Author: pony

Recently, discussions on the regulation of virtual assets in Hong Kong have entered a critical phase. Given that many clients and friends are very concerned about the second round of consultations regarding virtual asset custody and OTC (VA Dealing) at the end of August, Aiying, based on communications with relevant departments and informed individuals, can share some of the latest news in advance: currently, all practitioners must prioritize two key pieces of information that will determine the future of their business:

Clear Timeline:

The formal introduction and implementation of the virtual asset custody legislation is expected to take about one and a half years. This is a clear preparation window, and companies need to plan ahead.

No Unified Transition Period Arrangement:

Unlike some previous regulations, this legislation is expected to not establish a unified statutory transition period. This means that the effective date of the legislation is when unlicensed entities must cease related operations. The only "safe passage" is to proactively communicate with the Securities and Futures Commission (SFC) before the legislation is introduced, seeking case-by-case transitional support to ensure a smooth continuation of business.

During this critical window, Aiying, as one of the bridges connecting the industry and regulators, is committed to assisting companies in formulating forward-looking strategies. This article will provide you with a strategic roadmap that combines depth and practicality, guiding you on how to plan your path in the new regulatory landscape and prepare for the implementation of the legislation in advance.

Part One: In-Depth Analysis of the Regulatory Framework: The "New Rules" of Virtual Asset Custody in Hong Kong

To participate in the virtual asset custody business in Hong Kong, one must first thoroughly understand its regulatory framework. This core regulatory blueprint delineates clear boundaries and entry thresholds for the market.

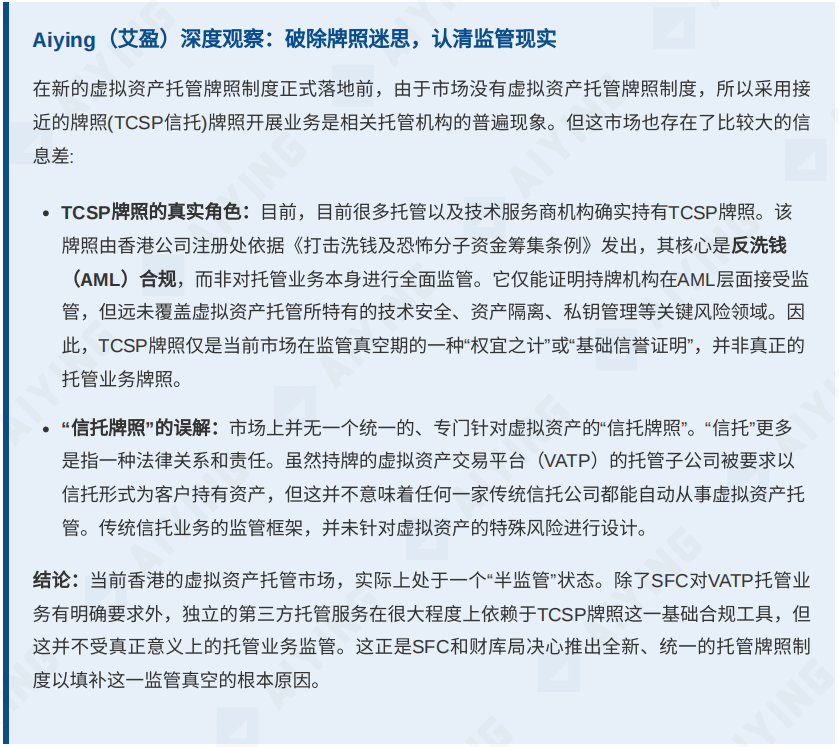

Clarifying the Current Situation: TCSP License, Trust License, and Regulatory Vacuum

1. License Scope: Who Needs to Apply for a Custody License?

According to paragraph 2.13 of the "Legislative Proposal," any entity that "holds virtual assets on behalf of clients" or "holds tools that can transfer clients' virtual assets (including but not limited to private keys)" will fall under the regulatory scope. This definition has significant "penetrative" characteristics, focusing on whether the entity has actual control over client assets.

