From $500 million to $1.34 trillion: Infrastructure, Participants, and the Path to Mass Adoption.

Written by: Tiger Research

Compiled by: AididiaoJP, Foresight News

Abstract

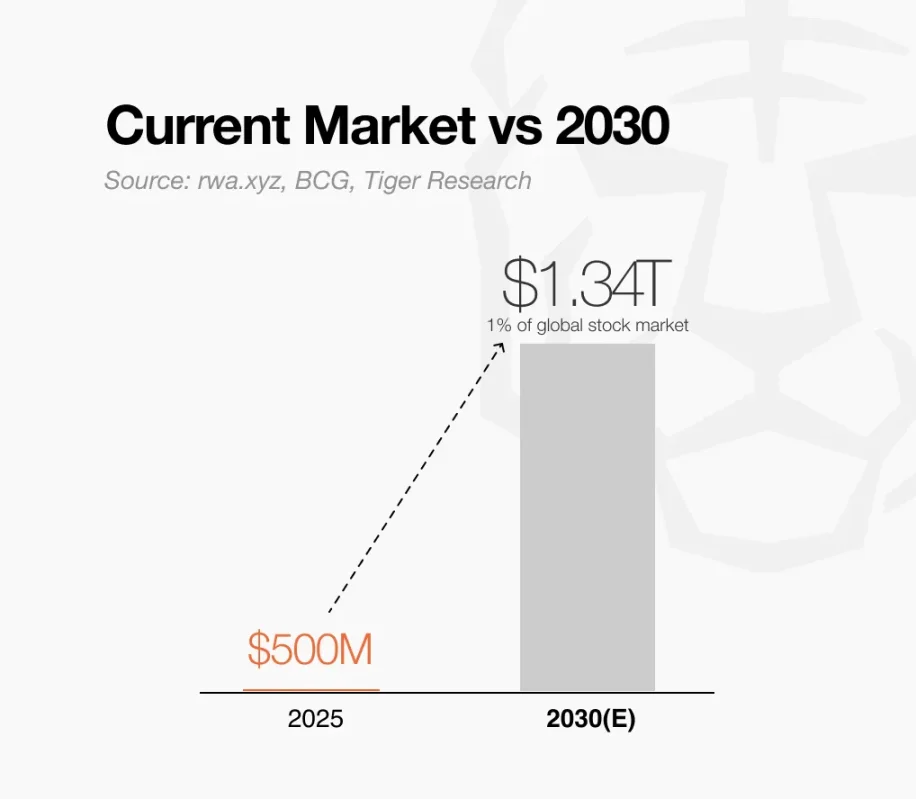

Market Opportunity: The tokenized stock market currently stands at $500 million, but if 1% of global stocks can be tokenized, the market size could reach $1.34 trillion by 2030. This represents a potential growth of 2,680 times, primarily driven by the dual push of regulatory clarity and mature infrastructure by 2025.

Value Proposition: Tokenized stocks support round-the-clock global trading and allow for tokenized ownership of stocks. Its key differentiation lies in the integration with decentralized finance (DeFi), enabling investors to use their stocks as collateral for lending and earning without selling them.

Reasons for Success: Unlike other real-world assets (RWA) that need to create demand from scratch, tokenized stocks directly tap into the $134 trillion global stock market and address clear pain points. The combination of existing demand and solvable pain points makes it the RWA category with the highest potential for mass adoption.

The Convergence of the Crypto Industry and Traditional Finance: Blurring Boundaries

Traditional finance and the crypto industry are moving closer together.

On one hand, institutions like Citigroup and Bank of America are preparing to issue stablecoins. On the other hand, projects like Injective and Backed Finance are tokenizing stocks like Apple and Tesla and putting them on-chain.

As traditional institutions adopt crypto technology and Web3 projects tokenize stocks, the boundaries between the two industries are gradually disappearing.

This convergence has accelerated following the U.S. "Crypto Week." "Crypto Week" is a period of regulatory activity focused on digital assets, with the passage of the GENIUS Act incorporating stablecoins into the federal regulatory framework. Wall Street and DeFi are no longer in competition but are increasingly complementary.

Traditional finance has a clear motivation to integrate crypto technology. Beyond potential innovation, the crypto market has proven its profitability, while traditional financial brands can provide the trust currently lacking in the crypto industry. However, the reverse logic of why crypto platforms would want to tokenize stocks is less obvious. The market is still in its early stages, with motivations being diverse and speculative.

This report explores this issue by analyzing the structure of the tokenized stock market and its key participants.

What is the Tokenized Stock Market?

The tokenized stock market refers to the conversion of traditional stocks into digital tokens on the blockchain. These tokens are designed to reflect the value of the underlying stocks but typically do not come with shareholder rights. Most tokenized stocks exist in the form of derivatives rather than direct ownership of stocks.

