Author: Miles Jennings, General Counsel of a16z crypto

Translation: AIMan@Golden Finance

Recently, the House of Representatives advanced an important new "market structure" bill with an overwhelming majority (294 votes in favor, 134 votes against, including 78 Democrats supporting it).

The bill, named the Digital Asset Market Clarity Act (abbreviated as "CLARITY Act," HR 3633), will establish a clear regulatory framework for the digital asset market. The bill has now been submitted to the Senate for review, where the Senate is drafting its own version of market structure legislation, referencing the CLARITY Act.

If passed, the bill will set clear rules for blockchain systems—ending years of uncertainty that stifled innovation, harmed consumer interests, and favored unscrupulous actors who pursued opacity over transparency. Just as the Securities Act of 1933 established investor protection mechanisms and facilitated capital formation in the U.S. for nearly a century, the CLARITY Act could become a far-reaching piece of legislation.

When our legal framework can both promote innovation and protect consumers, the U.S. can lead the way, and the whole world can benefit. The CLARITY Act represents such an opportunity. This legislation builds on the bipartisan cooperation of last year's FIT21 bill, but the CLARITY Act improves upon it in several key areas, which we will outline below: covering what innovators need to know and why this bill is crucial for aligning innovation, consumer protection, and U.S. national security.

With the recently signed GENIUS Act (which will be detailed below), the need for a broader market structure bill has become even more urgent.

Why the CLARITY Act is Important

Despite the cryptocurrency industry existing for over a decade, the U.S. has yet to establish a comprehensive regulatory framework. However, cryptocurrency is no longer just a trend among tech insiders; it has become infrastructure: blockchain systems are now foundational in various fields, including payment systems (including through stablecoins), cloud infrastructure, and digital markets.

But the construction of these protocols and applications lacks clear rules. What is the result? Legitimate entrepreneurs face regulatory shocks, while unscrupulous actors profit from the ambiguity of the law. The passage of the CLARITY Act will reverse this situation.

By providing projects with transparent compliance pathways and ensuring that regulators have better tools to oversee actual risks, the CLARITY Act (along with the stablecoin bill known as the "GENIUS Act") will bring the already vast cryptocurrency industry out of the shadows and into a regulated economic system. This new legislation creates a framework for responsible innovation, much like the foundational laws of the 20th century that helped public markets thrive and protected consumers.

In addition to providing clear compliance pathways, the bill also offers clearer rules—granting entrepreneurs the legal certainty needed to innovate confidently and operate domestically. This will ultimately alleviate the pressure on legitimate entrepreneurs to start businesses overseas (or to evade regulation using inefficient and opaque structures).

This legal clarity will open doors for the next generation of decentralized infrastructure, financial instruments, and user-owned applications—all of which will be built in the U.S. Ensuring that blockchain systems are developed in the U.S. will also protect global digital and financial infrastructure from reliance on blockchain systems created and controlled by entities such as China, while ensuring that U.S. regulatory standards apply to the core financial infrastructure increasingly used by those outside of cryptocurrency.

What Will the CLARITY Act Do?

Establish a Clear Regulatory Path for Digital Goods

The CLARITY Act creates a regulatory framework for digital assets (referred to as "digital goods"), granting users ownership of blockchain systems.

The bill allows blockchain projects to launch digital goods and enter the public market based on a maturity framework of control, without incurring excessive regulatory burdens or uncertainty.

Implement Oversight of Blockchain-Based Intermediaries

The bill ensures that centralized participants in the cryptocurrency space (such as exchanges, brokers, and dealers) are subject to strict regulation. These intermediaries include:

**Those required to register with the CFTC; and

Those that must comply with compliance standards similar to those governing traditional financial institutions.

These requirements enhance the transparency of core market infrastructure, help prevent fraud and abuse, and bolster consumer trust. They also address current regulatory gaps—gaps that allowed companies like FTX to operate unrestrained in the U.S. market.

Protect Consumers with Strong Safeguards While Promoting Innovation

The CLARITY Act also establishes direct consumer protection measures, including:

Mandatory public disclosure obligations for digital goods issuers—ensuring that retail investors can access essential, important information;

Restrictions on insider trading—limiting the ability of early stakeholders to harm user interests through information asymmetry.

These measures also provide a clearer roadmap for entrepreneurs building decentralized blockchain systems, helping to foster innovation.

Which Government Agency Will Regulate?

The CLARITY Act will provide a clear, structured pathway for the regulation of digital assets from the U.S. SEC to the Commodity Futures Trading Commission (CFTC).

