Original Title: "Interpreting Solana's Latest Roadmap: How to Build an Internet Financial Market"

Original Author: 0xTodd, Partner at Nothing Research

Yesterday, Solana announced a new roadmap.

Essentially, as improvements across various chains have entered a deep phase, there has indeed been some jargon piling up. I will try to interpret Solana's new roadmap in a way that everyone can understand, along with my own analysis.

First of all, Solana underwent a significant narrative shift in 2024, with Solana's goal now becoming to establish an "Internet Capital Market," whereas previously, Solana aimed to build a high-performance blockchain.

The Internet Capital Market, as the name suggests, aims to create a borderless, round-the-clock financial market where various assets—such as stocks, bonds, currencies, and real-world assets (RWA)—are tokenized and traded seamlessly on-chain.

This concept serves as an overarching program, and to achieve this program, task breakdown is necessary.

This time, the Solana roadmap, specifically the technical department's roadmap, aims to help realize the concept of the "Internet Capital Market," so you won't see efforts from Solana's business or compliance sectors.

You can think of it as the technical roadmap of Solana's technical department.

Image Source: https://www.anza.xyz/blog/the-internet-capital-markets-roadmap

The Solana technical department is not just the core developers of Solana Labs; there are several important roles, such as:

Anza, a big brother level. This is a low-profile Solana development company founded by former Solana Labs team members. I personally think its role is similar to that of ConsenSys/Ethereum or Blockstream/Bitcoin.

Jito, a second brother level. This is Solana's version of Lido, but it has more power than Lido because Jito controls almost all MEV (Miner Extractable Value) on Solana.

Multicoin, at least a third brother level. Although it is a capital entity, it holds a significant amount of SOL and projects within the SOL ecosystem, so it definitely has a say in the technical field.

DoubleZero, a younger brother level, focused on speeding up network performance.

Drift, also a younger brother level, which is a perpetual contract but also participates in some functional development for Solana.

The official Solana Labs, along with these three major players and two minor ones, form a six-person team for this roadmap, effectively acting as the true Solana Technical Reform Committee.

Next, let's take a look at what efforts the Solana technical department needs to make to achieve the "Internet Capital Market."

The Internet Capital Market is a slogan-like concept because it doesn't specify how to achieve it.

Therefore, to facilitate developers in "working towards a common goal," the technical department translated the entire slogan into technical language, which is "Application-Controlled Execution (ACE)."

This is where it starts to get complicated. What exactly is this awkwardly named Application-Controlled Execution (ACE)?

Solana believes that an internet financial market (especially one on par with Web2) must meet one condition: financial applications must have [millisecond-level control over their own transaction ordering].

Note: It requires both ordering rights and millisecond-level control.

Thus, to achieve Application-Controlled Execution (ACE), Solana's technology still lacks many components. To find out what is lacking, please refer to the roadmap:

· Short-term goals (1-3 months): Make the order book more user-friendly, suppress malicious MEV traps, and reduce transaction latency.

· Mid-term goals (3-9 months): Reduce latency through dedicated fiber optic networks; significantly overhaul Solana's consensus algorithm to greatly shorten transaction finality time; reduce transaction latency.

· Long-term goals (9-30 months): Transition Solana's consensus algorithm from a single leader to multiple leaders to increase the system's resilience to extreme risks and censorship, providing applications with greater ordering rights.

Next, let's discuss how the short, mid, and long-term goals will be achieved.

Short-term goals (1-3 months): Make the order book more user-friendly, suppress malicious MEV traps, and reduce transaction latency.

The responsible parties are Jito and Anza.