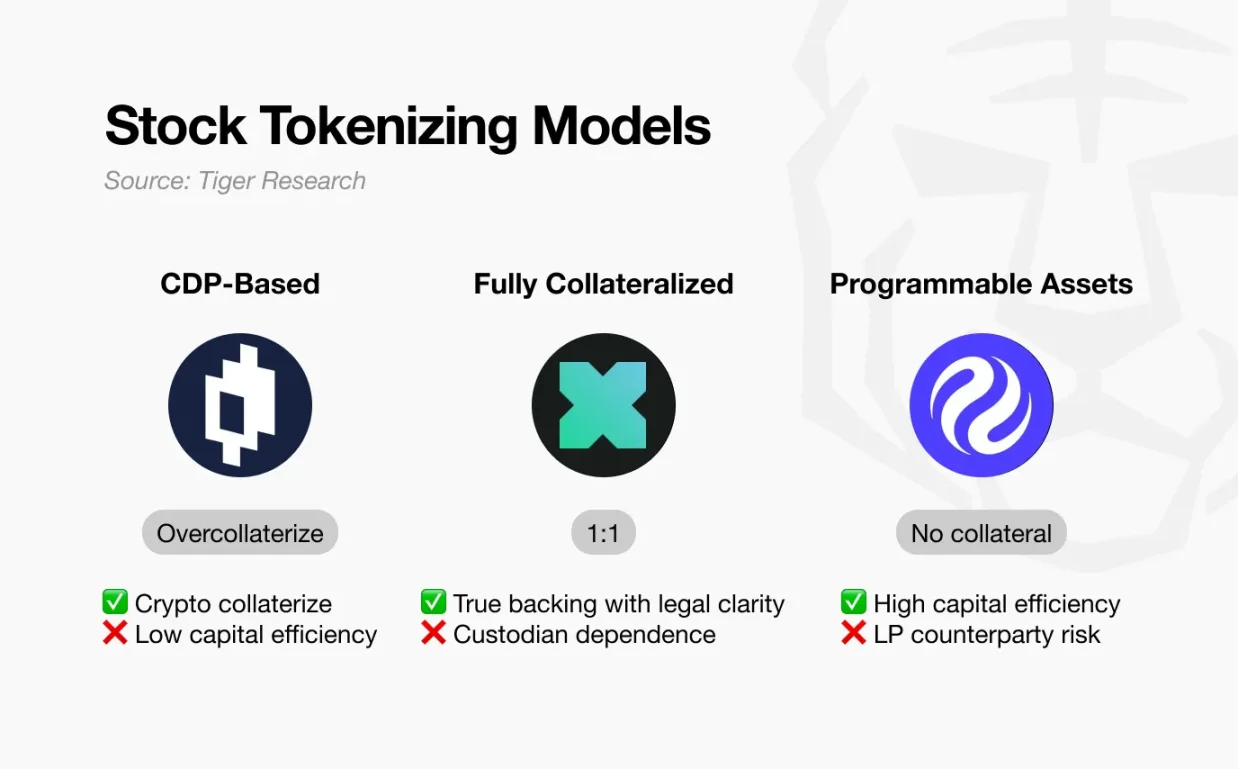

Although the first wave of tokenized stocks appeared in 2021, most early models (such as Mirror Protocol) failed to scale due to inefficiencies and systemic risks (especially in ecosystems like Terra). Recent approaches have introduced improved mechanisms with stronger capital dynamics and compliance frameworks, represented by Injective and xStocks.

The attention on tokenized stocks has surged with the rise of the RWA (real-world assets) trend, which has become a key narrative in the crypto market.

In addition to these direct advantages, tokenized stocks enable new use cases through composability. Existing outside traditional regulatory frameworks, they can serve as collateral for lending protocols or generate yields in DeFi applications.

For example, if an investor in Indonesia wants exposure to Tesla stock, the traditional method requires opening a foreign brokerage account, filling out paperwork, and paying currency conversion fees, with limited trading hours. Through tokenized stocks, the same investor can instantly purchase Tesla tokens via a smartphone and deploy them in DeFi protocols for lending, providing liquidity, or generating yields.

Market Scenario: 1% Tokenization of Global Stocks

The tokenized stock market is still in its early stages. According to data from rwa.xyz, the current market size is approximately $500 million. Compared to the $134 trillion global stock market, this figure represents only 0.0004%. However, if only 1% of global stocks are tokenized in the next decade, the market size could grow to $1.34 trillion, 2,680 times its current size.

2025 as a Turning Point

The second half of 2025 could become a critical turning point. Although still in its early stages, the trading volume of tokenized stocks within the Solana ecosystem surged from $15 million to $100 million in just one month, a growth of 566%.

