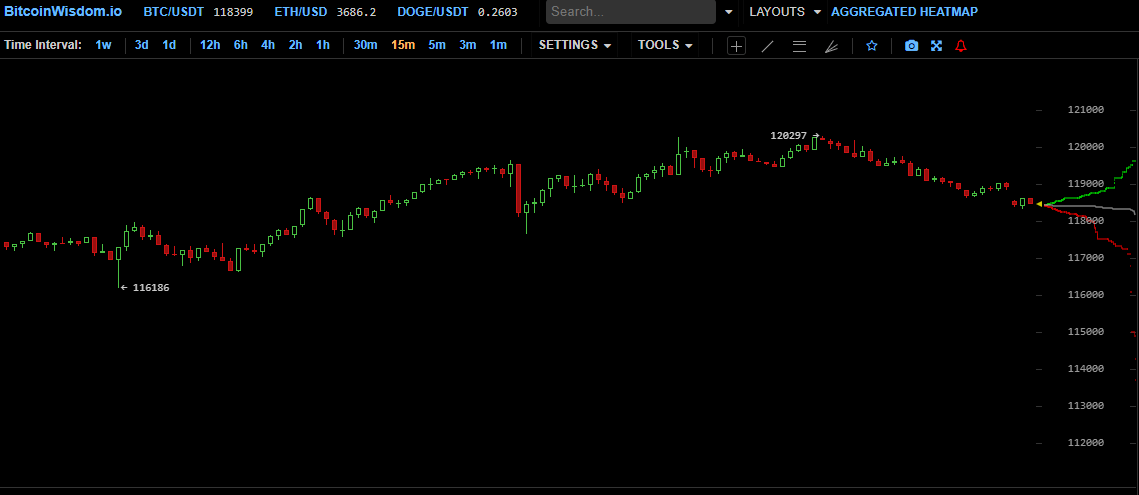

After a brief dip below the $116,200 mark, bitcoin ( BTC) staged a rally on July 22, breaching the critical $120,000 psychological barrier. This upward surge seemingly positions the top cryptocurrency to reclaim market initiative from a resurgent altcoin sector.

Market data tracked the ascent, showing BTC soaring to an intraday peak of $120,247 at 1:45 p.m. EST, before a minor consolidation saw it settle below the $120,000 threshold. Despite the slight retraction, some market analysts maintain a bullish outlook, asserting that prevailing macroeconomic signals continue to favor further upside. These underlying indicators suggest that bitcoin is well-poised to retest and potentially breach the formidable $123,000 resistance level, a key technical hurdle on its path to new highs.

James Toledano, chief operating officer (COO) at Unity Wallet, remarked on BTC’s apparent stability since July 14, noting that its consolidation around the $110,000 to $120,000 range hints at robustness. He attributes this to spot bitcoin exchange-traded fund (ETF) flows, institutional accumulation, and a “capital flight to a new decentralized home.”

However, Toledano cautions that BTC could still experience significant corrections before resuming its rally. “But, we must always be prepared for some sideways action or mild or even significant corrections as the market digests recent gains and waits for fresh catalysts,” the COO asserted.

His warning is echoed by Przemysław Kral, the CEO of Zondacrypto, who also sees room for BTC to rise by up to 30% from current levels.

“Following Bitcoin’s recent price surge, we are seeing a period of relative stability that is healthy for the market. It allows investors to digest gains, prevents speculative overheating, and can set a foundation for further, sustainable growth. This year, the price of Bitcoin could go down to $70,000 or up to $160,000. This will largely come down to the level of adoption in the second half of the year,” Kral stated.

Meanwhile, Kral also drew attention to a burgeoning “fevered interest” in various altcoins, particularly ethereum ( ETH), solana ( SOL), and XRP. Recent market data illustrates a significant surge across these altcoins over the past 10 days, capturing investor attention and driving considerable capital inflows.

Notably, XRP achieved a remarkable milestone by shattering a multi-year high last seen in 2018, underscoring renewed investor confidence and substantial price momentum for the asset following a period of legal uncertainty.

According to Kral, the digital asset regulations recently passed by the U.S. Congress have also “brought a new level of clarity on how they [crypto assets] can be used, setting up the scene for the long-term adoption of blockchain and utility tokens.”

Toledano also weighed in, stating that these altcoins have outperformed BTC because “they’re starting from a much lower market cap base, allowing for sharper price moves.” He added:

“Ethereum’s momentum has been driven by increasing institutional interest in ETH ETFs, scaling upgrades, and DeFi/NFT activity rebounding. While XRP’s rise is linked to renewed optimism following regulatory clarity, Ripple’s global banking expansion, and increasing optimism around XRP ETFs.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。