This is undoubtedly the major trend for 2025.

Since the Hyperliquid airdrop on November 29, 2024, which ignited the entire network, this sector has entered a high-speed lane. Hyperliquid, representing the new generation of order book Perp DEX, saw its token HYPE price soar to $50 at one point and has since stabilized around $47, becoming one of the most compelling and wealth-generating projects of the year.

The Perp DEX sector not only has high revenue but also significant growth potential, posing an unprecedented threat to CEX. The daily trading volume of crypto derivatives has long been 4-5 times that of spot trading, while the on-chain derivatives market penetration is currently less than 10%, indicating at least tenfold growth potential in the future.

Just as there is never just one centralized exchange, more and more teams are beginning to flock to this space, raising the ceiling of the sector and intensifying competition. Major projects are continuously upgrading in terms of technology, liquidity, depth, user experience, and incentive mechanisms, all ramping up their efforts. The clustering of projects and frequent innovations have also brought about a stronger "wealth overflow" effect, attracting a large amount of capital and user attention, especially from a new batch of unlaunched Perp DEX players.

Currently, the second season of Hyperliquid's airdrop is about to launch, while other rapidly growing projects with strong team backgrounds and high expectations for token issuance are also emerging. Rhythm BlockBeats will review five unlaunched Perp DEX dark horses—whether they are growing rapidly, have abundant resources, or are backed by star VCs, these are key projects that the "haircut" army and contract players cannot miss.

edgeX

edgeX is one of the first projects incubated by Amber Group's new accelerator launched in July 2024, currently enjoying high popularity in the Korean community, with a good mobile app experience.

As a Perp DEX built on Ethereum Layer 2 based on StarkEx ZK-Rollup, edgeX can process 200,000 orders per second, with order matching latency below 10 milliseconds, setting a new benchmark for speed and efficiency in decentralized derivatives exchanges. The transaction fees are 0.038% for makers and 0.015% for takers.

