I. Introduction

As the price of Bitcoin breaks through the new high of $120,000, the bull market "altcoin season" is brewing and heating up. The so-called altcoin season refers to a period of frenzy in the crypto market where non-Bitcoin assets (altcoins) collectively outperform Bitcoin. During this time, various altcoin prices soar, and investor sentiment is high. However, the background of this bull market is different from previous ones, such as persistently high global macro interest rates, a loosening regulatory environment for cryptocurrencies, institutional funds continuously entering through ETFs, companies increasingly laying out strategies for crypto asset reserves and treasury management, and the prevalence of meme coins, which give this round of altcoin market new characteristics.

This article will analyze the new trends and differences of the altcoin season in 2025 by reviewing the characteristics and patterns of altcoin sector rotation in previous bull markets, combined with the current macro market background and capital flow characteristics. It will also break down the phases and rhythm of altcoin rotation, assess the current position, and highlight sectors and potential assets worth paying attention to, providing ordinary investors with participation strategy suggestions during the altcoin season to help them remain rational amidst the market frenzy, seize opportunities, and avoid unnecessary risks.

II. Historical Review: Altcoin Season and Sector Rotation Patterns in Bull Markets

The concept of altcoin season truly entered the mainstream around 2017. In the early days of the crypto market, Bitcoin dominated, and other "altcoins" were relatively small. However, after Bitcoin climbed to $3,000 and then $10,000 in 2017, funds began to overflow from Bitcoin into Ethereum and various ICO tokens, triggering the first large-scale altcoin frenzy in history. The period from Q4 2017 to early 2018 is often regarded as the first typical "altcoin season," where investors were astonished to find that almost any token was skyrocketing. Several notable phenomena emerged in the market at that time:

Capital Rotation: After a period of significant gains in Bitcoin, it began to stagnate and consolidate, leading savvy investors to gradually take profits from BTC and seek higher-risk, higher-return targets, flowing into ETH, mainstream public chains, and large-cap altcoins, eventually even small-cap tokens and meme coins surged. During this process, Bitcoin's market cap share significantly declined—BTC's market share was as high as 80% in February 2017, but by January 2018, it had fallen below 32%. This rapid decline in BTC's share is often seen as an important sign of the start of altcoin season.

Price Performance: The overall increase in altcoins far exceeded that of Bitcoin. During the ICO boom in 2017, Bitcoin rose from under $1,000 at the beginning of the year to nearly $20,000 by the end of the year, an increase of about 20 times; meanwhile, Ethereum surged from around $10 to a peak of $1,400, an increase of over a hundred times, with some altcoins like XRP even achieving hundreds of times their initial value. According to CoinMarketCap statistics, during the altcoin season in early 2021, many large altcoins saw 90-day increases of several times or even tenfold, with over 75% of the top 50 altcoins outperforming Bitcoin. For example, from February to May 2021, the average increase of major altcoins reached 174%, while Bitcoin's increase was only 2%.

Sentiment and Trading Heat: The market was filled with FOMO sentiment, and there was a rush for any coin. Social media was flooded with discussions like "XX coin doubled again, did I buy too late?" Telegram groups and Discord channels were filled with people sharing screenshots of their wealth, and new investors rushed in. Experienced KOLs frequently made calls, centralized exchanges competed to list new coins, and it became common for small coins to double in price immediately after launch. The market sentiment index hovered in the extreme greed zone, with speculative fervor rising higher and higher.

Sector Rotation: Although it appeared that all coins were rising together at the peak of the frenzy, a closer observation revealed an internal rhythm of sector rotation. The hotspots in 2017 began with the ICO concept (driven by Ethereum's ERC20 token boom), followed by strong performances from platform coins/public chains (like EOS, NEO), interspersed with trends in privacy coins (such as Monero and Dash). By the 2021 bull market, sector rotation became even more pronounced: the DeFi boom in the summer of 2020 heralded the altcoin market, followed by the Layer 1 public chain battle (the rise of BSC ecosystem, Solana, etc.) and NFT frenzy at the beginning of 2021, then meme coins (Dogecoin DOGE, SHIB surged under Musk's influence) and the year-end metaverse/GameFi boom. Each sub-sector often led the charge for a period, then the momentum slowed, and market focus shifted to new themes. The overall duration of the altcoin season typically spans several months.

