Original Video: Michael Saylor

Translation|Odaily Planet Daily (@OdailyChina)

Translator|CryptoLeo (@LeoAndCrypto)

The corporate layout of Bitcoin reserves continues to heat up. Recently, several companies have accelerated their Bitcoin reserve strategies, with typical cases including:

Nasdaq-listed company Profusa: announced the signing of an equity credit agreement with Ascent Partners Fund LLC, planning to raise up to $100 million through the issuance of common stock, with all net proceeds used to purchase Bitcoin.

H100 Group: raised an additional approximately $54 million, which will be used to seek investment opportunities under its Bitcoin reserve strategy.

In addition to the above cases, many traditional companies are also actively raising funds to build Bitcoin strategic reserves. Meanwhile, the potential "battlefield" of the pension market is also revealing signs.

On July 18, the Financial Times reported that the Trump administration is considering opening cryptocurrency, gold, and private equity investment channels to the U.S. retirement market, which manages $9 trillion in assets. It is reported that Trump plans to sign an executive order allowing 401(k) retirement plans to invest in alternative assets beyond traditional stocks and bonds. If this policy is implemented, publicly traded companies focused on Bitcoin reserves or holding large amounts of Bitcoin are expected to become popular investment targets in the pension market, with their appeal potentially surpassing existing methods such as spot ETFs.

In this trend, Strategy (formerly MicroStrategy) is moving towards a broader stage with its business model. Previously, Strategy announced the "BTC Credits Model" for evaluating the equity value priced in Bitcoin, and founder Michael Saylor elaborated on the application and significance of this model in a recent interview. Odaily Planet Daily has compiled the key content as follows:

What is the next business model for Bitcoin reserve companies? Why is this model so simple yet powerful? How can maximum results be achieved through a focus on execution?

Saylor's first response is again a familiar topic (he always mentions this at the beginning of interviews) — the story of dentists buying Bitcoin to establish companies and Metaplanet; I have omitted this part, for details refer to previous translated Saylor interview articles: "BTC Conference|Michael Saylor's Speech: 21 Keys to Unlocking BTC Billion-Level Wealth" and "Exclusive Interview with Michael Saylor: $62 Billion is Just the Beginning, Strategy's Bitcoin Reserves Will Increase Exponentially";

I once said in Las Vegas that corporations are the most effective wealth creation machines we have designed so far. If we view the spread of Bitcoin as a monetary virus or super idea, when Bitcoin comes into contact with individuals, the virus spreader is a corporation. When a corporation restructures capital through Bitcoin, the real opportunity for any publicly traded company is to sell equity or issue credit.

All equity capital in the world is valued based on future expectations of fiat cash flows. For example, every company in Nigeria is valued based on expectations of Nigerian cash flows. Brazilian companies are based on Brazilian cash flows. American companies are based on cash flows. But we know that the value of cash is declining.

Faced with bullish, heterogeneous, and uncertain risks, such as credit risk or stock risk, all creditors' values are based on future expectations of cash flows. I don't have money to borrow from you, I promise to pay you back, and I plan to get this money in 10 years. Therefore, the existing market is based on future expectations of business operations. We are evaluating real-world assets, assessing future cash flows, and evaluating equity or opportunities.

And Bitcoin treasury companies have the most elegant business model; I have some Bitcoin (worth $10 million). I start issuing stock based on my ability to acquire more Bitcoin, then credit, fixed credit, convertible credit, other credits, and then I use it to buy Bitcoin. For example, Metaplanet reserves Bitcoin through frequent stock issuances, and its market value shows exponential growth, while Strategy announced a $21 billion ATM plan last year to purchase Bitcoin; if we achieve this in three years, it will become the most successful stock plan in capital market history.

I just want to say that a company is a gathering of a financial expert, a legal expert, and a leader — a CEO, a CFO, and a Chief Legal Officer coming together forms a Bitcoin treasury company. If you put Bitcoin in it, then your company can grow as quickly as issuing securities and purchasing Bitcoin.

