The narrative of NFTs is always romantic, but the reality is often stark.

Written by: Deep Tide TechFlow

The long-forgotten NFT market is re-entering the public eye.

At 5 AM on July 21, a single address spent 2,082 ETH (worth $7.91 million) to purchase 45 CryptoPunks series NFTs, which seemed particularly abrupt in a market that has been quiet for a long time, lacking liquidity and new IPs.

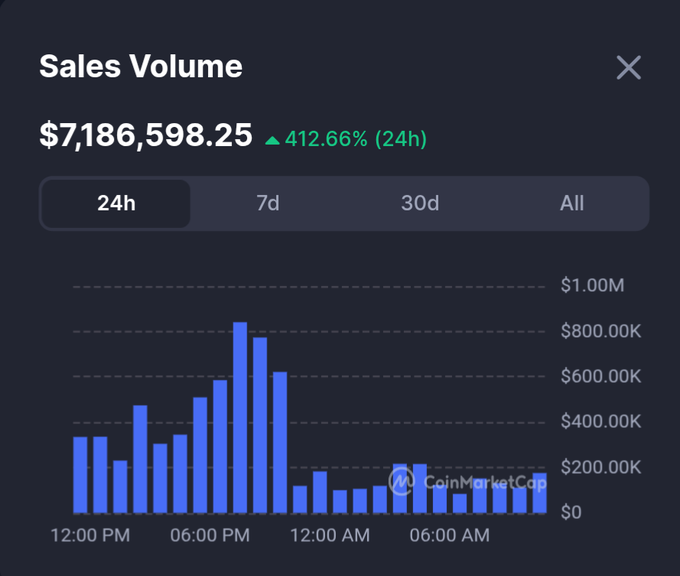

The market reacted swiftly to the news of the large purchase of CryptoPunks, with NFT market transaction volume surging by 412% in the past 24 hours. Over the past two weeks, the price of the NFT project Pudgy Penguins' token Pengu has risen by more than 157%.

The winds of the altcoin season have blown into the NFT market.

But is this phenomenon a precursor to the rekindling of NFT Summer, or a firm signal of a bull market?

NFT Market Heats Up Again

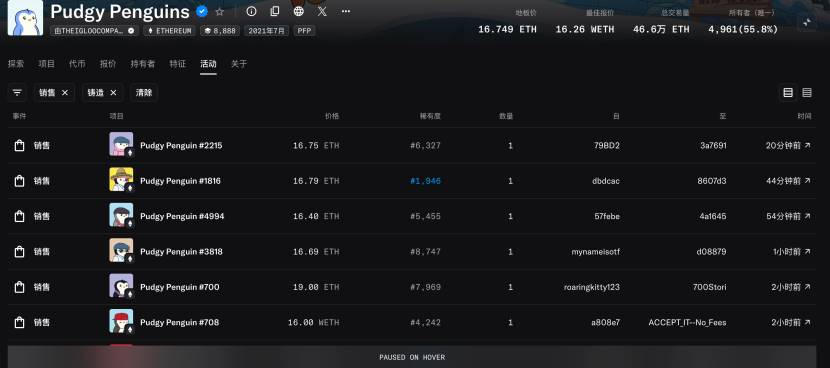

Not just CryptoPunks, the trading volume and floor prices of once blue-chip NFT projects have also seen significant increases in the past 24 hours.

As of 5 PM on July 21, the total market capitalization of the NFT market reached $6.68 billion, growing by 28.1% in 24 hours, with transaction volume increasing by 368.4% to $45 million. The data for major blue-chip NFT projects is as follows:

CryptoPunks floor price: 47.9 ETH (approximately $182,000), 24-hour increase: 16.9%, 24-hour transaction volume: 4,090 ETH (approximately $15.5 million).

Pudgy Penguins floor price: 16.75 ETH (approximately $63,600), 24-hour increase: 16.5%, 24-hour transaction volume: 1,698 ETH (approximately $6.43 million).

Bored Ape Yacht Club floor price: 13.24 ETH (approximately $50,300), 24-hour increase: 20.8%, 24-hour transaction volume: 934 ETH (approximately $3.53 million).

Moonbirds floor price: 1.94 ETH (approximately $7,372), 24-hour increase: 32.1%, 24-hour transaction volume: 528 ETH (approximately $2 million).

Azuki floor price: 2.43 ETH (approximately $9,234), 24-hour increase: 27.4%, 24-hour transaction volume: 367 ETH (approximately $1.39 million).

Although it is hard to believe, the NFT market has indeed warmed up. Both trading data and discussion heat are on a steep upward trend. While it is understandable that the rise in BTC and ETH is due to ongoing purchases by off-market funds, the resurgence of the NFT sector, which had long been considered "cold," has caught most people by surprise, sparking heated discussions in the market.

Sector Rotation or Temporary Peak?

With ETH's recent continuous rise, optimistic users explain the phenomenon of the NFT market returning to the public eye as "sector rotation":

Investors, after gaining unexpected returns on ETH and ETH ecosystem assets, have shifted their focus back to the NFT market, with blue-chip NFT projects naturally being more favored by investors.

A mainstream voice suggests that the market's rise has generated potential demand, while the identity of NFTs has shifted from crypto art to "utility tools." More and more developers are applying NFTs to asset issuance, DeFi, DAO governance, etc. The rise of NFTs will further drive ETH's continued popularity.

Countless investors who were previously trapped in the NFT market are also looking forward to the return of NFT Season.

