From the perspective of finance and compliance, let's review their story.

Written by: Financial Solutions Web3

The Story Behind xStocks - Rome Wasn't Built in a Day

The public only saw xStocks launch in the first half of 2025, but the team behind it had been preparing for at least four years. Throughout this process, there must have been many stories, and this article attempts to revisit their story from the financial and compliance dimensions, hoping to organize a set of financial compliance methodologies for similar projects in the future.

1. Tax Planning and Compliance Story of Company Registration

The founding team recognized the trend and immense potential of stablecoins and RWAs as early as 2021, so they aimed to build a bridge before equity and blockchain. With a dream in mind, the next step was to realize that dream.

The first step, of course, was to register a company.

The most important aspect of registering a company is choosing a good location. The team behind xStocks initially chose Switzerland.

Why Switzerland? Similar to Silicon Valley in the United States, the city of Zug in Switzerland is known as Crypto Valley, where the renowned Ethereum Foundation was established. Switzerland has always been an important financial center, not only maintaining an open attitude towards the blockchain industry but also leading the way in legislative compliance construction globally. As early as 2021, it expanded its securities law to officially launch DLT (Distributed Ledger Technology) related legislation, which partially came into effect on February 1, 2021, and fully came into effect on August 1 of the same year.

The timing of the issuer's company registration can be said to closely follow the pace of this legislation.

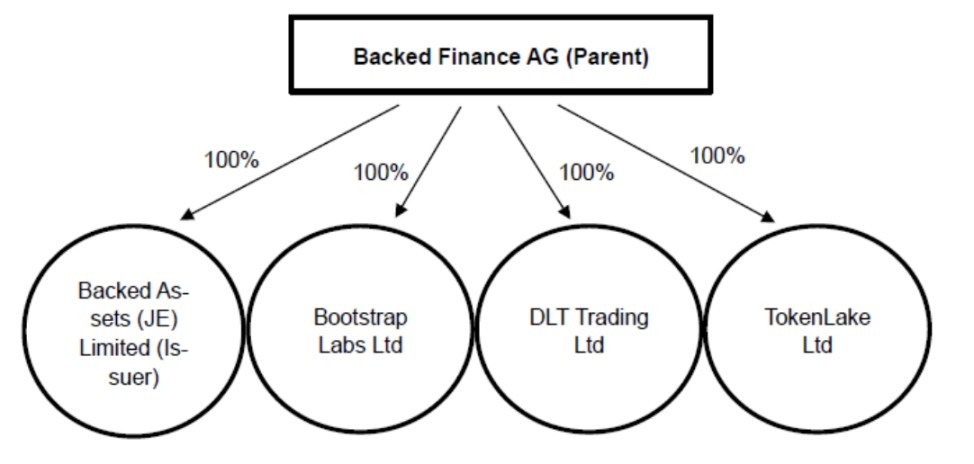

There are three main companies involved in xStocks' business:

Backed Finance AG, the issuer's parent company, is registered in Zug and was established in early 2021. On February 1, 2021, part of Switzerland's DLT legislation came into effect. These two timelines are certainly not coincidental; the founding team is very professional, perceptive, and decisive in their actions.

Backed Assets (JE) Limited, a private limited company registered in Jersey on January 19, 2024. It is the issuer of xStocks.

Backed Assets GmbH, established in Switzerland on April 20, 2021. This company merged with the issuer on February 23, 2024, with the issuer Backed Assets (JE) Limited as the surviving entity, inheriting all assets and liabilities of the original Backed Assets GmbH.

So the question arises: What is the purpose of establishing Backed Assets (JE) Limited? Why establish Backed Assets (JE) Limited as the issuer instead of having the parent company Backed Finance AG act as the issuer directly?

Answer: For functional division. By assigning the issuance function to a dedicated subsidiary, the parent company Backed Finance AG can focus on its core tokenization technology and services, while the issuer can concentrate on product issuance. This is a common corporate governance and risk management strategy.

Why not establish a company directly in Switzerland and instead set up a new company in Jersey? What is the appeal of Jersey?

What is Jersey? Jersey is an island located between the UK and France (only 8 kilometers long and 14.5 kilometers wide). Jersey has its own independent legal system, courts, and government, and is regarded internationally as an independent jurisdiction. (Source: Government of Jersey)

For the founding team, the primary consideration was "tax." The issuer's revenue comes from charging a maximum of 5% in additional fees on the issuance and redemption prices of products. As the business grows, this will become a significant income, so tax planning must be done well from the start, ideally avoiding taxes altogether. The team began exploring options and ultimately chose Jersey because when they looked at Jersey's Income Tax Law, they found three tax brackets:

0%: General cases

10%: Financial services companies

20%: Utility companies, cannabis industry companies, income related to land, profits from the import and supply trade of hydrocarbons.

