Source: The Kobeissi Letter

Ethereum is making history:

We are witnessing one of the largest short squeezes in cryptocurrency history. Since July 1, Ethereum's market cap has surged by $150 billion—just days ago, net short positions had reached an all-time high.

What exactly happened? This article will explain.

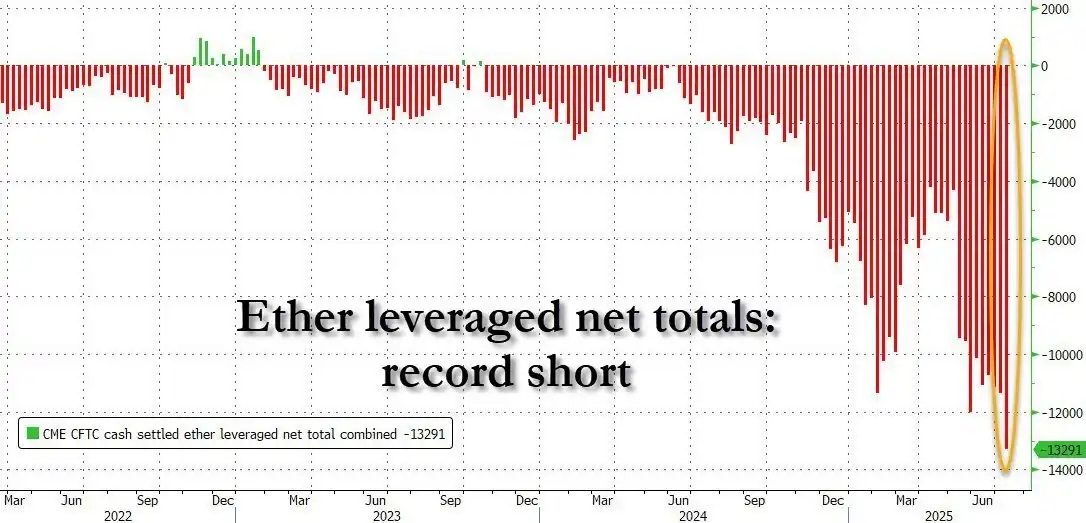

Please see the chart below:

According to data from Zerohedge, as July began, Ethereum's net leveraged short positions reached a historical peak. In fact, net short exposure was about 25% higher than the levels seen in February 2025. This directly led to a 70% surge in Ethereum in less than a month.

But the story is far from over.

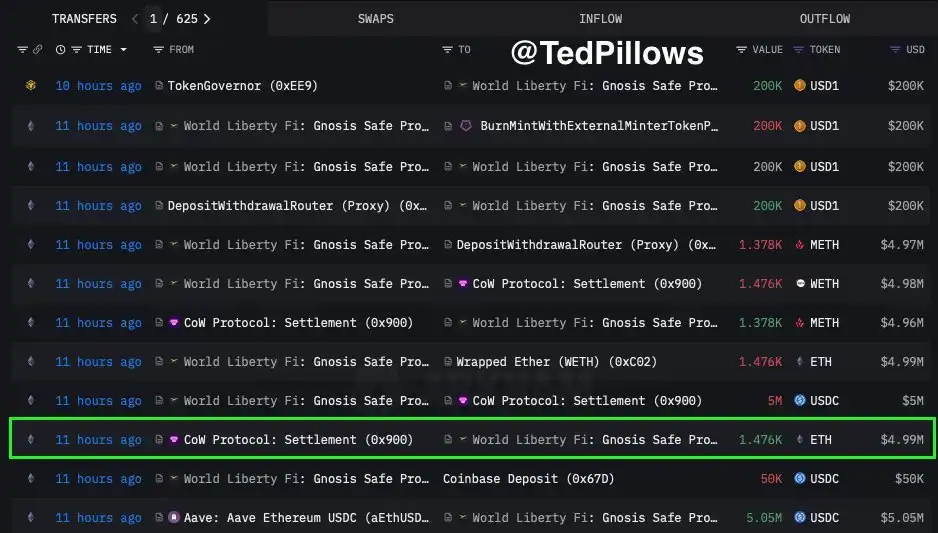

President Trump's World Liberty Financial has been increasing its holdings in Ethereum. The latest trading records show that just 24 hours ago, the firm completed a $5 million purchase. This added fuel to the already intense short squeeze.