More importantly, the entry of regulated participants is significant. Major fintech companies are expanding tokenization services globally, with Robinhood announcing the launch of related services in Europe. As the market expands from North America to Europe and Asia, regulatory clarity will act as a catalyst. Particularly, once stock tokenization is initiated under the EU's MiCA framework, the market is expected to expand rapidly.

Conditions for Success by 2030

Achieving 1% tokenization of the global stock market by 2030 requires clear justifications. Investors must have strong incentives to shift from traditional systems to tokenized platforms. This transition will only occur under the interplay of four key conditions.

First, cost savings must be demonstrated.

In theory, brokerage, settlement, and management fees could be reduced by 50%-70%, which needs to be validated in practice. If tokenization can significantly lower foreign exchange and cross-border transaction costs, it will provide a compelling alternative for global investors.

Second, the practicality of round-the-clock trading must be validated.

Tokenized stocks should support continuous trading across Asian, European, and U.S. markets. By eliminating the time constraints of traditional exchanges, they can offer higher liquidity and respond in real-time to global events, thereby enhancing overall trading efficiency.

Third, DeFi-based secondary yield generation must become a core feature.

Tokenized stocks should not only serve as tradable assets but also become fundamental components of DeFi protocols. If investors can use them for collateralized lending, AMM-based options, liquidity provision, and automated portfolio strategies, they can earn additional yields without selling. As these mechanisms mature, they will reinforce the primary advantages of tokenization: cost efficiency, accessibility, and continuous trading, making the appeal of detaching from traditional systems increasingly attractive.

Key Participants in the Tokenized Stock Market

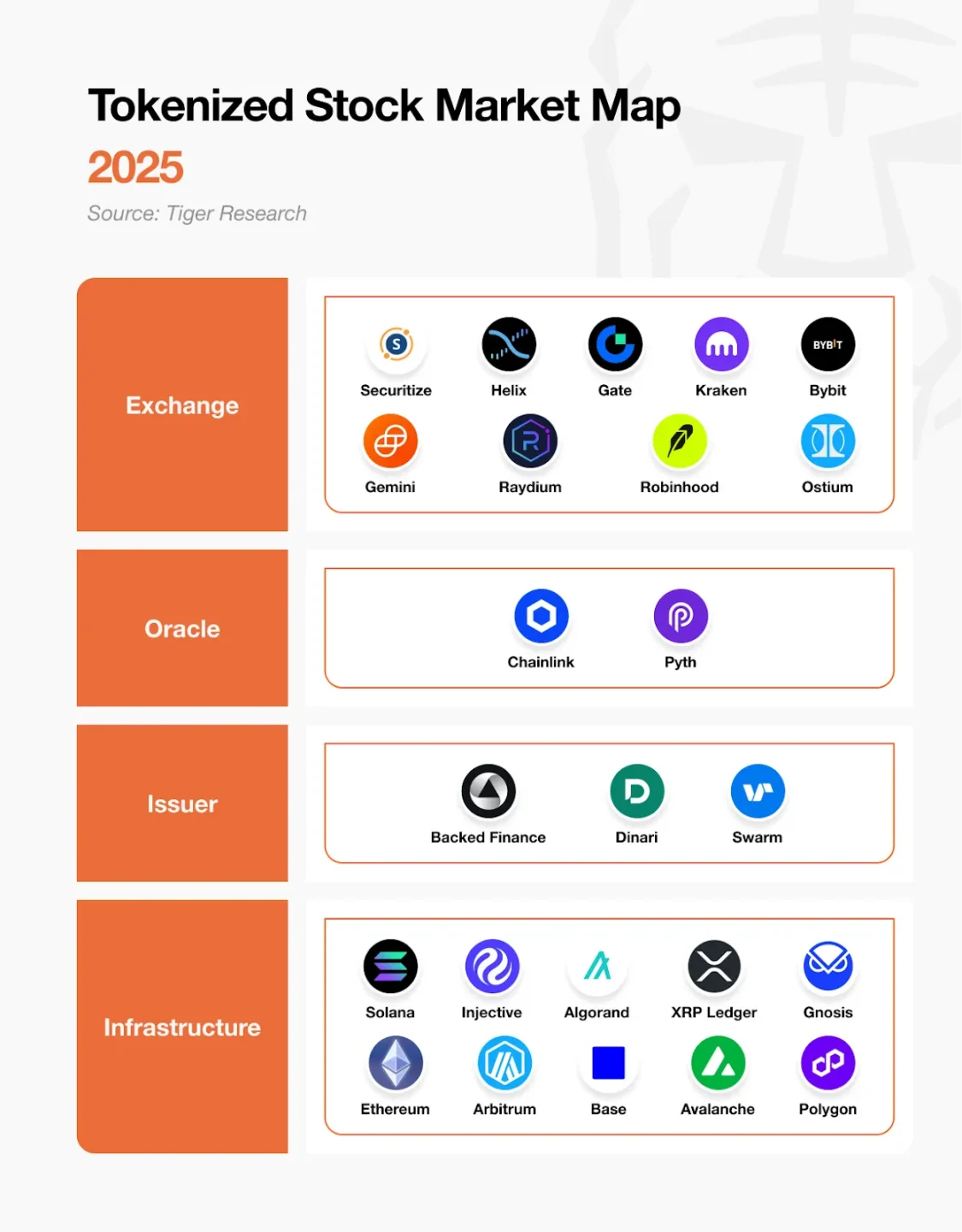

The tokenized stock market is built on four core layers that operate in coordination.