In other words, this is also an investment cycle, 1000 times faster than physical, real estate, or business cycles, and more uniform. The main conflict point is the issuance of securities, which requires compliance and is a regulatory challenge. If you are Japanese, the situation is different from that of a French person. In the UK, you need a Bitcoin treasury company that understands UK law, and similarly in France, Norway, Sweden, and Germany.

Moreover, these companies have local advantages; if you are a Japanese company, it is much easier to issue securities in Japan than for an American company to issue securities in Japan. I know this; I called Simon (Metaplanet CEO). I said, you might issue preferred stock in the Japanese market earlier than I do, go ahead.

So I think this is the simplicity of the business model; I just need to issue billions of dollars in securities and then purchase billions of dollars in Bitcoin.** I want to transform the stock and credit capital markets from the 20th century's simulated physical cash (based on cash) to the 21st century's Bitcoin (based on cryptocurrency).**

About the BTC Credit Model

We have developed a set of metrics to evaluate the equity value priced in Bitcoin. Since we adopt the Bitcoin standard, simple dollar accounting methods do not apply, as dollar accounting is designed for companies that generate revenue through operations. Therefore, we created the BTC yield, which is essentially the appreciation and percentage per Bitcoin.

The idea is that if you can achieve a 20% BTC yield, you can multiply it by a factor, say 10, so you can achieve a 200% premium relative to net asset value (NAV). To calculate what the premium is relative to NAV, it is a very simple method, depending on whether the company generates a 220% yield, or a 10% or 200% yield; for example, a bond that pays 200% interest after tax is worth much more than a bond that pays 5% interest after tax, therefore, BTC yield or dollar yield is an equity metric.

The dollar yield of Bitcoin is essentially equivalent yield. A Bitcoin company is based on Bitcoin; if you generate $100 million in Bitcoin dollar yield, that is equivalent to $100 million in after-tax yield, which directly counts towards shareholder equity, bypassing the profit and loss statement (PnL), but a company that can generate billions in BTC yield is the same as a company that can generate a billion in yield; you can use PDE (Note: PDE is a partial differential equation, a model that can dynamically model the prices of financial derivatives, widely used in options pricing) and then say, I should set the value of PDE to 10, 20, 30, or any other number multiplied by that yield.

This helps me understand the enterprise value of this business and the ability of the enterprise to execute this business. The question now is, how to generate BTC-based yield or BTC U-based yield? There are several ways to do this:

The first way is to manipulate cash flow, putting all operating profits into Bitcoin, which will yield corresponding returns, involving $100 million in operating cash flow. I use this money to buy Bitcoin. In this way, I achieve $100 million in Bitcoin yield without diluting any shareholder equity, but it requires an operating company that can generate substantial cash flow to do this;

The second way is, if you sell equity at a price higher than net asset value (M times NAV), for example, selling $100 million in equity at 2 times NAV, then you will achieve $50 million in BTC yield. Of course, if you sell equity below NAV, you are actually diluting shareholder stakes and will achieve negative yield;

I believe that BTC yield and returns are important because they provide investors with a simple, transparent, and immediate way to understand whether the management team is engaging in value-added transactions or dilution transactions on any given date. As long as publicly traded companies are willing to dilute shareholder equity, they can raise almost any amount of funds. The real trick is that these must be done in a value-added manner. So these two metrics are important, but now we have solved this problem.

For example, if my cash flow is exhausted, what will you do if the price of BTC rises? If M is 10 or 5 or 8, this is not a complicated issue. When M is 10, you achieve about 90% of the price difference, so every $1 billion in equity sold can generate $900 million in yield, which is risk-free immediate yield. Essentially, this is not complicated.

The question is, what happens if M drops to 1 or below? If you have no cash flow, and M drops to 1, but you have a billion dollars in Bitcoin on your balance sheet, what will you do? If you are a closed-end trust fund like Grayscale, or if you are an ETF (especially a closed-end trust fund), you are powerless. Therefore, your trading price will be below M times NAV.

And this is exactly what people want to avoid. However, the special power that operating companies have is to issue credit instruments. Therefore, if the discount price trades or the trading price drops to normal market price, then the real way to get out of trouble is to start selling credit instruments, which are secured by company assets, which leads to the concept of the BTC Credit Model.