In the market, besides those who believe the NFT market will heat up again, there are also many skeptical voices regarding the rise.

The main viewpoint of the pessimists is that the rise of the NFT market is taking on the identity of the "MEME frenzy" that typically occurs at the end of previous bull markets. In the past, whenever the bull market entered a phase where MEME assets generally surged, the market would transition from bull to bear.

Experience shows that the rise of the NFT market indicates that funds have begun to enter the "picking up trash" phase, also signaling an impending peak in the bull market, after which the market will enter a correction phase.

Regardless of whether the viewpoint is positive or negative, it is undeniable that the market generally believes that a series of actions seems to be brewing something, as if something "big" is about to happen.

When NFTs Become Strategic Reserve Assets Like BTC and ETH

Recently, more and more companies are listing cryptocurrencies as strategic reserve assets, and most companies that announce the establishment of cryptocurrency strategic reserves have seen their stock prices rise. This raises the question of whether NFTs could also appear on companies' strategic reserve lists.

On July 21, YugaLabs co-founder Greg Solano posted a tweet hinting that companies listing NFTs as strategic reserve assets are on the way.

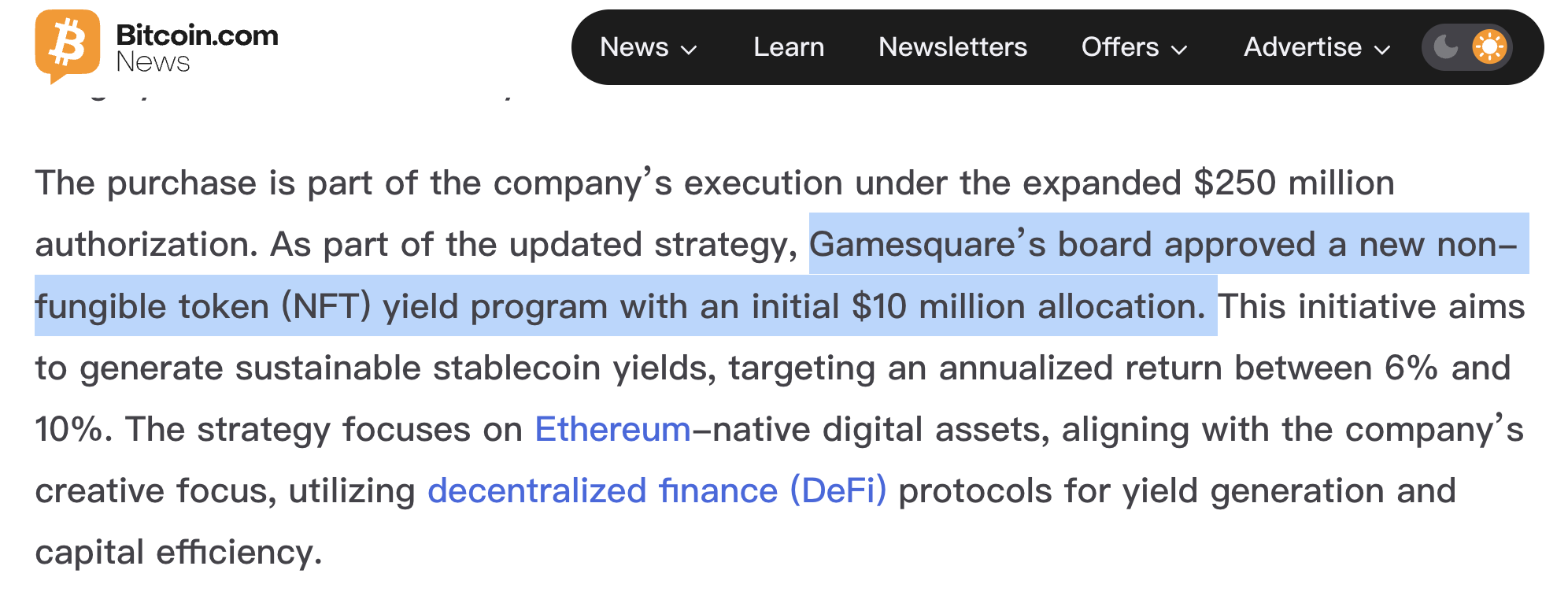

Today, the U.S. publicly traded company GameSquare Holding announced that it is increasing its cryptocurrency asset management fund from $100 million to $250 million and adding a new NFT yield strategy within the ETH ecosystem, with an initial allocation of $10 million and a target annual yield of 6%-10%.

The series of news seems to validate the possibility that "NFTs, like BTC and ETH, are becoming strategic reserve assets for companies." We may soon see more companies begin to include NFTs in their strategic plans, especially since they have all announced their entry into Web3; how could they not have attractive "Web3 business cards"?

Additionally, Ethereum officially launched the tenth-anniversary "The Torch" NFT on July 21, allowing users to mint a commemorative NFT on July 30. Whether this action can further fuel the current fire in the NFT market remains to be seen in the upcoming market trends.

Image source @Ethereum

The narrative of NFTs is always romantic, but the reality is often stark.

The warming of the NFT market is either a catalyst for further rises in the altcoin season or a sign that the market is about to enter a phase of correction; we cannot know for sure.

But it is undeniable that this sector, once thought to be dead by the public, has returned to the public eye, allowing countless "collectors" who were previously trapped to open their wallets again and reminisce about the past frenzy of "crypto art."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。