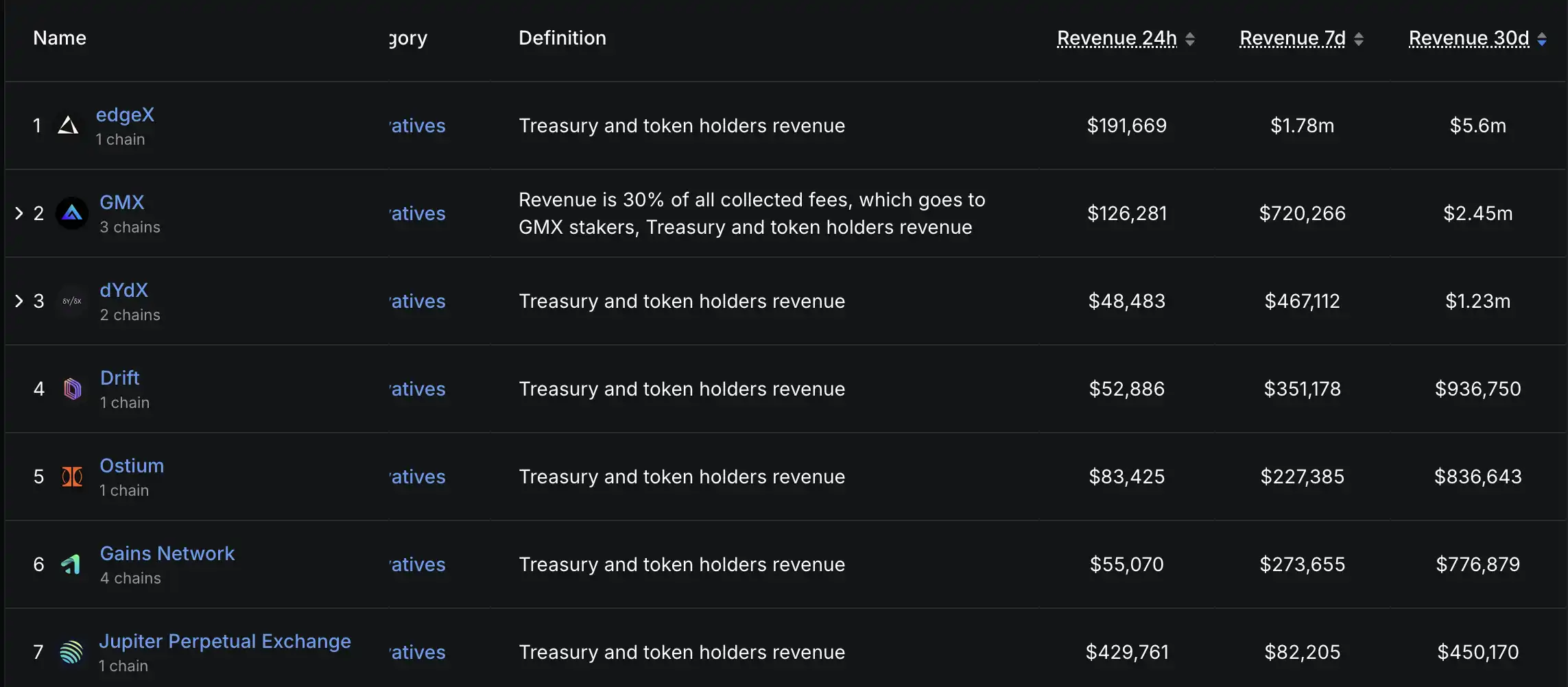

According to the latest data, edgeX's actual revenue in the past 30 days reached $5.6 million, surpassing leading Perp DEXs like GMX ($2.45 million) and dYdX ($1.23 million). Projects with high revenue rankings have more genuine capital flow, and users' transaction fees are "real." (Although Hyperliquid has a larger trading volume, it is not included in the DefiLama Perp DEX comparison list due to its positioning as an independent chain.)

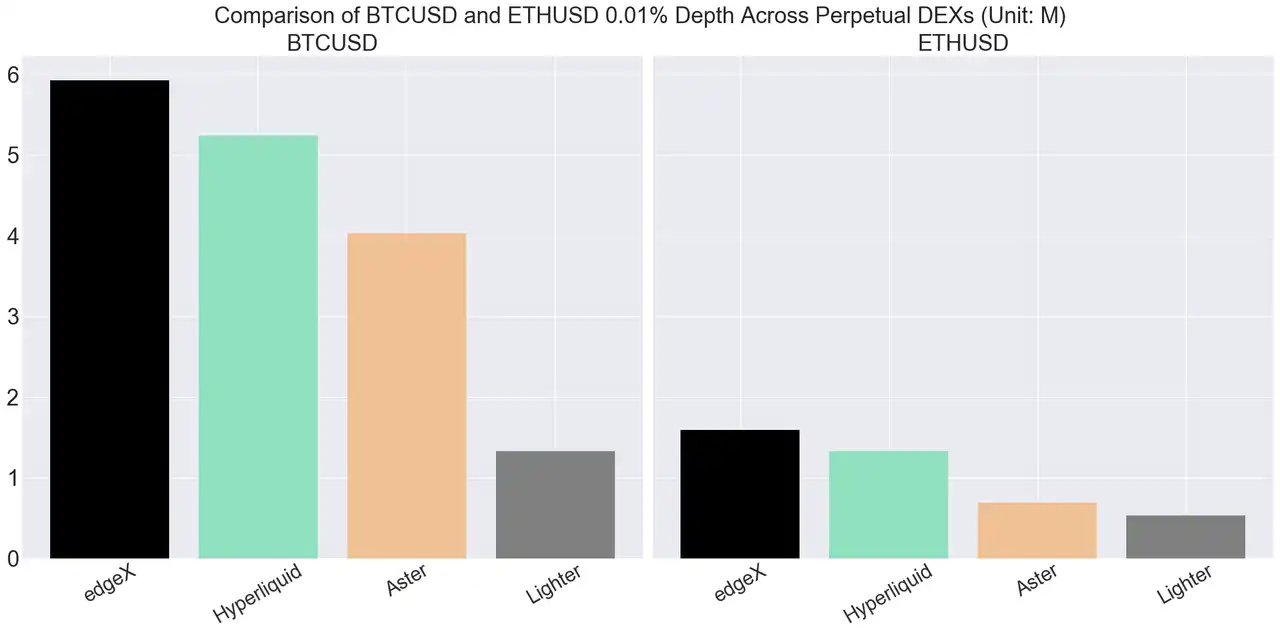

From a market depth perspective, edgeX currently performs the best among all Perp DEXs. For example, in the case of BTC/ETH, with a 0.01% price spread, edgeX can support a $6 million position in BTC, surpassing Hyperliquid ($5 million), Aster ($4 million), and Lighter ($1 million). Although the overall depth is still slightly inferior to Hyperliquid, in most scenarios, edgeX is the Perp DEX with the best depth aside from Hyperliquid.