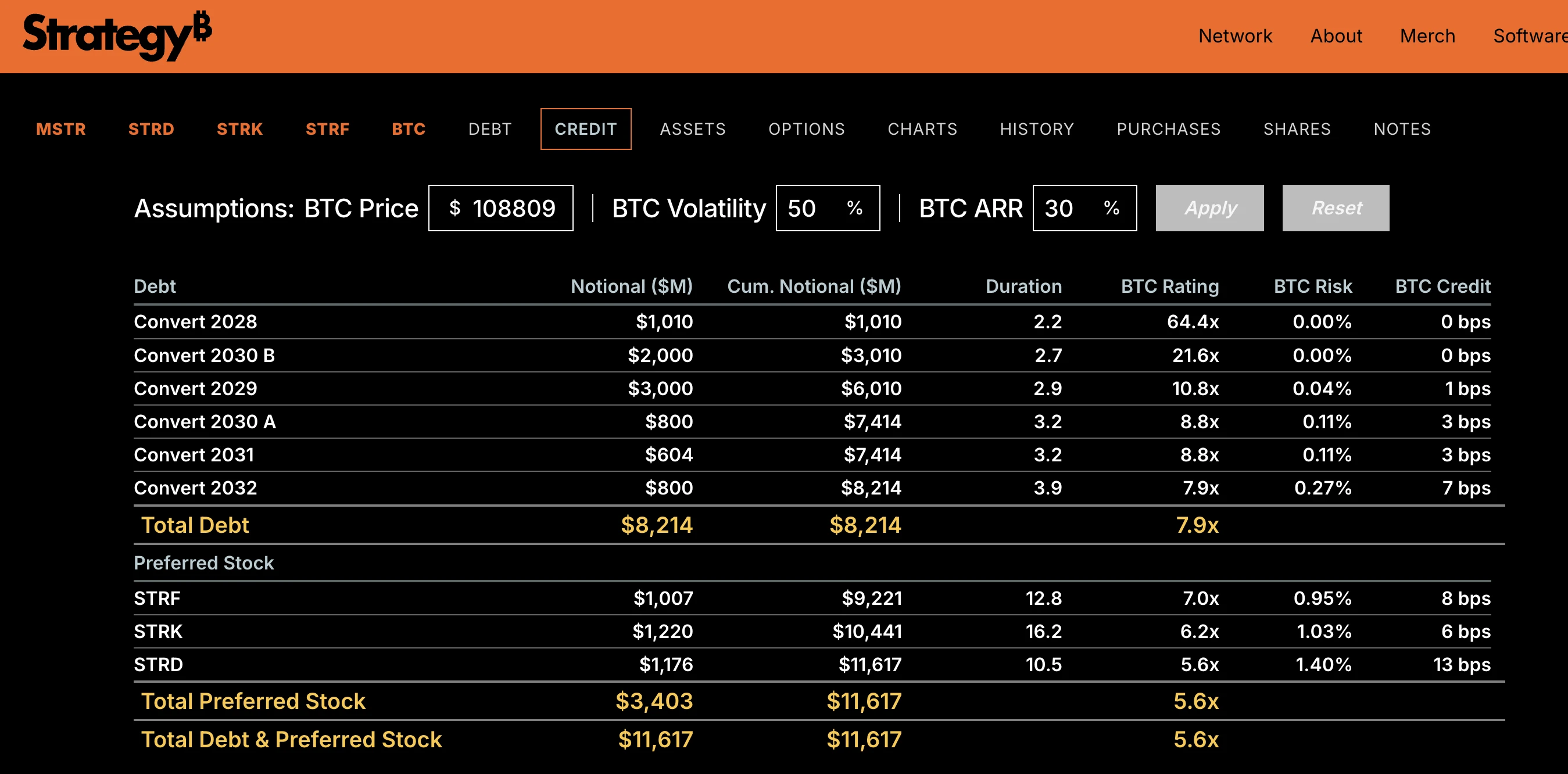

If I have $1 billion in Bitcoin, I can sell $100 million in bonds or $100 million in preferred stock with a dividend yield of 10%. This equates to a 10x collateral. Therefore, the Bitcoin rating is 10, and now you can calculate the risk; the risk lies in the fact that your $1 billion in Bitcoin could shrink to less than $100 million by the time the instrument matures. You can calculate this using statistical methods like the Black-Scholes Model (Note: The Black-Scholes Model is a mathematical model in finance widely used for pricing options and other derivative financial instruments), inputting volatility and the BTC rating to derive the risk, and then calculate the credit spread, which we refer to as BTC credit.

