Author: Tiger Research

Translation: AididiaoJP, Foresight News

Abstract

Regulatory and Government Dynamics

- Hong Kong plans to introduce stablecoin regulations in August to solidify its position as a digital financial hub.

- Singapore implements a strict licensing system, prohibiting unlicensed companies from operating locally.

- Thailand launches G-Tokens, becoming the first country to issue government digital bonds.

Corporate Activities

- Japanese listed companies are increasingly adopting Bitcoin as a reserve strategy, driving a surge in institutional investment.

- Chinese companies are circumventing domestic restrictions through Hong Kong licenses and beginning to accumulate Bitcoin.

Policy Shifts

- After the South Korean elections, the focus shifts to the Korean won stablecoin, but issues of regulatory fragmentation remain.

- Vietnam makes a historic shift from banning cryptocurrencies to full legalization.

- The Philippines adopts a dual-track strategy, combining strict regulation with a sandbox framework.

Asia's Web3 Market Q2: Regulatory Stability and Increasing Corporate Investment

Although the focus of the Web3 market has clearly shifted to the United States, the development of major markets in Asia remains crucial. Asia not only has the largest cryptocurrency user base globally but continues to operate as a core hub for blockchain innovation.

To this end, Tiger Research continues to track major trends in Asia's Web3 market quarterly. In Q1 2025, regulatory bodies across Asia laid the groundwork for policies: introducing new regulations, issuing licenses, and launching regulatory sandboxes, with cross-border cooperation beginning to take shape.

The regulatory foundation established in Q2 has driven substantial business activity and accelerated capital deployment. Policies introduced in Q1 have been tested in the market, prompting further refinement and implementation of regulations.

Institutional and corporate participation has significantly increased. This report analyzes the progress made in Q2 by country and assesses how policy shifts in various nations are shaping the global Web3 ecosystem.