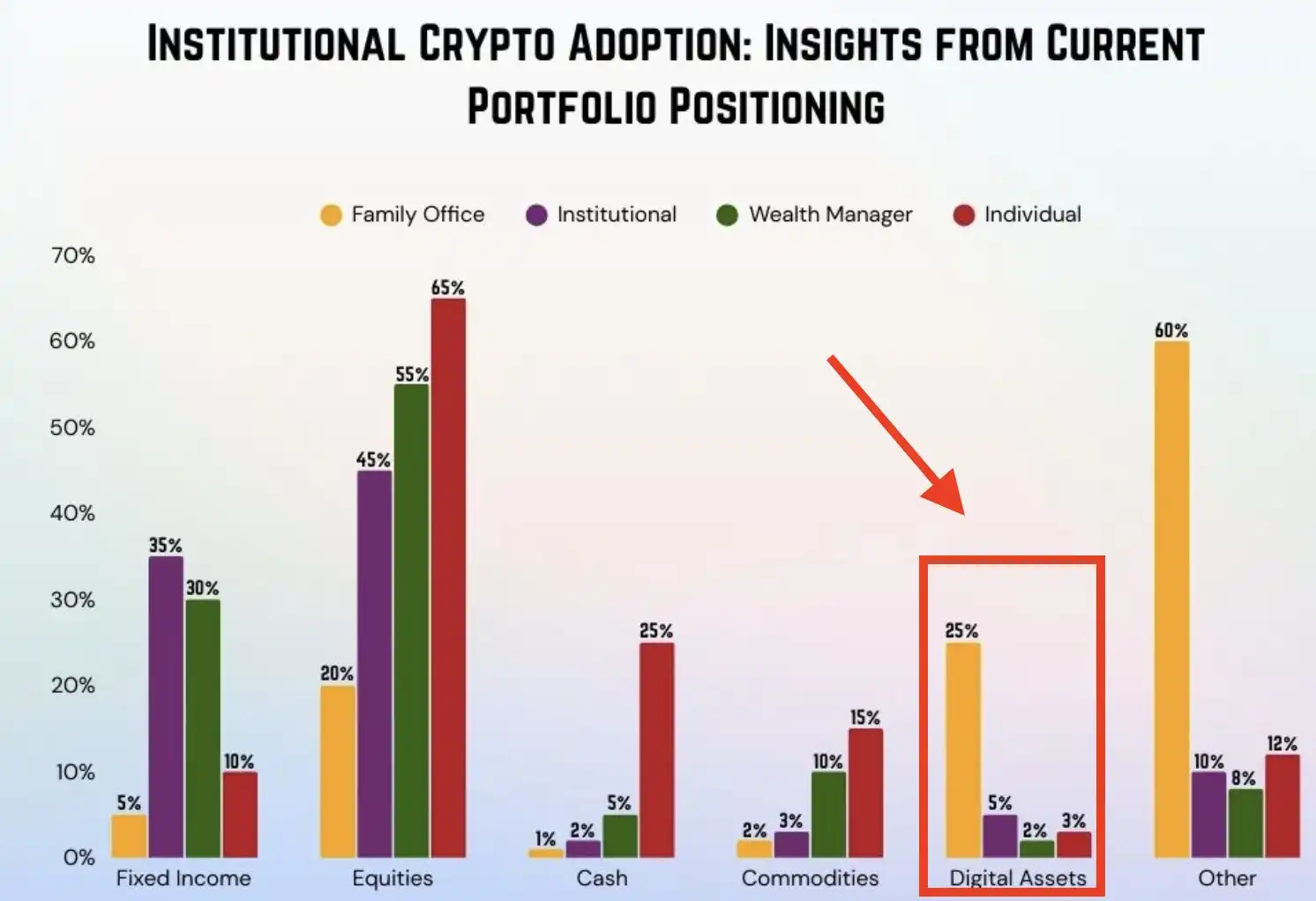

Notably, these short positions mostly come from institutional capital.