BTC credit represents the theoretical credit spread you need to offset the risk (relative to the risk-free rate), and of course, there is the credit spread itself. If the BTC rating is 2, the credit spread will be higher than in the case of a rating of 10; if the predicted volatility of Bitcoin is 50, then the credit spread must be higher than in the case of Bitcoin volatility being 30.

Therefore, if you input your expected Bitcoin return rate or annual yield into the BTC credit model, and fill in the expected volatility of Bitcoin, then input the price of Bitcoin, you will get the BTC rating, and the risk will pop up, and the BTC credit model will emerge. What we are doing is starting to issue credit instruments backed by Bitcoin; our idea is to sell securities to a market that is orthogonal (completely unrelated) to the stock market and the Bitcoin market, or to an unrelated market.

In the dollar yield market for American retirees, many people do not know what Bitcoin is, do not know what Strategy is, and are completely unaware of our business model. However, if we offer them preferred stock with a 10% dividend yield, providing them with a 10% yield and qualified income distribution, a qualified type of instrument, if your annual income is below $48,000, you can purchase this instrument in the U.S. and receive a 10% tax-free yield.

Many people want 10%. The question now is risk; if it is 5x or more than 10x collateral, then it does not seem so dangerous. If you are bullish on Bitcoin, my idea is simple: provide someone with high fixed returns at very low risk. I believe collateral is a killer application for Bitcoin. Strategically, we have created a convertible preferred stock called "Strike" (ticker: STRK), which allows you to gain 40% upside in stock and an 8% coupon dividend.

Then we created a convertible preferred stock called "Strife" (STRF), offering a 10% yield. These two stocks are the most successful preferred stocks of this century. They are the most liquid and highest performing; when other preferred stocks drop by 5%, they all rise by 25%.

They are the most successful because any security purely constrained by Bitcoin is always better. These equities are more valuable, convertible bonds are more valuable, and these preferred stocks are more valuable because you are connected to an asset that rises 55% annually. We put it into those instruments, and they will be very successful, listed, and achieve stock price increases. The current idea is that we can market to people.

We can sell people a 40% upside in stock, while Bitcoin may rise 80%, with downside protection and guaranteed dividends. So we call it "Strike." It’s like a Bitcoin bonus; it’s like you get a living allowance, you have enough funds to protect you, you can hold it forever.

This is for those who are curious about Bitcoin but afraid of the "roller coaster," like a "turbocharged" version of Bitcoin stock MSTR. But there are also many people who do not want to touch Bitcoin; they just want dollar yields, euro yields, or yen yields. But how many people in the world have this idea? The fact is that for all retirees, no one wants to earn 8% or 10% dividend yield with extremely low risk.

That is why the size of the credit market and fixed income market is larger than the stock market. What we are doing is using Bitcoin to generate this yield. If Bitcoin is rising and has already risen 55%, then you can almost carve out any proportion of yield from 50%, as long as it is below 55%, to distribute to investors. Moreover, I believe the long-term highest forecast for Bitcoin is 30%, but I think Bitcoin's annual yield will always remain between 20% and 60%.

As long as Bitcoin's return rate reaches 20% or above, you can sell these tools that offer 6%-10% return rates at any time and exchange them for 20%-40% return rates. This allows equity investors to capture the price difference, so the equity performance will outperform Bitcoin. As for convertible bonds, this is our financial engineering.

