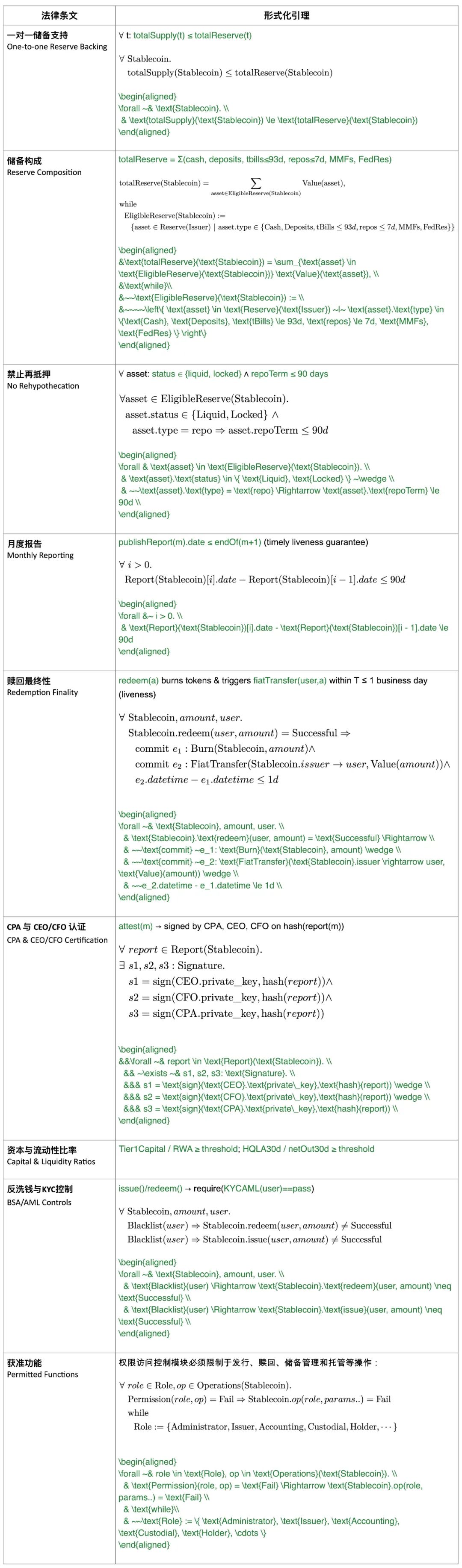

Example of Solana Stablecoin Program: How to Implement the Invariant Requirements of the GENIUS Act

