A sharp pullback across crypto markets on Tuesday triggered nearly $735 million in liquidations with bulls bearing the brunt.

Ether (ETH) and XRP tracked futures bets booked larger losses than bitcoin in an unusual move, indicative of the higher interest toward altcoin traders in the past week.

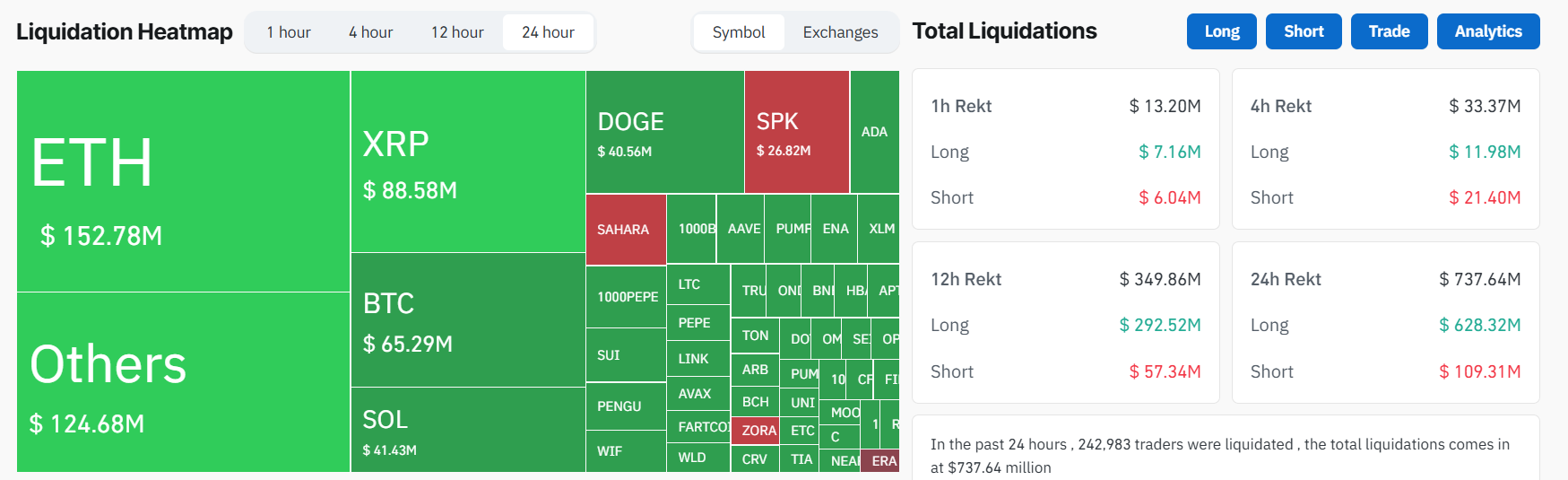

CoinGlass data shows ETH traders lost $152.78 million, the largest for any asset, followed by $88.58 million in liquidations for XRP. Bitcoin came in third at $65.29 million, despite its larger market cap and deeper liquidity.

While price action across the majors was mostly down by only a few percentage points, the high leverage used by retail traders in altcoins likely amplified their losses. In total, $625.5 million of the liquidations were on long positions, suggesting the selloff caught many bulls off guard after weeks of upward momentum.

Other heavily hit tokens included Solana’s SOL at $41 million, dogecoin (DOGE) at $40 million, and smaller DeFi tokens like SPK and PUMP seeing over $10 million in positions wiped.

The absence of a clear catalyst and profit-taking near key resistance levels may have exacerbated the selloff. Ether had recently flirted with the $4,000 mark while Bitcoin traded above $118,000 — levels that had already prompted profit booking from larger wallets.

As of writing, ETH is down roughly 3.6% on the day to trade near $3,540, while XRP fell 6% to $3.25, extending its weekly loss to over 12%. Bitcoin fared better, slipping just under 2% to hover around $116,800.

Crypto liquidations occur when leveraged positions are forcibly closed due to a price move beyond a trader’s margin threshold. This typically results in major losses and can trigger cascade effects during volatile moves.

Traders use liquidation data to gauge market sentiment and positioning. Large long liquidations often signal panic bottoms, while short liquidations may precede a squeeze.

Spikes in liquidations also help identify overcrowded trades and potential reversals. When paired with open interest and funding rate data, liquidation metrics can offer strategic entry or exit points, especially in overleveraged markets prone to sudden flushes or rallies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。