We are transforming companies, with the goal of making their actual performance exceed Bitcoin by 50% to 100%. If you want to invest directly in Bitcoin, you can buy BTC on IBIT and hold it. But through our stocks, you will receive all the gains and losses of Bitcoin, as well as all the volatility. The design of the STRK convertible bond is aimed at providing you with 80% to 100% of Bitcoin's returns, but only bearing 10% of the downside risk. So we hope you can achieve 80% upside returns, bear 10% downside risk, and receive guaranteed dividends. This is suitable for those who want to enjoy returns while avoiding risks; they do not want roller coaster-like volatility. This is almost to compete with IBIT; if I give you 80% to 100% upside returns, 100% downside risk, and no dividends, what will happen in the end (IBIT)?

I do not know if it will fully reach 100%, but the more equity we utilize, the greater the likelihood that convertible equity will perform similarly to Bitcoin. Therefore, our goal is to have convertible equity perform comparably to Bitcoin in the long term while providing principal protection, liquidation priority, and guaranteed dividend streams. That’s it. It seems there is a demand in the market; people want to enjoy the upside without bearing the downside risk, right? This is financial engineering; I bring you the upside, you have no losses, and while you wait to get rich, I will also give you dividends. In my view, smart financial engineers would agree with my point, but many people have not fully understood it. They have not fully understood it because in the last four years, among the last 10 preferred stocks issued, there has not been a permanent convertible preferred stock.

The top three of the 10 preferred stocks are all ours, and they are all permanent; the other seven are not. People generally do not sell perpetual dividends or perpetual call options because they do not have the right to use perpetual income; they cannot invest for 100 years. If you are confident in Bitcoin and believe Bitcoin will always outperform the S&P 500, then you can sell a dividend that is always below the S&P index. Then you can also sell convertible preferred stocks that outperform the market, which is a good thing. So we designed such products, and then the idea about fixed income is, do we want to give someone an indefinite perpetual dividend yield? Traditional thinking suggests that designing a call option is more reasonable.

If interest rates fall, you can redeem it. This is a way that traditional bankers like; you set a call option, and if interest rates fall by 200 basis points, you exercise this option and refinance it.

But you think this way: if you sell 144A (Note: 144A is SEC Rule 144A, which allows qualified institutional buyers to trade unregistered private securities in the over-the-counter market; these securities typically have lower liquidity but flexible trading, suitable for institutional investors) in the trading market for three years in exchange for trading in the over-the-counter market, but these are all incomplete tools from the 20th century, then the current way of thinking is: I inject STRF into the market; I do not care how much I see in the first week; I create this tool to maximize fundraising over the next 20 years.

So we want to design a tool; if Powell lowers interest rates by 200 basis points, then when the trading price of STRF rises to 150, the yield will drop to 6%. When the yield drops to 6%, we can sell it instead of buying it back.

The whole idea is that when interest rates fall, I will sell billions or even hundreds of billions of dollars of this financial instrument at prices of 150 or 200 through ATM, while those "smart people" will think, I have to buy it back, refinance it, and then go back to do a 144A deal with the investment bank, paying huge amounts to refinance it, so STRF will become both liquid and flawed, so I do not want to issue a series of flawed and illiquid securities.

By the way, what I am describing is the entire preferred stock market; all preferred stocks are, in my view, garbage. You buy these garbage tools, with daily trading volumes of only $400,000, yielding 6%, with credit ratings equivalent to a medium-sized regional bank, and the mortgage portfolio comes from a place you have never touched and do not understand, and yet you have to accept this non-liquid over-the-counter product with little trading and a yield of 6%, rather than a product with higher yields, better liquidity, and accessible to everyone.

Of course, the problem lies in all corporate credit; all preferred stocks are based on the century-old concept of 20th-century credit models. We conclude that the killer application for Bitcoin treasury companies is issuing Bitcoin credit, which is equity backed by Bitcoin, and that is the first step.

But the long-term sustainable business is issuing BTC-backed credit instruments, first issuing billions, tens of billions, and hundreds of billions. You are not competing with other Bitcoin treasury companies; you are competing with all the junk bonds issued by companies without funding and all the corporate bonds issued by investment-grade companies. Moreover, our collateral is better than the best investment companies issuing corporate bonds; our collateral is superior.

So, we are competing in this market with corporate bonds, investment-grade bonds, junk bonds, private credit, and preferred stocks. Our idea is to sell some products with better credit, lower risk, higher quality collateral, higher yields, and stronger liquidity.