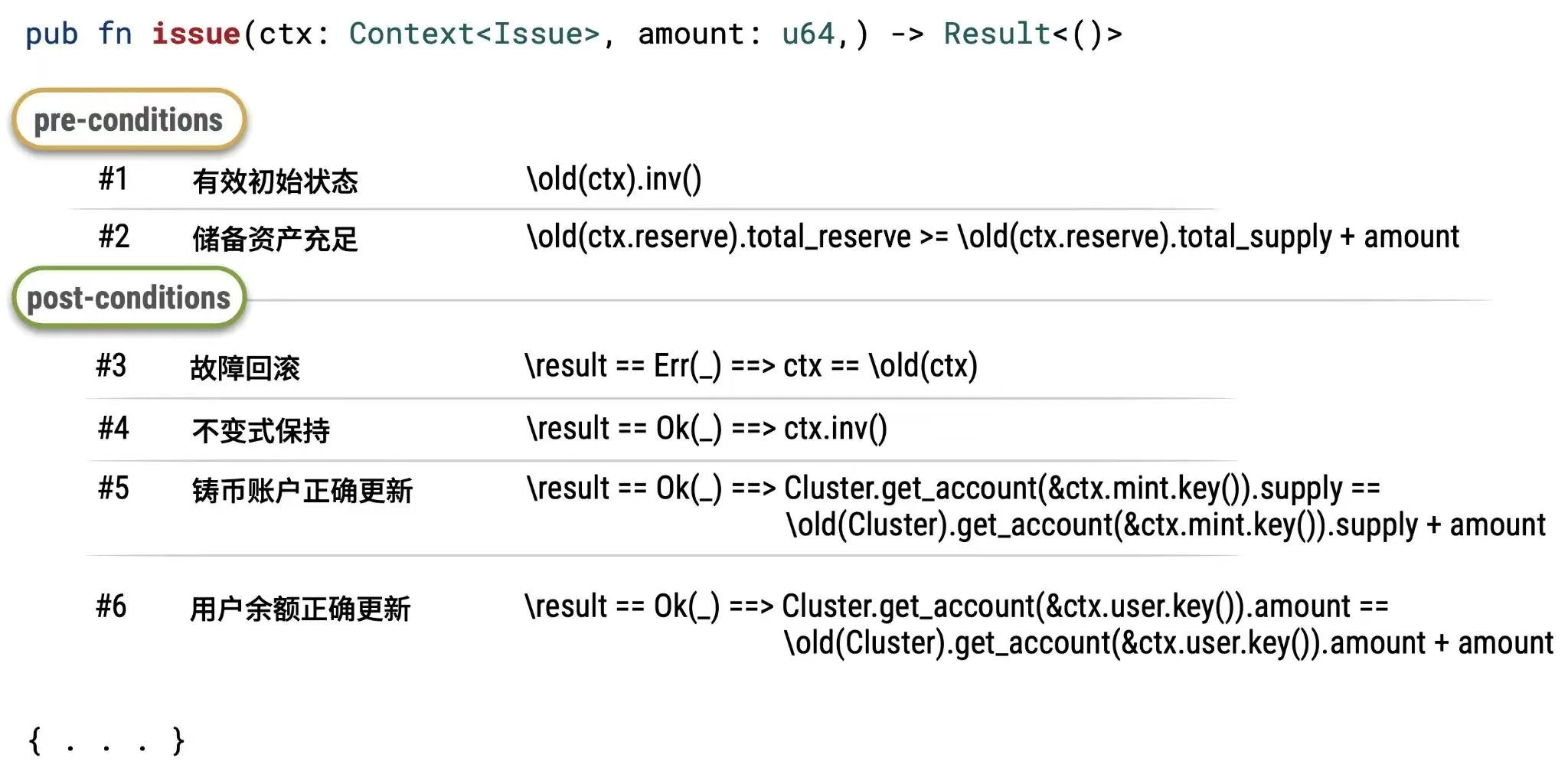

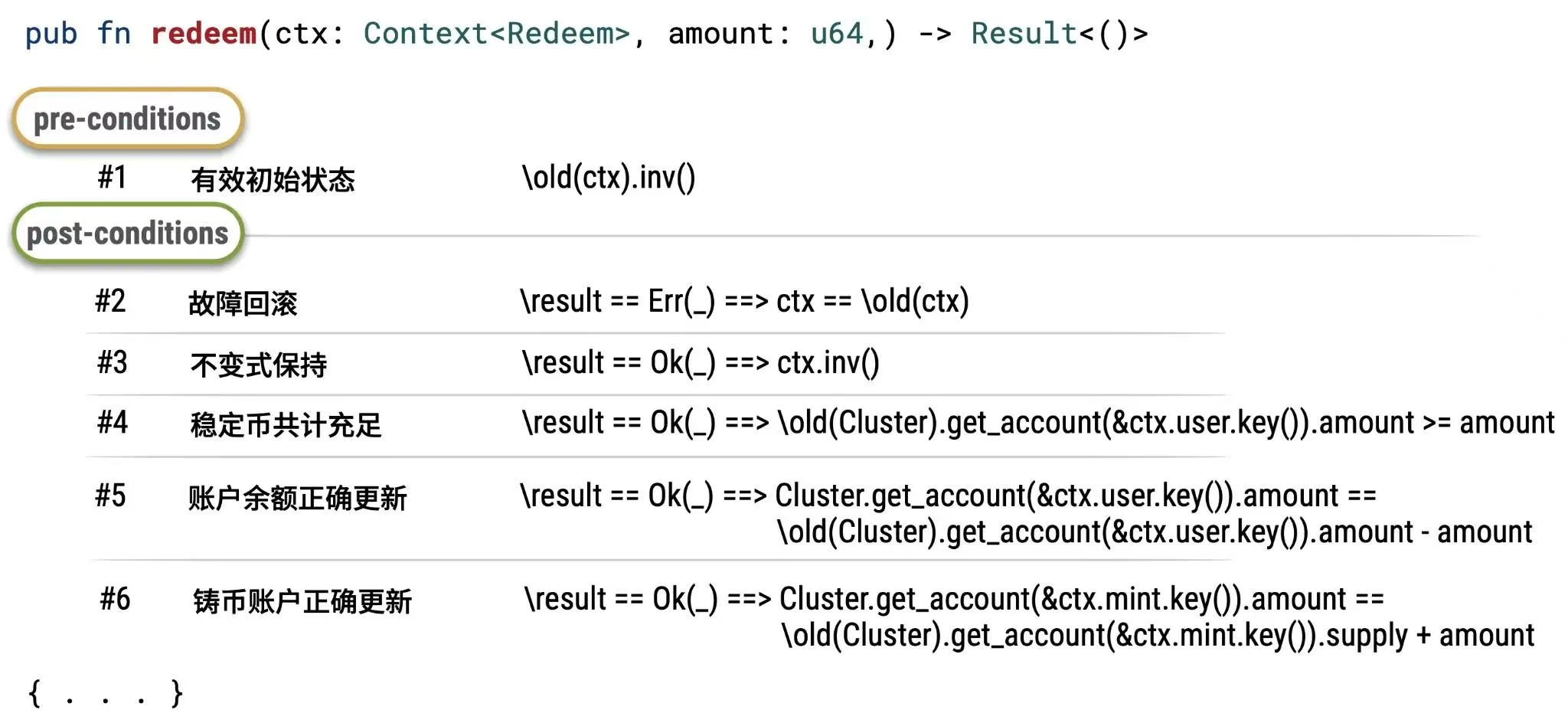

Below is a simplified version of the Solana stablecoin program we constructed, demonstrating how all operations on the chain meet its core invariants:

Formal Verification Output Example of Solana Stablecoin Program

The following is a simplified version of the Solana stablecoin program example, showcasing how to enforce core invariants on-chain:

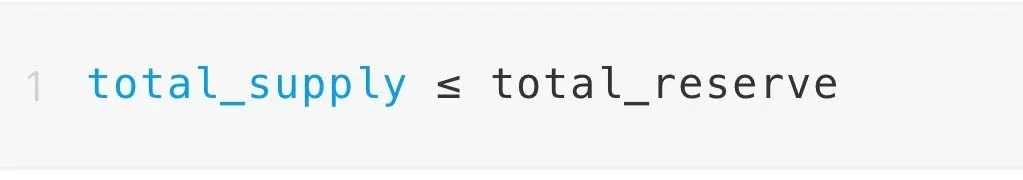

In the complete results, we successfully formally proved the invariant: total supply ≤ total reserve, where

total supply (total_supply) = ∑iAccount[i].amount

total reserve (total_reserve) = ∑kBank[k].reserve

Core invariant:

After all proof obligations are proven, the above Solana stablecoin program example can be mathematically proven to meet the compliance requirements of the GENIUS Act Section 4(a)(1)(A) regarding "one-to-one reserve backing."

After all proof obligations are proven, the above Solana stablecoin program example can be mathematically proven to meet the compliance requirements of the GENIUS Act Section 4(a)(1)(A) regarding "one-to-one reserve backing."

Why Formal Verification is Not Just "Nice to Have," but a Compliance Necessity

Formal verification is not a "nice to have" feature. For the compliance of stablecoins, it is crucial for protecting the funds and confidence of every participant. Any vulnerabilities in the actual code implementation could lead to severe asset losses, regulatory penalties, and even long-term negative impacts on the brand.