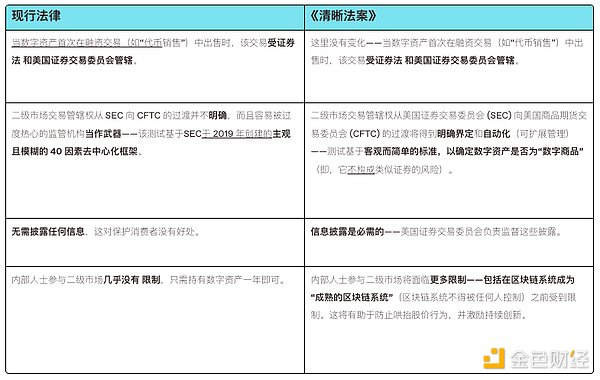

Let’s compare how current laws and the CLARITY Act (if passed) address the unique attributes of blockchain systems:

The above pathway is based on a carefully calibrated "control-based" risk framework; details will follow.

How Does the "Control-Based" Maturity Framework for Blockchain Systems Work?

Compared to the traditional effort-based decentralization test created by the U.S. SEC in 2019 (which has an unclear definition of decentralization that regulators can exploit against good actors), the CLARITY maturity framework adopts clear, objective, and measurable standards.

These standards focus on who has control over the underlying blockchain system and its associated digital goods. This is more consistent with other regulatory regimes (such as money transmission) and eliminates negative incentives that discourage builders from continuing to build to avoid being seen as centralized. More importantly, this approach will help legitimate builders thrive—and continue building (rather than being forced to abandon projects)—while making it harder for bad actors to exploit legal ambiguities, including through participation in performative "decentralization theater" (rather than true decentralization).

Specifically, the bill's framework incentivizes decentralization and protects consumers in the following ways:

Imposing more oversight and stricter regulatory burdens during the formation phase of the blockchain system—when centralized control exists, the risks associated with the native digital assets of that blockchain system are most similar to securities risks;

Reducing regulatory requirements as projects mature—when there is no centralized control, risks decrease, becoming most similar to commodity risks.

Similar to previous legislative efforts to regulate the transition from centralized to decentralized (see the comparison with FIT21 below), the regulatory obligations applicable to projects within the "maturity" range include:

Mandatory disclosures—which will enhance transparency; and

Restrictions on insider sales—which can protect early consumers from harm by insiders (such as participating entrepreneurs and investors) who may possess asymmetric information unknown to other consumers.

However, unlike FIT21, CLARITY establishes seven objective, measurable standards for determining when a specific blockchain system is no longer controlled by individuals or a jointly managed group (such as a foundation), thus its native digital assets no longer pose securities-like risks. Because this approach centers on eliminating control, it can protect consumer investors while fully realizing the potential of blockchain technology. Additionally, because CLARITY adopts measurable (rather than amorphous) standards, it provides a framework that is easier for regulators to apply and for builders to follow.

In short, this new framework is a significant improvement over traditional regulatory frameworks, as securities laws were not designed for assets (like blockchain systems) whose risk profile can shift from resembling securities to resembling commodities.

This new framework has also received broad support from the industry.

What Impact Will It Have on Specific Industries Like DeFi?

The CLARITY Act provides important safeguards for decentralized finance (DeFi). Specifically, the bill:

Exempts DeFi protocols and applications from regulatory requirements for intermediaries in digital goods trading (such as exchanges and brokers);

Establishes standards for DeFi—qualifying DeFi systems must not act as intermediaries—ensuring that specific DeFi systems do not reintroduce risks that regulation aims to mitigate.

Furthermore, the bill will provide the necessary legal clarity for DeFi projects:

Launching and selling their native tokens—processes that were previously fraught with risk and ambiguity;

Utilizing decentralized governance—avoiding the risk of being classified as centralized;

Providing self-custody rights—many have done this before, but now, through this bill, individuals will have "self-custody rights."

CLARITY creates a level playing field for DeFi projects. This also paves the way for integrating the advantages of decentralized finance into the broader financial system, thereby unlocking its true potential for consumers more widely.

However, the CLARITY Act is not without its flaws. Since the bill only focuses on digital goods, it does not cover other regulated digital assets, such as tokenized securities and derivatives. Although the CLARITY Act exempts DeFi systems from complying with federal intermediary rules, it does not replace state-level regulation—meaning the DeFi industry remains vulnerable to inconsistent or overly burdensome state policies. These gaps should be addressed by the Senate, future legislation, or through coordinated regulatory guidance (such as rulemaking by the SEC and CFTC).

Is CLARITY Better Than the Status Quo?

Yes; the CLARITY Act improves upon the status quo because…

……The industry currently lacks regulation. While some may argue that no regulation is better than regulation, the current lack of transparency in regulation provides convenience for criminals and unscrupulous actors who exploit this uncertainty to take advantage of consumers. (Not to mention that this can lead to unchecked abuse of power by regulatory agencies.) FTX is a prime example of these issues, which not only harmed the entire industry but also affected thousands of consumers. If we do not take action now, we will open the door to more criminals like the former CEO of FTX.

……The industry lacks transparency. Due to the absence of mandatory disclosure and listing standards, consumers often face the risk of scams and fraud. This lack of transparency has fostered a "casino" culture (rather than one focused on innovation), leading to the emergence of purely speculative products like memecoins.