More intriguingly:

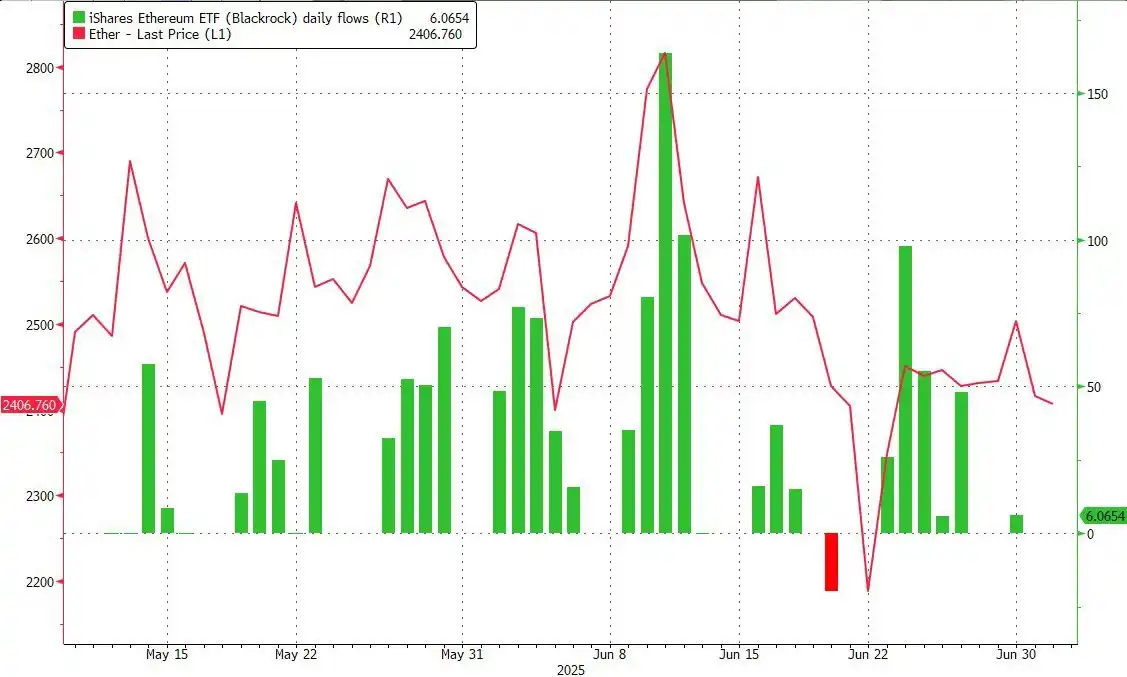

Zerohedge reports that in the 30 days leading up to July 1, BlackRock's ETF increased its holdings in Ethereum for 29 days. However, as mentioned earlier, due to the sudden surge in leveraged short exposure, prices continued to decline. Clearly, "smart money" anticipated this storm.