While the altcoin season has brought about astonishing wealth effects, it often signals the nearing end of the entire bull market cycle. Historical data shows that whenever altcoins experience a widespread surge and the public is intoxicated by the frenzy of "small coins multiplying tenfold," new funds are often close to depletion, and the market is in a state of extreme excitement yet fragility. Once the buying pressure fails to keep up, the bubble bursts rapidly. For example, after altcoins peaked in January 2018, their market cap halved within just a few weeks, and many investors were trapped at the top before they could exit. Similarly, the crash in May 2021 also proved that after the madness, risks surged. Altcoin seasons can occur in every bull market, but they are often accompanied by significant volatility and risks, requiring investors to seize opportunities while being vigilant about the arrival of market turning points.

III. Macroeconomic Background of the 2025 Altcoin Season: Characteristics of Capital Flow and Differences from the Past

In July 2025, the altcoin market showed a broad increase: CryptoBubbles data indicated that many mainstream altcoins had monthly increases ranging from 20% to 200%, creating a "green sea," signifying that capital was flowing from Bitcoin to a broader crypto asset market.

Source: https://cryptobubbles.net/

In this cycle, both the market environment and the altcoin market have undergone subtle changes. On one hand, after Bitcoin's fourth block reward halving (April 2024), the market entered a rising cycle as expected, but the macroeconomic environment is significantly different from previous bull markets: major global central banks experienced tightening from 2022 to 2023, and high-interest rate policies have not fully shifted to easing. In other words, the initiation of this crypto bull market did not occur under a backdrop of "abundant liquidity," but rather resembles a restructuring of existing capital and a market driven by future expectations. This is reflected in the new characteristics of capital inflow sources:

Stablecoins as the Main Incremental Capital Vehicle: The typical model of past altcoin seasons was that Bitcoin's surge led to a significant increase in the wealth of holders, with some profits converted into funds for buying altcoins. However, this time, funds are no longer primarily flowing into the altcoin market through selling BTC, but are directly injected via stablecoins. This means that both retail and institutional investors are more inclined to use stablecoins exchanged for fiat currency to directly purchase altcoins. This phenomenon reflects both the maturity of stablecoin infrastructure and indicates that a considerable proportion of new capital in this round is bypassing BTC to enter other tracks directly. Bitcoin is no longer the sole entry point for funds; stablecoins are taking on the role of a "reservoir."

Institutional Funds and ETF Effects: Another notable difference in this bull market is the increased participation of traditional institutions. With the approval of Bitcoin and Ethereum spot ETFs in early 2025, institutional funds have surged in, largely flowing from traditional stocks, gold, and other areas, primarily focusing on Bitcoin and mainstream assets, rather than chasing high-risk small coins. It can be said that the institutional bull market and retail bull market have somewhat diverged in this round: driven by ETFs, Bitcoin continuously attracts capital, which in turn creates a siphoning effect on altcoins. This contrasts with previous bull markets—where BTC's rise would lift ETH and altcoins together—this time, BTC has independently attracted market attention due to institutional entry.

Meme Coin Wave Diversion: If institutional funds prefer Bitcoin, then in the more fervent retail speculative arena, a different phenomenon has emerged this time: low-market-cap meme coins on-chain have siphoned off a large amount of speculative capital. The launch and rise of meme coin creation platforms like Pump.fun have provided a continuous stream of speculative themes for the market. These meme coins often lack fundamental support but attract a large number of followers due to the wealth myths of early participants. As a result, speculative funds that should have flowed to mainstream altcoin projects have been massively redirected to ultra-low-market-cap meme coins on-chain. Some early participants have seen their wealth multiply several times or even dozens of times within days, but for later entrants, most of these meme coins experience a subsequent 70% to 90% deep cut after surging, with liquidity quickly drying up, becoming traps that strangle retail wealth. This intense "internal capital consumption" was not as evident in previous altcoin seasons. It can be said that in this round of altcoin market, retail speculative enthusiasm has been partially diverted by the meme sector, leading to a dilution of funds for mainstream altcoins.