At the bottom is the infrastructure layer, which provides the blockchain network where all transactions occur. Above that are the issuers, responsible for creating tokenized representations of traditional stocks. To ensure accurate price tracking, oracle services provide real-time market data and maintain the link to the underlying assets. Finally, exchanges allow investors to buy and sell tokenized stocks.

A fully functional tokenized stock ecosystem requires all four layers. The absence of any layer would result in a lack of necessary components for secure issuance, pricing, and trading.

Tokenization in Practice

Suppose an investor wishes to gain exposure to Apple ($AAPL) stock in a tokenized form. They can trade iAAPL on Helix with leverage of up to 25 times, purchase the $xAAPL spot token issued by Backed Finance on Kraken, or access U.S. stocks around the clock through Robinhood EU as a European resident. Each exchange operates under different regulatory environments and trading models, catering to different investor needs.

To ensure that tokenized stocks accurately reflect the real stock prices, reliable market data is crucial. For example, Chainlink obtains real-time prices for Apple stock from Nasdaq and uploads them on-chain. It also provides proof of reserves to verify that each token is backed by an equivalent Apple stock on a 1:1 basis. This ensures that investors can trust the price integrity of the tokens.

Issuers convert traditional stocks into tokenized assets. Backed Finance holds actual Apple stocks in a Swiss bank and issues $xAAPL tokens on a 1:1 basis. In contrast, Injective's $iAAPL uses iAssets without holding the underlying stocks, synthesizing price tracking through oracle data to enable leveraged trading without physical settlement. These two approaches represent different paths to connect traditional stocks with blockchain infrastructure.

All transactions and token transfers occur on the blockchain network. On Solana, Backed Finance's xStocks trade with low latency and minimal fees. Injective supports high-performance trading based on order books. On Ethereum and Arbitrum, Dinari's dShares operate under U.S. regulatory compliance. Each chain offers different technical capabilities to meet the infrastructure needs of tokenized stock platforms.

Key Players in the Tokenized Stock Market

Key participants in the tokenized stock market shape the ecosystem based on different strategies and capabilities. Here is a summary of the main companies and their current positioning:

Injective: A leader in the tokenized stock perpetual contract space. As of the first half of 2025, it has accumulated over $1 billion in trading volume. Through its Helix DEX, it offers leverage of up to 25 times, driving liquidity in the derivatives space.

xStocks (Backed Finance): Holds 80% of the top 10 tokenized stocks by market capitalization. It employs a 1:1 backing model, with stocks held in a Swiss bank and widely adopted in the Solana ecosystem.

Robinhood: Expanding to Europe in 2025, offering over 200 tokenized U.S. stocks and private stocks. Provides zero-fee trading on Arbitrum, supporting 24/5 trading.

Gemini: Partnering with Dinari Global to offer over 60 tokenized stocks to EU investors. Compliant with MiFID II, providing services within the European regulatory framework.

Securitize: A leader in tokenizing real-world assets, including U.S. Treasury tokenization like $BUDIL. Also offers a total of $312 million in stock tokenization products, with the largest single asset deployed on Algorand.

Chainlink: Provides critical data infrastructure, including real-time stock and ETF price feeds, as well as asset-backed proof of reserves verification.

The Role of Tokenized Stocks in the RWA Market

A Limited but Most Viable Niche

Tokenized stocks represent a niche within the broader real-world assets (RWA) market. Without regulatory clarity, their adoption will be limited. However, this barrier is beginning to loosen. Robinhood has announced the provision of tokenized stock services in Europe, with other major platforms following suit. As more jurisdictions align with these developments, regulatory acceptance may expand.

Verified Demand and Clear Pain Points

The strength of this market lies in its fundamentals. Stocks are already widely traded assets with clear demand. At the same time, the trading process has long been plagued by inefficiencies, particularly in access, settlement speed, and geographical limitations. The combination of verified demand and solvable pain points makes stocks an ideal starting point for tokenization.

Unlike other RWA categories that need to generate demand first, tokenized stocks are directly built on the $134 trillion global stock foundation. The case for tokenization is strengthened by its tangible advantages: lower costs, broader access, round-the-clock trading, and DeFi integration. As regulatory frameworks mature, these advantages will drive the accelerated adoption of tokenized stocks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。