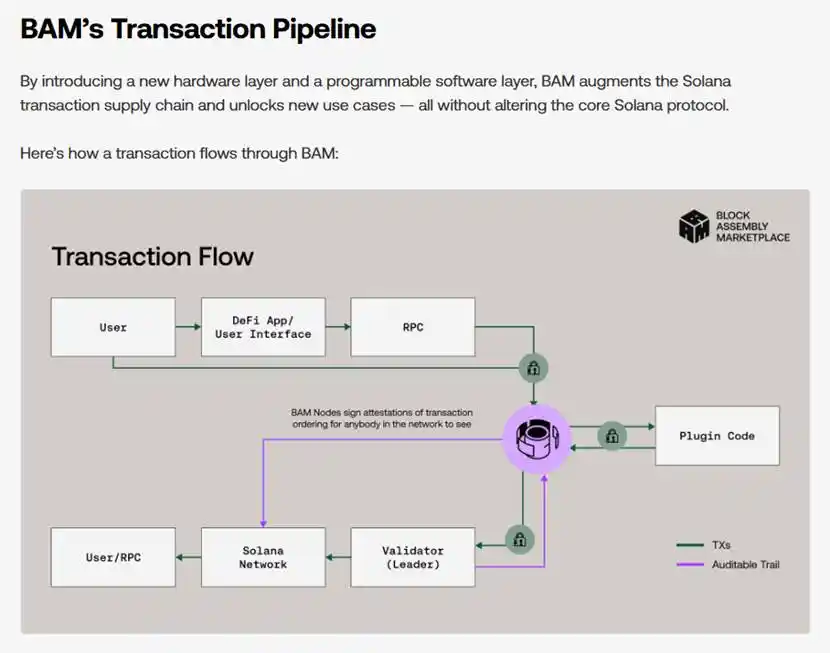

First, regarding the order book, Solana is very fond of it. I remember during the SBF era, Solana wanted to promote an order book model DEX. Today, Jito and Drift are developing a tool called BAM, which is a new way to construct trades; specific details will not be elaborated here.

Image Source: bam.dev

However, you just need to know that through this method, the order book can operate more smoothly without relying on traditional DEX models like Uniswap, and in the future, it can produce an order book comparable to CEX. After all, if a chain doesn't have an order book, how can it be considered an internet financial market?

Suppressing malicious MEV traps is also part of Jito's routine. Of course, this is also part of further strengthening Jito's power; all blocks must go through Jito and the entire BAM to be constructed, akin to the cabinet of the Ming Dynasty.

Anza contributed a new TPU client to reduce transaction sending latency.

Mid-term goals (3-9 months): Reduce latency through dedicated fiber optic networks; significantly overhaul Solana's consensus algorithm to greatly shorten transaction finality time; reduce transaction latency.

The responsible parties are: DoubleZero and Anza.

As everyone knows, the main cause of Solana node lag is insufficient bandwidth. The previously mentioned younger brother project, DoubleZero, aims to establish a dedicated fiber optic network to significantly increase the bandwidth available to ordinary Solana validators.

Of course, there are other protocols like Optimum also focusing on bandwidth issues. However, DoubleZero essentially sells hardware, while Optimum sells better algorithms.

Additionally, the issue of Solana's consensus algorithm should be highlighted, but due to space limitations, I will keep it brief.

Solana's consensus algorithm, as is well known, is Proof of History (PoH) + Tower BFT.

The essence of this consensus is to first create an internal clock through historical proof, and then select a leader each time based on time. The leader is responsible for block production, while other nodes are only responsible for voting, which is known as a single-leader system.

The advantage of a single leader is speed, while the disadvantage is singularity, which is why Solana has experienced several outages.

I believe everyone who has worked in a company knows the difference in efficiency between having one leader and having a group of leaders, so I won't elaborate further.

Of course, Solana believes that the main contradiction of the single-leader system now is that the final confirmation time is not fast enough.

Currently, Solana's final confirmation takes 12.8 seconds, while its competitors, such as Sui, only take 0.5 seconds.

The so-called final confirmation has been discussed many times before. Before final confirmation, a blockchain theoretically has the possibility of rollback; after final confirmation, even the king cannot change a single bit, which is the essence of blockchain immutability.

A more intuitive example is the time you wait for several blocks to be credited when depositing on an exchange; that is a precaution taken by the exchange to prevent blockchain rollbacks.

Although in 99.9% of cases, a blockchain will not fail due to insufficient final confirmation time, there have indeed been historical cases where someone used ETC or BTC fork coins to scam exchanges.

However, remember that Solana aims to create an Internet Capital Market—financial markets have very high requirements for finality, leaving no room for error, so 12.8 seconds is not enough. Thus, Solana is determined to develop a new consensus mechanism.

It is important to note that the consensus mechanism is the foundation of a blockchain's existence; it is its soul. The responsibility for this development has been entrusted to Anza, which is why I refer to Anza as the big brother of Solana's technical department.

Although Anza is an external member, he is definitely part of the regular army.

Image Source: danbaileyphoto

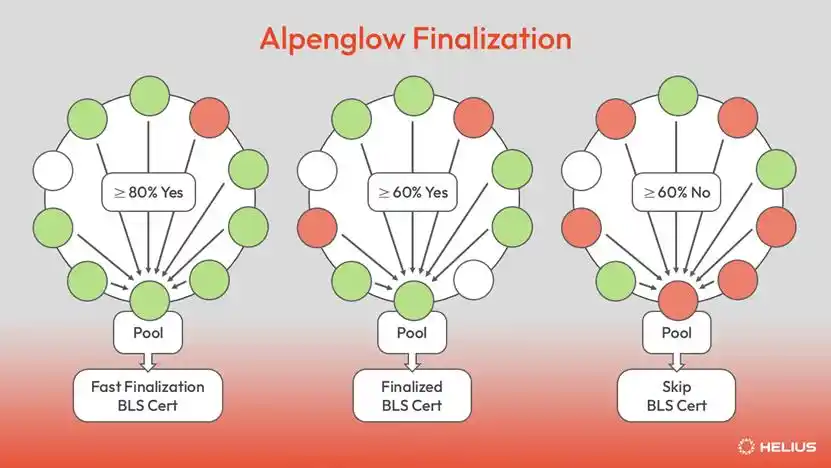

Solana's new consensus mechanism is called Alpenglow, meaning "the glow of the Alps," symbolizing the protocol's Swiss origins.

