Surf should be one of the #AI applications in the #Web3 field that I have been using frequently lately. It not only pushes the hottest crypto news and investment opportunities related to public opinion monitoring every day. For example, the recently popular stablecoin veteran #ENA may become the second stablecoin shell company listed in the U.S. after #Circle, and this news was pushed by #Surf's public opinion heat early on.

Additionally, a major update is here, #Surf recently launched a web version, an #AI platform focused on aggregation and concentration in Web3, which has become my "research + operation all-in-one machine" during my recent on-chain Alpha explorations.

After testing it myself, I found the three most satisfying points:

✅ Research + execution done in one go

In the past, researching a project might take you 30 minutes to gather information and 15 minutes to build a spreadsheet, and you still wouldn't know if you were missing something.

Now I just need to ask Surf directly, for example:

“Is the ENA project worth participating in?”

“Is the task for this new project about to end?”

“I have a sum of idle stablecoin funds, how should I allocate them with low risk?”

Surf will automatically call on-chain data, project background, and community participation levels, providing a structured judgment within 30 seconds. It saves time, and the answers are backed by logic, not just "blind guesses."

✅ Identify Alpha in advance, not chasing trends, but seizing opportunities

Surf has a strong capability: it doesn't recommend projects based on popularity but actively scans on-chain and community raw data to discover new opportunities.

This is crucial!

For example, while others are chasing popular rankings, it can catch:

- Frequently active contract addresses on-chain

- Sudden new task activities

- Interaction data behind newly launched tokens that are opportunities invisible to the naked eye, which can tell you in advance where there might be "unexplored airdrop potential stocks."

✅ Operate as naturally as chatting, truly an AI assistant

You don't need to understand any on-chain data sources, contract interaction logic, or Tokenomics models. You just need to state your question in one sentence, and it can automatically check data, model, and summarize conclusions.

For example, I directly ask:

“Am I late to this project?”

“I have interacted three times, do I have investment qualifications?”

“Which task among the recent popular projects has a higher ROI?”

It provides me with a complete analysis, from on-chain interaction frequency, task activity levels, to airdrop rule summaries, all sorted out.