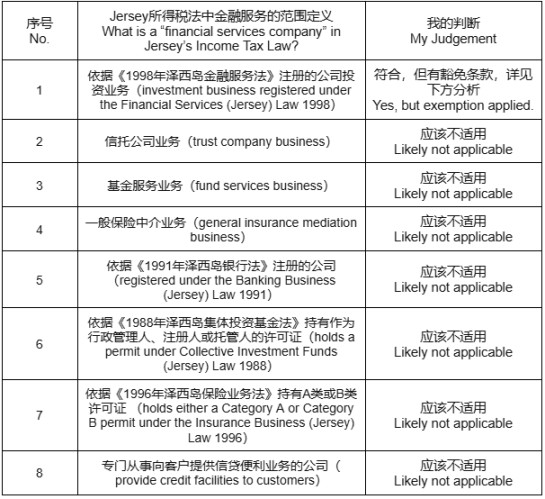

They thought that this business would likely be classified as a financial service, so how could they enjoy the 0% tax rate? The table below summarizes the scope definition of financial services companies from that tax law, along with my judgment (which I believe is similar to the founding team's judgment).

Detailed Analysis: How to avoid being classified as a financial service and taxed at the 10% rate, the team conducted quite in-depth research here, which is also the core of the overall business structure design. Let's analyze it in depth.

First, according to the Financial Services (Jersey) Law 1998, the specific definition of "Investment Business" mainly includes:

Buying and selling investments: Buying, selling, subscribing, or underwriting investments as a principal or agent.

Arranging transactions: Arranging for others (whether as a principal or agent) to buy, sell, subscribe, underwrite, or convert investments.

Considering that the issuer's main business model involves additional fees (commissions) during the buying and selling process, it initially appears to fit the definition of "Investment Business" and should be taxed at the 10% rate.

However, the team did not stop there and found another law, the Financial Services (Investment Business (Special Purpose Investment Business – Exemption)) (Jersey) Order 2001. The 4(1) clause of this law actually provides exemption provisions for special purpose entities (SPVs), meaning that if certain conditions are met, they do not fall under the companies registered according to the Financial Services (Jersey) Law 1998, and thus the 10% tax rate in Jersey's Income Tax Law does not apply.

The conditions for these exemptions are as follows:

It is a special purpose company and has obtained the relevant consent.

The sole or primary activity involves:

Issuing loans, providing guarantees, engaging in derivative transactions.

Issuing securities.

Asset securitization, acquisition, or asset repackaging.

Capital market transactions.

Or any other transactions approved by the committee.

Or any transactions related to the above transactions.

Seeing these conditions, the team began to think about how to make their business meet the exemption criteria. Naturally, if they set up a company in Jersey that only issues "securities," they should have a chance to be exempted. Even if that doesn't work, they could try to go through special approval. For the team, the action plan was clear: to establish a special purpose company (SPV) in Jersey.

Thus, we see that after the issuer Backed Assets (JE) Limited was established on January 19, 2024, just one month later, on February 23, Backed Assets GmbH was absorbed and merged by the issuer, which was quite a swift action. Moreover, such a special purpose company also meets the management requirements for functional division mentioned earlier.

Choosing to establish the issuer in Jersey also had another consideration: "licensing." Generally speaking, issuing securities requires a license. From the perspective of the founding team, Jersey, as an independent autonomous "small village," does not even require a license for issuance; it only needs permission from the local government, which makes it relatively easier. Of course, Switzerland could also obtain a license, but the difficulty of obtaining a license, combined with the aforementioned tax planning factors, makes Jersey undoubtedly a better location.

-----------------------------------------------------------------------------------------------------------------------------

Insights for future teams: Tax law reflects the rights and will of the state. To protect national interests, tax laws typically cover the entire scope of taxation. If you cannot find tax incentives in the main text, do not give up; look for them in subsequent supplementary laws, special provisions, etc., as there are often surprises. There are two directions to search: one is already defined incentive provisions, and the other is opportunities for special approvals, i.e., whether the government has intentionally opened a flexible loophole.