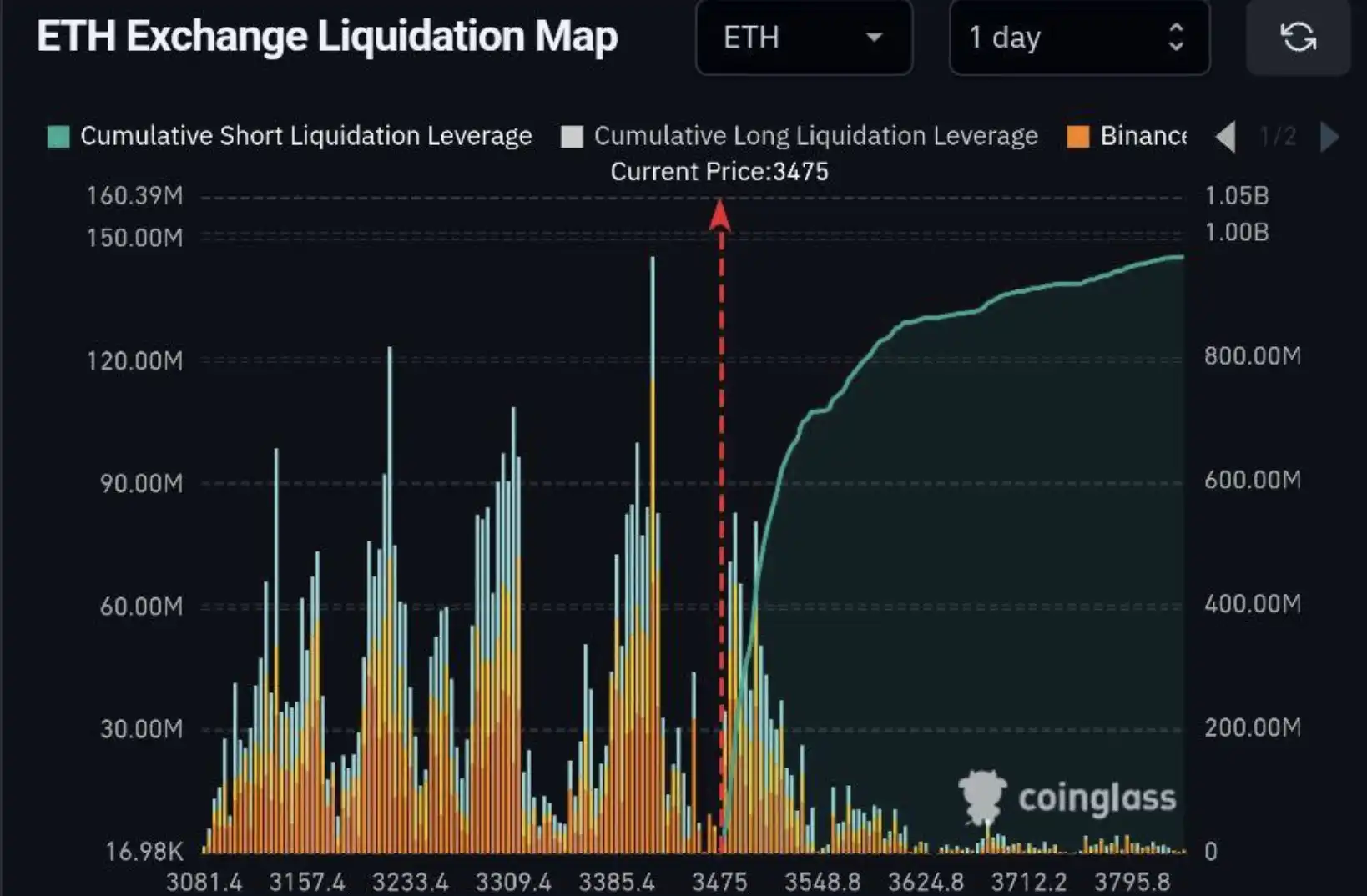

Now we are witnessing billions of dollars in short positions being liquidated in succession. If Ethereum rises another 10%, an additional $1 billion in short positions will be liquidated.

Moreover, since these short positions are mostly leveraged, the market is facing stronger short squeeze pressure.

Ethereum may soon reach $4,000.

