On July 21, according to an official announcement from BitGo and confirmation from multiple media outlets, this established cryptocurrency custody company has secretly submitted a draft registration statement for an IPO of Class A common stock to the U.S. Securities and Exchange Commission (SEC), planning to list on a major U.S. exchange. According to insiders, BitGo chose the confidential filing format to control the pace of information disclosure, avoiding valuation games or premature exposure of sensitive operational data during market volatility.

Once the IPO is realized, BitGo will become another publicly listed cryptocurrency company with "compliance services + institutional-grade custody" as its core capabilities, following Coinbase and Circle. With more and more cryptocurrency infrastructure accelerating its entry, what impact will BitGo's IPO have on this unique "bull market"?

The Capital Path of the Custody King

BitGo co-founder and CEO Mike Belshe is an early architect of the Chrome browser and one of the top 10 engineers on the Google Chrome team, having also participated in the design of the web security protocol SPDY. As a technology entrepreneur, he created the world's first multi-signature network wallet for Bitcoin, and after entering the cryptocurrency industry in 2013, he founded BitGo. His entrepreneurial logic believes that "compliance, security, and institutions" are the only directions for the long-term development of the industry.

BitGo is one of the earliest service providers to offer cryptocurrency custody, multi-signature security architecture, and on-chain settlement solutions for institutional investors. It has received investments from institutions such as Founders Fund, Galaxy Digital, Goldman Sachs, and Pantera Capital, a major player in this round of U.S. stock "ETH Microstrategy." Headquartered in Palo Alto, California, it has obtained digital asset custody and trust licenses in the U.S., Germany, Singapore, and other locations, with clients including over 1,500 mainstream platforms and funds such as Pantera Capital, Bitstamp, and Swan Bitcoin, making it the largest institution for Solana custody.

BitGo previously planned to be acquired by Galaxy Digital, but the deal was terminated in 2022 due to accounting issues. Subsequently, BitGo shifted to an independent development path, launching enhanced custody services, stablecoin settlement solutions, and planning to start CaaS (Crypto-as-a-Service) in the second half of 2024, expanding API-level custody and trading integration modules to provide cryptocurrency underlying access capabilities for TradFi institutions.

According to public information, as of the second quarter of 2025, the scale of cryptocurrency assets under BitGo's custody has exceeded $100 billion, making it one of the few companies globally with "fully compliant + full-chain custody" capabilities. In fact, Pantera also chose BitGo as one of the three custodians in its private fund's compliance custody arrangements, alongside Coinbase Custody and Silicon Valley Bank (SVB), to provide asset security for the fund. Additionally, BitGo's board and advisory team include many executives with traditional finance backgrounds. In recent years, the company has continued to strengthen cooperation with auditing firms, insurance companies, and bank custody departments, aiming to build a neutral infrastructure platform that serves both the crypto-native market and connects with traditional capital.

In multiple interviews with American Banker and others, Belshe has publicly opposed "speculation-driven cryptocurrency platforms," advocating for the promotion of the industry into mainstream financial markets with bank-level custody standards. BitGo's renewed independent listing plan is clearly aimed at seizing the valuation reconstruction opportunity of "compliant infrastructure" against the backdrop of stablecoin regulatory implementation and a shift in U.S. cryptocurrency policy.

The Intersection of Regulatory Clarity and Capital Revaluation, Infrastructure Companies Queuing for IPOs

From BitGo's IPO movements, it is positioned at the intersection of the current narratives of "regulatory clarity + capital revaluation." In June of this year, Circle, the issuer of the stablecoin USDC, successfully listed on the New York Stock Exchange, becoming the world's first stablecoin platform to go public. In July, the U.S. passed the "GENIUS Act," establishing a federal regulatory framework for stablecoins and granting licensed trust institutions and banks statutory custody status. As one of the earliest crypto companies to hold a New York trust license, BitGo has a regulatory advantage.