Direct License Holders:

Independent third-party custodians, licensed virtual asset trading platforms (VATP) and their custody subsidiaries, fund managers who self-custody client private keys, and banks and their affiliates providing such services.

Possible Exemptions:

Mainly targeting "incidental exemptions." If a licensed entity (such as a broker) temporarily holds client virtual assets without accessing private keys during the course of providing its main business, it may be exempted. Additionally, licensed issuers that only custody their own issued stablecoins are also included.

2. License Threshold: Key Standards to Overcome for Application

The SFC has set strict entry standards for custody licenses, aiming to filter out "regular troops" with strong capabilities and high compliance awareness.

Financial Strength:

Applicants must meet high capital requirements, including a minimum paid-up capital of HKD 10 million and a minimum liquid capital of HKD 3 million. This not only proves financial stability but also tests the applicant's long-term commitment to operating.

Core Personnel:

At least two SFC-approved responsible officers (RO) must be appointed, and all executive directors must serve as ROs. ROs must take personal responsibility for the company's compliance status.

Fit and Proper Principle:

The SFC will conduct a comprehensive background check on the company and its major shareholders and executives, covering financial status, professional experience, reputation, and conduct.

Aiying's In-Depth Observation: Decoding the "Experience Fog" of RO Personnel

The experience requirements for ROs in the regulatory guidelines are principled and not quantified, which creates confusion for companies in hiring and appointing. Based on Aiying's long-term communication with regulatory agencies and analysis of past cases, we find that the SFC will conduct a penetrating assessment of whether candidates possess the comprehensive ability to manage specific business risks, rather than a single-dimensional experience. Key considerations include:

Compliance Gene in Traditional Finance:

Having custody, risk management, or compliance experience in traditional banks or financial institutions is seen as an important advantage.

Practical Experience in Virtual Assets:

Holding management positions in licensed virtual asset service providers (VASP) or having rich experience in virtual asset trading and operations.

Depth of Technical Understanding:

A solid understanding of core technologies (such as MPC, hot and cold wallet architecture, blockchain protocols) to assess technical risks.

Comprehensive Risk Management Ability:

The ability to clearly articulate and effectively manage the unique risks posed by virtual assets, including technical risks, operational risks, and market risks.

The Aiying team can assist companies in evaluating potential RO candidates and tailor resumes and interview strategies to effectively demonstrate their comprehensive capabilities to meet the SFC's implicit standards.

3. Cost of Violations: Strict Penalties and Regulatory Powers

The new regulations grant regulatory agencies strong enforcement powers, and violations will face severe penalties. For example, unlicensed operations can incur fines of up to HKD 5 million and imprisonment for seven years; fraudulent transactions can incur fines of up to HKD 10 million and imprisonment for ten years. This clearly indicates that compliance is the bottom line that all market participants cannot cross.

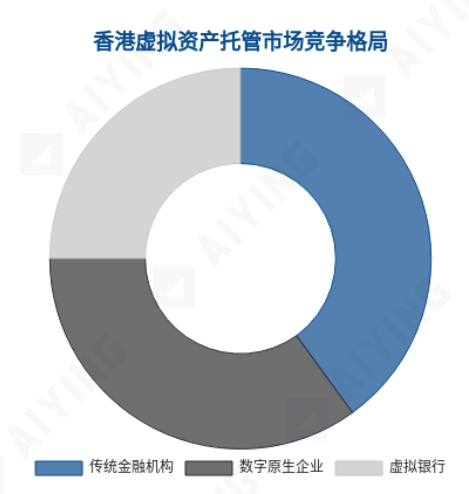

Part Two: Market Competition Landscape Analysis: The Game of Three Forces and the Future

With the clarification of the regulatory framework, the competitive landscape of the virtual asset custody market in Hong Kong is becoming increasingly clear, primarily driven by three forces, each shaping the market's future with different advantages.

The Hong Kong virtual asset custody market consists of three main forces: traditional finance, digital native enterprises, and virtual banks.

Traditional Financial Institutions (e.g., Standard Chartered Bank):

Their core advantages lie in strong brand reputation, substantial capital, and mature compliance and risk control systems. They primarily target risk-sensitive institutional investors, establishing trust barriers by providing "bank-grade" custody services. Their subsidiary Zodia Custody's layout in Hong Kong is a typical example.