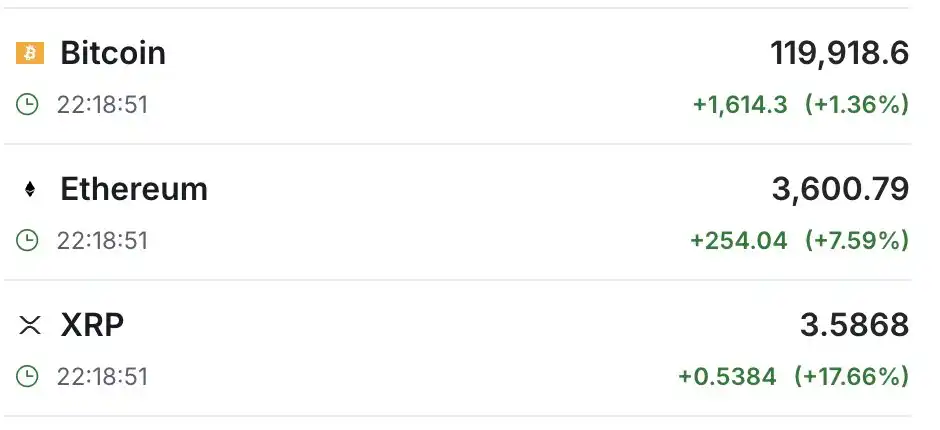

We are also observing a similar effect with Ripple, while Bitcoin continues to show relative strength. Bitcoin has officially returned to the $120,000 mark, with a market cap increase of $900 billion since the low in April. After months of stagnation, Ethereum and Ripple have finally begun to catch up to Bitcoin's gains.

