Coinbase's challenge lies in how to build an ecosystem that protects user choice through healthy competition and continuous innovation while retaining the core values of cryptocurrency.

Written by: Tiger Research

Translated by: AididiaoJP, Foresight News

TL;DR

Coinbase has evolved from a centralized exchange into a full-stack cryptocurrency ecosystem built on the Base chain and Base application.

The company continuously consolidates its influence in the cryptocurrency industry through the acquisition of multiple cryptocurrency startups and a strong network of Coinbase partners.

Coinbase's strategic initiatives aim to promote the adoption of cryptocurrency. However, they also create new centralized structures and bring challenges in balancing decentralized values.

1. Coinbase: Ambition to Build a Crypto Ecosystem

In April 2021, Coinbase became the first publicly listed cryptocurrency exchange. The company went public on Nasdaq through a direct listing. This was not just an IPO for a single company; it marked a symbolic turning point, indicating that the cryptocurrency industry had officially entered the mainstream financial system.

Source: Nasdaq

Its company name is also quite symbolic. "Coinbase" derives from the "Coinbase transaction" in Bitcoin, which is the first transaction recorded when creating a new block. This represents the moment cryptocurrency entered the mainstream world. The company name reflects its firm commitment as the starting point of the cryptocurrency ecosystem.

The symbolism of Coinbase extends beyond its name. The company is based on its exchange business and continuously expands its scope, now building a vast ecosystem. The company launched the Ethereum-based Layer 2 chain Base and released the Base application (TBA) during its "A New Day One" event. These developments indicate that Coinbase is completing a full-stack cryptocurrency ecosystem that covers everything from infrastructure to applications.

This report explores how Coinbase has evolved from an exchange into an empire encompassing the entire cryptocurrency ecosystem and analyzes the implications of these changes for the cryptocurrency industry.