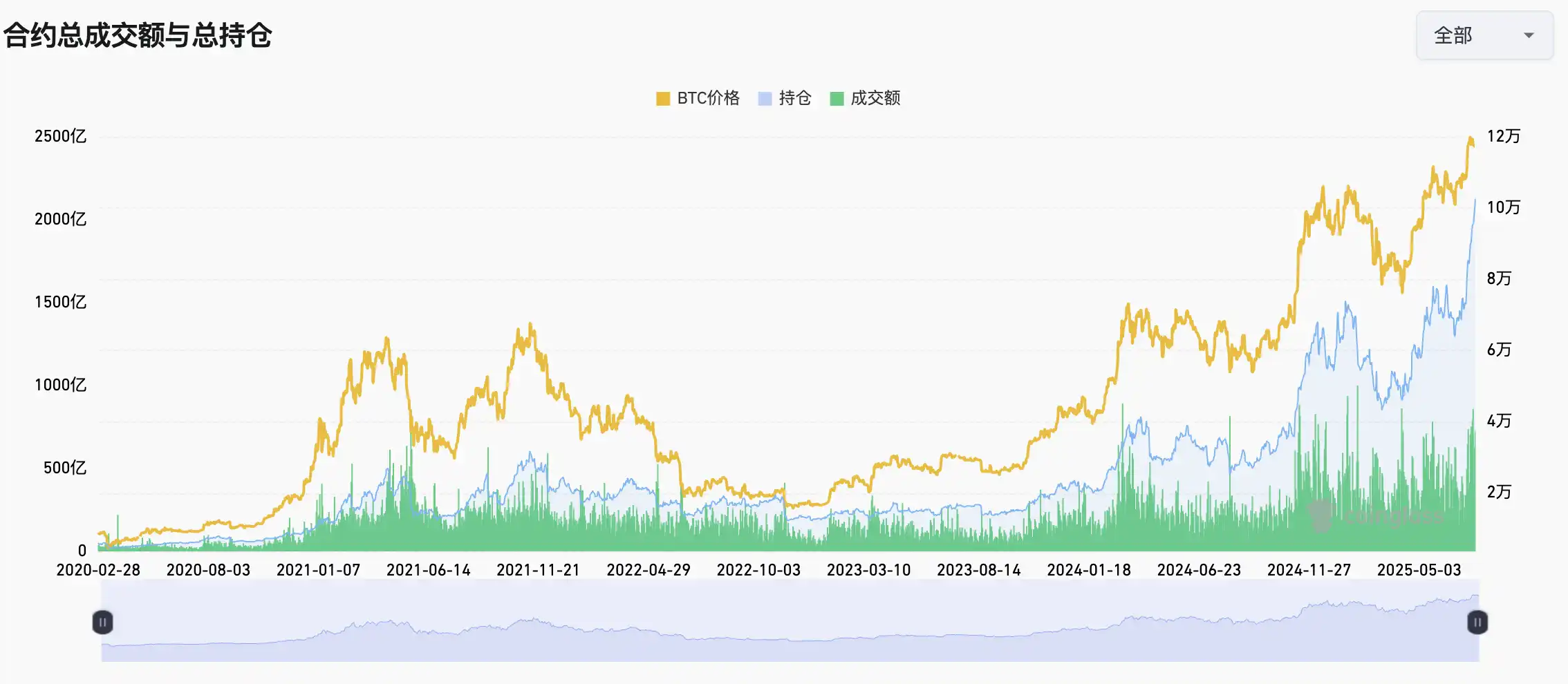

At the same time, former President Trump recently signed an executive order encouraging retirement accounts to allocate Bitcoin and stablecoins, further increasing the compliance demand for custody and insurance mechanisms. Bitcoin's price briefly surpassed $120,000 in July, driving a surge in trading platforms and on-chain trading and asset transfer volumes, which also rapidly increased the income of custodians.