Adhering to best practices in formal verification will bring additional advantages to stablecoin protocols:

1. Gaining Regulatory Trust: Regulators do not need to review a large number of legal documents or audit reports one by one; they can directly refer to machine-verified compliance proofs.

2. Reducing Risks: When code is iterated, its handling contracts will automatically generate proofs, avoiding potential risks from regression issues.

3. Enhancing Audit Efficiency: Since financial and technical proofs are checked simultaneously, security audits and CPA audits can proceed in parallel.

4. Achieving Market Differentiation: A "provably compliant" statement can effectively enhance the trust of partners such as banks, merchants, and DeFi platforms, becoming an important pillar of brand reputation and partnership expansion.

Moreover, when introducing your stablecoin to the board, community, or regulatory bodies, being able to say, "Our protocol has been formally verified according to the requirements of the GENIUS Act, with no unresolved proof obligations," transforms compliance risks into competitive advantages.

This not only enhances the project's credibility but can also significantly accelerate multiple key processes, including:

Regulatory approval timelines (review approval, entry into regulatory sandbox)

Enterprise-level integration (completeness proofs required by banks and payment service providers)

DeFi partnerships (oracles and lending platforms are more inclined to trust mathematically verified protocols)

Next Steps: Partner with CertiK for a Safer and Faster Launch

As global regulatory agencies deepen their focus on stablecoins, compliance and security[5] have become core challenges faced by issuers. Whether to meet the requirements of the GENIUS Act or to plan for global expansion, stablecoin projects need to build a reliable security foundation from the ground up.

CertiK's self-developed formal verification framework is designed specifically for real blockchain application scenarios. Our approach breaks through the abstract models at the academic level, generating on-chain machine-verifiable security proofs that directly correspond to compliance requirements. This is not theoretical exploration, but a reliable guarantee for practical production environments.

As the largest security company in Web3, CertiK is committed to the mission of "full-line protection, achieving excellence." Whether you are looking to meet the compliance requirements of the GENIUS Act or aiming to create a trustworthy stablecoin for global use, CertiK can safeguard your project and help it launch safely and efficiently.

We offer:

Customized formal verification framework tailored to your system architecture;

Compliance consulting services for the GENIUS Act, ADGM, MAS, HKMA, and other regulations;

End-to-end security audits covering threat modeling, penetration testing, on-chain formal verification, and more;

Regulatory communication services to assist you in smoothly navigating OCC, Federal Reserve, and state-level regulatory reviews.

How is CertiK Different from Traditional Formal Verification Products?

Implementation-level verification: Ensures that the source code complies with specifications, not just the abstract model of the protocol.

Proprietary attribute verification: Can verify the unique attributes of customized code, going beyond conventional general attributes.

Complex reasoning capabilities: Through automated reasoning, it can verify any complex code and attributes, far exceeding the levels achievable by developers, auditors, or even formal verification engineers through manual reasoning.

Production environment focus: Suitable for code in actual production environments, verifiable without large-scale restructuring, unlike formal verification solutions limited to prototypes or academic research.

As a leader in formal verification and blockchain security, CertiK has provided security assurance for over $530 billion in digital assets and has safeguarded more than 5,000 blockchain projects, laying a solid foundation for the compliance and security of stablecoin projects.

We welcome further communication and can arrange a technical seminar on proof-of-concept audits to discuss how systematic, provably secure methods can help your stablecoin project achieve compliance and high reliability in its launch and operation.

[1] Web3:https://www.certik.com/resources/blog/Web3

[2] Stablecoins:https://www.certik.com/resources/blog/the-rise-of-stablecoins-in-unstable-times

[3] Since the launch of the first batch of crypto stablecoin projects in 2014:https://blog.bitmex.com/a-brief-history-of-stablecoins-part-1/?utm_source=chatgpt.com

[4] The electronic money (E-Money) regulatory framework launched in 2009:https://finance.ec.europa.eu/consumer-finance-and-payments/payment-services/e-money_en

[5] Security: https://www.certik.com/resources/blog/security-risks-of-stablecoins

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。