Comparison of BTC and ETH depth across platforms with a 0.01% price spread

On the team side, edgeX is backed by Amber Group, with top institutions like Morgan Stanley, Barclays, Goldman Sachs, and Bybit having crypto and traditional finance professionals with over 7 years of exchange operation and trading experience.

Additionally, perhaps benefiting from the resources of the incubator Amber Group, edgeX's market-making treasury has more strategy designs to help improve capital efficiency and risk management. In a typical Perp DEX structure, the treasury acts as a central liquidity pool, responsible for market-making and bearing the burden of liquidating positions. Although statistics usually show positive returns within quarterly cycles, the treasury still faces risks from unilateral market exposure, "bankruptcy," or capital shortage attack vectors.

Unlike traditional "MM Vaults," edgeX's eLP (Edge Liquidity Pool) combines passive liquidity with intelligent hedging mechanisms, ensuring that funds always provide depth to the order book and dynamically hedge large risk exposures. Meanwhile, the treasury also features dynamic leverage adjustments and a dedicated insurance fund, adjusting in real-time based on profits/leverage to guard against malicious operations on large funds, with 10% of each profit entering the insurance pool to buffer treasury losses from extreme market conditions.

Next, edgeX will upgrade from the current perp app rollup (V1) to a high-performance financial chain (V2), supporting fully modular and composable financial infrastructure.

Lighter

Lighter is a new Perp DEX in the Ethereum ecosystem, initially launched as a spot DEX on Arbitrum in 2023, transitioning to a zksync layer3 DEX in March 2024, and then to a ZK Perp DEX in November, built on zk-rollup, with a mechanism similar to edgeX. Technically, it achieves 5 milliseconds of soft finality and a matching speed of 10,000 orders per second.

Although it is currently invite-only, Lighter's daily trading volume has stabilized between $1 billion and $2 billion, with a cumulative trading volume of $2.4 billion, second only to Hyperliquid and making it the fastest-growing Perp DEX.

One reason for Lighter's rapid trading volume growth is its zero-fee model similar to Robinhood—both makers and takers are completely exempt from fees. However, correspondingly, while Lighter's trading volume is massive, its zero-fee (0-fee) model may include elements of wash trading, and the platform currently lacks a solid revenue model.

In terms of protocol mechanisms, Lighter has a native market-making treasury LLP similar to Hyperliquid's HLP. LLP allows retail investors to inject funds into a public pool managed by professional traders, sharing profits based on their contribution ratio, and it is also currently fee-free. However, deposits in LLP no longer earn points. Currently, Lighter's points are priced at $5 each in the over-the-counter market.

On the team side, Lighter's founder and CEO Vladimir Novakovski graduated from Harvard University and was an angel investor in Fabric Cryptography and Daimo, with a strong background. Institutional investors include top-tier capital such as a16z and Lightspeed Ventures.

Aster

Aster was formed from the merger and upgrade of Astherus and APX on March 31, 2024, originally focused on the liquidity of staked assets, and now entering the Perp DEX market as part of the Binance ecosystem. Aster is highly integrated with the BNB ecosystem, natively compatible with the Binance wallet, fully funded by YZi Labs, and has received strong ecological resource and traffic support with multiple interactions from CZ.

With strong backing and high expectations for token issuance, Aster's trading volume is also growing rapidly.

Aster supports two trading modes. The Simple mode pursues extreme simplicity and ease of use; the Pro mode is aimed at professional users, with transaction fees of 0.01% for makers and 0.035% for takers. Additionally, Aster has innovatively launched a Dumb prediction game, allowing users to predict short-term asset fluctuations by the minute and place bets, offering a unique gameplay experience.