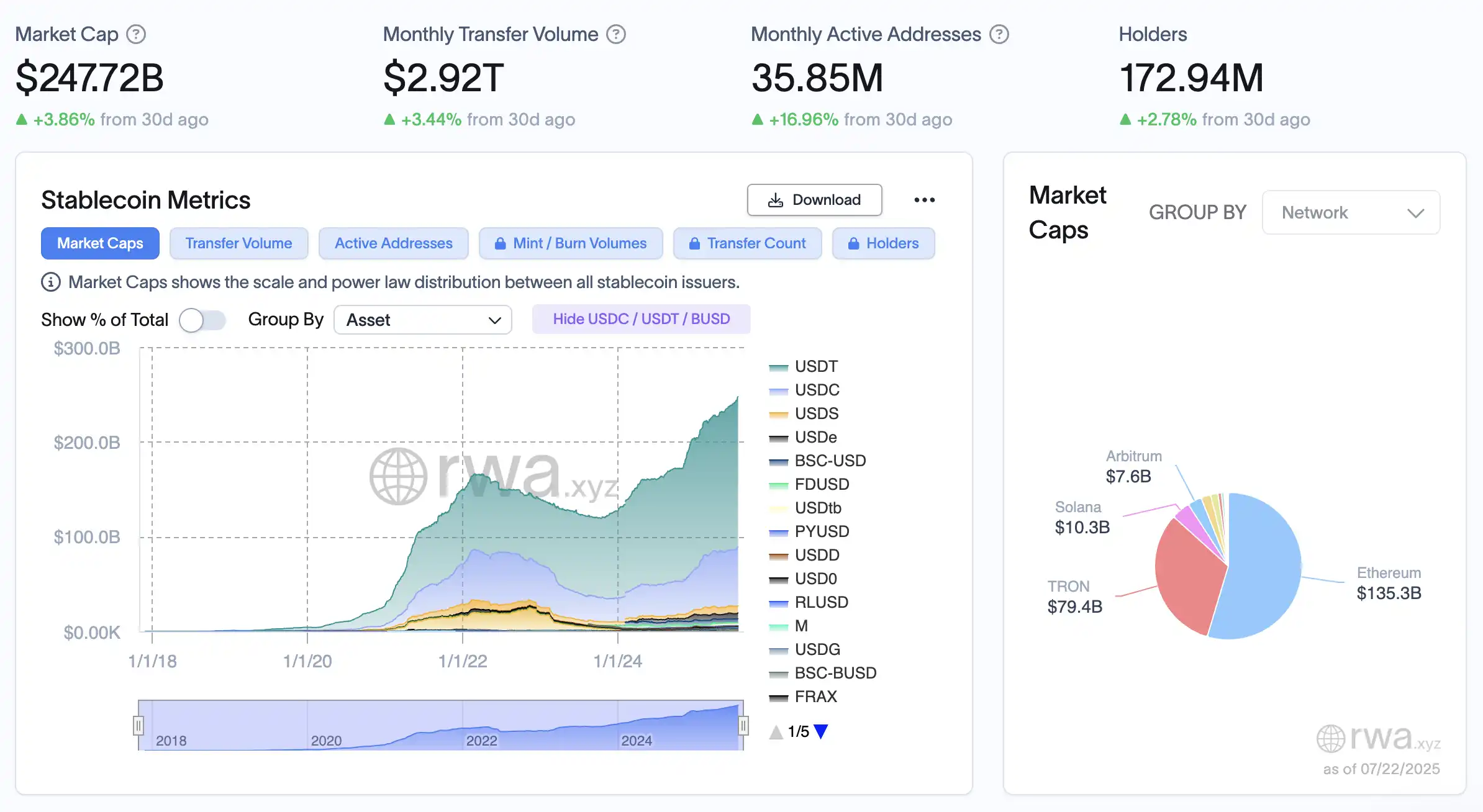

Meanwhile, the circulation of on-chain stablecoins continues to grow, especially after the passage of the Genius Act, which has been hitting new highs almost daily, driving a simultaneous increase in custody demand. This year, the total market capitalization of the entire cryptocurrency market has surpassed $4 trillion, with the total amount of stablecoins exceeding $240 billion. As one of the largest custodians, BitGo's listing can release valuation.

Circle and BitGo, representing "cryptocurrency infrastructure companies," possess greater stability. They focus on low-volatility, high-regulatory-requirement services such as custody, payment, clearing and settlement, and stablecoin issuance, making it easier to gain acceptance and valuation support from regulators, traditional investment banks, and retirement funds.

With the acceleration of trends in RWA, stablecoins, and the financialization of Bitcoin, the "underlying clearing logic" of on-chain value is gradually shifting to custody, auditing, and clearing modules. Projects like BitGo, Anchorage, and Fireblocks are also strengthening compliance pathways and insurance capabilities to adapt to the growing influx of institutional funds.