2. Full-Stack Cryptocurrency: Exchange, Infrastructure, and Consumer Applications

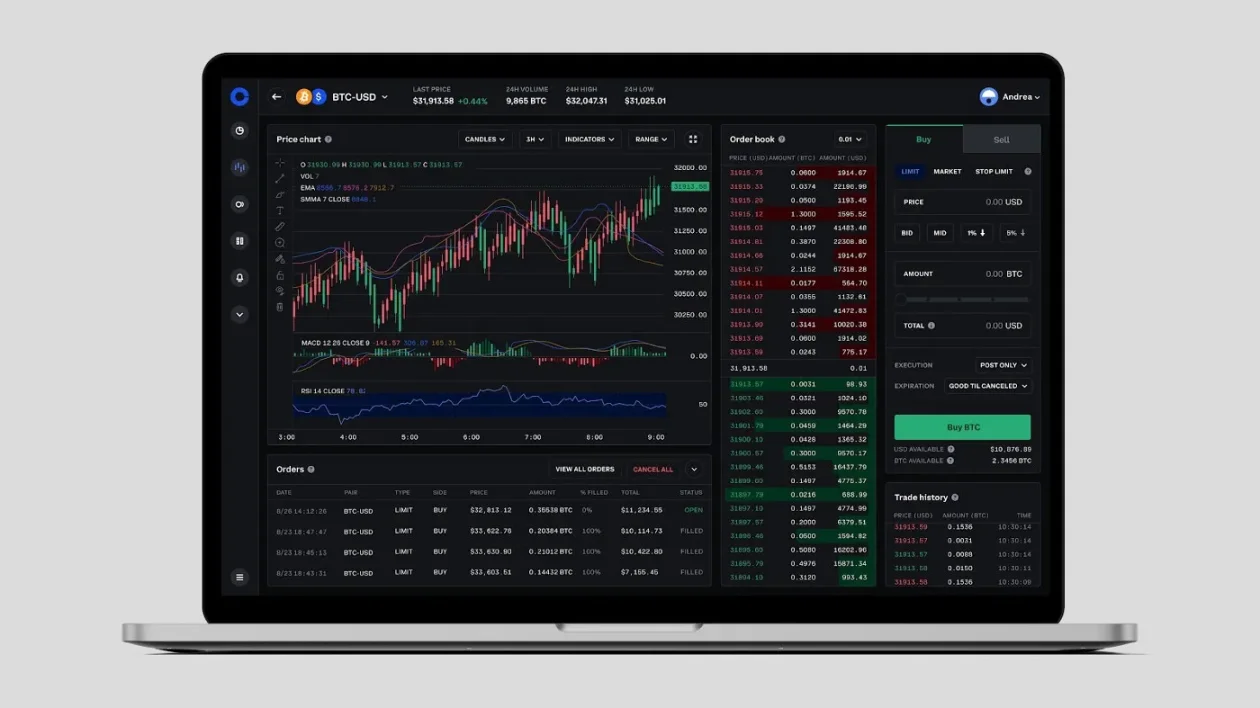

2.1. Exchange: Coinbase's Stable Cash Cow

Coinbase's core business is undoubtedly its exchange. The company provides cryptocurrency trading services for a wide range of users, from individuals to institutions, and generates revenue through trading fees. As of 2024, trading fees account for about 60% of total revenue, reaching approximately $4 billion. The relatively stable trading fee income lays the foundation for Coinbase's new business expansion, similar to how Amazon expanded multiple businesses using AWS as its cash cow.

Source: Coinbase

Moreover, the value of the exchange also lies in its strategic scalability. The exchange is the core entry point connecting fiat currency and cryptocurrency, boasting a large user base and trading data. Based on this, it becomes a strategic hub that naturally leads users into a broader ecosystem. The exchange provides Coinbase with financial stability and strategic scalability, serving as the core foundation for ecosystem development.

2.2. Base Chain: From Off-Chain to On-Chain

The Base chain is a Layer 2 blockchain built directly by Coinbase based on Ethereum. Through this chain, Coinbase has achieved an expansion from its exchange business into the on-chain domain.

Source: Base

This expansion stems from the structural characteristics of the cryptocurrency ecosystem. The cryptocurrency ecosystem is divided into off-chain and on-chain environments. Exchanges primarily provide trading services between fiat and cryptocurrency in the off-chain environment.

However, the actual use of cryptocurrency occurs in the on-chain environment, such as cryptocurrency-based collateral lending and governance participation. Users may purchase cryptocurrency on Coinbase and then transfer it on-chain to participate in specific DeFi protocols. This means Coinbase faces structural limitations, forcing users to engage with other ecosystems.

The Base chain addresses these limitations. Now, after purchasing cryptocurrency on Coinbase and withdrawing it, users can still remain within Coinbase's ecosystem. Just as Apple controls both hardware and software, Coinbase can now manage the entire user operation from the exchange to the infrastructure. This is highly significant.