-----------------------------------------------------------------------------------------------------------------------------

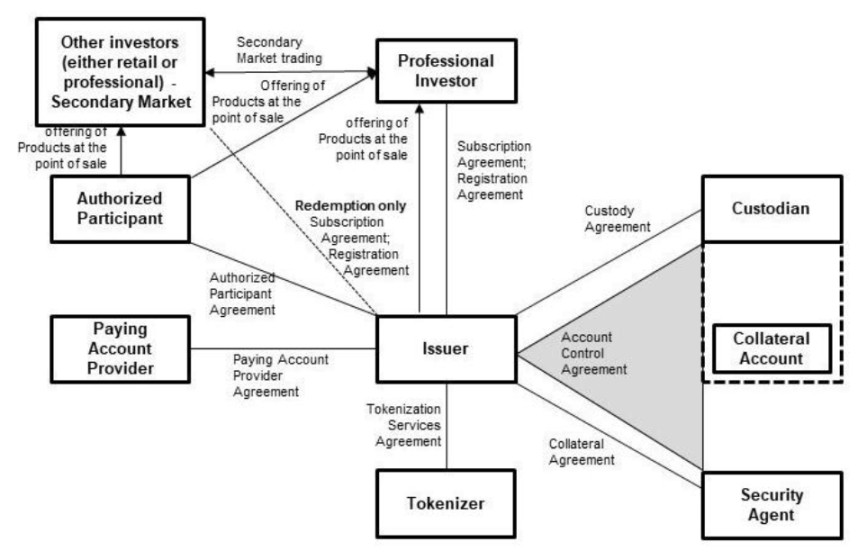

2. Compliance Story Regarding Custody

Source: Company's Securities Notes

The product logic of xStocks is that investors first transfer funds to the issuer, who then uses this capital to purchase corresponding real stocks, while crediting the investors' wallets with equivalent xTokens. To prevent these real stock assets from being misappropriated or lost, a secure practice is to entrust these assets to a trusted third party for custody. This third party is the custodian.

Custody is not only to ensure asset security but also plays an important role in anti-money laundering (AML), customer due diligence (KYC), and other matters. Therefore, various countries have targeted laws, such as the Investment Advisers Act of 1940 in the United States and the CASS rules in the UK.

From the xStocks product page, we can see three different custodians. Why is that?

Generally speaking, using multiple custodians is based on the following considerations:

Risk diversification. Ensuring that even if one custodian encounters issues (such as asset loss or system failure), other custodians can still maintain the security of the assets.

Meeting regulatory requirements of different jurisdictions. xStocks targets a global market (excluding the U.S.), and regulatory requirements may vary across different countries/regions.

Enhancing operational flexibility and efficiency. Some custodians may excel in handling specific types of assets (such as stocks or ETFs) or have better technical integration capabilities on certain blockchains (like Solana or Ethereum). By collaborating with multiple custodians, xStocks can optimize asset management and transaction settlement efficiency.

Addressing the demands of scale growth. As the business grows, multiple custodians can share the workload, ensuring the efficient operation of the system and laying the groundwork for future expansion into more asset types (such as bonds or other RWAs).

The situation of these three custodians is as follows. It can be seen that the custodians include those that comply with U.S. regulatory requirements as well as those that comply with EU regulatory requirements.

Alpaca Securities LLC (Wilmington, North Carolina, USA): A broker-dealer registered with the U.S. SEC and a member of FINRA, with a securities account control agreement dated June 20/23, 2025, governed by New York state law.

Maerki Baumann & Co. AG (Zurich, Switzerland): A Swiss bank licensed by FINMA, which will act as the Swiss custodian. The custody agreement (framework agreement) signed with the issuer is dated November 23/24, 2022, governed by Swiss law.

InCore Bank AG (Zurich, Switzerland): Maerki Baumann & Co. AG has outsourced its securities trading to InCore Bank AG.

Alpaca Crypto LLC (San Mateo, California, USA): A money services business registered with the U.S. FinCEN, which will act as the U.S. custodian. The cryptocurrency service agreement signed with the issuer is dated March 28, 2025, governed by California state law.

Another question arises: Since the business cannot operate in the U.S., why introduce U.S. custodians?

This brings us to an innovation by the team: an alternative collateral structure. Simply put, this is a new method of holding and managing collateral introduced by the issuer to increase the scalability of its product xStocks and further reduce risks in the settlement process.

Since many popular underlying assets (such as U.S. stocks) are primarily traded in the U.S. market, using custodians and brokers located in the U.S. can handle the purchase, holding, and sale of these underlying assets more directly and efficiently, thereby optimizing the settlement process and reducing the complexity and potential delays of cross-jurisdictional transactions. The innovation lies in mimicking the practice in the real economy of establishing warehouses at the origin of goods to facilitate faster and more efficient handling of goods, regardless of where the final customer is located.

Insights for future teams: Custody is a necessary step, and based on the location of the underlying assets, the team can introduce multiple custodians.