Narrative Explosion and Political Factors: Macroeconomic narratives and political events have also had a direct impact on the crypto market, a characteristic rarely seen in previous altcoin seasons. U.S. President Trump has actively promoted crypto-friendly policies, and the Trump organization has made a high-profile entry into the crypto space, establishing the World Liberty Financial platform and issuing the $WLFI token, promoting the inclusion of Bitcoin in the U.S. national strategic reserve, among other events, igniting the so-called "political narrative" sector and driving short-term surges in related tokens like MAGA and TRUMP. At the same time, signs of loosening in the U.S. policy and interest rate environment have further stimulated market imagination. The involvement of political forces has brought short-term hotspots while elevating crypto topics to a national strategic level, a situation not seen in previous bull markets. Additionally, "AI narratives," "Web3 social," and other tech trends have emerged in this round, developing in parallel and leading to a highly fragmented market focus.

Considering the above factors, it can be observed that the altcoin season in 2025 presents an ecosystem different from the past: capital no longer pushes all altcoins up simultaneously but rotates quickly between different sectors, with hotspots rising and falling. Each sector, based on its thematic strength and capital background, is experiencing its own "battle." The crypto market has seen the emergence of various "mini-booms" such as AI Agents, Social Finance (SocialFi), Political Finance (Politifi), SciFi (Scientific Finance), Ethereum Restaking, DePIN, RWA, etc. Each sector has attracted a brief influx of capital, only to quickly recede. In this rhythm, the traditional picture of "altcoins rising and falling together" is no longer evident; the "altcoin season" is no longer a period of simultaneous prosperity for all altcoins but resembles a series of narrative-driven rotation markets.

IV. Phases and Rhythm of Altcoin Rotation: Which Phase Are We Currently In?

Although the current altcoin market has evolved in its form of expression, the phase of capital rotation still exists. Combining historical patterns with the current market, the altcoin season often undergoes a rotation process from "large" to "small," which can be roughly divided into four phases:

- Phase 1 – Bitcoin Dominance (Altcoin Season Index: 0-25):

IV. Phases and Rhythm of Altcoin Rotation: Which Phase Are We Currently In?

In this phase, the entire market is driven by Bitcoin, with a significant influx of capital into BTC, pushing up both the price and market cap share of Bitcoin. At this time, the altcoin season index is usually at a low level (0-25 range), indicating that the market is clearly dominated by BTC, and while altcoins may rise with the market, they generally underperform BTC. This pattern is common in the early stages of a bull market or recovery. Since the beginning of 2025, Bitcoin has led the way for most of the time, with BTC.D reaching a multi-year high of over 65%. The investor sentiment during this phase is typically "hold and wait for appreciation, firmly grasping BTC as a core asset."

- Phase 2 – Ethereum and Large Altcoins Launch (Altcoin Season Index: 25-50):

Next, when Bitcoin's gains become excessive and it starts to consolidate or slow down, the market experiences a "capital overflow effect." Smart capital partially takes profits from BTC and flows into Ethereum and other large coins that follow closely. A typical signal is the rising ETH/BTC exchange rate, indicating that Ethereum is outperforming Bitcoin. The market begins to discuss the possibility of "Ethereum surpassing Bitcoin." Coupled with increased DApp activity on the Ethereum network, this creates additional positive sentiment for ETH. In the later stages of Phase 2, capital also begins to flow moderately into other high-market-cap altcoins, with some mainstream coins ranked in the top 20-30 (such as BNB, SOL, ADA, etc.) showing significant recovery trends. Current market characteristics indicate that we are in the later stages of this phase (Altcoin Season Index close to 50): Ethereum is performing better relative to Bitcoin, and market capital flows are becoming more diversified.