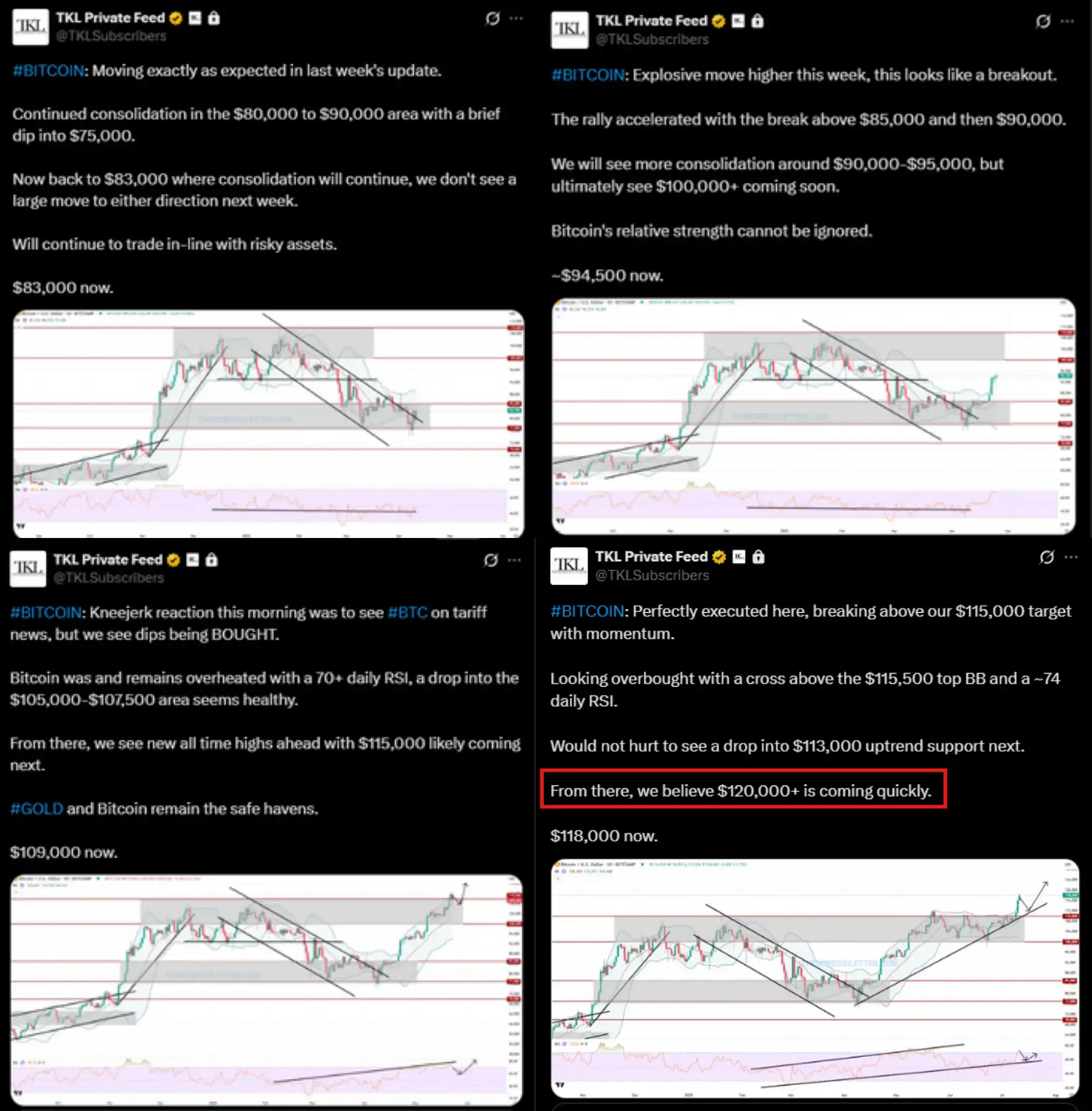

We anticipated this trend in advance. Here are some warning signals we provided to our premium members: we gradually bottomed out at $80,000, $90,000, and $100,000, and accurately predicted a target of $115,000. Last week, we raised the target to $120,000+, and this target has just been achieved.

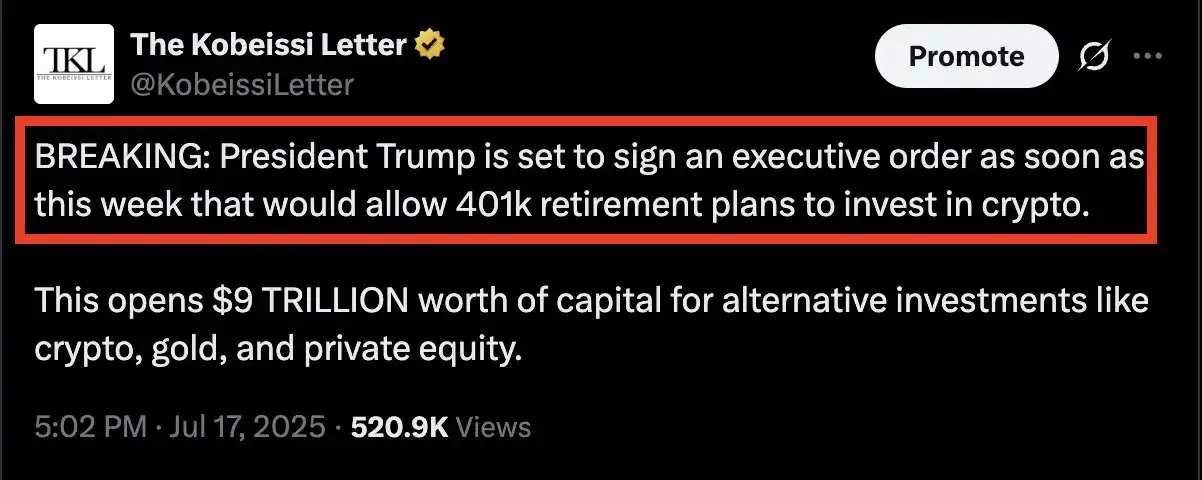

More importantly, the market is digesting today's major report released by the FT. President Trump is expected to sign an executive order this week allowing 401k pension plans to invest in cryptocurrencies. This will become one of the most significant positive developments in cryptocurrency history.