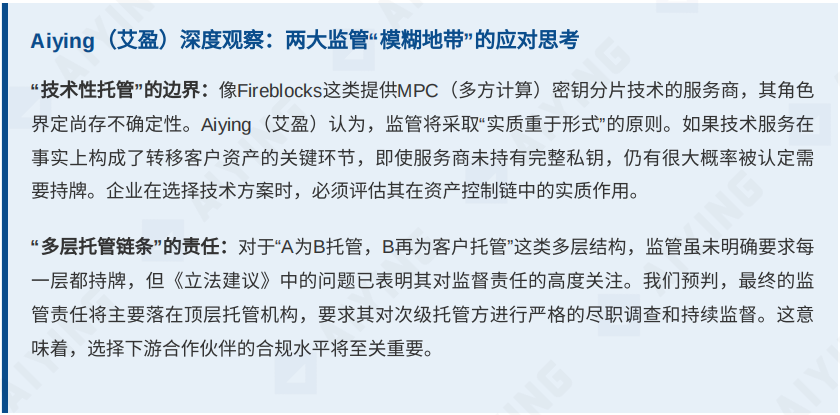

Digital Native Enterprises (e.g., Fireblocks, Bitgo):

Their core advantage is leading technological strength and deep industry understanding. They typically position themselves as technology infrastructure providers, offering underlying custody technology solutions for exchanges, funds, and even banks. Their strategic focus is to convert technological advantages into compliance advantages to meet Hong Kong's strict regulatory requirements.

Virtual Banks (e.g., ZhongAn Bank):

Their advantage lies in the compliance of having a banking license combined with the flexibility of a technology company, especially excelling in retail user experience and convenient fiat channels. They aim to provide one-stop virtual asset services for retail customers through partnerships with licensed exchanges, such as ZhongAn Bank's collaboration with HashKey, thereby achieving breakthroughs in the retail market.

In the future, the market's ultimate outcome will not be dominated by a single player but will be a diverse ecosystem of cooperation and competition. In the short term, "seizing licenses" will be the main theme; in the medium to long term, the market will differentiate, with different types of advantageous players dominating the institutional, technological, and retail markets, and cross-industry cooperation will become the norm.

Part Three: Corporate Compliance Strategy Guide: From Response to Leadership

In the face of a clear timeline and strict regulatory requirements, companies must develop comprehensive compliance strategies. Aiying suggests focusing on the following aspects to turn compliance challenges into development opportunities.

1. Strategic Planning: From Passive Compliance to Proactive Communication

Companies should first conduct a comprehensive gap analysis to assess the discrepancies between their existing business models, technical architectures, and internal controls against the new regulatory requirements. More importantly, they need to shift from passive waiting to proactive communication.

Aiying's Core Recommendation: Given that there will be no unified transition period after the legislation takes effect, passively waiting is akin to placing the business on the edge of a cliff. Companies must take the initiative during the upcoming one-and-a-half-year window to establish effective communication with the SFC and seek case-by-case transitional support for themselves.

This is precisely where Aiying will assist companies:

Accurate Interpretation of Regulatory Intent:

Transforming complex regulatory texts into clear business language and actionable items.

Building a Compliance Narrative:

Helping companies articulate their business models, technical architectures, and risk control measures clearly to regulators, demonstrating their compliance capabilities and long-term commitment.

Facilitating Effective Dialogue:

Leveraging our long-term communication experience with regulatory agencies to establish efficient and professional dialogue channels for companies, ensuring the quality and effectiveness of communication, and laying a solid foundation for seeking transitional support.

