Important project company xTAO Technologies Inc. in the Bittensor ecosystem has recently received final approval for its common stock to be officially listed on the Toronto Stock Exchange (TSX Venture Exchange) on July 23, 2025, with the stock code $XTAO.U.

Against the backdrop of a series of Web3 projects launching listing plans, xTAO's listing has also attracted market attention: is this project just another concept marketing, or is it an infrastructure innovation built on the underlying logic of a "decentralized AI network"? This report will briefly review the underlying Bittensor network and the mechanism and positioning of its core token TAO, starting from the technical architecture and network positioning, and attempt to uncover the logic behind xTAO's listing.

1. What is Bittensor?

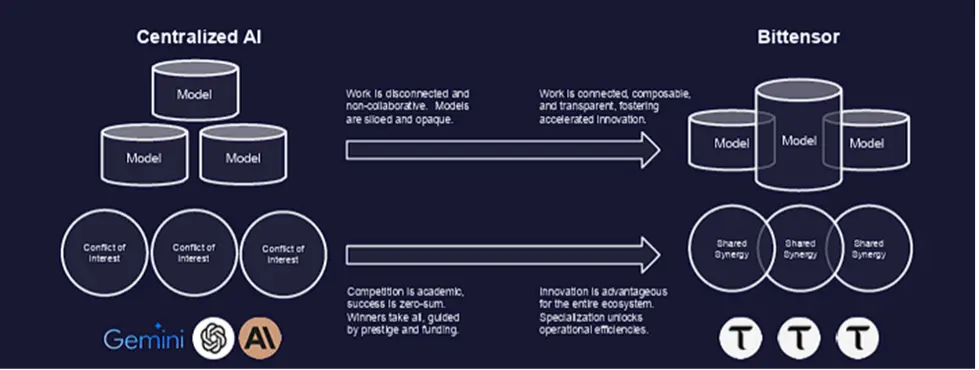

Bittensor is a complete Layer 1 blockchain network dedicated to building a decentralized AI service network. In simple terms, it is not a specific AI application like ChatGPT or Midjourney, but rather a more foundational system platform, akin to an "operating system," specifically serving the entire AI ecosystem.

To put it another way: If the goal is not just to provide a road for a supercar but to ensure that all vehicles can pass smoothly, then a fully functional highway must first be built. What Bittensor does is construct such a "highway system" for all AI tasks and developers—a decentralized platform where anyone in the world can upload models, receive tasks, earn rewards, and freely combine AI services.

In this system, the Bittensor network itself plays the role of the "builder and maintainer" of the highway: it is responsible for establishing operational rules, building pathways, designing entrances and exits, and creating an economic incentive system to ensure that all participants can pass in an orderly manner, ultimately forming an efficient collaborative "AI traffic system."

2. Roles of Participants in the Bittensor Network

On this "AI highway," various participants collaboratively build a decentralized collaborative network:

Miner Nodes are like various "drivers" or "truck drivers": they drive their own AI models on the road, handle tasks assigned by the system, and strive for validators' praise and TAO rewards through high-quality output results.

Validator Nodes are akin to "traffic police" or "quality inspectors": they score the service quality of models (0-1), ensuring that the "AI services" circulating in the network possess stability and credibility, and determine the reward distribution for miner nodes.

Subnet Owners are comparable to "highway segment contractors" or "road planners": they design rules for specific AI service scenarios, guide the aggregation of model resources, and build independent economic and governance systems.

Delegators can be likened to "investors funding road construction": they support the operation of certain nodes by staking TAO tokens and receive returns, although they do not directly participate in model operation, they share risks and rewards in the network incentive mechanism.

End Users are like "passengers" or "freight owners" traveling on the highway: they call upon the AI services provided by models in the network (such as text generation, image recognition, etc.) and pay fees for this.

Fuel Cards and Tickets (TAO Token): used to pay salaries to drivers and traffic police, provide funding support for new routes, and offer voting governance rights and other related support.

3. Review of Interesting and Novel Technologies in Bittensor

1. Decentralized Expert Mixture (MOE) Mechanism

Bittensor does not rely on the traditional platform model of "centralized training + single model service," but instead adopts a decentralized expert mixture (MOE) mechanism: it connects existing, trained AI models from around the world to the network, dynamically calling the most suitable model combinations based on task requirements to jointly output high-quality content, thus quickly responding to various intelligent needs.

This mechanism can be understood as: transforming AI services from "centralized cultivation" to "global scheduling." Models do not need to be trained by a single institution; instead, multiple "expert models" are organized collaboratively through network routing to generate more accurate and adaptable answers.