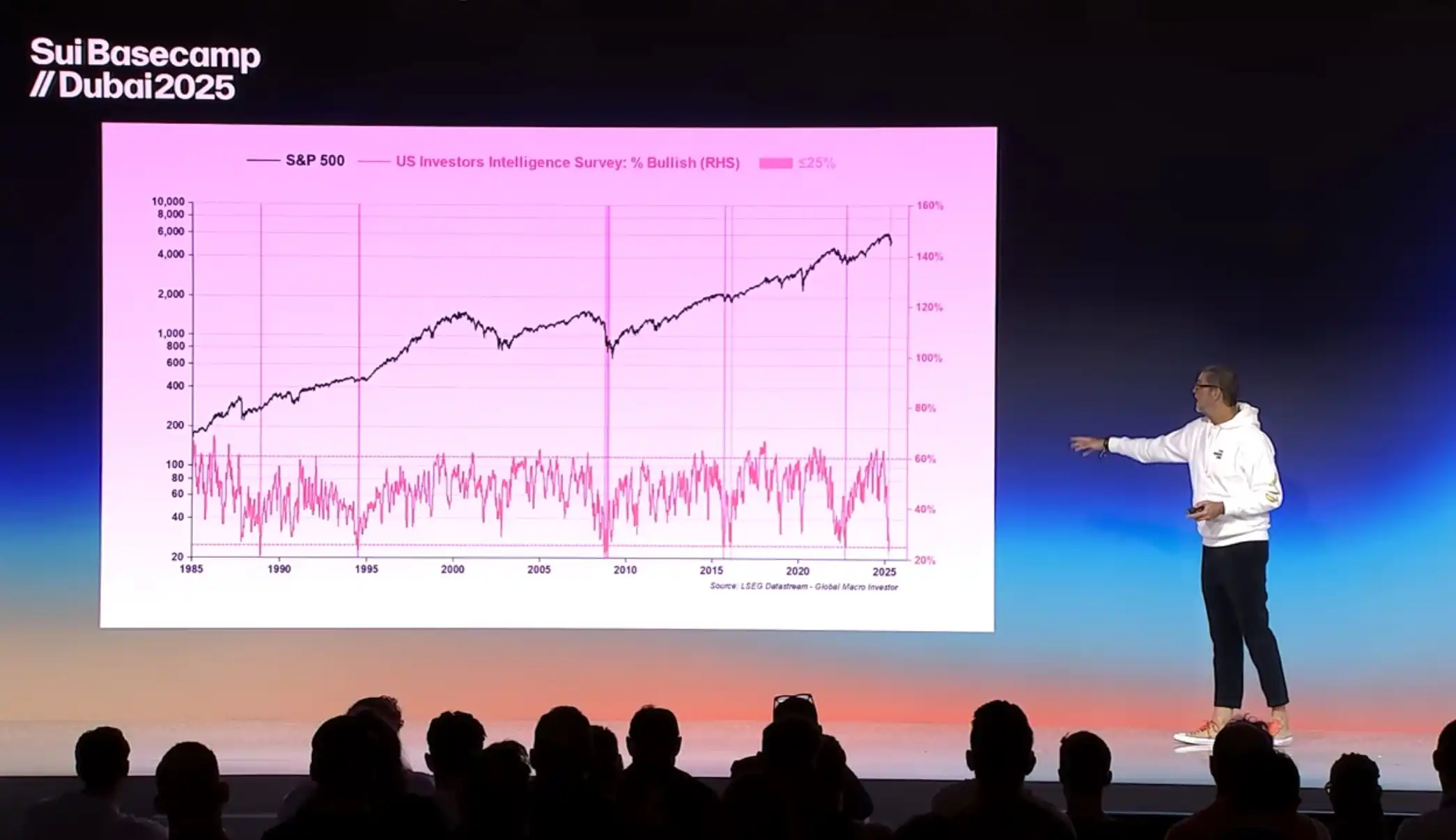

Market participants point out that if BitGo successfully goes public, it will join Circle and Coinbase to form a "compliance triangle," becoming the technical infrastructure for the mainstream financial system to access the cryptocurrency market. Raoul Pal, founder and CEO of Global Macro Investor, has frequently mentioned the concept of the "Banana zone" on social media, describing the steepest and most explosive upward phase in the cryptocurrency market cycle.

Just two months ago, the 2025 Sui Basecamp also cited multiple data points indicating that this cycle has arrived, while he emphasized that "crypto is not an asset, but a systemic reconstruction." The underlying significance of crypto is not just speculation, but the reshaping of the global financial architecture. The IPO of custodians and financial infrastructure like BitGo represents a trend of "fully compliant" and "lower funding risk," which may become one of the bridges for more institutional funds to enter this bull market.

More Important than "On-Chain" is "Underpinning"

As the market narrative gradually shifts from "Token is the new stock" to "Custody is the new infrastructure," BitGo's IPO may not only represent a valuation leap for the company itself but could also become a footnote for the entire industry entering the era of "compliant asset internet." If the IPO is successful, it will not just be a small step for the cryptocurrency market but a foundational bridge between Web3 and Wall Street.

We are all in the Banana Zone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。