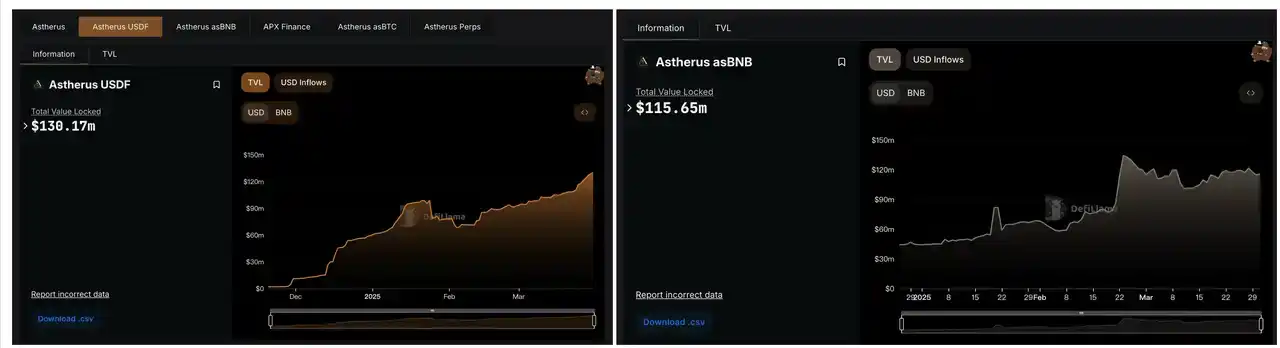

Unlike the treasuries of other Perp DEXs, most of Aster's liquidity is supported by its own liquidity hub, without relying on external market-making teams. The TVL of the USDF stablecoin within the protocol has reached $130 million, and the TVL of asBNB (in collaboration with the BNB chain) is about $115 million.

Data source: DefiLama

Furthermore, Aster is promoting the combination of US stocks and crypto contracts, currently supporting perpetual contracts for seven US blue-chip stocks including Amazon, Apple, Google, Facebook, Microsoft, Nvidia, and Tesla. Users can trade US stocks with cryptocurrency as margin 24/7, although depth may decrease during non-trading hours.

In the long-term plan, Aster will also develop a dedicated Layer 1 public chain for on-chain derivatives trading, providing exclusive infrastructure for on-chain derivatives trading.