Key Developments in Major Asian Markets

2.1. South Korea: Intersection of Political Transition and Regulatory Adjustments

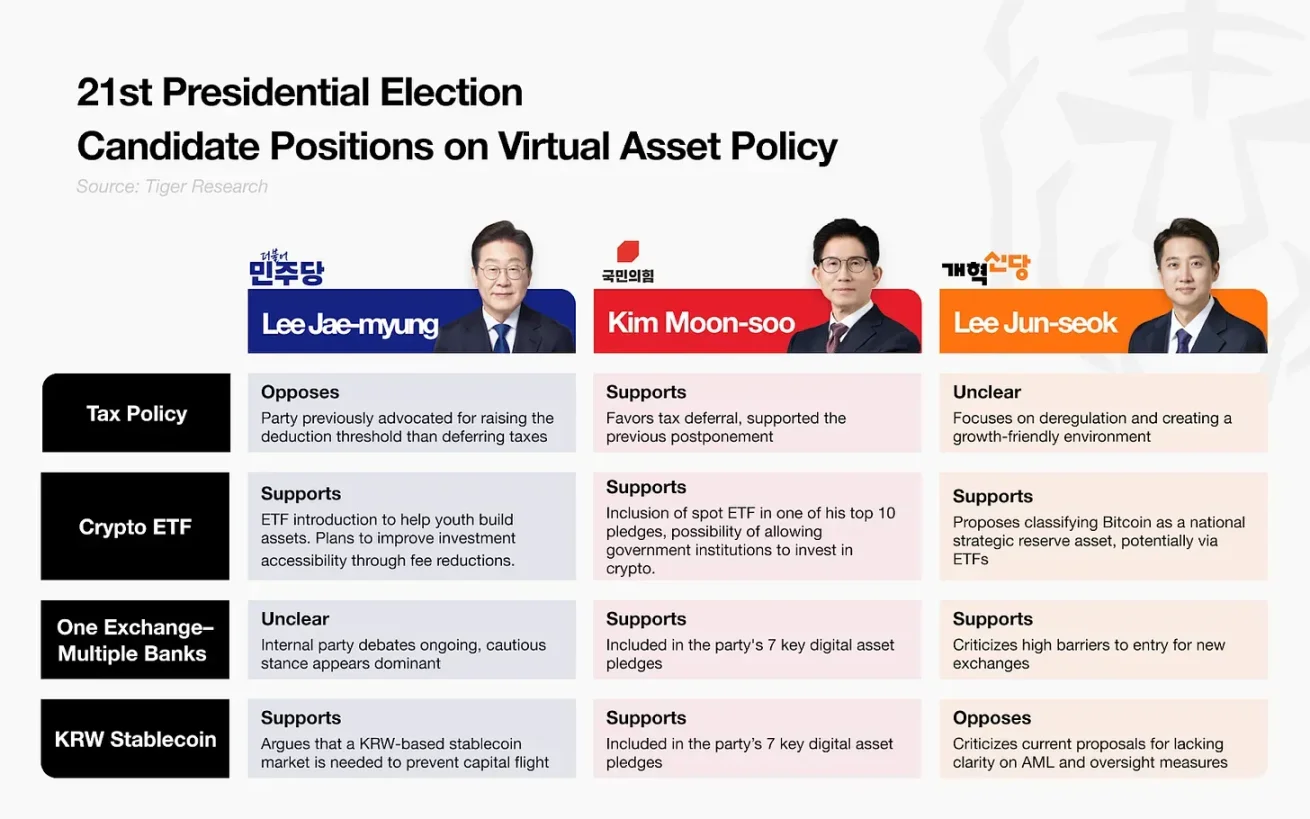

Source: Tiger Research

In Q2, cryptocurrency policy became a hot topic ahead of South Korea's presidential election in June. Candidates actively made Web3-related commitments, and with Lee Jae-myung's victory, the market anticipates significant policy adjustments.

One of the core issues is the launch of the Korean won stablecoin. Related stocks (such as Kakao Pay) surged, and traditional financial institutions began applying for Web3-related trademarks in preparation for market entry.

However, conflicts arose during the policy-making process, particularly between the Bank of Korea and the Financial Services Commission (FSC) over jurisdiction. The central bank advocates for early intervention in the approval process, viewing stablecoins as part of a digital financial ecosystem alongside central bank digital currencies (CBDCs).

In July, the Democratic Party announced a 1-2 month delay in the introduction of the "Digital Asset Innovation Act." The lack of a clear policy leader seems to be a key bottleneck, with inter-departmental negotiations remaining fragmented. Thus, while the Korean won stablecoin has become a focal point, specific regulatory guidance is still lacking.

Nevertheless, incremental progress has been made at the institutional level. New regulations in June allow non-profit organizations and exchanges to sell donated crypto assets and immediately liquidate them, while requiring operations to minimize market impact.

Global exchanges continue to show heightened interest in the Korean market: Crypto.com Korea has completed integration with Upbit and Bithumb, and KuCoin has indicated plans to return to the market once regulatory standards are met.

Offline activities have noticeably increased. The number of meetups hosted by projects has surged compared to last year, and the frequency of international projects visiting Korea outside of conferences has also risen significantly. However, business-focused activities have led to fatigue among local builders.