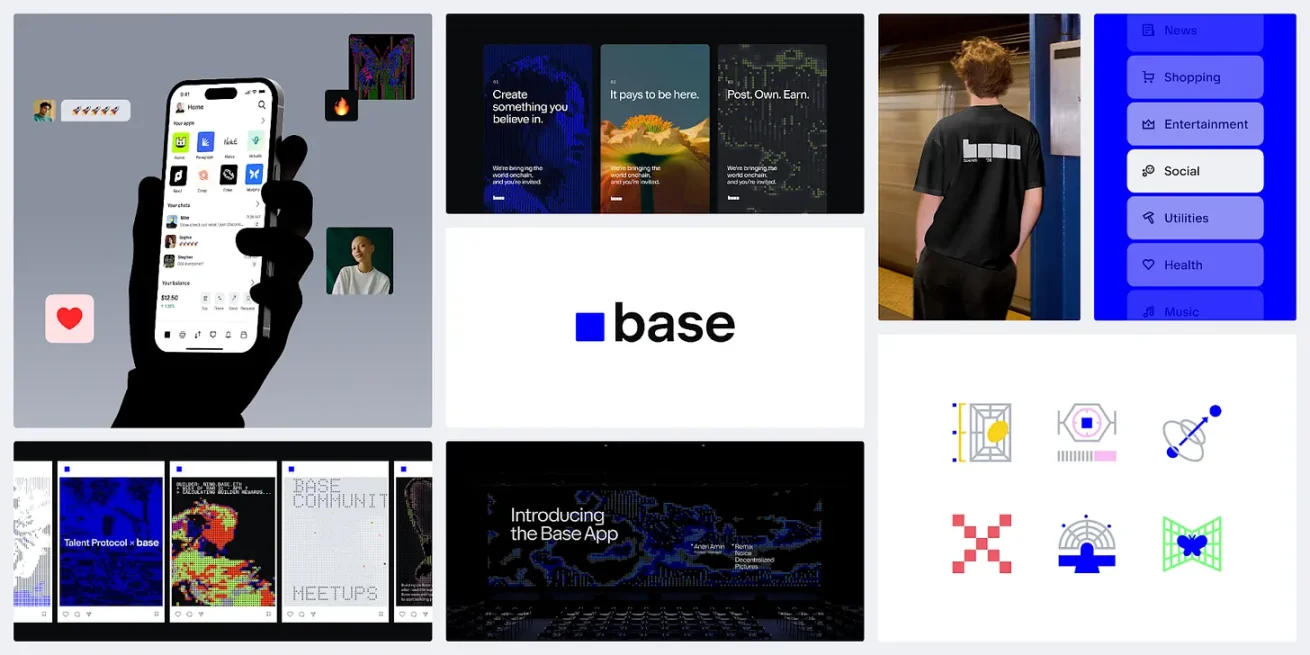

2.3. TBA: Completing the Last Piece of the Crypto Ecosystem Puzzle

Source: Base

In July 2025, Coinbase announced the launch of the on-chain super application TBA, moving towards a larger vision. This strategy is not limited to acquiring users through the exchange but also provides a practical application layer through Base infrastructure. Although there are many excellent decentralized applications (dApps) on the Base chain, they are scattered and difficult to discover centrally. Regardless of how outstanding the performance of the Base chain is or how low the fees are, if ordinary users cannot easily access it, its significance will be greatly diminished.

Source: Base

TBA integrates the core elements of the cryptocurrency ecosystem—exchange, infrastructure, and applications—into a single platform, providing a seamless user experience. Users can make cryptocurrency payments and transfers, earn through Farcaster-based social services, and immediately use those earnings for online or offline payments. The synergy of multiple services builds a robust on-chain economic ecosystem. Thus, the barrier to participating in the on-chain economy is significantly lowered. This completes the last piece of the vast ecosystem that Coinbase has been building.

3. Coinbase Builds a Crypto Empire

Coinbase is no longer just an exchange. The company has gradually built blockchain infrastructure and consumer applications on the foundation of its exchange, evolving into a vast empire encompassing the entire cryptocurrency ecosystem. **Additionally, through an aggressive acquisition strategy, Coinbase has expanded into more areas. For example, the company acquired the token management platform LiquiFi, zero-knowledge proof technology company Iron Fish, Web3 advertising platform Spindl, and cryptocurrency derivatives exchange Deribit, extending its reach into various corners of the Web3 industry.

Source: Tiger Research

These initiatives indicate that Coinbase is attempting to occupy all services related to cryptocurrency like an aircraft carrier. Furthermore, its relationship with the stablecoin USDC issuer Circle has become more intriguing. Coinbase is a major shareholder in Circle, and besides equity investment, it also receives a portion of the interest income from USDC. There are even clauses stating that if Circle goes bankrupt or fails to fulfill its income distribution obligations, some rights related to USDC will transfer to Coinbase. This indicates that Coinbase almost controls all core infrastructure of the cryptocurrency ecosystem.