Ethereal

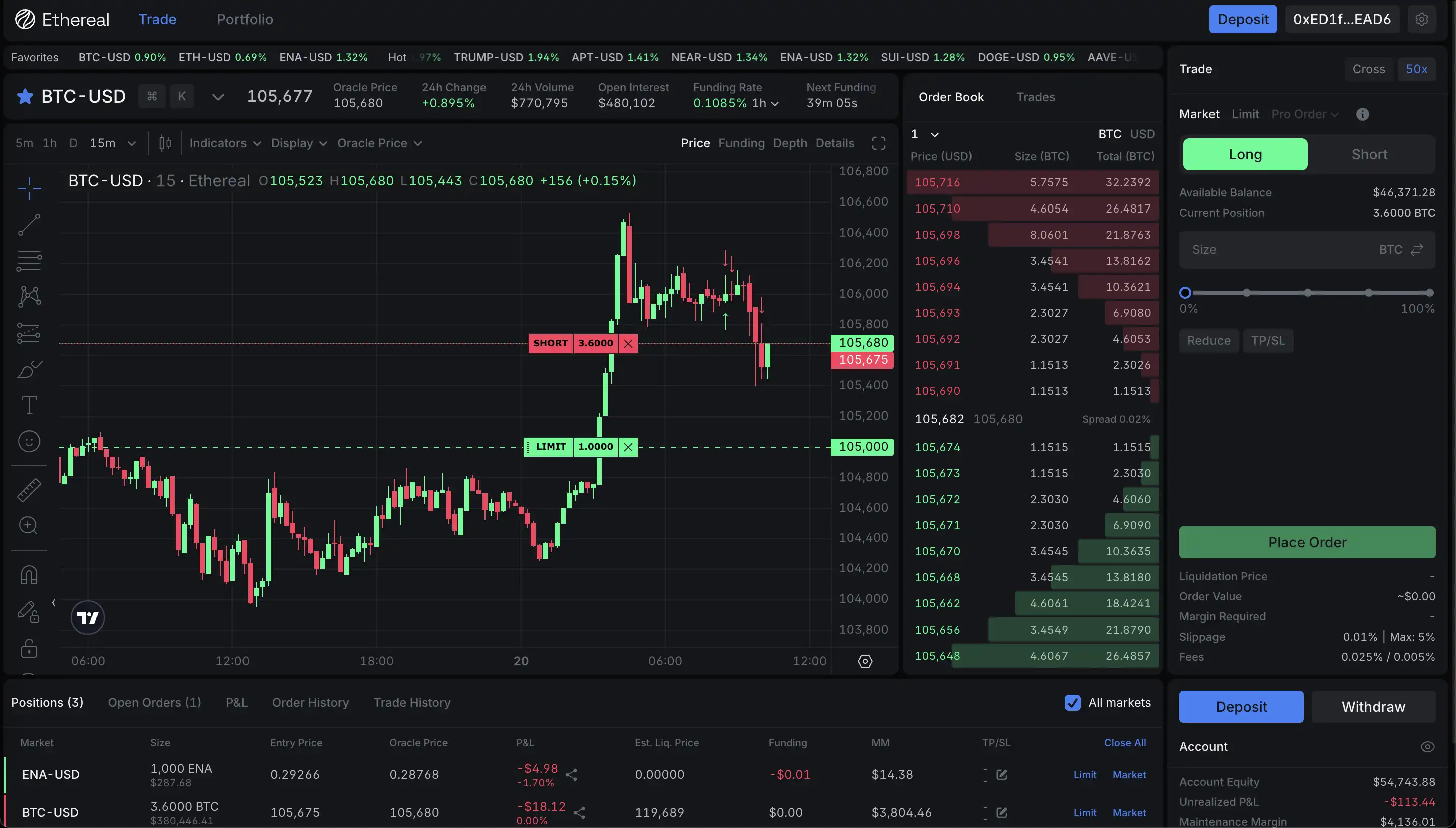

Ethereal is the first project natively built on the Ethena Network and is also the "favorite child" project of the ENA community, supported by the USDe stablecoin, aiming to create a one-stop, vertically integrated DeFi platform to fully unleash the potential of USDe.

Ethereal V1 is the starting point of this vision, bringing a fully functional spot and perpetual contract to the upcoming Ethena network. In terms of technical architecture, Ethereal adopts an EVM solution, with settlement through Converge, Arbitrum execution environment, and Celestia data availability layer, achieving order matching latency below 20 milliseconds, with a peak capacity of processing about 1 million orders and 1,000 transactions per second.

In terms of liquidity, Ethereal V1 aims to become the core venue for on-chain USDe capital hedging and trading. The platform has received formal approval from Ethena governance (99.6% support rate) and has committed to allocating 15% of future governance tokens to ENA stakers (sENA), deeply binding community interests.

On June 20, 2025, Ethereal officially launched its testnet, allowing users to experience high-performance on-chain trading products supported by USDe at testnet.ethereal.trade.

In the future, Ethereal will gradually introduce various derivative financial products based on USDe, including spot trading, lending, loans, RWA, and more, continuing to expand the DeFi landscape.

Paradex

Paradex is incubated by the crypto institutional liquidity platform Paradigm (unrelated to the similarly named venture capital firm) and is built on the Paradex Network, an Ethereum Layer 2 blockchain based on the Starknet Stack, which is positioned for high-performance decentralized trading and asset management.

Although the incubator is not the well-known top crypto VC Paradigm, but rather the similarly named crypto institutional liquidity platform, it is still worth paying attention to.

Founded in 2019, Paradigm serves institutions such as hedge funds, market makers, and family offices, with extensive research in the crypto options and derivatives trading market. Initially, its business model involved handling over-the-counter matching, delegating on-exchange execution, clearing, and settlement to exchanges like FTX. At its peak, it held a 30% share of the global cryptocurrency options market, completing a $35 million funding round at a $400 million valuation, co-led by Jump Crypto and Alameda Research.

However, after the collapse of FTX, Paradigm, as a partner, was also significantly impacted, and after a rapid decline in trading volume, it launched Paradex to rebuild its ecosystem.

Thanks to its years of research in the derivatives market, Paradex features support for perpetual contracts, perpetual futures, perpetual options, and spot trading, with all transactions unified under a single account. Any asset can be used as collateral, supporting isolated, cross, and combined margin modes. In terms of fees, Paradex charges a taker fee of 0.03%, and limit orders (maker orders) receive a -0.005% rebate.

In asset management, the Paradex treasury allows users to earn LP tokens based on their shares and can be combined with mainstream DeFi projects like Pendle, Morpho, and Aave. The treasury supports both active trading and passive income from treasury trading funds (VTF), and some LP tokens may be directly used as collateral in the future to participate in more on-chain strategies. Additionally, the integrated lending market supports users borrowing directly with the same account, allowing for combined investment portfolios to be used as collateral.

Currently, Paradex has announced its token economics, and the community has exceptionally strong expectations for its token issuance. The platform token DIME will have future uses including payment for trading fees, fee discounts, staking and liquidity mining rewards, as well as participation in governance/voting. At present, Paradex ranks first among cryptocurrency options DEXs, although its trading volume in perpetual contracts has not seen particularly outstanding growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。