Our ultimate goal is, rather than having a thousand preferred stocks, each with a market cap of $500 million, all of which are illiquid, worthless junk stocks, it is better to have only one preferred stock with a market cap of $50 billion, trading $2 billion daily, which will yield higher than any yield you have heard of, backed by Bitcoin. To achieve this, you only need to adopt the metrics I just described, which every Bitcoin treasury company can replicate, and I sincerely invite all companies to give it a try.

I encourage companies to do this, because just as 20 Bitcoin treasury companies issuing stocks have legitimized Bitcoin and Bitcoin stocks, 20 companies issuing Bitcoin-backed credit instruments will also legitimize Bitcoin credit, which will accelerate the digital transformation of all credit markets and trigger capital to transform the flawed credit tools of the 20th century into digital credit tools of the 21st century, and S&P, Moody's, and Fitch will begin to rate them.

Everyone's understanding of credit risk will evolve. Retirees will receive a 200 basis point yield while their risk is reduced by at least an order of magnitude. If Bitcoin's price rises to $1 million or $2 million, the value of the collateral will also increase, and the overall market will evolve accordingly.

What I am expressing is that the digital transformation of capital markets driven by these blockchain technology companies will quickly end the currently popular ways of capital markets.

Answering Journalists' Questions

This section contains Saylor's responses to journalists' questions.

Journalists express concerns about the centralization of Bitcoin mining pools.

The network is decentralizing, and I am not worried about the centralization of mining pools. I believe Bitcoin mining is becoming decentralized globally. Today, it is more decentralized than during the period when China banned mining, at which time China accounted for half of the mining volume. Mining was somewhat centralized back then, but it later migrated to the United States, and in the past year or two, mining has moved from the U.S. to various parts of the world. Ultimately, I feel that mining does not have such a significant impact.

The computing power is in the hands of economic participants, political participants, Bitcoin miners, and technology providers, and compared to five years ago, there is now more consensus among all parties. Moreover, I believe that policy-driven mining will eventually be replaced by economic and technological participants. In my view, Bitcoin is actually stronger than ever before. I am not worried about the current situation, and I believe it will continue to be good in the future.

Journalists ask questions about exchange KYC review-related issues

We need to clarify one point: you are not working with exchanges or companies, but rather in a world of Bitcoin, where exchanges are merely a medium. You can completely bypass them. The way people handle cryptocurrency exchanges today is dynamically evolving. As the digital asset environment becomes more flexible, we will see an explosive growth of innovation happening at both the national and individual levels. Regardless of the current situation today, it may not be the same five years from now. There will be more freedom and privacy, and they will develop very good technologies that may spread to other parts of the world. Other countries will also make mistakes regarding KYC and scrutiny, rather than privacy.

KYC is not a Bitcoin issue; it is a question of nation-states and citizenship. If you find yourself in a particularly unfriendly country that deprives you of your privacy or economic freedom, then the answer is, of course, to either use technology from elsewhere, such as VPNs and firewalls, or to obtain citizenship from another country.

Bitcoin is global; it allows participants from every country to engage, and Layer 2, 3, and 4 technologies may be developed as quickly as possible around the world. Some things done in countries where you do not reside may be illegal or culturally unacceptable in your own country. As a Bitcoin holder, you may benefit from someone else in another place; if you own Bitcoin in Cuba or North Korea, although profitable, these actions may be illegal in certain locations.

Similarly, many technologies will flow from the United States into countries that do not allow them. And there will be technologies flowing from other countries into Europe, which may not be permitted. I believe this dynamic balance has no standard answer; the best answer will be protocols like the Bitcoin Lightning Network, which can provide you with the most sovereign-resistant and robust means of acquiring and circulating monetary assets.

So these are all gradual processes; everything is evolving. Do not be overly idealistic. The fact is that Bitcoin has now surged to a market cap of $2.3 trillion, and we are in a very good position. The best and brightest technologists around the world are starting to spend more money on programming and innovation, as well as on BTC Layer 2 and 3, to solve all existing problems. Bitcoin is a movement, a technology, and a protocol that offers us a hopeful path to solutions, better than any other protocol I currently know of.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。