Author: Yue Xiaoyu

With the listing of the compliant stablecoin leader Circle, a benchmark effect has emerged, prompting domestic attention towards stablecoins.

Various stablecoin payment conferences are emerging one after another, and companies are organizing learning sessions. Of course, discussions are also active within the cryptocurrency community, with scholars engaging in debates.

Amidst the excitement, who is actually making money?

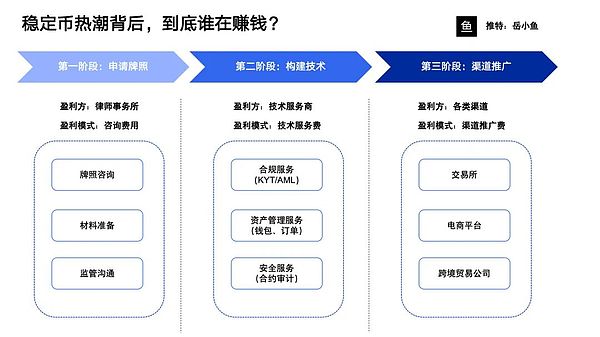

In fact, the development of stablecoins can be divided into three stages, each with different roles that can profit.

Stage One: Applying for Licenses.

Compliance comes first, and currently, everyone is applying for licenses in Hong Kong.

The biggest issue with Hong Kong's regulation is its strictness, with many requirements that many companies are unsure how to meet.

At this time, law firms have stepped in to provide legal consulting services to companies applying for licenses, helping them submit materials and communicate with regulators.

So, in this stage, law firms are the first to make money.

Stage Two: Building Technology.

Compliance and technology can proceed in parallel. Many companies are applying for licenses while simultaneously building their technical systems, so once the license is approved, they can immediately launch their stablecoin and seize the opportunity.

If they wait until the license is granted to start the project, they will miss the window of opportunity and be too late.

Creating stablecoin payments is quite complex, requiring compliance services, asset management services, token issuance services, liquidity management services, security services, and more.

This includes KYB, KYT, AML, order management, address management, clearing and settlement, deposits and withdrawals, contract auditing, on-chain security, etc.

However, traditional Web2 companies often lack relevant experience and talent in blockchain development, so they need to collaborate with Web3 technology service companies.

Therefore, in this stage, many crypto technology service providers also begin to attract clients and directly earn income.

Stage Three: Channel Promotion.

Once a license is obtained and technology is in place, business can be launched directly.

However, currently, the vast majority of companies are still in the first and second stages, with the third stage mostly in negotiation.

But once business is initiated, it will lead to a "battle of a hundred coins."

For stablecoins, liquidity is key.

Various stablecoins need to find their business scenarios and expand their usage scale.

Thus, channel promotion is very important, requiring partnerships with channels that have volume.

A typical example is Circle, whose USDC rapidly rose mainly due to the liquidity and brand endorsement provided by Coinbase.

This is a clear development path, and for stablecoin players in Hong Kong, they must bind various channels to seize the market.

In this stage of the battle of a hundred coins, the most profitable will naturally be various channels, including exchanges, e-commerce platforms, cross-border trade companies, and more.

After going through the above three stages, only the stablecoins that emerge can truly make money.

Ultimately, one stablecoin will emerge as the leader in the Hong Kong region or the Chinese-speaking area, squeezing out the space of other competitors and gaining the majority of market share through a siphoning effect.

Once a solid market share is established, the next step is to increase profitability, which is when stablecoin issuers start making money.

Referencing domestic battles in ride-hailing, shared bicycles, and food delivery, they all follow this path.

Initially, it is a chaotic battle, and the final players that emerge will take all the winnings. After a subsidy war, they will need to recuperate, reduce subsidies, and increase prices to achieve profitability.

At this point, profitability can be quite substantial, as stablecoin issuers rely on a large asset volume to generate profits.

In addition to various project parties, for ordinary users, the more direct benefit is that when new stablecoin forces grab market share and liquidity through subsidies, retail investors can also profit from it.

In summary, the stablecoin craze can be described as "the bigger the water, the bigger the fish," and one must seize their own piece of the pie.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。