2.2. Japan: Institutional and Corporate Adoption Driving Bitcoin Strategy Expansion

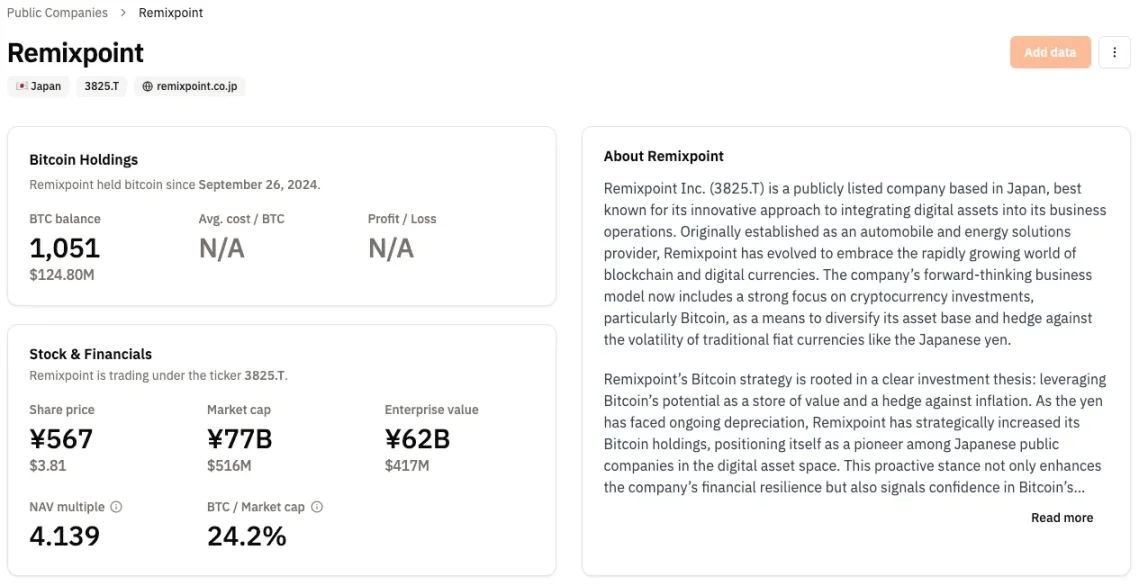

Source: Bitcoin Treasury

In Q2, Japanese listed companies initiated a wave of Bitcoin allocation. This trend was primarily driven by MetaPlanet, which achieved approximately 39 times returns after its first Bitcoin purchase in April 2024, setting a market benchmark that prompted companies like Remixpoint to follow suit.

At the same time, the construction of stablecoin and payment infrastructure accelerated. Sumitomo Mitsui Financial Group is collaborating with Ava Labs and Fireblocks to prepare for stablecoin issuance; Mercari's crypto subsidiary Mercoin has added XRP trading support, reaching over 20 million monthly active users.

As the private sector becomes more active, regulatory discussions are also evolving. The Financial Services Agency (FSA) has proposed a new classification system that divides crypto assets into two categories:

- Type 1: Tokens used for financing or business operations

- Type 2: General-purpose crypto assets

However, these updates are still in the discussion phase, with limited substantive changes.

Retail investor participation remains sluggish. Japanese retail investors have traditionally favored conservative strategies and are cautious about crypto assets. Therefore, even with new entrants, it is unlikely to bring retail capital inflows in the short term.

This contrasts sharply with markets like South Korea, where active retail participation directly provides early liquidity for new projects. While Japan's institution-led model is more stable, it may limit short-term growth momentum.