……The industry lacks protection. Due to the unclear constraints on the regulatory authority of various federal agencies, blockchain projects (especially DeFi projects) remain vulnerable to the excessive regulation common during the previous administration.

……The industry lacks standards. Without standards for decentralization/control, consumers face unknown risks when using blockchain systems. For example, they may believe their assets (including stablecoins) are safe—but if these blockchain systems are controlled by a single entity (which could shut it down directly), they may not be safe. As all industries mature, the establishment of standards becomes increasingly common.

How does the CLARITY Act compare to previous legislative efforts, such as the Financial Innovation and Technology for the 21st Century Act (also known as FIT21)? The CLARITY Act actually learns from the lessons of FIT21 and improves upon it:

It increases transparency by closing loopholes in FIT21, preventing certain legacy projects from evading disclosure. CLARITY provides a framework for legacy projects that are still operational to fulfill their disclosure obligations.

It offers stronger consumer protection by making it more difficult for insiders to exploit information asymmetry. For example, CLARITY strictly limits insiders from selling assets before the project matures (i.e., while they still control the project).

Its maturity framework provides a more principled, control-based decentralization test, significantly improving upon the vague approach of FIT21. The framework is also more precise, as CLARITY proposes seven objective, measurable standards to determine whether a blockchain system is mature.

It enhances regulatory oversight and provides regulators with greater flexibility, which will help ensure that the regulatory framework evolves and scales with the maturity of the industry.

How does the CLARITY Act align with the recently passed GENIUS Act?

The GENIUS Act represents a key step toward modernizing our financial system. The House passed this important legislation with an overwhelming majority (308 votes in favor, 122 votes against, including 102 Democrats supporting it), creating history. However, the stablecoin legislation significantly increases the necessity for broader market structure legislation like the CLARITY Act.

Why? Because GENIUS will accelerate the adoption of stablecoins, thereby driving more financial activities onto the blockchain, enhancing reliance on blockchain, and facilitating broader payment and commercial activities. This is already happening, as ubiquitous payment processors, traditional financial institutions, established payment networks, and other entities increasingly accept and adopt stablecoins.

But the current stablecoin legislation does not regulate the blockchain through which stablecoin assets circulate—it does not require these tracks to be secure, decentralized, or transparently managed. This gap exposes consumers and the entire economy to new systemic risks.

With the GENIUS Act now signed into law, the demand for CLARITY has become more urgent.

The CLARITY Act provides the necessary standards and oversight to ensure that the infrastructure supporting stablecoins (underlying blockchains, protocols, and other tools) meets safety, transparency, and control standards. Its objective, measurable requirements for mature blockchain systems also better assist entrepreneurs in understanding how to meet these standards.

Without the complementary protections of the GENIUS Act and the CLARITY Act, the adoption of stablecoins could accelerate the use of unregulated, opaque, and even adversarial infrastructures. The passage of the CLARITY Act will ensure that stablecoins operate on secure networks, further protecting consumers, reducing financial risks, and solidifying the dollar's strong position and leadership in the next generation of financial systems.

What Happens Next?

With the CLARITY Act having passed the U.S. House of Representatives, it will be sent to the Senate. The Senate Banking Committee and the Agriculture Committee may choose whether to take up the bill, modify it through their respective amendment processes, and then submit it to the full Senate for a vote.

However, it is more likely that a bipartisan group of senators will propose a separate Senate version of the cryptocurrency market structure bill, which may resemble the CLARITY Act in many ways. The Senate Banking Committee and Agriculture Committee will then review the bill through their respective processes, and if approved, it will be submitted for a Senate vote.

If both chambers of Congress pass their respective bills, the House and Senate will need to reconcile any differences—whether through informal negotiation processes or a more formal conference committee—before each chamber votes on the final compromise version.

When might all this happen? The main leaders of the House and Senate have set a goal to send the market structure bill to the President for signature by the end of September.

The CLARITY Act received 216 Republican votes and 78 Democratic votes, continuing the bipartisan momentum established by the FIT21 Act (which passed the House with 71 Democratic votes). The bill represents a comprehensive improvement over the FIT21 Act—strengthening consumer protections, clarifying decentralization standards, and aligning more closely with existing regulatory models.

The passage of the CLARITY Act will ensure that the U.S. continues to maintain its global leadership in blockchain infrastructure, benefiting developers and consumers alike. As a serious, thoughtful, and bipartisan effort, the CLARITY Act aims to build an effective regulatory framework for U.S. cryptocurrency that strikes a balance between innovation and regulation. It provides Congress with an opportunity to protect consumer rights while supporting the infrastructure of the digital economy, creating jobs and opportunities—marking the next significant milestone in the field of computational innovation, as important as previous milestones like personal computing, cloud computing, and mobile computing.

We are at a critical moment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。