- Phase 3 – Comprehensive Rise of Large-Cap Altcoins (Altcoin Season Index: 50-75):

When Ethereum has already made significant gains and market risk appetite increases, capital further flows into other large-cap altcoins. In this phase, mainstream coins with large market caps (L1 public chains, platform coins, etc.) often show a synchronized rise, with considerable and sustained increases, and market sentiment is optimistic but not yet completely euphoric. The altcoin season index is in the mid-high range (50-75), indicating that more than half of mainstream altcoins are beginning to outperform Bitcoin. At this time, rational investors will gradually consider which coins have risen too much and should start to take some profits.

- Phase 4 – Small-Cap and Emotional Frenzy (Altcoin Season Index: 75+):

This is the peak of the altcoin season and also its conclusion. In this phase, regardless of the fundamental quality of the projects, almost all tokens of varying market caps are soaring, and the market is filled with extreme excitement and irrational sentiment. The altcoin season index is in a very high range (75-100), indicating that the vast majority of altcoins are comprehensively outperforming Bitcoin, and the market is in a state of irrational rise. Typical signs include: meme coins like Dogecoin experiencing rapid surges; media language filled with "frenzy" and "feast"; Bitcoin's market share dropping below 50% or even below 45%. However, this phase is often also the time of highest risk and greatest bubble. When the altcoin season index exceeds 75 and continues to rise, investors need to be highly vigilant and gradually reduce their positions to avoid risks.