2.3. Hong Kong: Regulating Stablecoins and Expanding Digital Financial Services

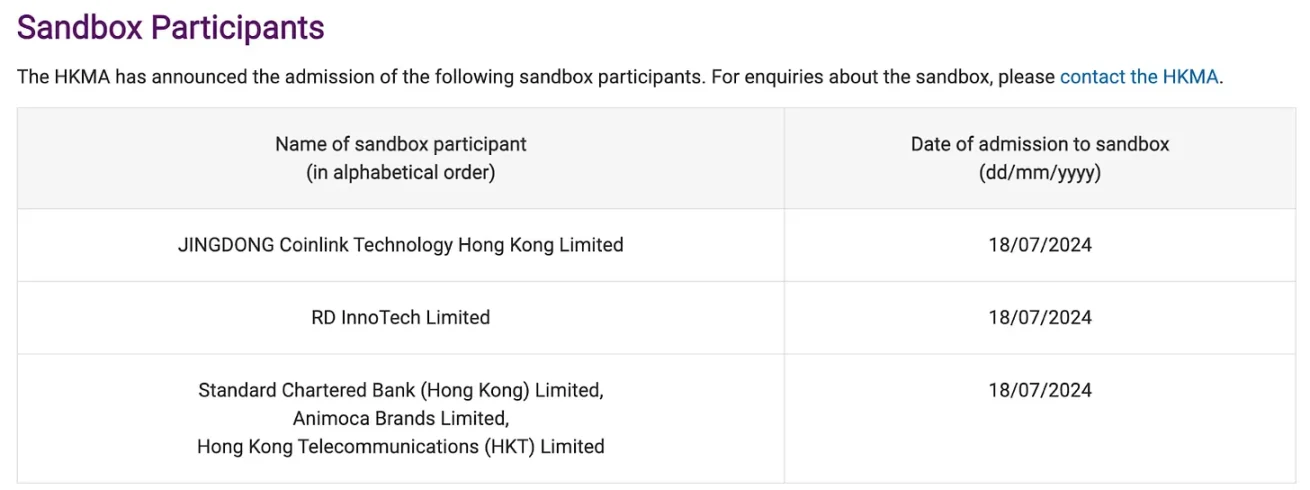

In Q2, Hong Kong advanced its stablecoin regulatory framework, reinforcing its position as a digital financial hub in Asia. The Hong Kong Monetary Authority (HKMA) announced that new stablecoin regulations will take effect on August 1, with a licensing system for issuers expected to be implemented by the end of the year.

Source: HKMA

The first regulated stablecoins are expected to launch in Q4 (as early as this summer), with companies that participated in the HKMA sandbox likely to be pioneers, making their progress worth monitoring.

The scope of digital financial services has also significantly expanded. The Securities and Futures Commission (SFC) plans to allow professional investors to trade virtual asset derivatives, and licensed exchanges and funds are permitted to offer staking services. These measures reflect Hong Kong's clear intention to build a more comprehensive and institution-friendly digital asset ecosystem.

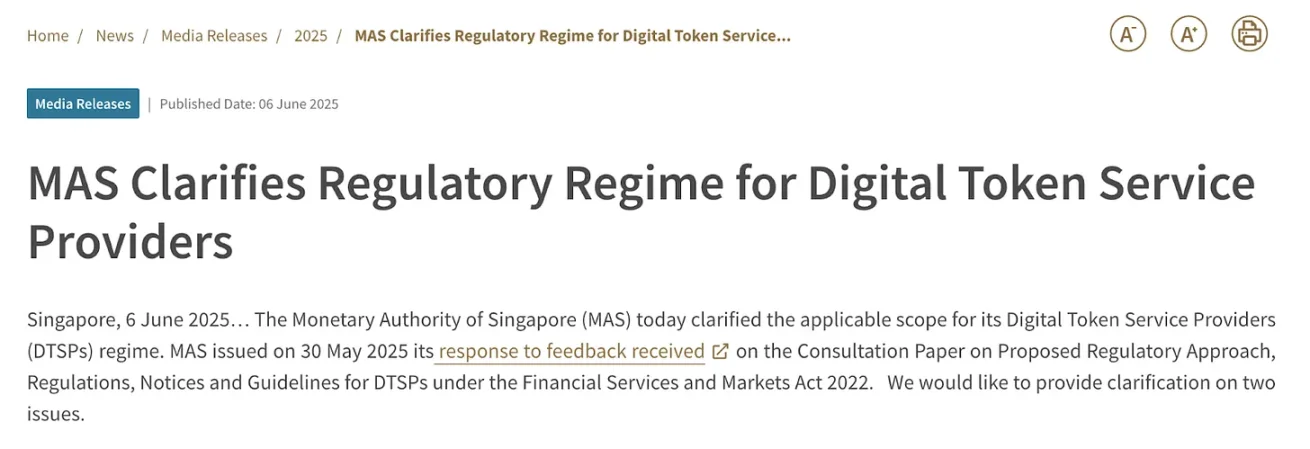

2.4. Singapore: Regulatory Tightening—Balancing Control and Protection

Source: MAS

In Q2, Singapore's cryptocurrency regulation clearly shifted towards strictness. Most notably, the Monetary Authority of Singapore (MAS) has comprehensively banned unlicensed digital asset companies from operating locally, explicitly opposing regulatory arbitrage.