3. The Story from Professional Investors to Ordinary Investors

According to Jersey law, products can only be issued to the following two categories of people:

Professional Investors: Individuals whose regular activities involve acquiring, holding, managing, or disposing of investments for business purposes (as principals or agents).

Individuals who have received and confirmed the "SPB Order Investment Warning": This warning indicates that the product is only suitable for individuals with a "considerable asset base" to bear potential losses and who are "sufficiently financially knowledgeable" to understand investment risks; at the same time, the issuance of the product and any activities of the functions involved are not entirely subject to all provisions of the 1998 Jersey Financial Services Law. Investors will be required to confirm that they belong to one of the above categories before issuance.

In simple terms, it can only be issued to professional + affluent investors. We can understand that if issued to individuals outside these two categories, it would violate the Jersey government's consent conditions for the issuer's business, which could lead to losing the 0% tax rate at best, or being unable to continue operations at worst.

So how can ordinary investors also invest in xStocks?

From my analysis, this is mainly achieved by leveraging the layered structure of financial markets, the openness of blockchain technology, and the ecological cooperation between Backed Finance and exchanges and DeFi platforms.

Taking exchanges as an example, the key is that as long as ordinary investors do not directly participate in the initial issuance, it is acceptable. Currently, the exchanges that the issuer collaborates with are all regulated and have comprehensive user KYC procedures. xStocks, as a tokenized asset, was indeed initially issued to the aforementioned two categories of investors, but once it is on-chain, ordinary investors can participate in buying and selling. At that point, even if the Jersey government wants to intervene, it would be out of reach.

Further extending this idea, in addition to exchanges, ordinary investors can also participate through DeFi platforms, or qualified professional investors can participate in the initial issuance and then repackage these xStocks into other financial products to sell to ordinary investors.

Insights for retail investors: This operation, which circumvents the initial issuance regulations, essentially transfers the risk to retail investors. Retail investors must fully recognize their information and cognitive limitations and should thoroughly read the risk warnings in the issuance prospectus before investing in such products to ensure they truly understand what they are investing in.

4. The Team's Story

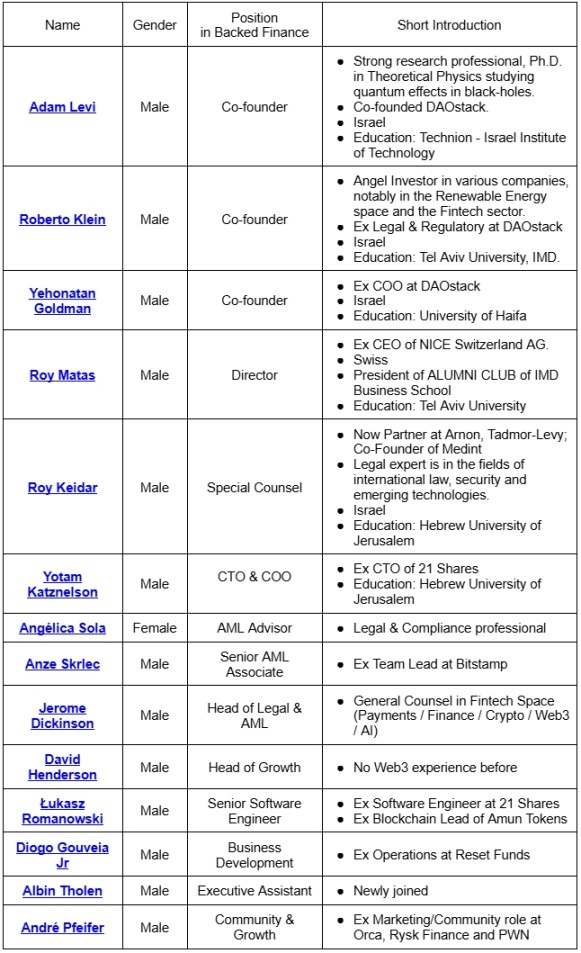

From the table above, we can see:

The core team is from Israel, likely Jewish.

The founding team has a very high level of understanding and shares similar backgrounds and philosophies, with several being alumni or former colleagues from the same company.

They place great importance on compliance. In addition to legal experts, there are three individuals responsible for anti-money laundering (AML).

Summary:

In the more than four years since 2021, an innovative financial product has gone from initial conception to final listing, facing challenges that are far beyond what most people can imagine. The three stories above are only one-sided, but it is not difficult to see that success requires the convergence of favorable timing (the trend of tokenization), advantageous location (a good company registration site), and harmonious relationships (talented team and major ecosystem partners).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。