To illustrate: when you visit a hospital, you no longer need to randomly book an unfamiliar expert appointment; instead, you can instantly receive a joint consultation from the team of experts worldwide that best meets your needs. You do not need to train these experts or own them; you just need to find and call upon them at the moment you need them, thus obtaining answers tailored to your personal needs.

Furthermore, these model "experts" can continuously learn from new samples and feedback while processing new tasks, improving their performance, ultimately forming a self-reinforcing positive feedback loop network.

2. Yuma Consensus (POI: Proof of Intelligence)

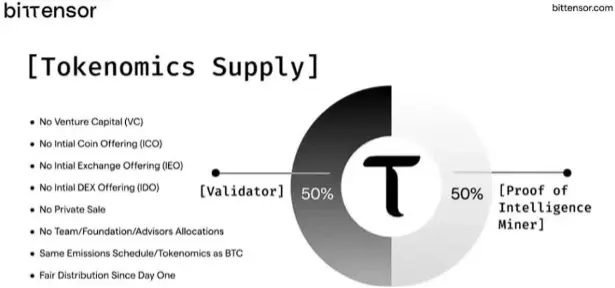

The consensus mechanism adopted by Bittensor is called Yuma Consensus, and its core concept can be summarized as "Proof of Intelligence (POI)," a composite design that integrates PoW (Proof of Work) and PoS (Proof of Stake) mechanisms, aimed at decentralized quality assessment and incentive distribution for AI model performance.

This mechanism consists of four core dimensions: stake + weight + trust + clipping, with the specific operational logic as follows:

(1) Continuation of PoW Thinking: Miners still require computational power support, but the core competition is not in GPU performance, but in model performance and strategy optimization.

That is, whether the model is stable, whether the response is accurate, and whether the invocation is quick will directly affect its score and reward distribution.

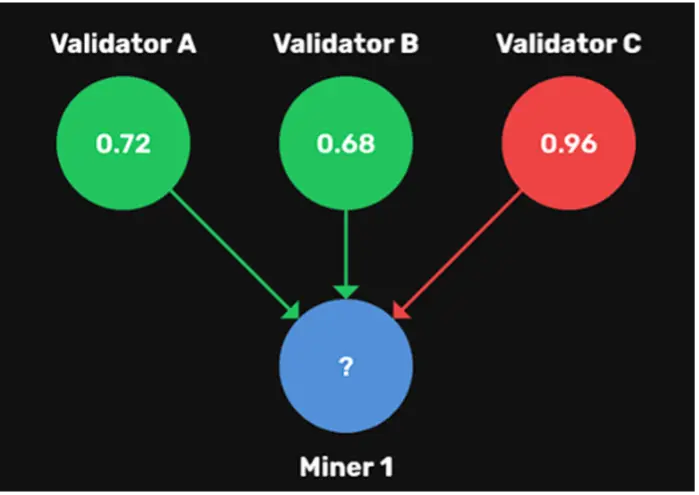

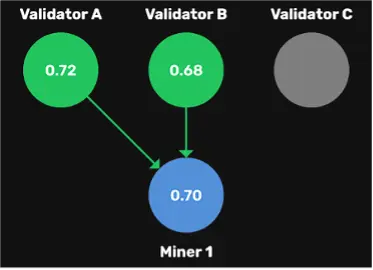

(2) Weights (Scoring Weight): Validators need to score each miner model's output from 0 to 1.

This score represents the validator's evaluation of the model output quality and is one of the core reference dimensions for the system's incentive distribution.

(3) Stake (Equity Weighting): The scoring weight of validators will be dynamically adjusted based on the amount of TAO they stake.

In other words, the more TAO a validator holds, the greater the impact of their score. This mechanism ensures that network governance and reward distribution are more decentralized and resistant to manipulation.

(4) Clipping Mechanism: Scores from validators that deviate significantly from the majority will be automatically clipped by the system and not counted in the final consensus.

This mechanism aims to prevent scoring malfeasance or manipulation, enhancing the robustness and objectivity of the entire scoring system.

(5) Trust Mechanism: If a validator's long-term scoring behavior is consistent with the evaluations of other validators, their trust score will gradually increase. The higher the trust score, the stronger the validator's scoring influence in the network, and the easier it is to receive recommended rewards distributed by the system, thus incentivizing them to continue fair and reasonable scoring behavior.

Ultimately, the system will complete the distribution of TAO rewards in each block cycle based on the mixed calculation results of miner scores and validator scoring weights. This process ensures a strong correlation between reward distribution and actual performance, encouraging various nodes in the ecosystem to continuously optimize model and evaluation behavior.