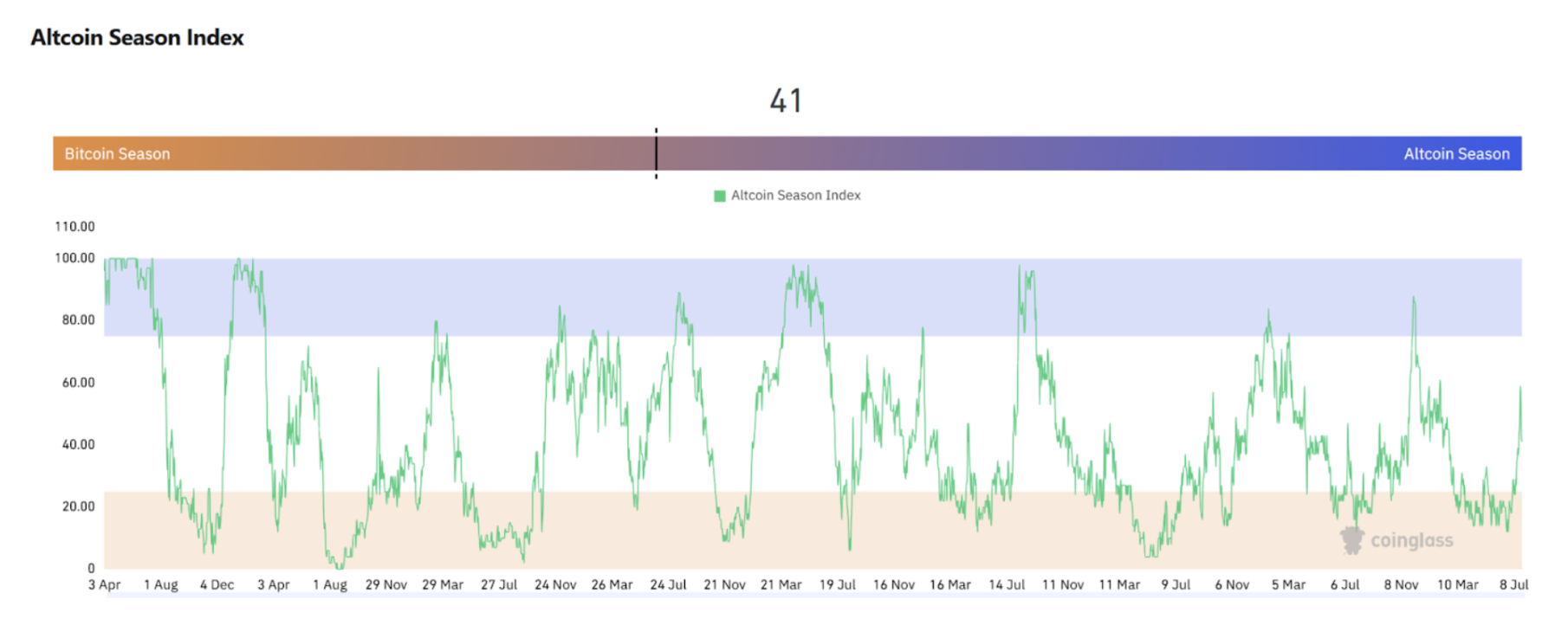

Source: https://www.coinglass.com/pro/i/alt-coin-season

The market characteristics since July 2025 indicate that the altcoin season has started but has not yet entered the most frenzied phase. Specifically, Bitcoin initially surged in the first half of the year and consolidated its market share at over 60%, completing Phase 1; recently, ETH has begun to consistently outperform BTC, indicating the start of Phase 2. Under Ethereum's leadership, large-cap altcoins (such as SOL, ADA) have also shown significant upward momentum, signaling a transition to Phase 3. However, a comprehensive small-cap frenzy (Phase 4) does not seem to have arrived yet: the current Altcoin Season Index is around 40-50, not reaching extreme values; Bitcoin's share has only dropped from a high of about 65% to just over 60%, without a cliff-like collapse. Some sentiment indicators, such as meme coin activity, have warmed up, but there is still a distance from true "frenzy." Therefore, the current phase roughly corresponds to the late stage of Phase 2 to the early stage of Phase 3, where large-cap altcoins dominate the rise and spread to mid- and small-cap coins.

V. Analysis of Current Sectors and Coins Worth Attention

Although this round of altcoin season exhibits characteristics of "fast sector rotation and less synchronized rise," this does not mean there are no investment opportunities. Correctly grasping hot sectors and quality coins remains key to obtaining excess returns. In a highly fragmented narrative market, investors need to have a discerning eye to distinguish which tracks are genuinely driven by capital and supported by fundamentals, and which are merely fleeting speculative hype. In this section, we will review several major sectors and related coins worth paying attention to, based on market trends and research institutions' perspectives.

RWA Sector: The RWA concept is one of the standout sectors in this round of market activity. Statistics show that RWA protocol tokens have achieved an average increase of over 15 times in this cycle, far exceeding most other sectors. The strength of the RWA sector lies in its narrative aligning with institutional needs—tokenizing real-world assets (such as bonds, notes, and real estate rights) on-chain is seen as a bridge connecting traditional financial markets and the crypto market. When focusing on the RWA sector, it is advisable to prioritize projects that have already achieved significant scale and have been tested during the bear market (such as ONDO, SKY), as they have advantages in institutional participation and risk control.

AI Sector: The AI concept is also extremely hot in the Web3 space. The intersection of AI and blockchain includes: using blockchain to ensure the credibility of AI data sources and model training, incentivizing AI computing power or data contributions through token mechanisms, and creating so-called autonomous AI agents (AI Agents) that execute tasks independently on-chain. The "AI Agent" craze that emerged earlier this year is a product of this idea. For the AI sector, investors should be cautious as many projects lack clear profit models and rely solely on hype. However, there are also some quality projects worth noting that have technical accumulation or partnerships with major companies. For example, Bittensor (TAO) aims to build a decentralized machine learning network based on blockchain. Fetch.ai, Ocean Protocol, and SingularityNET merged in July 2024 to form the Artificial Super Intelligence Alliance (ASI). According to the plan, the first phase will temporarily merge AGIX and OCEAN tokens into FET tokens, which will then be uniformly converted into ASI tokens. Virtuals Protocol (VIRTUAL) combines blockchain technology with AI, aiming to break through current limitations in AI agent deployment, monetization, and interaction.

DePIN Sector: DePIN (Decentralized Physical Infrastructure Network) refers to projects that use crypto incentives to build physical world infrastructure. For example, Helium builds a distributed IoT hotspot network through token incentives, Pollen Mobile attempts to establish a decentralized cellular network, and Filecoin uses blockchain to incentivize distributed storage. Institutional reports view DePIN as one of the important new themes for 2024, believing it has the potential to extend the incentive mechanisms of cryptocurrencies into the physical realm. DePIN projects attract industrial capital and cutting-edge technology players, so they often have independent market trends during bull markets. Helium created a hotspot in 2021, and recently, Filecoin's decentralized storage has also regained attention. If infrastructure tokens (such as FIL, HNT, etc.) have experienced prolonged stagnation and have solid fundamentals, then once market preferences shift from pure financial speculation to technological implementation, these tokens may see valuation recovery. Allocating to the DePIN sector is suitable for patient investors looking to hold long-term, but position sizes should be controlled due to the high technical and policy risks associated with such projects (involving spectrum resources, physical equipment deployment, etc.).

