Bitcoin ETFs See First Outflow in 12 Days As Ether ETFs Hit $19 Billion in Net Assets

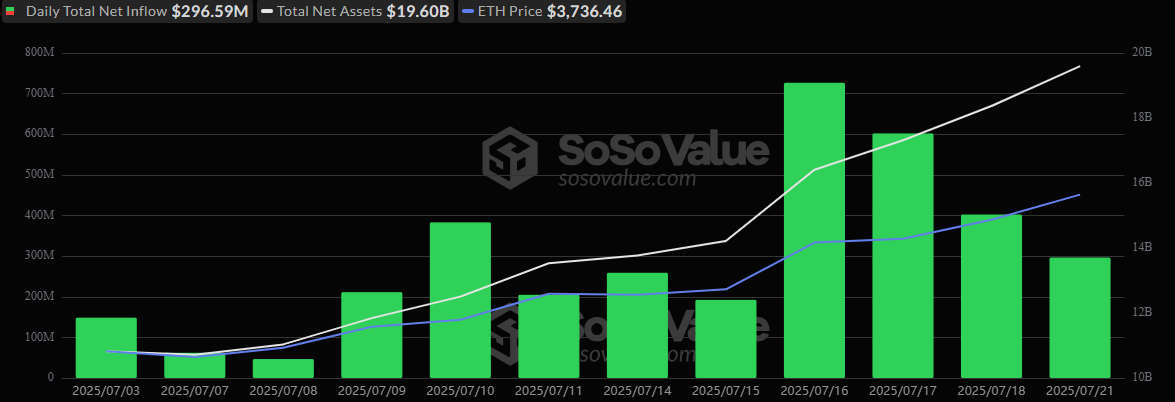

Ether ETFs delivered another commanding performance, locking in their 12th consecutive day of inflows with $296.59 million. The action was led by Fidelity’s FETH and Blackrock’s ETHA, which brought in $126.93 million and $101.98 million, respectively.

Grayscale’s Ether Mini Trust followed with a solid $54.90 million, while Bitwise’s ETHW added $13.15 million. A lone outflow of just $374K on 21Shares’ CETH was negligible in the broader green wave.

Trading volume in ether ETFs also hit a new daily record of $3.21 billion, and net assets surged to a fresh high of $19.60 billion, now representing 4.32% of ether’s market cap.

Ether Inflow Streak. Source: Sosovalue

In contrast, after nearly two weeks of steady green days, bitcoin ETFs stumbled, posting a $131.35 million net outflow, snapping a 12-day inflow streak. It was a rare red moment in what has otherwise been a remarkably bullish July.

The outflows were driven primarily by Ark 21shares’ ARKB, which bled $77.46 million, followed by Grayscale’s GBTC at $36.75 million and Fidelity’s FBTC at $12.75 million. Minor outflows also trickled out of Vaneck’s HODL and Bitwise’s BITB, down $2.48 million and $1.19 million, respectively.

Still, trading activity was healthy with $4.10 billion in value exchanged, and net assets remained strong at $151.60 billion, hinting this may just be a brief correction.

As ether ETFs continue to outpace their bitcoin counterparts, the market narrative may be tilting toward the biggest crypto altcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。