Crypto ETF Flows Favor Ether ETFs as Bitcoin ETFs Stay Positive

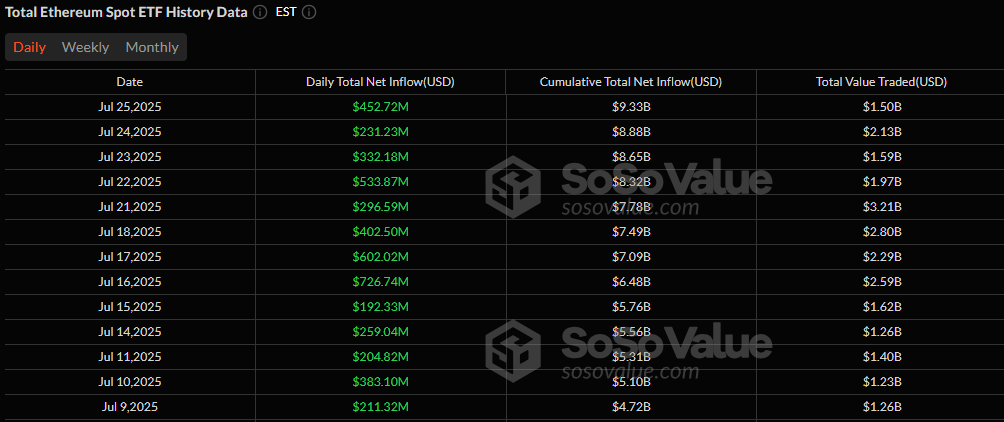

The week ended with a bang for ether exchange-traded funds (ETFs), while bitcoin ETFs managed to hold their ground. Ether ETFs extended their remarkable green streak to 16 straight sessions, pulling in $452.72 million on Friday, while bitcoin ETFs added $130.69 million despite a hefty outflow from Grayscale’s GBTC.

Ether ETFs remained the clear leader for the umpteenth time this week. Blackrock’s ETHA dominated inflows with a massive $440.10 million, overshadowing the $23.49 million outflow from Grayscale’s ETHE. Grayscale’s Ether Mini Trust added $18.87 million, while Bitwise’s ETHW and Fidelity’s FETH chipped in $9.95 million and $7.30 million, respectively.

The total traded value was $1.50 billion, pushing ether ETFs’ net assets to $20.66 billion, underscoring their growing market influence.

Source: Sosovalue

For bitcoin ETFs, 6 funds saw inflows. Blackrock’s IBIT once again topped the charts with $92.83 million, while Ark 21Shares’ ARKB added $30.27 million. Bitwise’s BITB brought in $20.96 million, and Vaneck’s HODL contributed $18.16 million.

Smaller entries came from Fidelity’s FBTC ($10.19 million) and Grayscale’s Bitcoin Mini Trust ($8.79 million). The day’s momentum was partially offset by a $50.50 million outflow from GBTC, but strong inflows kept bitcoin ETFs positive overall. Total trading activity hit $4.45 billion, with net assets steady at $151.45 billion.

With ether ETFs now consistently pulling in hundreds of millions daily and bitcoin ETFs holding resilience, the question becomes: is institutional preference shifting more toward Ethereum?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。