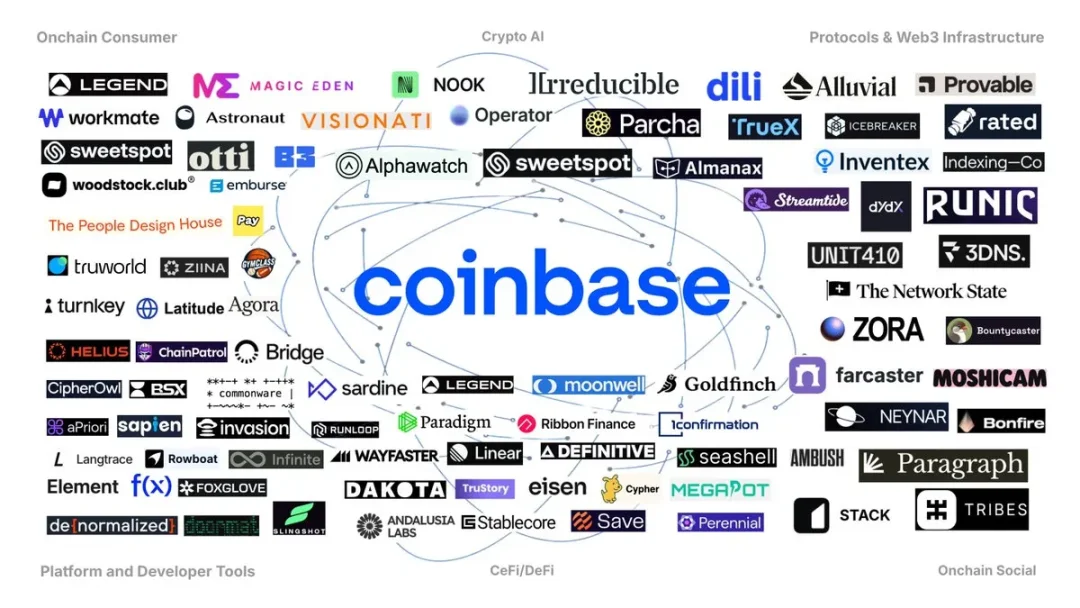

Source: Coinbase Ventures

Coinbase's expansion strategy relies not only on acquisitions. Another core strategy is the expansion of the Coinbase partner network's influence throughout the cryptocurrency industry, similar to the past "PayPal Mafia." The company has invested in over 40 Web3 startups founded by former Coinbase employees and continues to build a tight collaborative network through partnerships. For instance, Coinbase's first employee Olaf Carlson-Wee founded Polychain Capital, while well-known Web3 projects like dYdX, Farcaster, Zora, and B3 were all founded by Coinbase employees.

We still view Coinbase as an exchange, but its actual operational model resembles that of Google in the Web2 era. Just as Google started with search and gradually dominated the entire digital ecosystem, including advertising, cloud services, and mobile ecosystems, Coinbase has also built a vast empire covering all areas of the cryptocurrency ecosystem starting from its exchange business.

4. Exchange-Centric Crypto Market: Good or Bad?

Coinbase is building a vast empire. From the exchange to the Base chain to TBA, the company's initiatives are clearly strategic. However, we need to consider what its position is under these aggressive strategies.

Cryptocurrency once advocated decentralization, but in the pursuit of convenience, it has now returned to centralization. Users voluntarily enter Coinbase's ecosystem and have no reason to leave. This is essentially no different from traditional financial structures.

This change is not entirely negative. Integrated platforms like TBA bring real benefits to users. Users can access all services in one application without complex wallet connections, platform switching, or worrying about high Gas fees. From earning through social activities to using it for actual payments, the entire process is seamless. Coinbase's model clearly helps in the adoption of cryptocurrency.

However, we cannot ignore an important issue. The original intention of cryptocurrency was to achieve decentralization, but in the pursuit of convenience, new centralized structures have formed. Users voluntarily stay within Coinbase's ecosystem and have no motivation to leave. This is essentially no different from the traditional centralized financial structures we are trying to escape.

The market has chosen convenience. Reversing this trend seems difficult. The key now is to find a balance between the convenience of centralization and the spirit of decentralization. The real challenge lies in building an ecosystem that can protect user choice through healthy competition and continuous innovation while retaining the core values of cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。