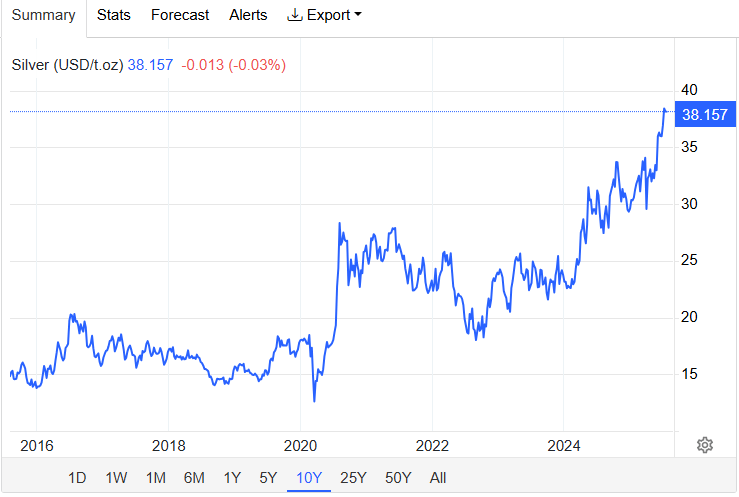

Despite growing demand from industries like solar energy, electric vehicles (EVs), and advanced technology, silver prices have remained stubbornly suppressed. Data shows silver spiked in 2020 after the COVID-19 pandemic triggered a flight to safe-haven assets, including silver.

After languishing below the $20 per ounce mark for several protracted years, silver suddenly surged in the latter half of 2020, rising to over $27 by early August. Yet, this initial burst proved to be a mere prelude; it wasn’t until March 2024 that the precious metal truly ignited a sustained rally, propelling its price to a peak exceeding $38 – a gain of over 50% in just over 15 months.

At current prices, the precious metal is still more than $10 below its all-time high (ATH) of $49.45 per ounce, reached in January 1980. When adjusted for inflation, silver’s ATH rises to $140 per ounce, about $100 more than its current price. It is this abysmal performance that prompts silver proponents to cry foul and question why the precious metal is not in tandem with other alternative assets.

A recent report from Goldsilver HQ, a social media-based gold and silver news platform, sheds light on the alleged culprit: pervasive and blatant market manipulation, specifically through a deceptive tactic known as “spoofing.” According to Goldsilver HQ, the persistent undervaluation of silver is not a result of natural market forces but rather a deliberate strategy by powerful players.

In a post shared via X, Goldsilver HQ asserts that the objective behind this spoofing is to create a deceptive “illusion of massive supply.” This fabricated glut on the order books is designed to trigger panic among legitimate buyers, driving down the market price. Once the price plummets, the manipulators swiftly cancel their fake orders and then capitalize on the artificial dip by buying real silver at significantly lower prices. This, according to the X post, is “pure fraud.”

In the silver market, these “riggers”—often identified as large financial institutions, with JP Morgan specifically named—are accused of flooding the COMEX (Commodity Exchange Inc.) with these spoof orders. Goldsilver HQ highlights that these orders frequently represent “hundreds of millions of ounces worth,” strategically deployed during key trading hours, particularly the New York morning session. While prices might see a recovery in Asian and European trading hours, the practice is said to have contributed to the systematic suppression of spot silver prices over years.

Explaining how the practice is executed, the X post states:

Trader places 1,000+ contracts to sell at a low price (spoof side), while quietly buying on the opposite side. Algos & HFT [high-frequency trading] bots react to the fake supply, slamming prices. Spoofer cancels, profits from the dip. Recidivists do this 100s of times!

To back claims that large financial institutions are involved in the practice, Goldsilver HQ shares screenshots of a September 2020 report stating that JPMorgan was fined a staggering $920 million by the U.S. Department of Justice (DOJ) for spoofing in precious metals, including silver. Traders involved in the scandal admitted to engaging in market rigging for over eight years, actions which the DOJ labeled a “criminal enterprise.”

As per the post, JPMorgan traders also faced prison sentences in 2023 for their spoofing activities, while UBS and Deutsche Bank were also fined millions in 2018 for similar offenses.

Meanwhile, Goldsilver HQ argues that besides investor losses, the practice has consequences for everyday consumers and industries. For instance, consumers may “pay more for solar panels, electronics” because the cost of a key component, silver, is not accurately reflected by market dynamics. On the other hand, miners suffer as the profitability of extracting silver is artificially constrained.

“It’s not free market—it’s cartel control since 1965 US policy to suppress silver,” Goldsilver HQ concludes.

The social media post also details “advanced tactics” employed by manipulators, such as cross-market spoofing (rigging futures to impact exchange-traded funds like SLV) and predictive spoofing (flooding orders pre-news releases to exploit anticipated volatility). While the Commodity Futures Trading Commission (CFTC) is aware of these practices, Goldsilver HQ suggests that enforcement often lags.

Though “recidivists” like Daniel Shak have been permanently banned after engaging in gold and silver spoofing, the post indicates rigging persists. Despite this, Goldsilver HQ says manipulators could be left exposed if demand for silver explodes.

“A massive squeeze could still brew if physical demand explodes, exposing the manipulators once and for all. History echoes 1980 Hunt brothers saga, but today’s digital games could end in fireworks,” Goldsilver HQ asserts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。