3. Digital Hivemind

The "Digital Hivemind" proposed by Bittensor refers to constructing a decentralized brain system through the collaboration of thousands of AI models worldwide. Unlike the traditional approach that relies on a single strong model, Bittensor achieves dynamic evolution and intelligent aggregation through competition and scoring among models.

Many people may confuse this mechanism with the expert mixture model (MoE), but the two are fundamentally different. MoE is more like a group of experts arranged internally within a hospital for collaborative diagnosis, centrally scheduled by a system; whereas the digital hivemind is more like all top hospitals worldwide automatically participating in a joint consultation, where who sees the patient and how to divide the work is not determined by a center, but dynamically chosen by validator scoring and Yuma consensus to select the most suitable "experts."

In this mechanism, models do not need centralized training; instead, the network allocates tasks and rewards based on actual performance, gradually forming a self-optimizing, decentralized intelligent ecosystem.

4. Relationship Between xTAO and TAO

xTAO is the world's first company focused on the commercialization of the Bittensor network, founded by former WonderFi executive Karia Samaroo. The team background combines Web2 listing experience (WonderFi), financial resources (CapitalG, Arche), and blockchain-native technical strength (Ala Shaabana), possessing strong cross-border integration capabilities.

According to Private Capital reports: at the time of xTAO's listing, it coincided with the completion of $22.78 million in subscription receipt financing, with an investment lineup including leading Web3 institutions such as Animoca Brands, Arca, Arche Capital, Borderless Capital, DCG, FalconX, Hypersphere Ventures, Off the Chain Capital, Republic, and Stratos.

Core Business: This includes operating the Validator verification nodes within the Bittensor network, responsible for scoring miner models, providing model access services to enterprise clients, and assisting third parties in deploying miner nodes, acting as an interface between Bittensor and external users.

In short, TAO is the "fuel" in the network, while xTAO is a company specializing in gas stations, transforming the on-chain computing power value into an off-chain business revenue model through node operation and service output.

5. What Does xTAO's Listing Mean?

xTAO's listing is similar to the trend of several cryptocurrency companies seeking IPOs, with the core intention of connecting the real asset market through public offerings to attract traditional capital. For ordinary investors, xTAO provides a channel to indirectly participate in the TAO ecosystem through secondary market investments; for institutional investors, although TAO is a cryptocurrency asset with compliance holding barriers, xTAO stock (XTAO.U) serves as a regulatory-compliant financial product, becoming a "shadow asset" for Web2 investors to access Bittensor.

At the same time, xTAO is expected to become an important interface for traditional enterprises to connect with Bittensor model services, playing a bridging role in the future commercialization of AI services. If the company regularly discloses financial data in the future, it will also provide the market with a set of indirect observation indicators regarding the commercial value of TAO, assisting professional investors in evaluating the growth potential of the ecosystem.

Despite having a certain narrative logic and capital background support, xTAO's first-day trading performance was relatively rational. On the opening day, the stock price fluctuated in the CAD 1.45–1.80 range, ultimately closing flat without significant volatility. This trend was viewed by some as a "healthy opening," avoiding irrational speculation; however, others believe that the market enthusiasm is insufficient, reflecting current investors' wait-and-see attitude towards new Web3 AI infrastructure, necessitating further observation of its performance realization and ecosystem implementation pace. The price trend on the second day showed a downward trend, which further indicated its weak market position.

6. Conclusion (Note: This article does not constitute investment advice)

Overall, the Bittensor network and its native token TAO still demonstrate a relatively complete technical design framework, cutting-edge consensus mechanism, and decentralized model architecture, possessing long-term development potential and ecological scalability. It exhibits certain innovations in model scheduling, reward mechanisms, and system governance, forming a clearer path for application implementation.

As a key participant in the commercialization path of Bittensor, xTAO shows strong execution and resource integration capabilities in narrative construction, capital lineup, and team background. However, from the current development stage, its listing action still struggles to completely escape the common strategy characteristics of current cryptocurrency projects, which often "leverage the IPO narrative window to capture the era's dividends." Although its business positioning has some substance, how to continuously realize technical value and commercial revenue in actual operations still requires time for validation.

Under this premise, xTAO's listing more represents the first step of the TAO ecosystem moving towards the capital market, and its long-term value relies on the breadth and depth of the Bittensor network's continued expansion in AI infrastructure, as well as whether TAO can truly assume a central value role across models and services within the on-chain economic system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。