The new regulations apply to all local businesses providing services to global users, effectively mandating formal licensing. Business registration can no longer be used to operate.

This change puts pressure on local Web3 companies. Businesses face a choice: either establish fully compliant entities or relocate to regions with looser regulations. While the policy aims to enhance market integrity and consumer protection, the restrictions on early cross-border projects are evident.

2.5. China: Internationalization of Digital Yuan and Corporate Web3 Strategies

In Q2, China advanced the internationalization of the digital yuan, with Shanghai becoming a core battleground. The People's Bank of China plans to establish an international operations center in Shanghai to support the cross-border application of digital currency.

However, there is a disconnect between policy and practice. Despite a nationwide ban on cryptocurrencies, local governments in places like Jiangsu have reportedly sold confiscated digital assets to fill budget gaps, showing a pragmatic attitude contrary to central policy.

Chinese companies are also adopting flexible strategies. Logistics group AdanTex and others have begun to accumulate Bitcoin, emulating Japanese companies; other firms are using Hong Kong licenses to circumvent domestic restrictions and participate in the global Web3 market.

Interest in the yuan stablecoin has also increased towards the end of the quarter. Concerns over the dominance of US dollar stablecoins and the depreciation of the yuan have led to more active discussions. On June 18, the central bank governor Pan Gongsheng proposed a vision for building a multipolar global currency system, hinting at an open attitude towards stablecoin issuance. In July, the Shanghai State-owned Assets Supervision and Administration Commission initiated discussions on the development of a yuan stablecoin.

2.6. Vietnam: Legalization of Cryptocurrency and Strengthened Digital Control

Vietnam officially announced the legalization of cryptocurrency in Q2, marking a significant policy shift. On June 14, the Vietnamese National Assembly passed the "Digital Technology Industry Law," which recognizes digital assets and outlines incentives for sectors such as artificial intelligence, semiconductors, and digital infrastructure.

This marks a historic reversal of Vietnam's previous ban on cryptocurrencies, positioning the country as a potential catalyst for widespread cryptocurrency adoption in Southeast Asia. Given Vietnam's prior restrictive stance, this move signifies a major adjustment in the region's cryptocurrency policy.