Layer 2 and Modular Blockchain Sector: Tokens in the Layer 2 space (such as ARB, OP) are expected to benefit from increased on-chain activity and user migration during the bull market, becoming one of the new "large-cap altcoins." For example, Robinhood announced the launch of tokenized stock trading and introduced a dedicated Layer 2 blockchain for RWA based on Arbitrum. Particularly noteworthy is the modular blockchain concept, such as the modular blockchain architecture proposed by Celestia, which separates the execution layer from the data layer to enhance network efficiency, heralded as a new paradigm in blockchain technology. Once the feasibility of such underlying technology is validated, related tokens (such as Celestia's TIA) have the potential to attract capital.

DeFi 2.0 and New Financial Native Sector: Although the DeFi sector appears much more subdued in this bull market compared to the DeFi boom of 2020, having experienced a significant decline and purging in 2022, the valuations of leading DeFi projects have plummeted. For instance, Uniswap, Aave, and Compound have seen their market caps drop by over 70% from their peak periods. If the overall market continues to warm up and a large amount of capital flows back into on-chain activities, these DeFi protocols with real revenue and user bases could very well undergo a value reassessment. After the Ethereum Shanghai upgrade opened staking withdrawals, the LSD and Restaking ecosystems have generated new yield strategies and protocols (such as EigenLayer and Pendle). When investing in the DeFi sector, several indicators can be monitored: the growth of protocol revenue and transaction fees, changes in total value locked (TVL), and dynamics of community governance and token buyback/burn activities.

Meme Coin Sector: Memes are an eternal topic in the crypto market, and various meme coins emerge like mushrooms after a rain during the late stages of a bull market. For example, this round has seen BONK, PENGU, USELESS, and others rise to fame, not to mention the "evergreen" coins like Doge, SHIB, and PEPE. Investing in meme coins is more akin to participating in a social psychology experiment—price fluctuations often depend entirely on market sentiment and narratives rather than any intrinsic value. As mentioned earlier, many on-chain meme coins have surged and then subsequently plummeted by 70-80%, validating their nature as a game of passing the parcel. If investors are interested in participating, they must be well-prepared for risks: small positions, strict profit-taking and stop-loss settings, treating meme coins as entertainment or seasoning, and avoiding an all-in approach, as this could lead to becoming the last one holding the bag.

VI. Participation Strategies for Ordinary Investors: Rationally Navigating the Altcoin Season

While the altcoin season can be exhilarating, for ordinary investors, maintaining calm amidst the frenzy and avoiding risks while seizing opportunities is key to long-term success. In this section, we provide suggestions for the general public on risk management, position control, and phased operations to help everyone participate in the altcoin season with ease.

1. Risk Awareness Prioritizes Profit Aspirations: As we enter the altcoin season, it is crucial to recognize that risk coexists with opportunity. History has repeatedly shown that altcoins often experience sharp volatility during their surges, with the largest gains frequently followed by the steepest declines. Therefore, mentally prepare for potential pullbacks of 30%, 50%, or even more. When you hear people around you discussing a coin that has increased tenfold, jumping in at that moment is likely to be close to the peak. Remind yourself: "The market always follows the 80/20 rule; while others become the 20% who profit, you may very well fall into the 80% of those left holding the bag." Only by constantly tightening the risk awareness string can you maintain clarity amidst the frenzy.