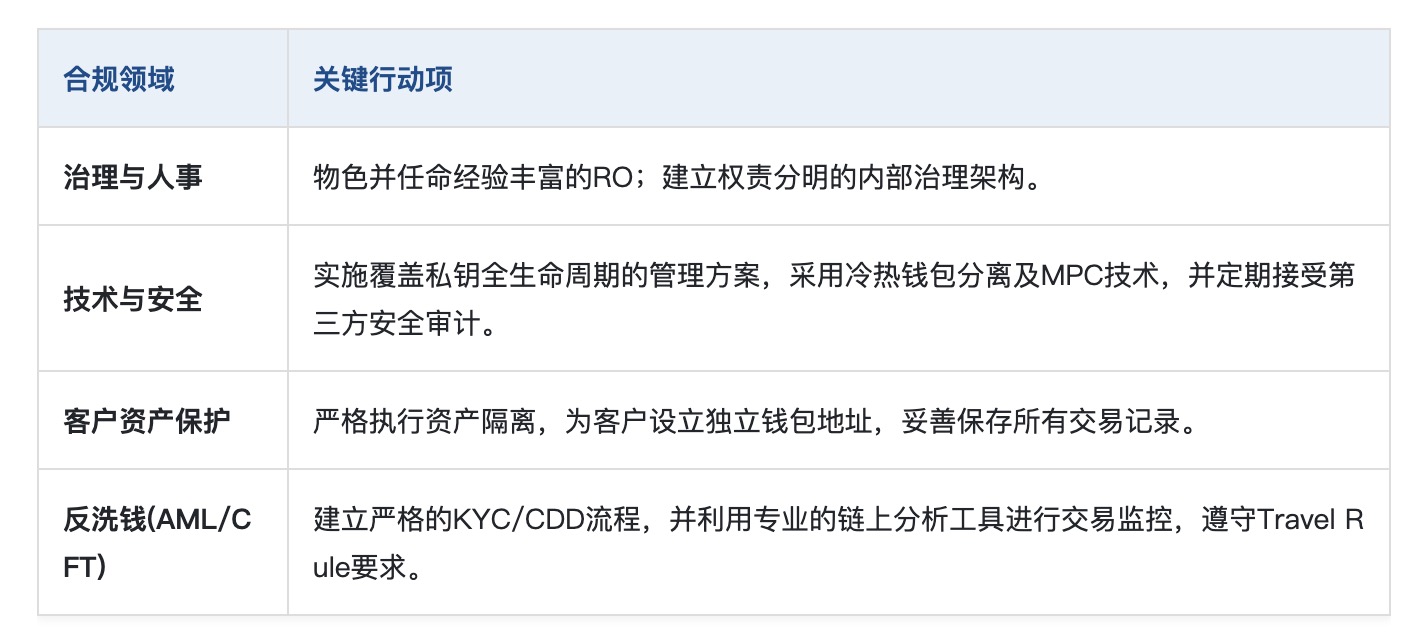

2. System Construction: Building a Robust Internal Compliance and Risk Control Framework

A sound internal system is the cornerstone for obtaining and maintaining a license. Companies should focus on building in the following areas:

3. Implementation: Technology Selection and Group Management

At the execution level, companies need to pay attention to the selection of technology partners and internal compliance management within the group. When choosing technology service providers, priority should be given to their depth of understanding of Hong Kong regulations and technical support capabilities. For group companies, unified group compliance standards must be established, and the responsibilities of each legal entity should be clarified through service level agreements (SLA) to ensure that all key operational personnel meet the SFC's regulatory requirements.

Conclusion: Embracing Regulation, Welcoming New Opportunities

The regulatory framework established by Hong Kong for virtual asset custody businesses, while presenting challenges, more importantly creates unprecedented certainty and opportunities. By introducing "trust" as a core element, it paves the way for institutional capital to enter the market and lays a solid foundation for the healthy development of the entire virtual asset ecosystem (including spot ETFs, RWA tokenization, etc.). Aiying will continue to work alongside industry peers, leveraging professional insights and rich experience to jointly embrace a broader future for virtual asset custody businesses in Hong Kong. In the next issue, we will interpret the latest developments and "intelligence" regarding the Hong Kong OTC legislation, so stay tuned!

Reference Materials

Legislative Proposal Report on Regulating Virtual Asset Custody Services: https://sc.sfc.hk/TuniS/apps.sfc.hk/edistributionWeb/gateway/TC/consultation/doc?refNo=25CP7

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。