This Alpine consensus mechanism can be summarized in three characteristics:

(1) Final confirmation reduced to 150 milliseconds (three times faster than competitors)

(2) No more voting (off-chain signatures, saving costs for small nodes)

(3) More elegant (eliminating technical debt, preparing for multiple leaders)

Under the new Alpine consensus, it remains a single leader, but:

Propagation Layer: Introduced relay nodes to help forward transactions, significantly reducing latency.

Voting Layer: Although the fault tolerance has been reduced from 33% to 20%, there is a slight sacrifice in security, but the time to achieve final confirmation is greatly shortened. Additionally, cryptography is used to ensure that voting is off-chain.

New propagation layer schematic. Image Source: Helius

New voting layer schematic. Image Source: Helius

This way, the final confirmation time is expected to be reduced to 150 milliseconds.

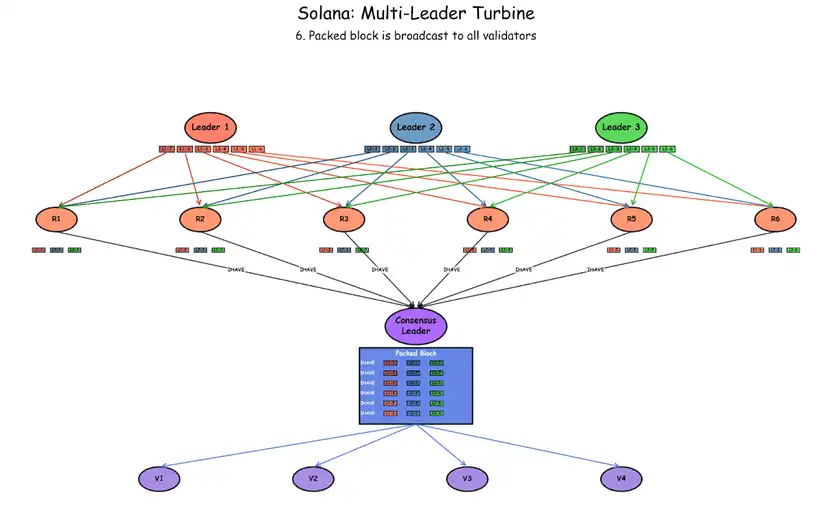

Finally, the long-term goal (9-30 months): Transition Solana's consensus algorithm from a single leader to multiple leaders to increase the system's resilience to extreme risks and censorship, providing applications with greater ordering rights.

This is also understandable, as the goal is to establish a free "Internet Capital Market," so it assumes the worst-case scenario.

What is the worst-case scenario? For example, a single leader wants to censor transactions, or a single leader wants to order transactions (instead of allowing applications to order themselves).

Why is Solana so persistent about letting financial applications order themselves? Let me give you an example, and you'll understand. Suppose you are trading stocks through a brokerage, and unexpectedly, China Telecom uses its advantage of network base stations to front-run your trades. Can you tolerate that? Right? MEV is actually quite unreasonable; it's just that everyone has gotten used to it. How can the power of the chain and nodes override that of the applications?

Therefore, to avoid such worst-case scenarios, Solana must introduce a multi-leader model in the future. This way, if one leader node acts maliciously, including but not limited to censoring transactions, such as addresses sanctioned by the U.S.; or ordering transactions, such as personally front-running, other leaders must be able to counteract it.

Multi-leader mechanism schematic. Image Source: Anza

This section is relatively short because there is currently no clear path to achieve it; it is still in the ideal discussion phase.

Thus, looking at the short, mid, and long-term goals of the technical department, from the simplest task of how to order blocks, to the more complex improvements in the consensus mechanism, and finally to the extremely challenging multi-leader model, it is essentially a step-by-step approach serving the ultimate goal of the "Internet Capital Market."

In conclusion, although Solana's technical roadmap is filled with a lot of jargon, after analysis, its technical route is undoubtedly effective and feasible. We look forward to the day when traditional financial applications truly take root and land on Solana!

This article is a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。