2. Position Control and Diversification: For highly volatile altcoins, position management is particularly important. Avoid going all-in on a single altcoin, regardless of how optimistic you are about a particular project; always guard against black swan events and sudden market reversals. A reasonable approach is to divide your investment funds into several parts: allocate a core position to relatively stable assets (such as BTC, ETH, or the top ten market cap coins) to ensure that even if altcoins experience a broad pullback, your portfolio retains some downside protection; a smaller portion of your capital can then be used to speculate on high-risk, high-reward small coins or hot topics. For example, you might set a limit of no more than 20%-30% of your total funds for altcoin season speculation, while keeping the rest in core assets or stablecoins. This way, even if your judgment is incorrect, your losses remain manageable. Additionally, within your altcoin positions, diversify across multiple sectors and coins to avoid putting all your eggs in one basket.

3. Go with the Flow, Pay Attention to Rhythm Shifts: Operations during the altcoin season should align with market rhythms rather than stubbornly resisting them. In phases 1-2 (when Bitcoin and ETH are leading), it may be wise to hold more BTC/ETH and avoid frequently switching coins, as strong performers tend to remain strong; hastily switching to weaker coins could result in missed gains. When entering phases 3-4, as many altcoins start to surge, you can gradually roll profits from BTC into strong altcoins, but be sure to closely monitor market trends. For instance, when you notice various small-cap coins skyrocketing and new investors flooding in, it may signal that the end is near, prompting you to consider reducing your risk exposure. At the same time, you can refer to some objective indicators to gauge the rhythm: the Altcoin Season Index is a useful tool; when it rises to a very high level (e.g., >75) and remains there, it is crucial to be highly alert to overheating in the altcoin market. Additionally, watch for Bitcoin's market share dropping below key levels (e.g., 50%) and any signs of irrational exuberance in media commentary.

4. Set Goals and Stop Losses, Execute Trading Plans: Discipline is especially important during the high-speed movements of the altcoin season. It is advisable to think about your selling conditions and plans before buying any altcoin. For example, you could set a series of rules for yourself: "If a coin rises by +50% or +100%, sell a portion in batches"; "If it drops more than -20%, cut losses to prevent deeper entrapment," and so on. Establishing and strictly adhering to these rules can help avoid emotional decision-making. This is particularly crucial for small coin investments, as a misstep in timing can lead to consecutive crashes. For profit-taking, consider a gradual exit strategy, selling portions at intervals during the rise rather than trying to wait for an absolute peak to sell everything at once—history has shown that it is nearly impossible to sell at the highest price. Gradually closing positions allows you to lock in some profits while letting the remaining holdings ride for a potential final surge, significantly reducing psychological pressure.

5. Stay Rational, Don't Be Driven by Greed and Fear: The altcoin season tests human greed and fear. When the coins you hold are hitting daily limits, it is easy to become overly confident, heavily invest, or even borrow money to leverage, but this often harbors the greatest risks; conversely, when the market crashes and despair reigns, it is easy to lose control and panic-sell, potentially at an irrational bottom. Therefore, investors must constantly remind themselves of discipline. If you feel unable to remain rational amidst high volatility, consider reducing your trading frequency or lowering your position size, or even opting to sit on the sidelines. As the old saying goes: "The market always has the next opportunity; first, ensure you stay in the game." Never let a moment of greed lead you to go all-in, and don't lose your judgment out of panic.

Conclusion

The altcoin season in the crypto market is both a stage for ordinary investors to achieve wealth leaps and a battleground where greed and fear intertwine. Looking back at past bull markets, we have witnessed the cyclical patterns of altcoin sector rotations and have seen countless legends and bubbles. Similarly, in this round of market activity in 2025, although the altcoin season shows more fragmentation and faster rotation dynamics, its core driving force remains: the human propensity for risk and the pursuit of new opportunities. For ordinary investors, embracing the opportunities of the altcoin season must be balanced with a respect for the market and an awareness of risk. Opportunities are always reserved for those who are prepared. We hope everyone can find joy in this grand altcoin season while also managing to exit unscathed.

About Us

Hotcoin Research, as the core research and investment hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global crypto asset investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering deep analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and around-the-clock monitoring of market fluctuations. Combined with our weekly live strategy sessions of "Hotcoin Selection" and daily news updates from "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries inherent risks. We strongly recommend that investors engage in investments only after fully understanding these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。