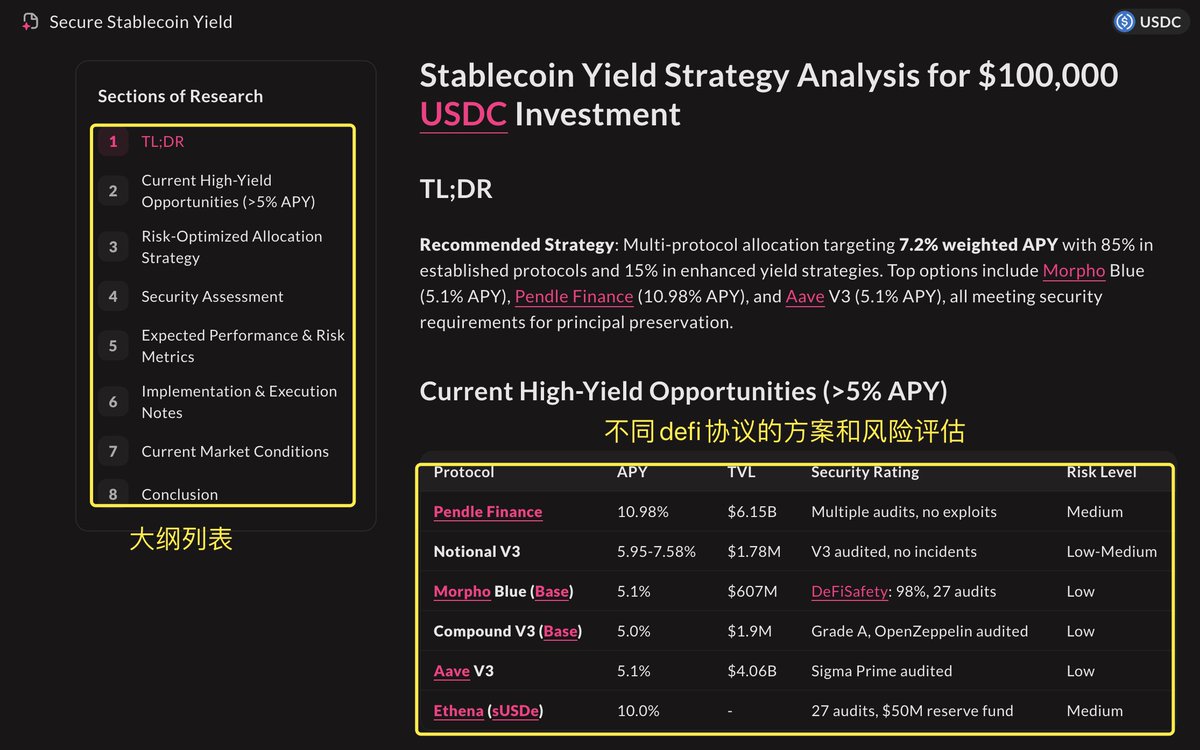

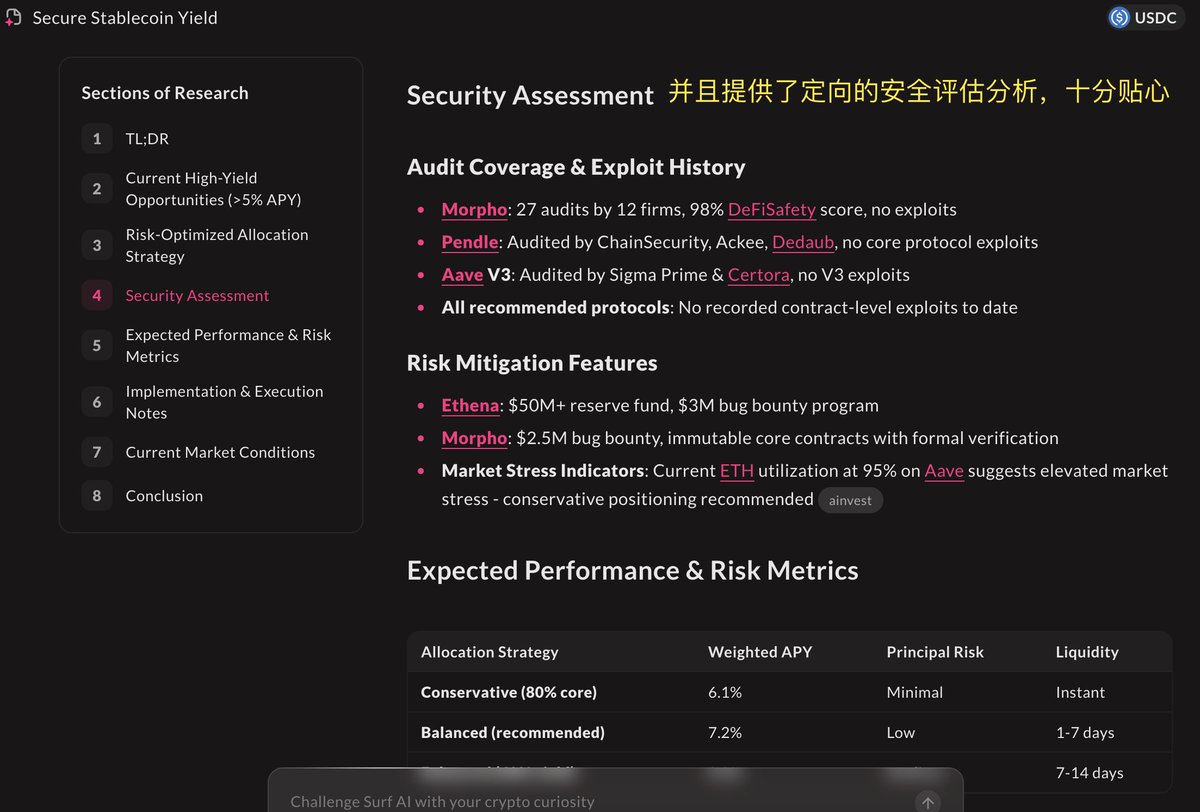

👇 Below is my actual usage case, asking: ‘I have $100,000 in USDC stablecoin, help me find a stablecoin financial protocol with an annual yield of over 5% and low risk. No principal loss is acceptable, and multiple DeFi protocols can be combined.’