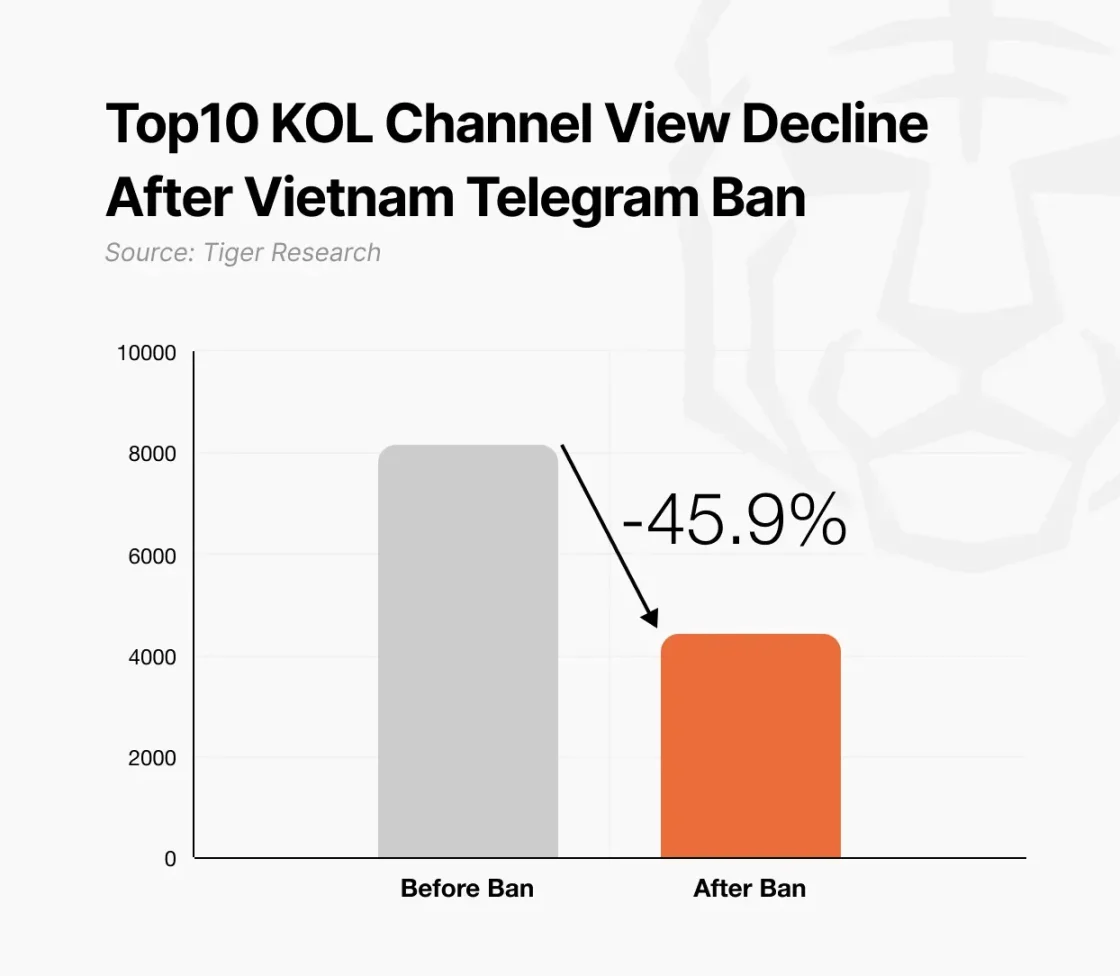

At the same time, the government has strengthened control over digital platforms. Authorities have required telecom companies to block Telegram, citing involvement in fraud, drug trafficking, and terrorism. Police reports indicate that 68% of the 9,600 active channels on the platform are involved in illegal activities.

This dual approach reflects Vietnam's intention to allow innovation within a framework of strict monitoring, simultaneously legalizing cryptocurrency while cracking down on digital abuse. While digital assets are now legally recognized, activities involving them for illegal purposes are facing stricter enforcement.

2.7. Thailand: Government-Led Digital Asset Innovation

Thailand advanced its government-led digital asset program in Q2. The Securities and Exchange Commission (SEC) plans to allow exchanges to list their own functional tokens, easing previously strict listing rules.

Notably, the government announced the issuance of digital bonds. On July 25, Thailand will issue $150 million worth of "G-Tokens" through an approved ICO portal, which cannot be used for payments or speculative trading.

This initiative represents a rare case of direct public sector involvement in digital asset issuance, providing an early model for global tokenized finance.

2.8. Philippines: Parallel Strict Regulation and Innovation Sandbox

The Philippines implemented a "regulation + innovation" dual-track strategy in Q2. The central bank and the Securities and Exchange Commission (SEC) have strengthened controls over token listings, significantly expanding VASP registration and anti-money laundering compliance requirements.

Notably, new regulations targeting influencers have emerged. Content creators promoting crypto assets must register with authorities, with violators facing up to five years in prison, making it one of the strictest enforcement regimes in the Asia-Pacific region.

Simultaneously, an innovation support framework has been launched. The SEC has opened applications for the "StratBox" sandbox program, providing a controlled testing environment for crypto service providers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。