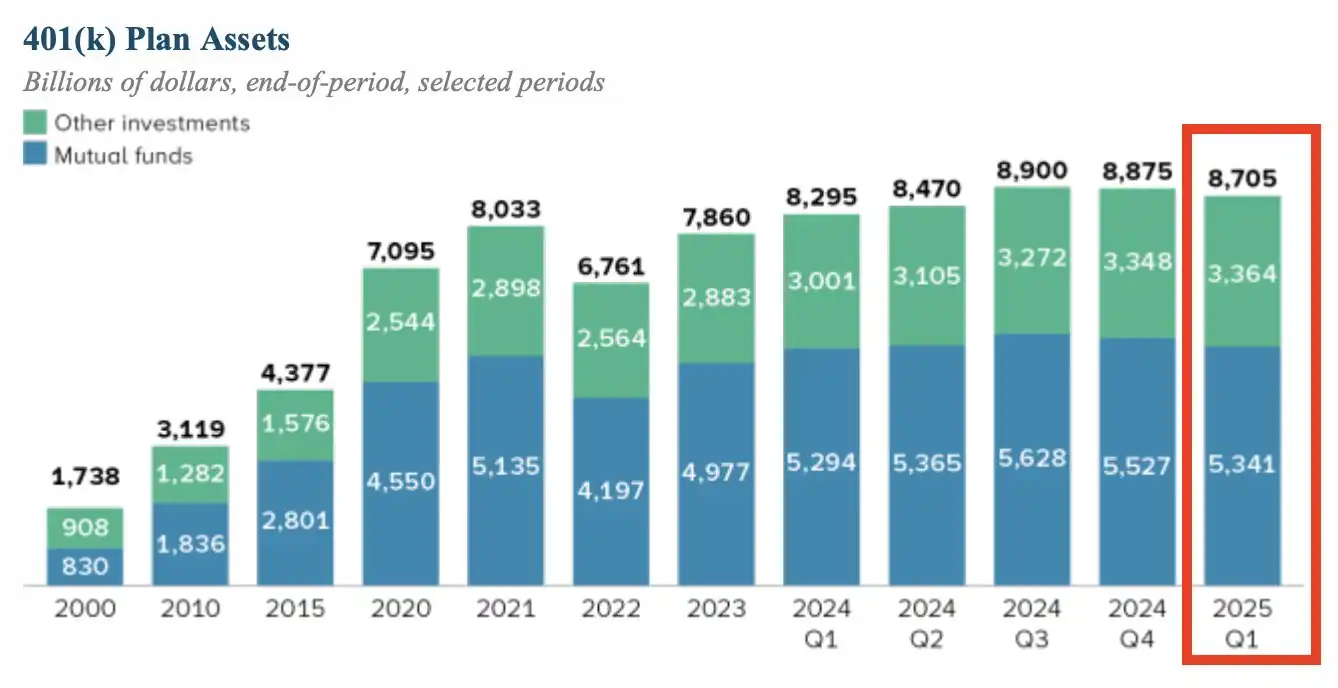

As of the first quarter of 2025, the size of U.S. 401k pensions reached $8.7 trillion. Meanwhile, the total market cap of cryptocurrencies is only $3.8 trillion. This means that funds equivalent to 2.3 times the entire cryptocurrency market size are about to gain entry. This is groundbreaking.

Even more significantly, the U.S. House of Representatives has passed three important bills regarding Bitcoin and cryptocurrencies: the "Clarity Act," the "Genius Act," and the "Anti-CBDC Act."

The biggest victory for the cryptocurrency industry is gaining bipartisan support. Candidates who refuse to embrace cryptocurrencies can no longer win elections.

As we have always emphasized: institutional capital can no longer ignore cryptocurrencies. Over the past 13 years, Bitcoin has achieved a compound annual growth rate of +90%, outperforming almost all global assets.

We continue to receive feedback from institutional investors that their assets under management (AUM) are gradually allocating to crypto assets.

Looking ahead, the core logic driving the rise of cryptocurrencies will trigger significant macroeconomic changes. This is redefining the operational paradigm of financial markets.

Lastly, don't forget the strongest bull market engine for cryptocurrencies—the U.S. deficit spending crisis. Not only has Bitcoin risen 55% since April, but the dollar index has also fallen 10% this year. The dollar has entered a perpetual bear market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。