Surf's proposed plan:

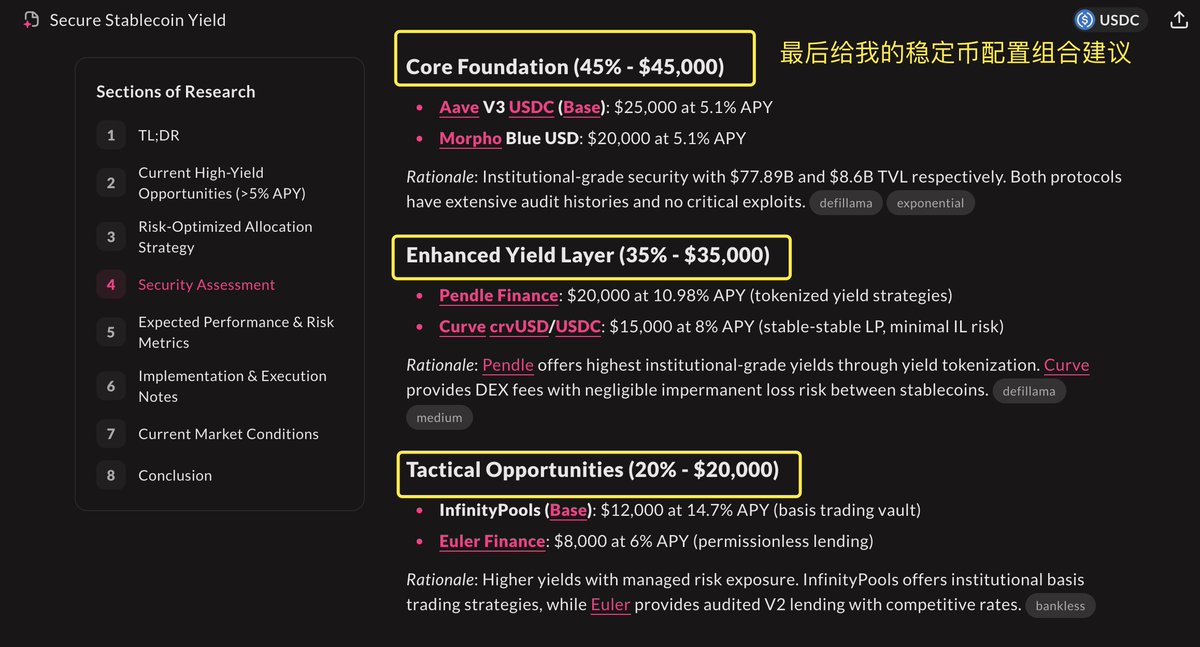

1️⃣ Core Fund (45% - $45,000)

@aave V3 USDC (base): $25,000, annual yield 5.1%

@MorphoLabs USD: $20,000, annual yield 5.1%

Reason: Institutional-level security, with $77.89B and $8.6B TVL respectively. Both protocols have extensive audit histories with no serious vulnerabilities.

2️⃣ Enhanced Yield Layer (35% - $35,000)

@pendle_fi: $20,000, annual yield 10.98% (tokenized yield strategy)

@CurveFinance crvUSD/USDC: $15,000, 8% APY (stable LP, minimal IL risk)

Reason: #Pendle offers the highest institutional-level yield through yield tokenization. #Curve provides negligible impermanent loss risk between stablecoins for DEX fees.

3️⃣ Tactical Opportunities (20% - $20,000)

@InfPools (base): $12,000, annual yield 14.7% (base trading treasury)

@eulerfinance: $8,000, annual yield 6% (permissionless lending)

Reason: Achieving higher yields by managing risk exposure. #InfinityPools offers institutional base trading strategies, while #Euler provides audited V2 loans at competitive rates.

Since I purchased the Pro version, the highest-tier Max version also supports direct on-chain account setup, making it completely foolproof and comfortable. 🧐

Overall, I have already made #Surf a part of my daily workflow. Opening #Surf every day to scan for new opportunities and check the progress of my projects is much more efficient than jumping around on a dozen platforms like I used to. Hurry up and start using it! 🎉

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。